What Expenses Can You Deduct As An Independent Contractor Jun 30 2025 nbsp 0183 32 When you claim the GST HST you paid or owe on your business expenses as an input tax credit reduce the amounts of the business expenses by the amount of the input tax

Oct 1 2023 nbsp 0183 32 The excessive interest and financing expenses limitation EIFEL rules limit the deductibility of interest and financing expenses by affected corporations and trusts The rules Calculating motor vehicle expenses If you use a motor vehicle or a passenger vehicle for both business and personal use you can deduct only the portion of the expenses that relates to

What Expenses Can You Deduct As An Independent Contractor

What Expenses Can You Deduct As An Independent Contractor

http://www.emmanuelbaccelli.org/wp-content/uploads/2022/10/printable-contract-employee-invoice-template-doc.png

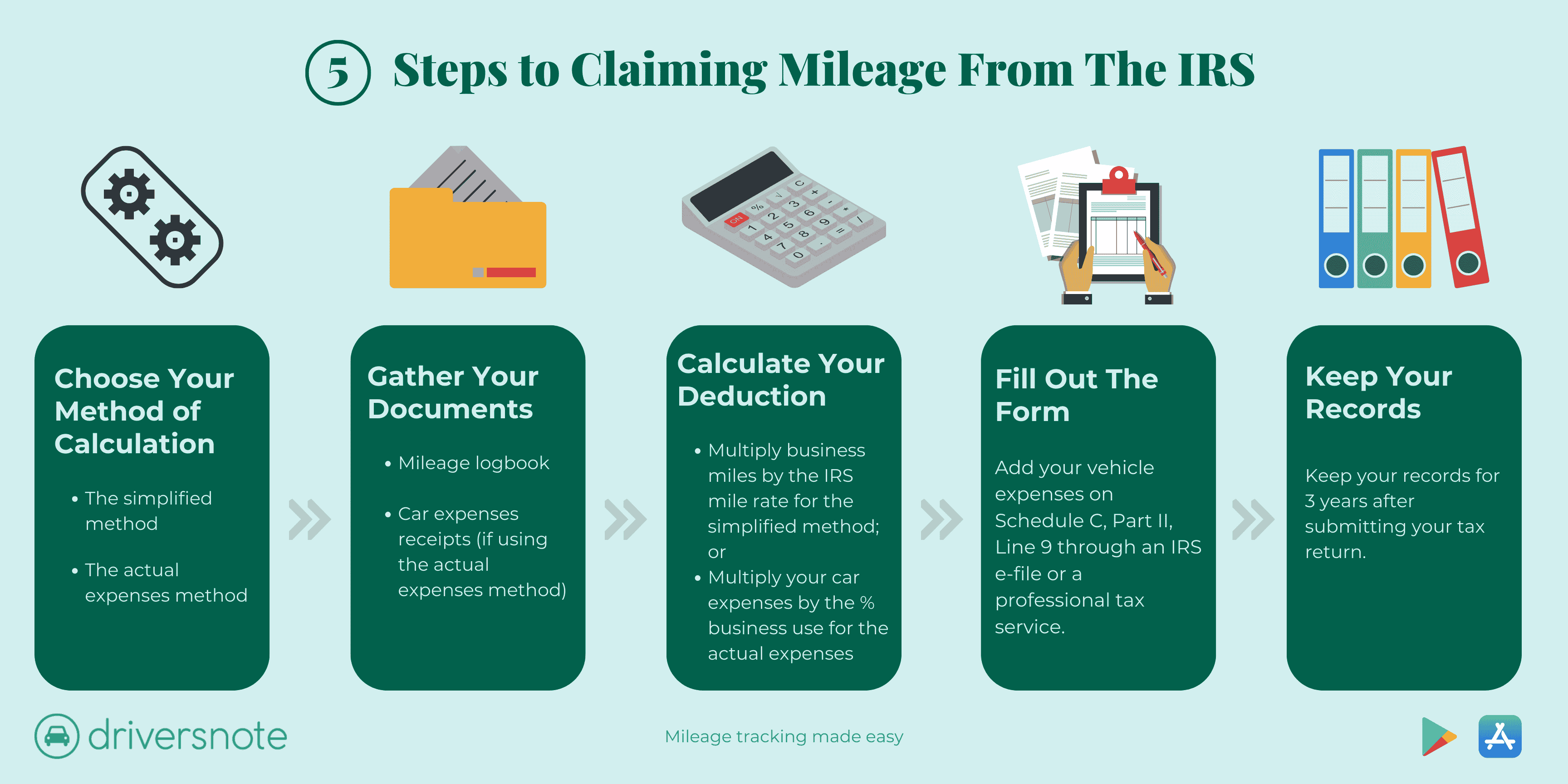

Annual Miles On A Car If Running Errands Online Emergencydentistry

https://lh5.googleusercontent.com/kUVgqrvbua_7HuEDDMUtTO2eaX-hVmRikRsAxqYFhV6A22VPlemTi3gX9sXNhAsDCgwVHGVXB51Z9ViBx9JxBAyGxNnML9zUy5seRR6kW1qMbv2010MJCgfLnxr_8DzChvG6kJJEeVlOA4nl4iqYsLw

Are You Unsure What Expenses Are Deductible For You Business This

https://i.pinimg.com/736x/b9/76/ac/b976ac9170bf1f7f342c4f4eee6194f2.jpg

Use this form if you are an employee and your employer requires you to pay expenses to earn your employment income Feb 3 2025 nbsp 0183 32 Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later

Attendant care and care in a facilityAll regular fees paid for full time care in a nursing home or for specialized care or training in an institution are eligible as medical expenses including fees for Accrual expenses in the Fall Economic Statement are on a gross basis meaning the revenues are included in the accrual based revenue forecast while they are netted against expenditures

More picture related to What Expenses Can You Deduct As An Independent Contractor

Save Yourself A Lot Of Money And Get This List This Cheat Sheet Has

https://i.pinimg.com/originals/8d/81/e0/8d81e0464430c01ba243468c905bdd81.jpg

FREE Estimated Tax Payments As An Employee Some Of Your Taxes Are

https://media.brainly.com/image/rs:fill/w:750/q:75/plain/https://us-static.z-dn.net/files/d45/72c4642ecf8835996215bc636d589382.png

FREE As An Employee Some Of Your Taxes Are Paid With Each Paycheck

https://media.brainly.com/image/rs:fill/w:750/q:75/plain/https://us-static.z-dn.net/files/d20/4672ffa96f7800df124f63ec70819555.jpg

Jan 1 2024 nbsp 0183 32 The CRA will permit GST HST registrants to use factors for calculating ITCs on expenses charged to procurement cards and corporate credit cards provided they satisfy The expenses are related to the performance of their employment duties step 2 If the allowance or reimbursement you provide to your employee for travel expenses does not meet all of the

[desc-10] [desc-11]

2024 Mileage Deduction Rate Sibby Othella

https://storage.googleapis.com/driversnote-marketing-pages/US-infographic-how-to-deduct-mileage-landscape.png

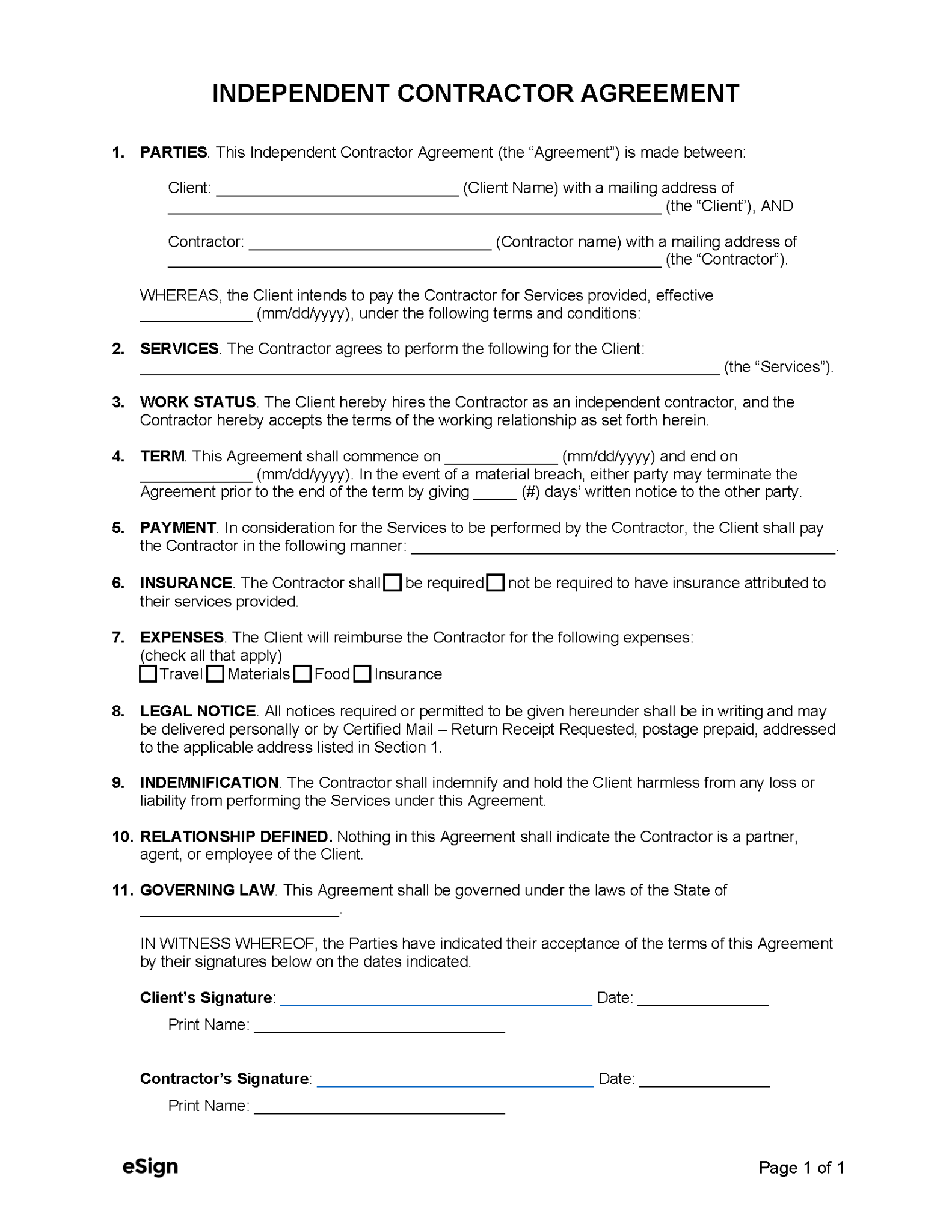

Free Intellectual Property Non Disclosure Agreement NDA PDF Word

https://esign.com/wp-content/uploads/Simple-Independent-Contractor-Agreement-1583x2048.png

What Expenses Can You Deduct As An Independent Contractor - Attendant care and care in a facilityAll regular fees paid for full time care in a nursing home or for specialized care or training in an institution are eligible as medical expenses including fees for