What Expenses Can I Deduct As An Independent Contractor Jul 1 2024 nbsp 0183 32 Contractors and other self employed workers can deduct home office expenses advertising expenses accounting fees phone bills equipment depreciation travel and car expenses healthcare and retirement contributions and more from their taxable income

Jan 22 2025 nbsp 0183 32 Discover the 17 best self employed tax deductions for freelancers and independent contractors Learn how these deductible expenses can reduce your tax bill What Expenses Can I Deduct on My Taxes as a 1099 Contractor A free tool by If you re a freelancer 1099 contractor or small business owner you get tax write offs that W 2 employees can t claim

What Expenses Can I Deduct As An Independent Contractor

What Expenses Can I Deduct As An Independent Contractor

https://i.ytimg.com/vi/9FuFp2NCG3E/maxresdefault.jpg

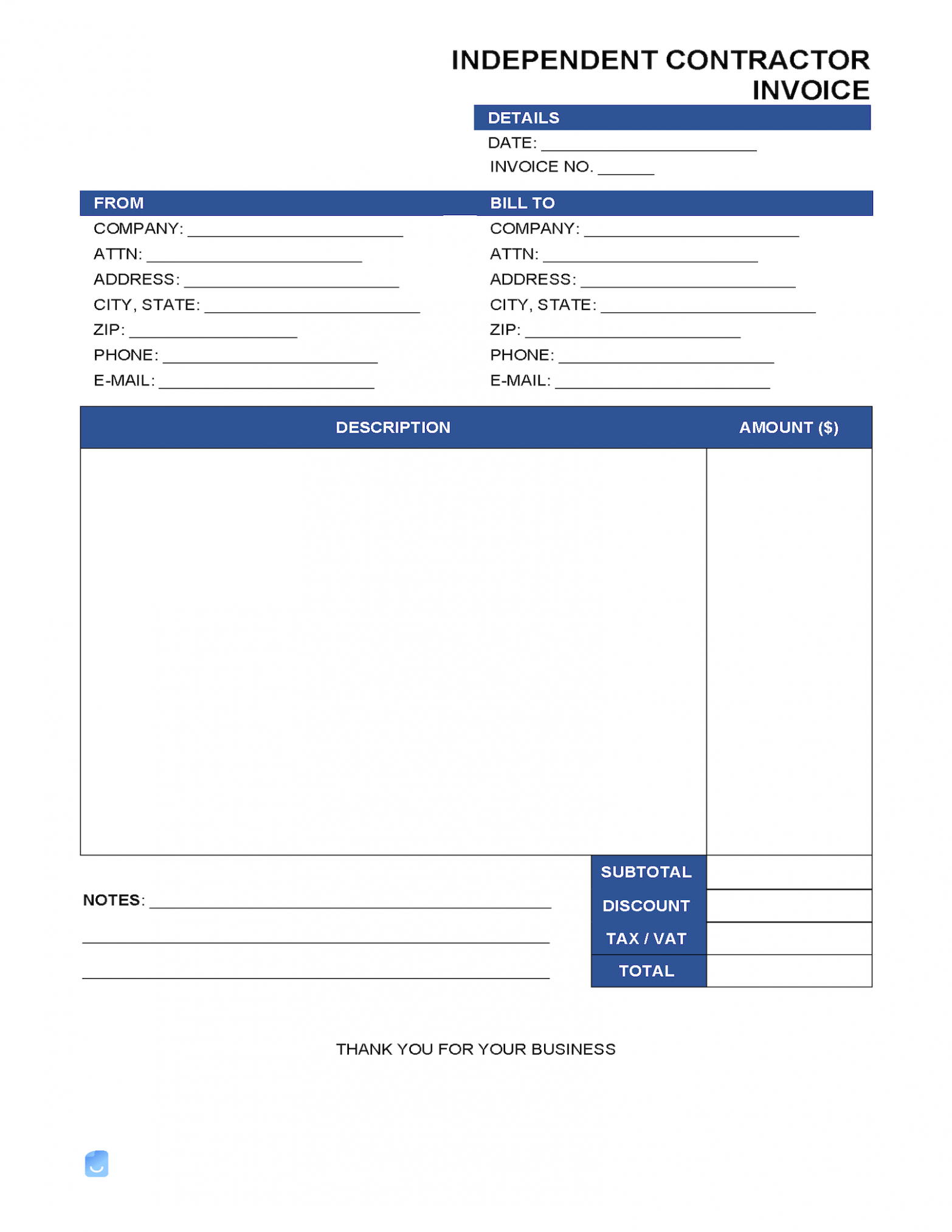

Contract Employee Invoice Template

http://www.emmanuelbaccelli.org/wp-content/uploads/2022/10/printable-contract-employee-invoice-template-doc.png

Annual Miles On A Car If Running Errands Online Emergencydentistry

https://lh5.googleusercontent.com/kUVgqrvbua_7HuEDDMUtTO2eaX-hVmRikRsAxqYFhV6A22VPlemTi3gX9sXNhAsDCgwVHGVXB51Z9ViBx9JxBAyGxNnML9zUy5seRR6kW1qMbv2010MJCgfLnxr_8DzChvG6kJJEeVlOA4nl4iqYsLw

Jul 23 2024 nbsp 0183 32 The good news is that if you re an independent contractor sole proprietor or another form of self employed worker many of your business expenses are tax deductible These deductions also known as write offs are subtracted from Jun 15 2021 nbsp 0183 32 There are a number of business deductions you can take as an independent contractor including health insurance home office deductions mileage and deductions for your phone

Feb 5 2025 nbsp 0183 32 What expenses are tax deductible for an independent contractor Self employed people can take numerous potential deductions since they foot the bill for their business expenses Home office expenses If you work from home you can deduct the cost of your home office to reduce your taxable income A write off is when you claim tax deductions on the money spent as an independent contractor on eligible expenses For example the truck driver example from earlier can write off expenses related to their truck while the photographer can write off expenses related to

More picture related to What Expenses Can I Deduct As An Independent Contractor

Are You Unsure What Expenses Are Deductible For You Business This

https://i.pinimg.com/736x/b9/76/ac/b976ac9170bf1f7f342c4f4eee6194f2.jpg

Save Yourself A Lot Of Money And Get This List This Cheat Sheet Has

https://i.pinimg.com/originals/8d/81/e0/8d81e0464430c01ba243468c905bdd81.jpg

FREE Estimated Tax Payments As An Employee Some Of Your Taxes Are

https://media.brainly.com/image/rs:fill/w:750/q:75/plain/https://us-static.z-dn.net/files/d45/72c4642ecf8835996215bc636d589382.png

Aug 16 2024 nbsp 0183 32 Along the same lines there are expenses you can write off as an independent contractor Doing so reduces your tax liability thus allowing you to keep more money in your pocket Of course with the IRS watching closely you must make sure that you only deduct qualified expenses Nov 7 2024 nbsp 0183 32 What Tax Deductions Can Independent Contractors Claim The key to lowering your tax bill is through tax deductions and there are a bunch of them for independent contractors One of the largest deductions you can take is the home office deduction which lets you deduct a portion of your home s expenses mortgage insurance utilities etc

Jul 15 2024 nbsp 0183 32 If you re an independent contractor you can reduce your tax bill by claiming write offs on your self employment income Here is a list of all the tax deductions available for independent contractors self employed personnel in the US along with where to include the relevant expenses on a specific schedule Mar 6 2025 nbsp 0183 32 Plenty of contractor deductions can lower taxable income from home office expenses to travel and marketing costs This guide covers 12 key tax deductions for independent contractors in 2025

FREE As An Employee Some Of Your Taxes Are Paid With Each Paycheck

https://media.brainly.com/image/rs:fill/w:750/q:75/plain/https://us-static.z-dn.net/files/d20/4672ffa96f7800df124f63ec70819555.jpg

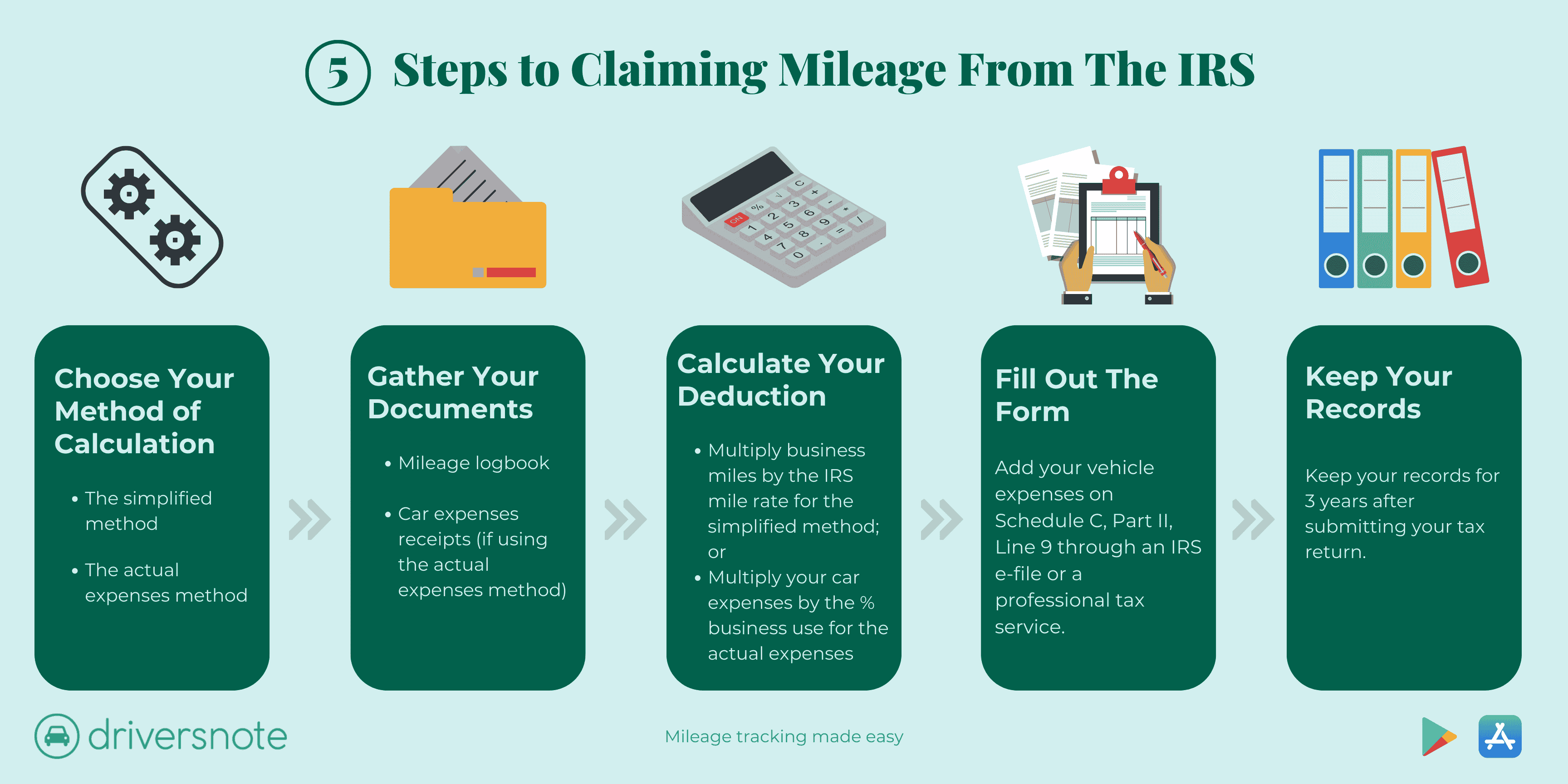

2024 Mileage Deduction Rate Sibby Othella

https://storage.googleapis.com/driversnote-marketing-pages/US-infographic-how-to-deduct-mileage-landscape.png

What Expenses Can I Deduct As An Independent Contractor - Feb 5 2025 nbsp 0183 32 What expenses are tax deductible for an independent contractor Self employed people can take numerous potential deductions since they foot the bill for their business expenses Home office expenses If you work from home you can deduct the cost of your home office to reduce your taxable income