What Expenses Can I Claim As An Independent Contractor Jun 30 2025 nbsp 0183 32 When you claim the GST HST you paid or owe on your business expenses as an input tax credit reduce the amounts of the business expenses by the amount of the input tax

Oct 1 2023 nbsp 0183 32 The excessive interest and financing expenses limitation EIFEL rules limit the deductibility of interest and financing expenses by affected corporations and trusts The rules Calculating motor vehicle expenses If you use a motor vehicle or a passenger vehicle for both business and personal use you can deduct only the portion of the expenses that relates to

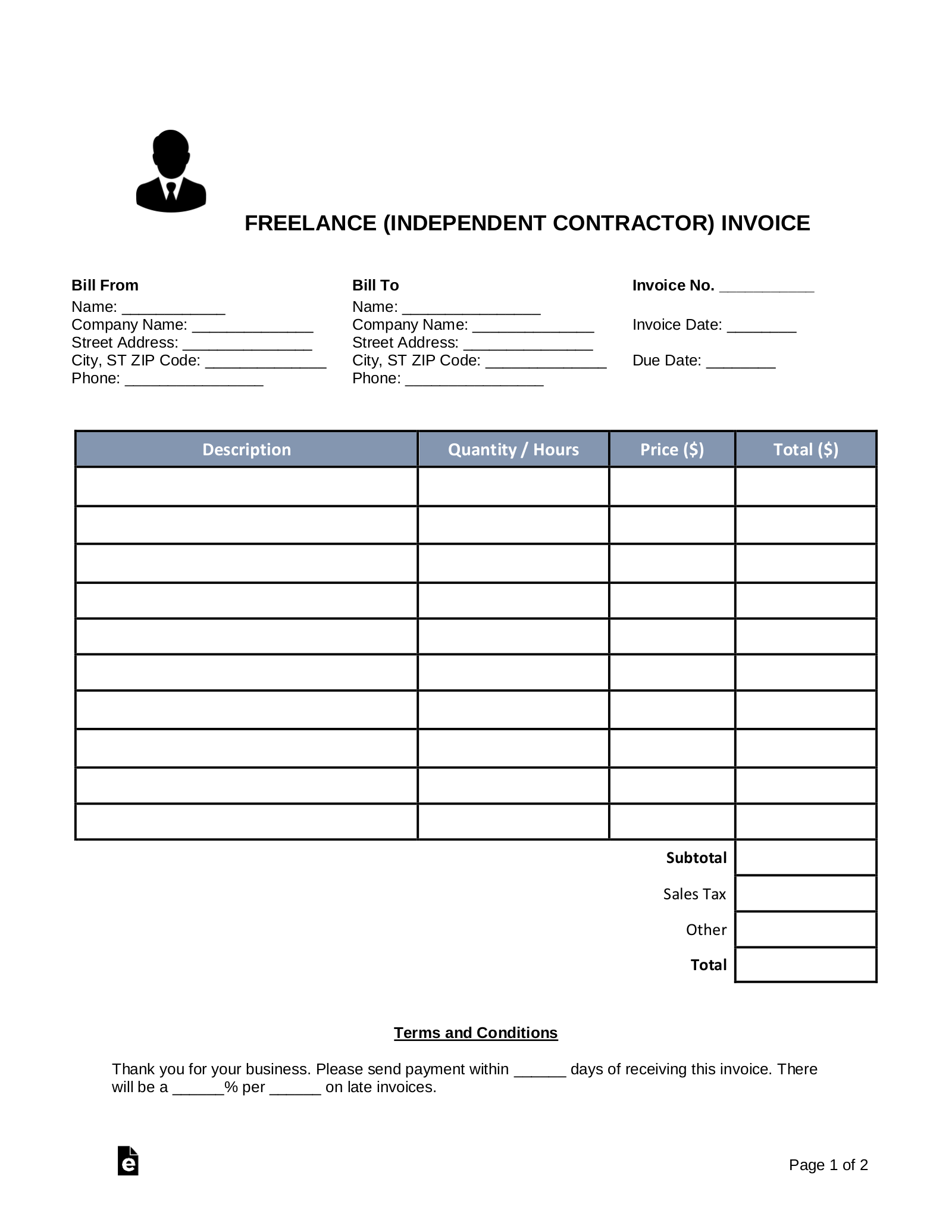

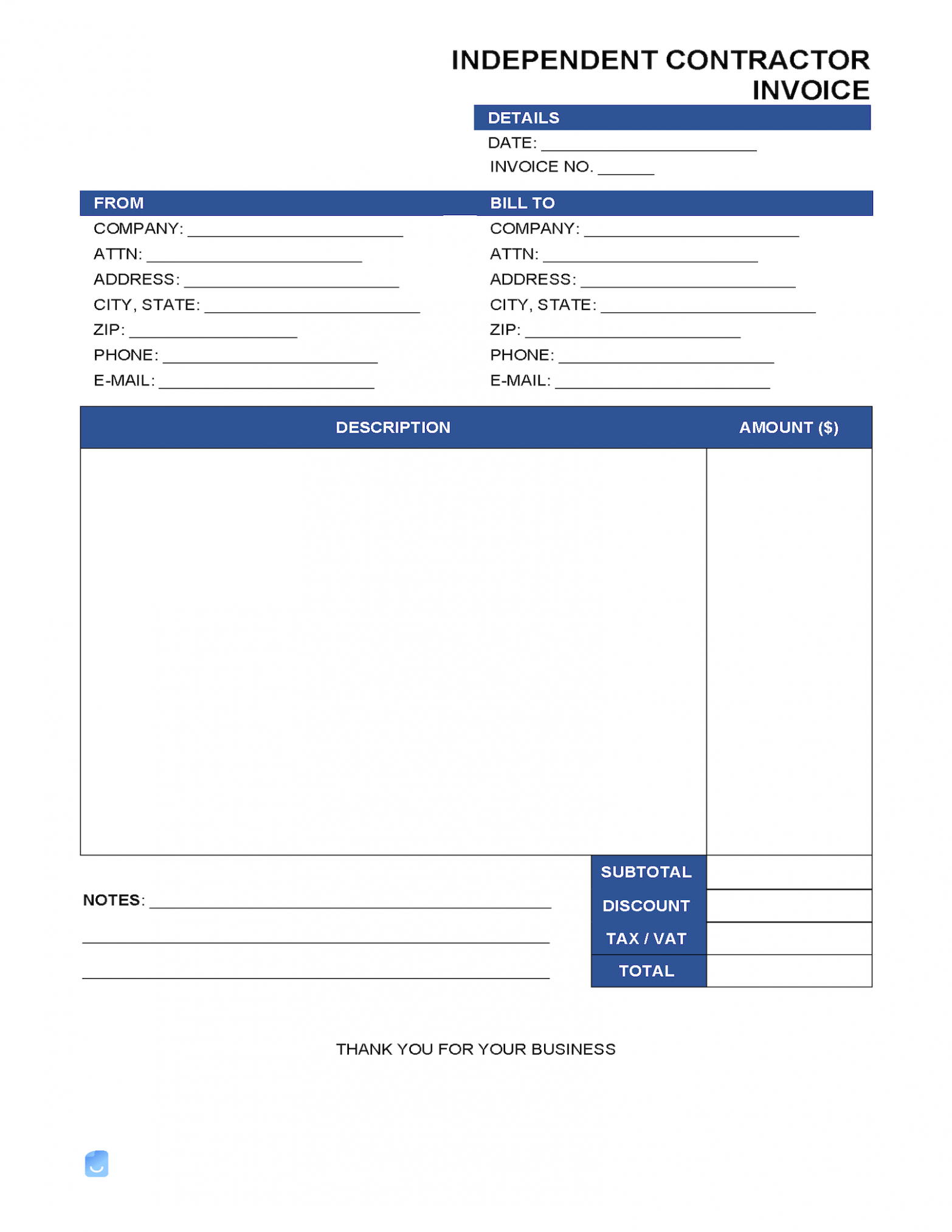

What Expenses Can I Claim As An Independent Contractor

What Expenses Can I Claim As An Independent Contractor

https://eforms.com/images/2016/10/freelance-independent-contractor-invoice-template.png

Excel Bill Tracker Template

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349af5f4a6db36bd21473a4_1099-excel-template.png

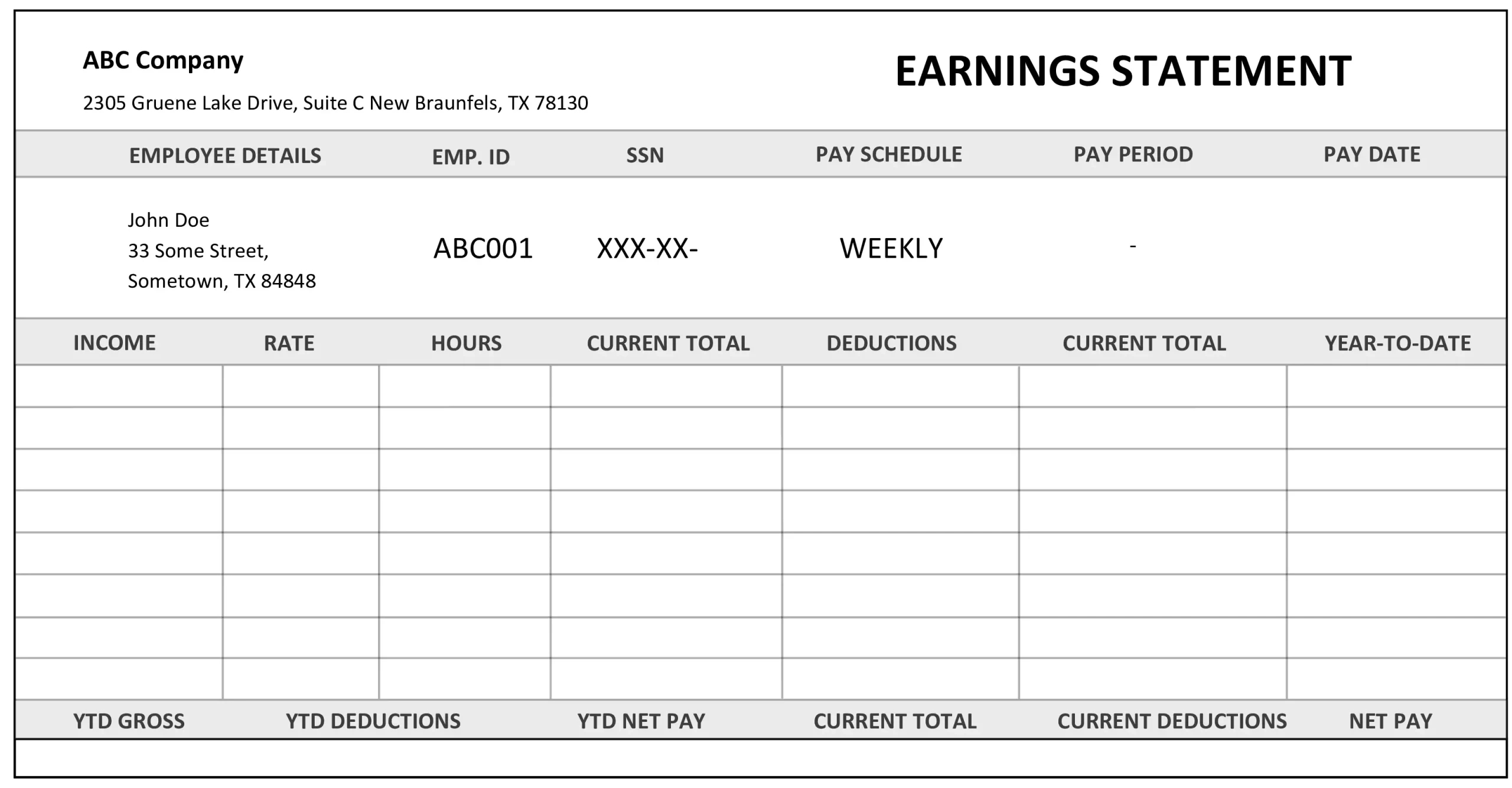

Paycheck Stub Template Sample Template Samples

https://templatesamples.net/wp-content/uploads/2024/08/independent-contractor-pay-stub-template-e289a1-fill-out-pdf-forms-online-inside-paycheck-stub-template-sample.webp

Use this form if you are an employee and your employer requires you to pay expenses to earn your employment income Feb 3 2025 nbsp 0183 32 Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later

Attendant care and care in a facilityAll regular fees paid for full time care in a nursing home or for specialized care or training in an institution are eligible as medical expenses including fees for Accrual expenses in the Fall Economic Statement are on a gross basis meaning the revenues are included in the accrual based revenue forecast while they are netted against expenditures

More picture related to What Expenses Can I Claim As An Independent Contractor

Landlords Rental Income And Expenses Tracking Spreadsheet

https://officetemplates.net/wp-content/uploads/2020/08/Rental-Property-Income-and-Expenses-Monthly-Profit-and-Loss.jpg

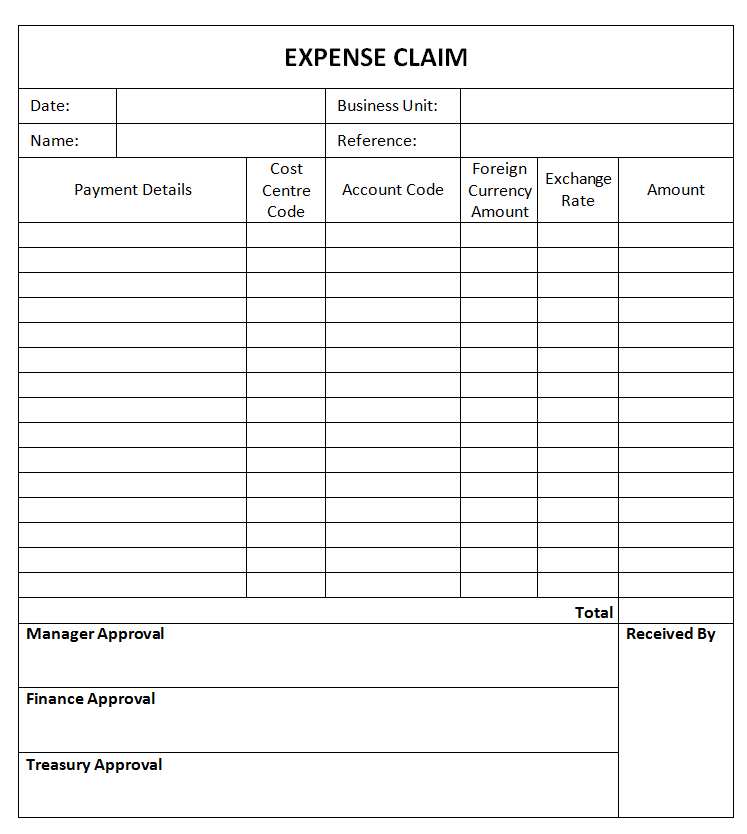

Expenses Claim Form Template

http://wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

Track Small Business Expenses In 5 Easy Steps

https://www.stampli.com/wp-content/uploads/2022/06/2-Common-expenses-1024x536.png

Jan 1 2024 nbsp 0183 32 The CRA will permit GST HST registrants to use factors for calculating ITCs on expenses charged to procurement cards and corporate credit cards provided they satisfy The expenses are related to the performance of their employment duties step 2 If the allowance or reimbursement you provide to your employee for travel expenses does not meet all of the

[desc-10] [desc-11]

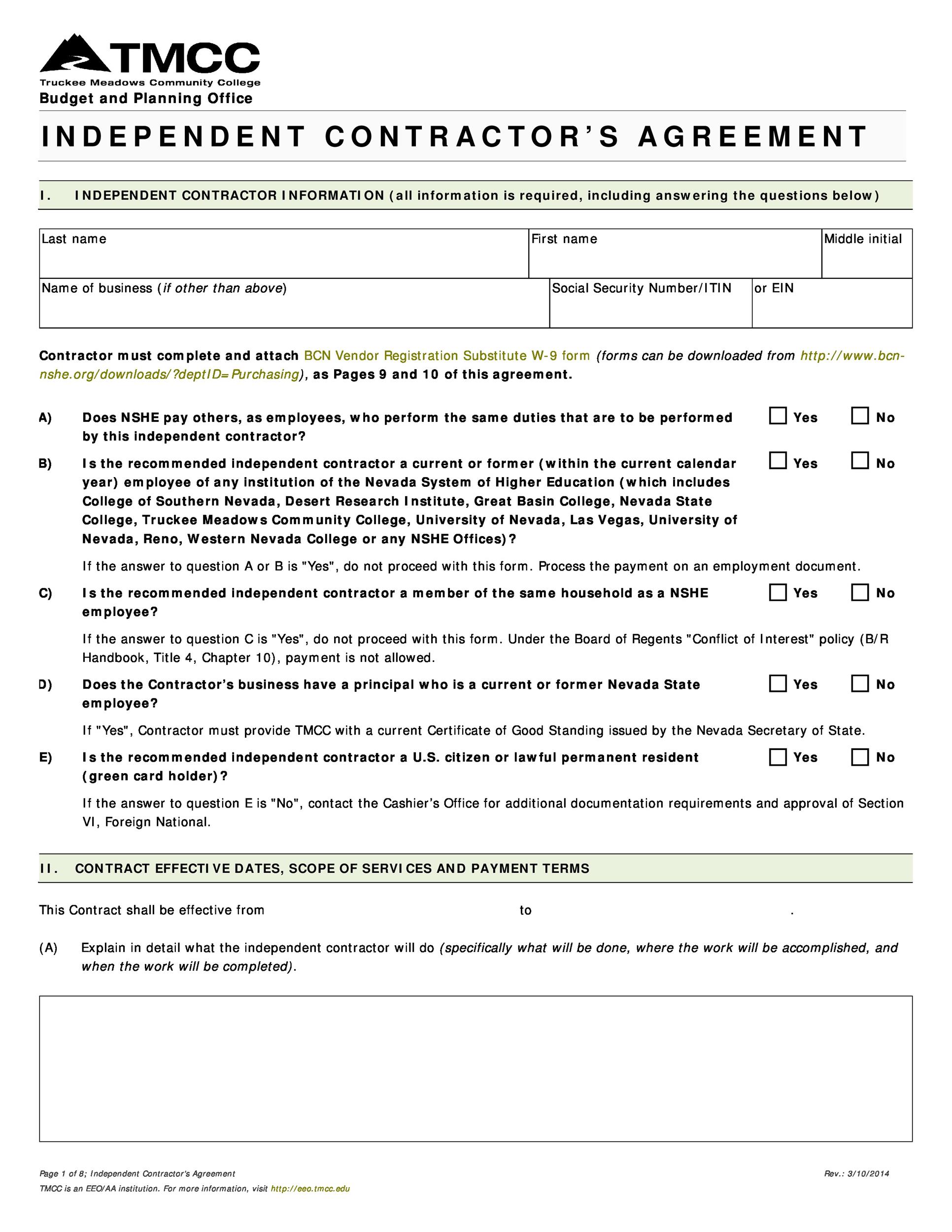

50 FREE Independent Contractor Agreement Forms Templates

http://templatelab.com/wp-content/uploads/2017/01/independent-contractor-agreement-44.jpg

Contract Employee Invoice Template

http://www.emmanuelbaccelli.org/wp-content/uploads/2022/10/printable-contract-employee-invoice-template-doc.png

What Expenses Can I Claim As An Independent Contractor - Feb 3 2025 nbsp 0183 32 Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later