Is Zakat Tax Exemption Mar 26 2025 nbsp 0183 32 Zakat is meant to be distributed entirely to the needy This means that the entire donation is supposed to go directly toward helping those in need The money cannot be kept

Feb 25 2022 nbsp 0183 32 Zakat al Mal The most common type of Zakat Zakat al Mal is the annual donation made on the the wealth of an individual The wealth include money in cash gold silver and Zakat spending as per the Quran on 8 categories of people Silver or gold coinage is one way of granting zakat Zakat or Zak h is one of the Five Pillars of Islam Zakat is the Arabic word

Is Zakat Tax Exemption

Is Zakat Tax Exemption

https://i.ytimg.com/vi/1Rc0qPtVff8/maxresdefault.jpg

Affidavit Of Zakat Exemption Sample Zakat Declaration 59 OFF

https://i.ytimg.com/vi/_1f8C8x9HAk/maxresdefault.jpg

Tax In KSA Income Tax Zakat And Other Taxes Simply 48 OFF

https://www.bmsauditing.com/upload/files/saudi-zakat-tax-and-customs-authority-exempts-taxpayers-from-fines-in-saudi-arabia.jpg

Jul 25 2024 nbsp 0183 32 Zakat is an Islamic finance term referring to the obligation that an individual donate a certain proportion of their wealth each year to charitable causes Zakat is mandatory for all Zakat must be paid as soon as it is due one lunar year from the anniversary of holding the nisab Only persons who meet a determined criteria are eligible to receive Zakat Zakat al Fitr rules

Zakat is not only a sacred pillar of Islam it has the power to ease the suffering of millions around the world Picture this if just the ten richest people in the world paid Zakat that would be a Mar 23 2025 nbsp 0183 32 Zakat al mal meaning zakat on wealth is the most commonly known form of zakat It is an obligation requiring Muslims whose wealth exceeds the nisab threshold to

More picture related to Is Zakat Tax Exemption

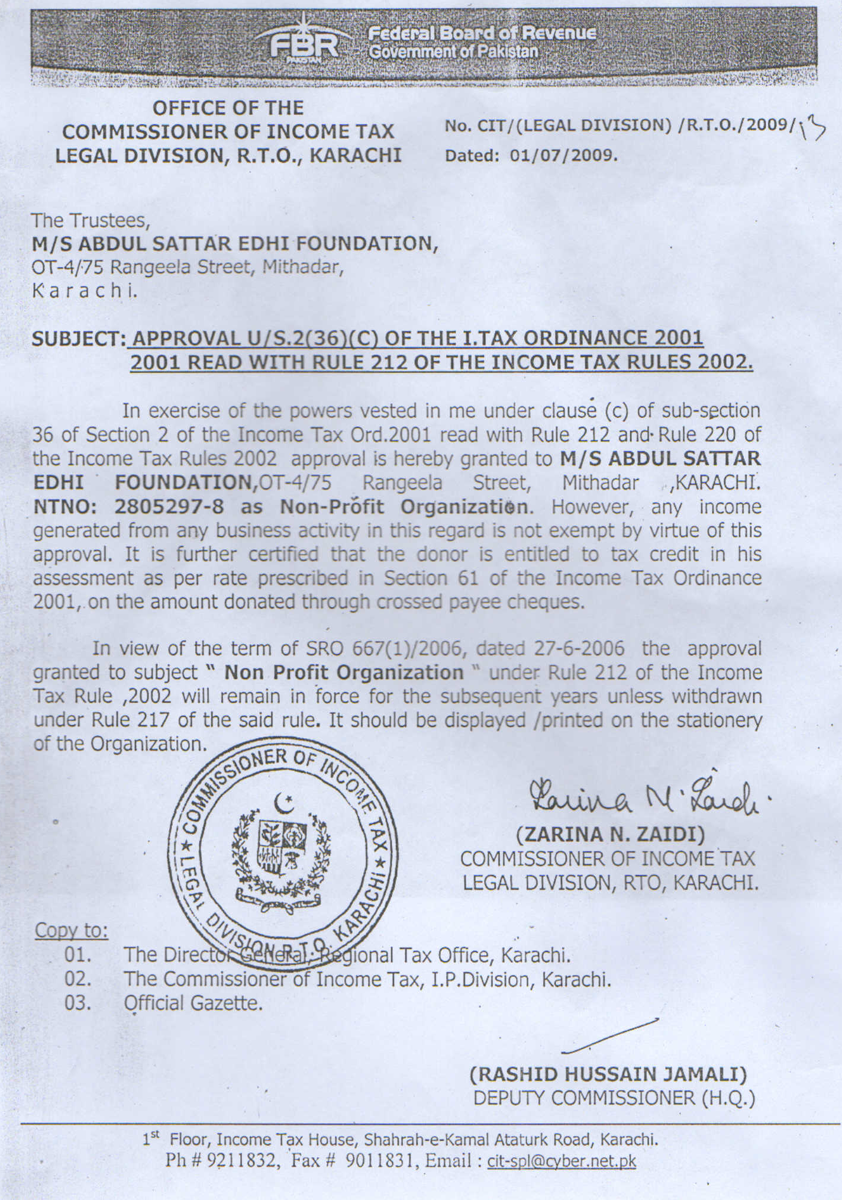

Exemption Certificate Edhi Welfare Organization

https://edhi.org/wp-content/uploads/2017/08/FBRCert.png

Zakat Tax

https://elayouty.com/wp-content/uploads/2024/06/zzz.jpg

https://cdn.media.amplience.net/i/xcite/VAT-certificate-1

Zakat administrators those responsible for collecting and distributing Zakat The needy al masakin individuals facing hardship The poor al fuqara those with little to no income Zakat is only obligatory upon wealth or assets that one has complete ownership over For example Zakat is payable for savings investments insurance gold and businesses Where

[desc-10] [desc-11]

https://www.afnan-co.com/wp-content/uploads/2022/08/Zakat-1-1024x719.png

News Report Islamic Real Estate Investment Trust Islamic REITs Ppt

https://slideplayer.com/slide/13660886/84/images/8/Issues+The+trust+is+merely+a+tax+advantage+tool+used+to+convert+an+asset+to+cash.+Hence%2C+there+are+no+real+Islamic+issues+in+REITs..jpg

Is Zakat Tax Exemption - [desc-13]