Income Tax Pdf Notes In Hindi How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must

Jul 1 2025 nbsp 0183 32 The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government tables a Motion to The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

Income Tax Pdf Notes In Hindi

Income Tax Pdf Notes In Hindi

https://i.pinimg.com/originals/b9/30/60/b93060810912e52c246a6906d071f04e.gif

Class 11 Biology Chapter 1 The Living World NCERT Biology Class

https://i.ytimg.com/vi/ryiS5XdFbfo/maxresdefault.jpg

Ba 4th Semester Hindi Chapter 2 Class2 Ba 4th Semester Hindi

https://i.ytimg.com/vi/TkEbvOefTaQ/maxresdefault.jpg

If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery Formerly known as Climate action incentive payment Basic amount and rural supplement for residents of Alberta Manitoba New Brunswick Newfoundland and Labrador Nova Scotia

2 49 In broad terms the enhanced dividend gross up and dividend tax credit apply to dividends distributed to an individual from corporate income taxed at the general corporate income tax Your income It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year 86 912 for

More picture related to Income Tax Pdf Notes In Hindi

Essay On Computer In Hindi Computer Par Nibandh

https://i.ytimg.com/vi/8ikyRALx7vU/maxresdefault.jpg

Course Notes Bible Study Downloads

https://biblestudydownloads.org/wp-content/uploads/2015/10/Bible-Geography-296_eng_cn_7801_v1.0.0.jpg

Course Notes Bible Study Downloads

https://biblestudydownloads.org/wp-content/uploads/2015/10/Discipleship_Ministries_EN_1-291_eng_cn_v2.jpg

If you are reporting only Canadian source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from The personal income levels used to calculate your Manitoba tax have changed The basic personal amount has changed The maximum annual amount of eligible expenses for fertility

[desc-10] [desc-11]

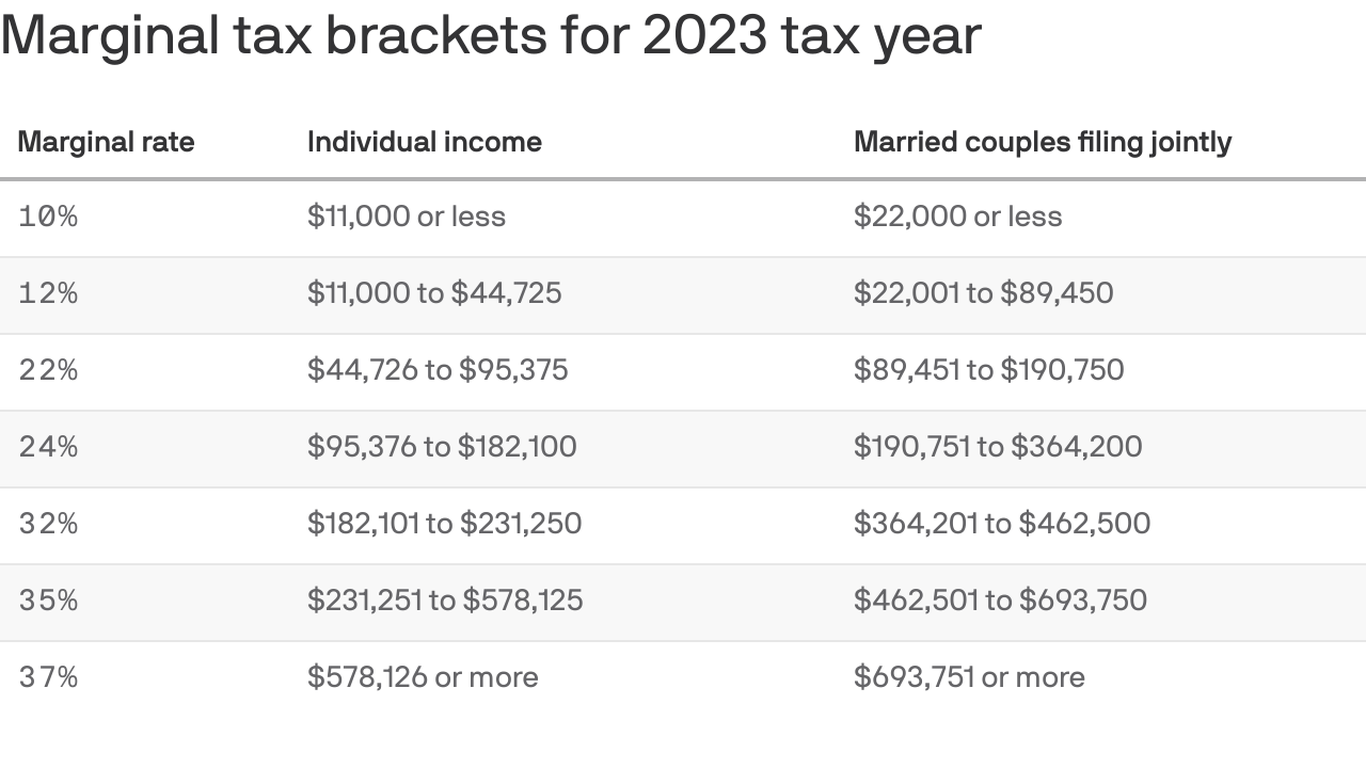

2025 Tax Leo S Fawkner

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974.png

2025 Fed Tax Brackets Ian S Burnham

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

Income Tax Pdf Notes In Hindi - If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery