Income Tax Law And Accounts Notes In Hindi Pdf The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a

Income Tax Law And Accounts Notes In Hindi Pdf

Income Tax Law And Accounts Notes In Hindi Pdf

https://i.ytimg.com/vi/pQ3jRAqWlfg/maxresdefault.jpg

INCOME TAX LAW AND ACCOUNTS Previous Year Question Papper important

https://i.ytimg.com/vi/y-D_r4DaAGA/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLBffT7xCMeXoYMLZnsqNINOkhUnRQ

Introduction Part 1 Basic Concept Of Income Tax Income Tax Law

https://i.ytimg.com/vi/BFbY-9aXX0Q/maxresdefault.jpg

If you receive federal benefits including some provincial territorial benefits you will receive payment on these dates If you set up direct deposit payments will be deposited in your This Chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in Canada focusing on dividends received by individuals and corporations who are

How does the recovery tax deduction work Once your Old Age Security Return of Income form is received the net world income you report is used to estimate your Old Age Security OAS The personal income levels used to calculate your British Columbia tax have changed The amounts for most provincial non refundable tax credits have changed The training tax credit

More picture related to Income Tax Law And Accounts Notes In Hindi Pdf

Income Tax Unit 3 4 Income Tax Law And Accounts Mcq income Tax Law

https://i.ytimg.com/vi/Z_4MbjDwsps/maxresdefault.jpg

INCOME TAX LAW ACCOUNTS Prashn Bank

https://prashnbank.csjmu.ac.in/wp-content/uploads/2024/05/Income-tax-law-and-accounts-dr-vishal-saksena.jpg

Chart Of Accounts A Simple Guide

https://i.pinimg.com/originals/37/55/14/3755142c799c90d0d716787f92d15e37.png

Personal income tax Manitoba tax information for 2024 Use the information on this page to help you complete your provincial tax and credits form General information for corporations on how to complete page 3 of the T2 Corporation Income Tax Return

[desc-10] [desc-11]

BCOM SEM VI Income Tax Law And Accounts Unit I Part

https://i.ytimg.com/vi/96qEHmA32QQ/maxresdefault.jpg

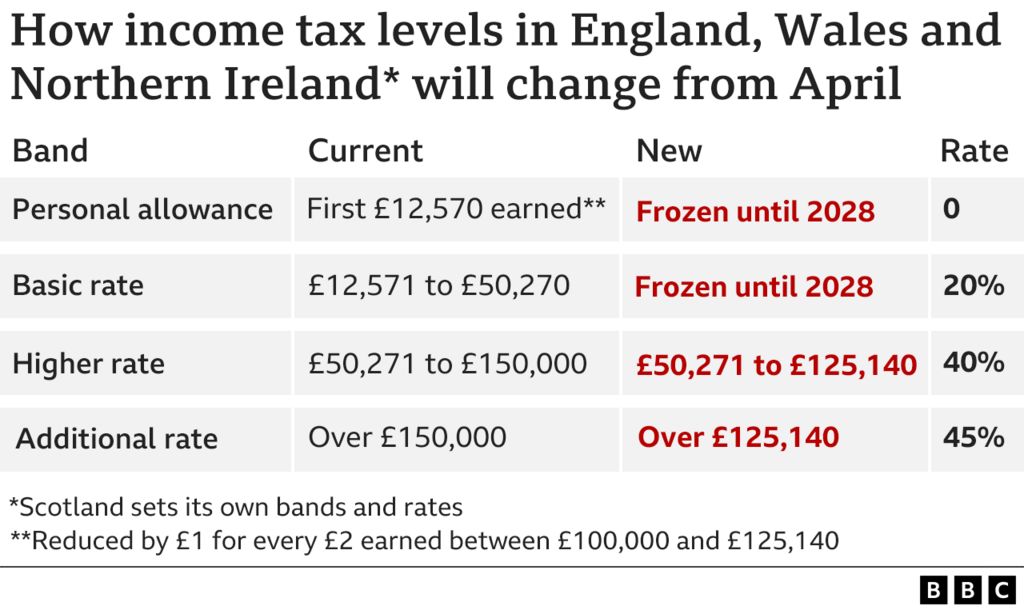

Uk Income Tax Rates 2024 25 Debi Mollie

https://ichef.bbci.co.uk/news/1024/cpsprodpb/17D8C/production/_127667679_income_tax_bands_17_11_640_x2-nc-2.png

Income Tax Law And Accounts Notes In Hindi Pdf - If you receive federal benefits including some provincial territorial benefits you will receive payment on these dates If you set up direct deposit payments will be deposited in your