Zakat Exemption Rules In Pakistan Feb 25 2022 nbsp 0183 32 What is zakat It is the religious obligation on Muslims to distribute a portion of their wealth in eight different categories of receivers There are five essential pillars in Islam which

Jul 25 2024 nbsp 0183 32 Zakat is an Islamic financial term that obligates Muslims to donate a portion of their wealth to charitable causes While the practice is mandatory in many Islamic nations some Mar 26 2025 nbsp 0183 32 Zakat is the third pillar of Islam and refers to the obligation of a Muslim individual to donate a certain portion 2 5 of their wealth to those in need each year In most countries

Zakat Exemption Rules In Pakistan

Zakat Exemption Rules In Pakistan

https://imgv2-2-f.scribdassets.com/img/document/419913457/original/64784d4ece/1707730104?v=1

Solemn Affirmation For Zakat Exemption By Non Muslims PDF

https://imgv2-2-f.scribdassets.com/img/document/724021511/original/6e28617084/1713527397?v=1

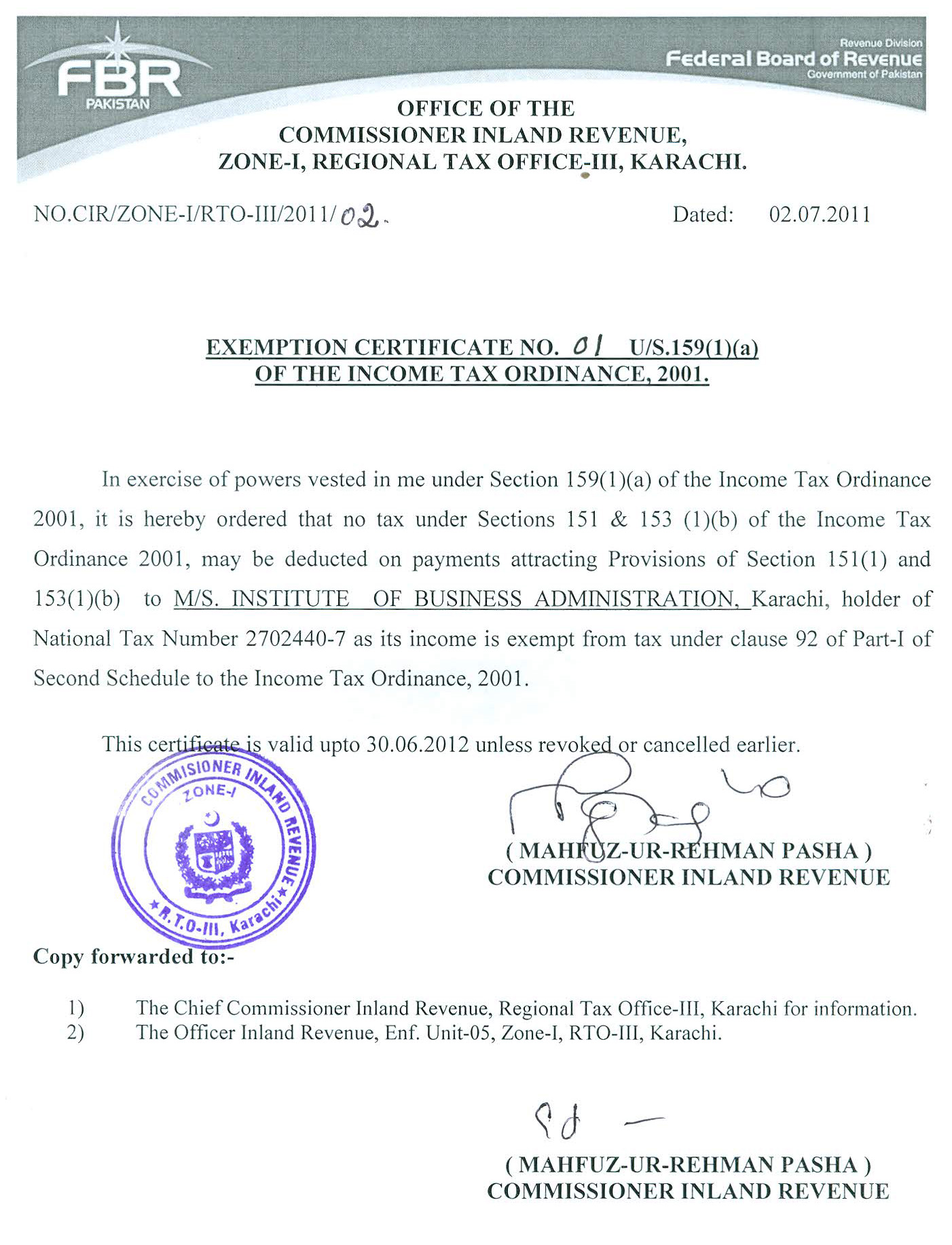

Income Tax Exemption Certificate 2011 12

https://www.iba.edu.pk/News/tax/images/Income_Tax_Exemption_Certificate.jpg

Jan 2 2025 nbsp 0183 32 Zakat is one of the Five Pillars of Islam signifying a critical act of worship and social responsibility for Muslims It is a mandatory charitable contribution designed to purify wealth Fourth of the 5 Pillars of Islam is known as Zakat in Islam which is a way to purify one s wealth It is obligatory on all Muslims who fall under the category of Nisab to give Zakat to poor and needy

Zakat refers to two types Zakat al Mal and Zakat al Fitr Zakat al Mal is the obligatory annual payment that can be made at any time However Zakat al Fitr Fitrana must be made during Aug 1 2022 nbsp 0183 32 Zakat functions as the primary socio financial institution of the global Muslim community It aims at annually recalibrating the just human balance in society fostering

More picture related to Zakat Exemption Rules In Pakistan

Can We Submit Donation Slips Of Zakat Or Charity To Get Tax Deductions

https://i.ytimg.com/vi/rK7hy2_qMdI/maxresdefault.jpg

What Is The Zakat Exemption Form What Is CZ 50 Form How To Save An

https://i.ytimg.com/vi/pmITeqFlN3c/maxresdefault.jpg

Zakat Deduction From Bank Accounts Exemption From Zakat YouTube

https://i.ytimg.com/vi/fHIH7VUcl9k/maxresdefault.jpg

Zakat is an obligatory act ordained by Allah The Glorified and Exalted to be performed by every adult and able bodied Muslim It is an important pillar among the five pillars of Islam Zakat is a Zakat stands as the third pillar of Islam and is obligatory for every financially capable Muslim whose income meets or exceeds the prescribed amount by Sharia Nisaab in addition to their

[desc-10] [desc-11]

Zakat Declaration Form Stamp Paper To Avoid Zakat Deduction YouTube

https://i.ytimg.com/vi/_1f8C8x9HAk/maxresdefault.jpg

TUTORIAL MEMBUAT FORM KARTU ZAKAT FITRAH DI MICROSOFT WORD YouTube

https://i.ytimg.com/vi/-Iih-_hP6BA/maxresdefault.jpg

Zakat Exemption Rules In Pakistan - [desc-14]