What Screenwriting Software Do Professionals Use Feb 28 2025 nbsp 0183 32 Once HMRC has details of dividends from Close Companies the Government will finally be able to solve the IR35 problem It can just make close company dividends liable to employee and or employer NI contributions

May 20 2025 nbsp 0183 32 However with HMRC s many rules and updates understanding how this process operates can be confusing for both you and your employees This blog aims to offer a complete guide on everything you need to know regarding HMRC mileage reimbursement rates in 2025 What is HMRC s mileage allowance Mar 26 2025 nbsp 0183 32 HMRC is now working with us other professional bodies and the software houses to try to identify possible gaps in provision and improve guidance Key to this will be a redesign of HMRC s software list so that those affected especially the unrepresented can make fully informed choices

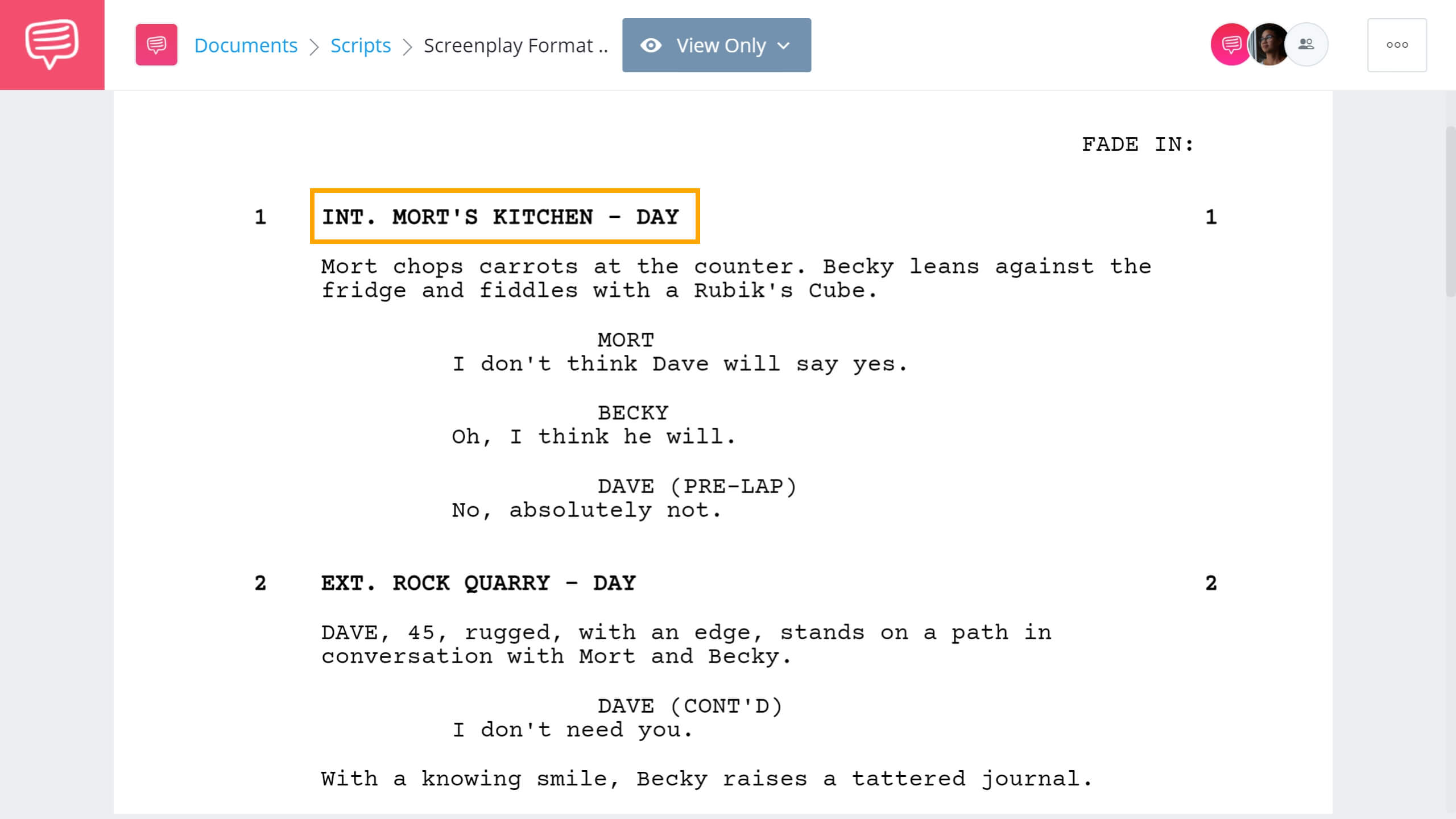

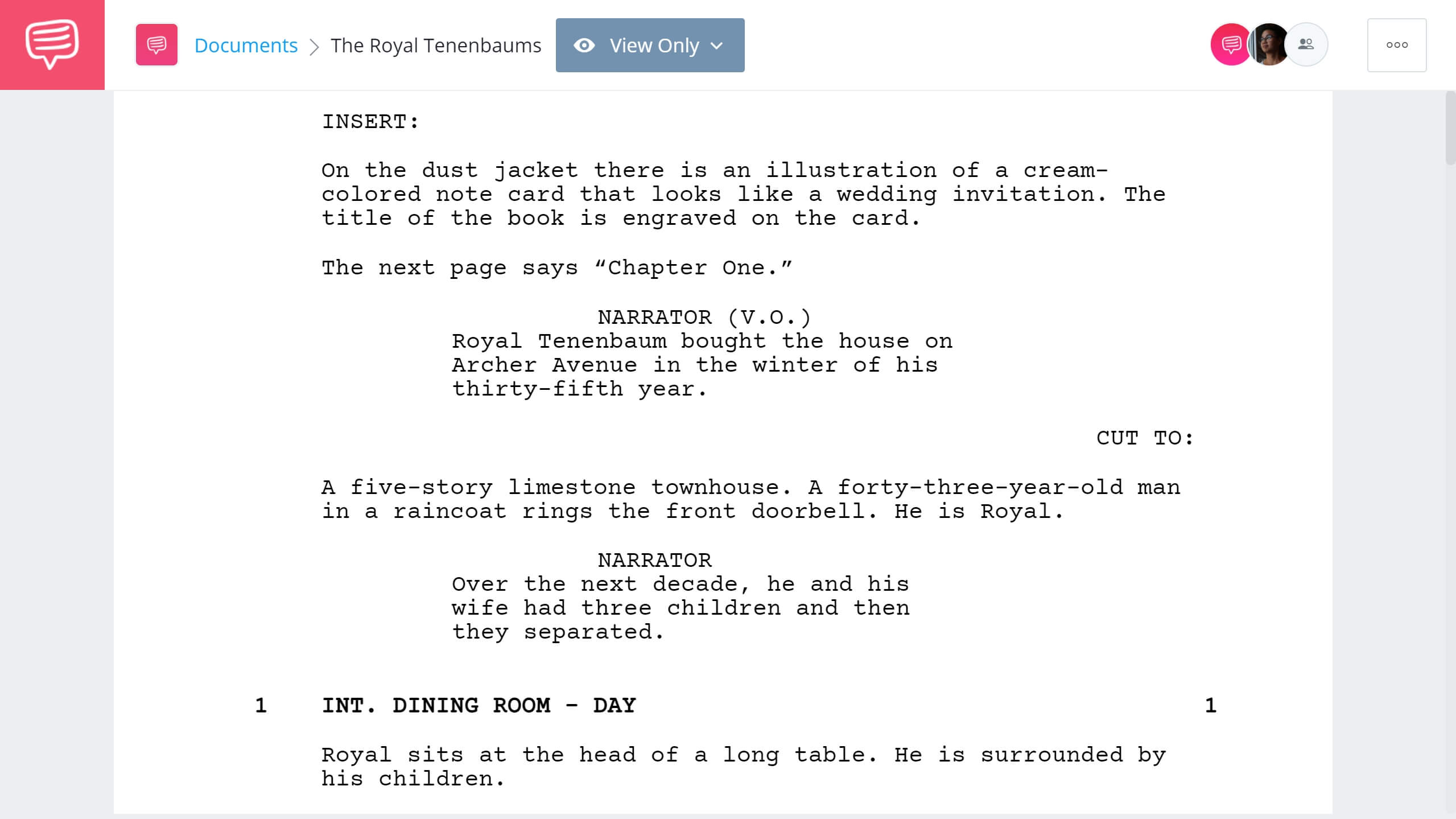

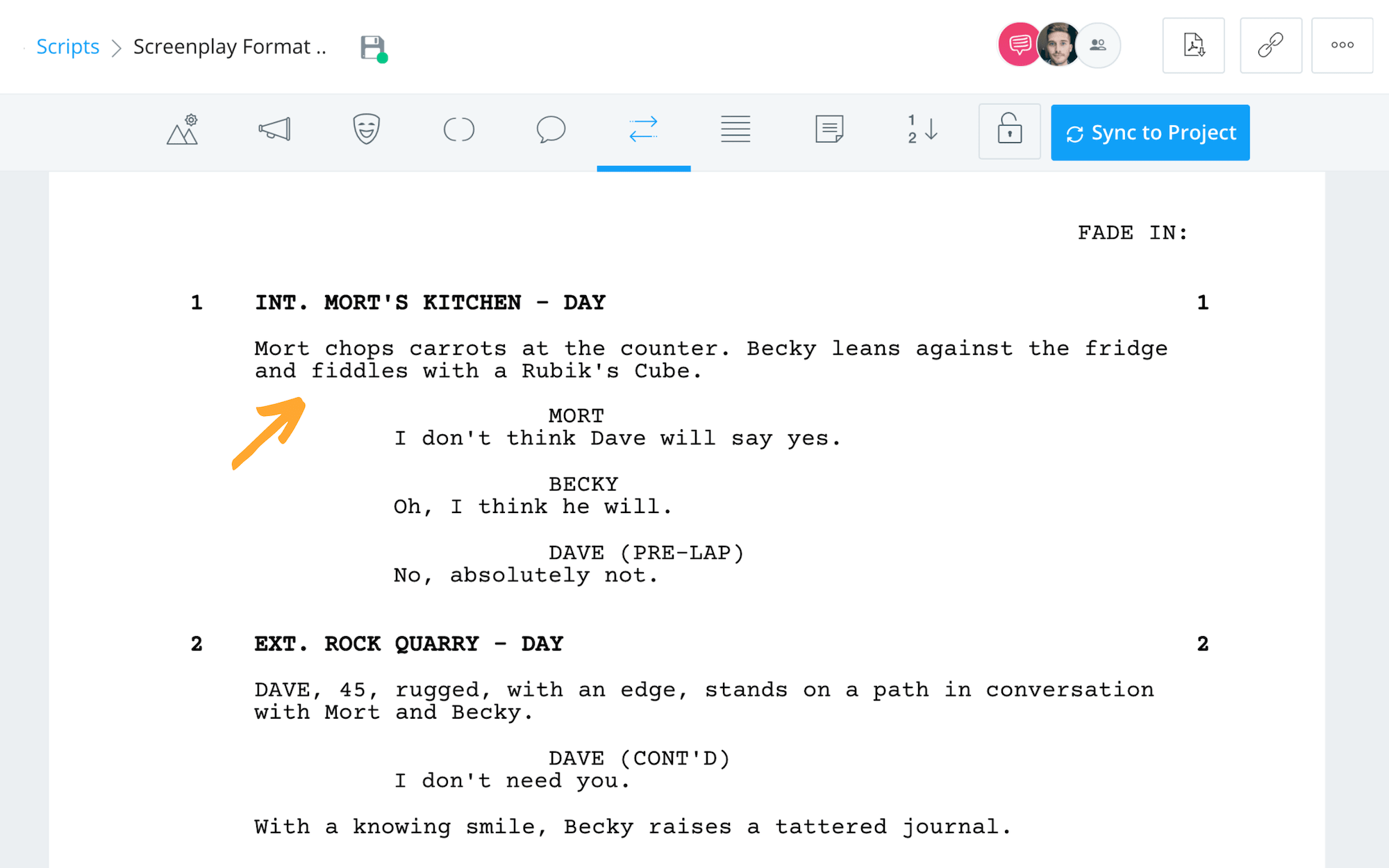

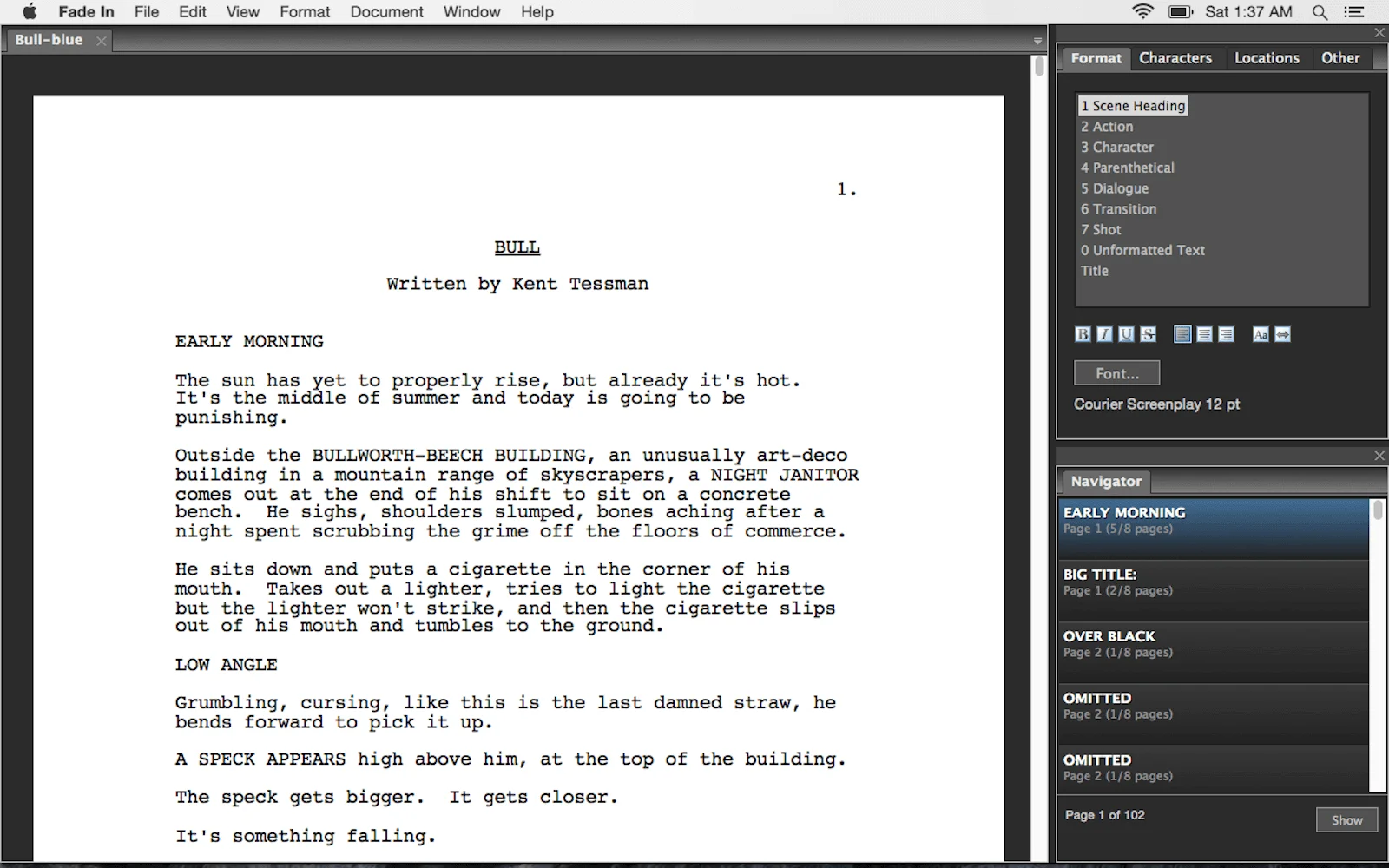

What Screenwriting Software Do Professionals Use

What Screenwriting Software Do Professionals Use

https://startupstash.com/wp-content/uploads/2022/11/Formatting-a-Screenplay-Screenplay-Format-Sluglines-StudioBinder-Screenwriting-Software.jpg

188job

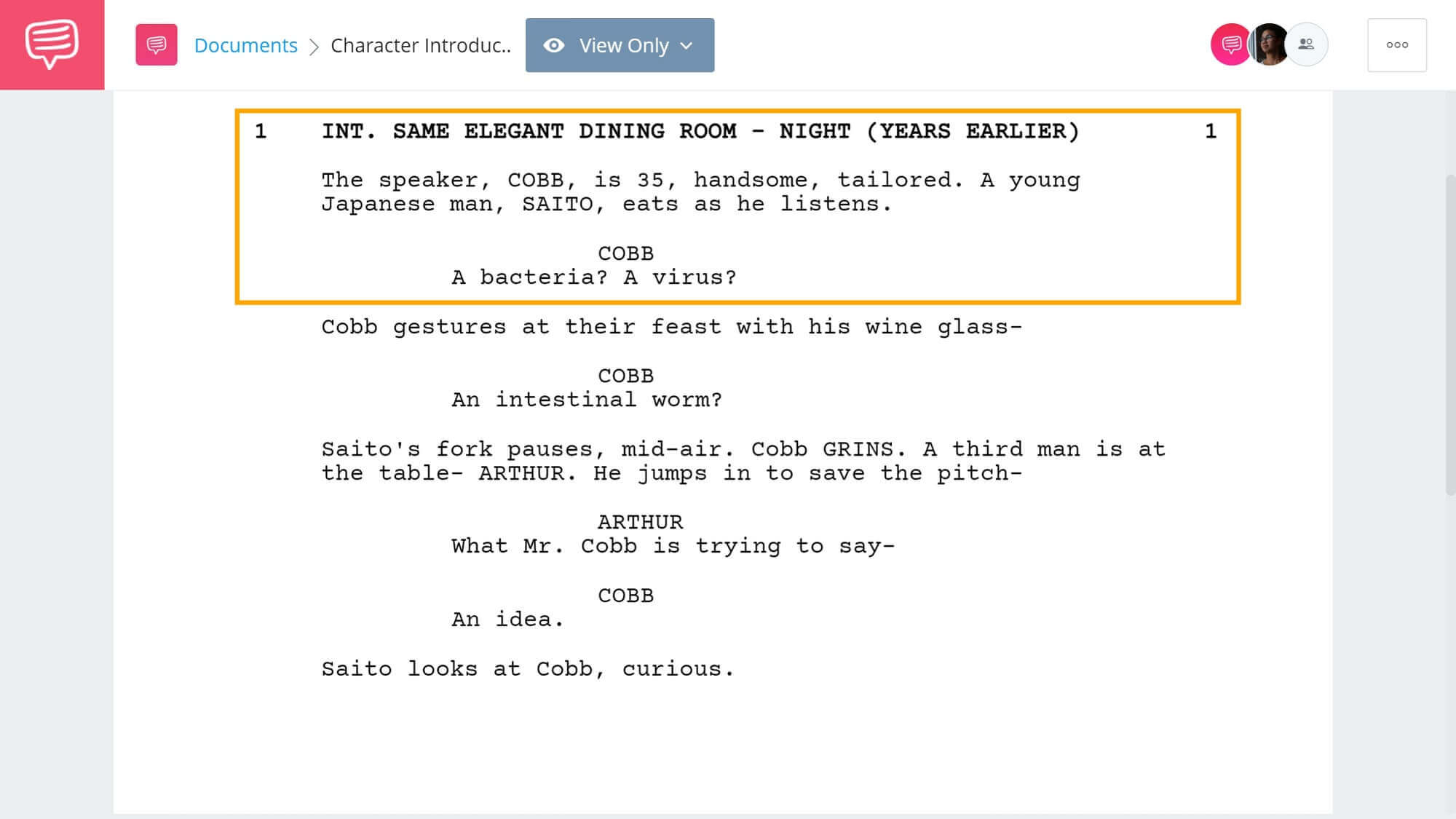

https://s.studiobinder.com/wp-content/uploads/2021/02/Character-Introductions-Inception-Character-Introduction-StudioBinder-Screenwriting-Software.jpg

188job

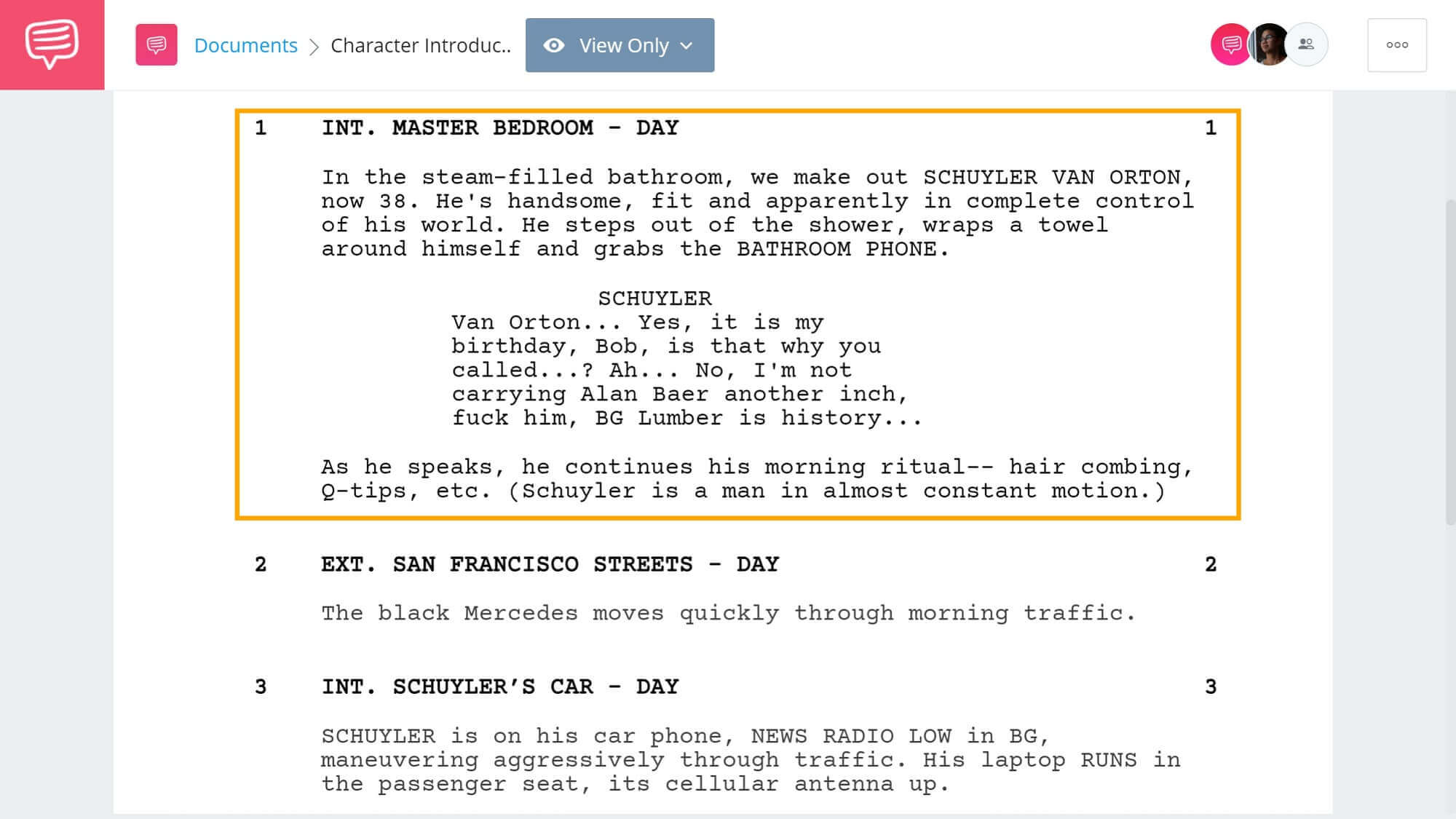

https://s.studiobinder.com/wp-content/uploads/2021/02/Character-Introductions-The-Game-Character-Introduction-StudioBinder-Screenwriting-Software.jpg

Apr 17 2025 nbsp 0183 32 From HMRC s tax calculation guidance notes page TCSN35 Class 2 NICs You pay Class 2 contributions if you re self employed Class 2 contributions are 163 3 45 a week or 163 4 10 for share fishermen for 2024 to 2025 If your profits D12 are below 163 6 725 for 2024 to 2025 you can elect to pay Class 2 NICs voluntarily Jan 21 2025 nbsp 0183 32 Practical issues These relaxations appear pragmatic if complex However practical challenges remain Only reporting income each quarter and not expenses means HMRC s tax estimates are likely to be highly inaccurate for joint property owners In addition as a single MTD quarterly update is made for the whole property business where a taxpayer has a

Aug 5 2025 nbsp 0183 32 Draft legislation on mandatory registration for tax advisers introduces some potentially very wide changes that could affect anyone providing tax Aug 19 2025 nbsp 0183 32 Have you found this content useful Use the button above to save it to your profile Eight years after the failure to prevent the facilitation of tax evasion offences were introduced HMRC has finally brought its first ever corporate prosecution and the defendant is an accountancy firm Bennett

More picture related to What Screenwriting Software Do Professionals Use

Csgo

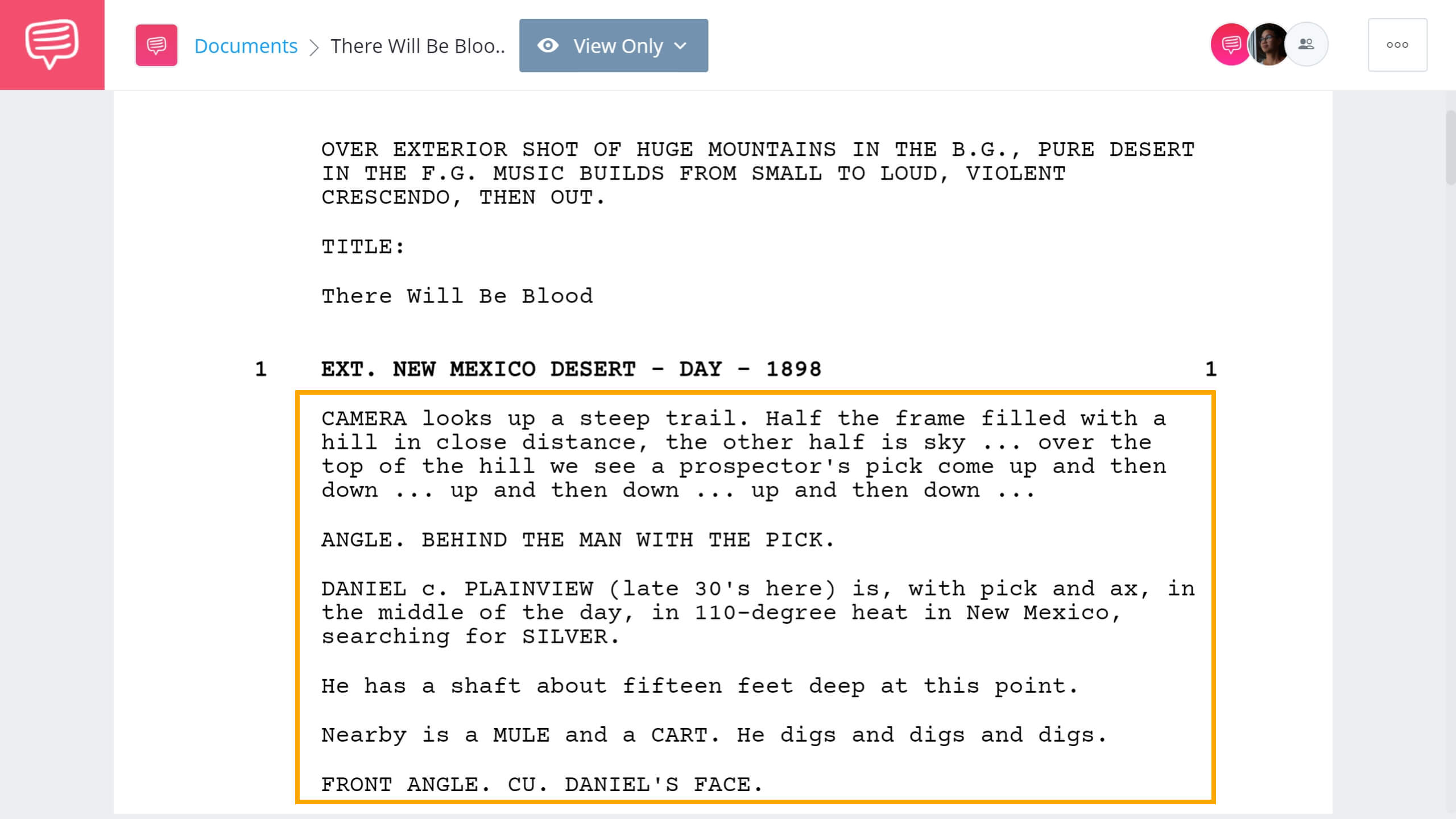

https://s.studiobinder.com/wp-content/uploads/2021/08/Formatting-a-Screenplay-There-Will-Be-Blood-Example-StudioBinder-Screenwriting-Software.jpg

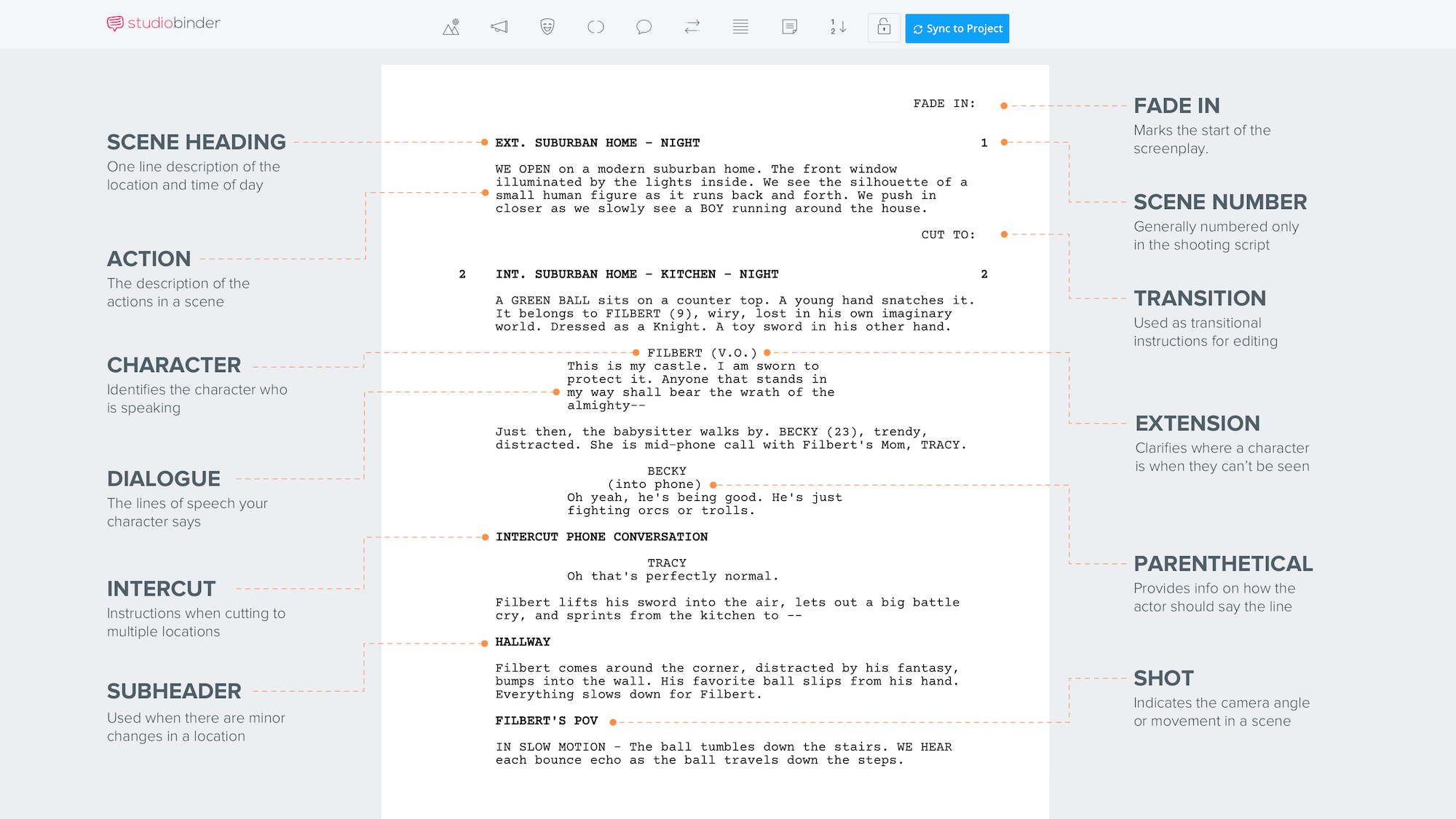

Parts Of A Movie Script

https://s.studiobinder.com/wp-content/uploads/2019/06/How-to-Format-a-Screenplay-StudioBinder-Scriptwriting-Software.png?resolution=1440,1

188job

https://s.studiobinder.com/wp-content/uploads/2021/03/The-Royal-Tenenbaums-Script-StudioBinder-Screenwriting-Software-1.jpg

Dec 19 2024 nbsp 0183 32 A new name will be soon chiselled onto the chief executive s door in the halls of HMRC That name is John Paul Marks Jun 5 2025 nbsp 0183 32 HMRC has lost 163 47m to a sophisticated fraud after cybercriminals used stolen personal data to access or create tens of thousands of online tax accounts

[desc-10] [desc-11]

188job

https://s.studiobinder.com/wp-content/uploads/2019/07/Formatting-a-Screenplay-Screenplay-Format-Action-Lines-StudioBinder-Screenwriting-Software.png

2021 Csgo

https://s.studiobinder.com/wp-content/uploads/2018/04/Best-Screenwriting-Software-for-Film-and-TV-Fade-In-Script-Writing-Software.png.webp?x25081&resolution=1680,2&resolution=2560,2

What Screenwriting Software Do Professionals Use - Aug 19 2025 nbsp 0183 32 Have you found this content useful Use the button above to save it to your profile Eight years after the failure to prevent the facilitation of tax evasion offences were introduced HMRC has finally brought its first ever corporate prosecution and the defendant is an accountancy firm Bennett