What Is Valuation In Investment Banking Explore CFI s valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth

Thus valuation is an important part of mergers and acquisitions M amp A as it guides the buyer and seller to reach the final transaction price Below are three major valuation methods that are FMVA 174 Program Overview CFI s Financial Modeling amp Valuation Analyst FMVA 174 Certification imparts vital financial analysis skills emphasizing constructing effective financial models for

What Is Valuation In Investment Banking

What Is Valuation In Investment Banking

https://i.ytimg.com/vi/0e_9FwBih-Q/maxresdefault.jpg

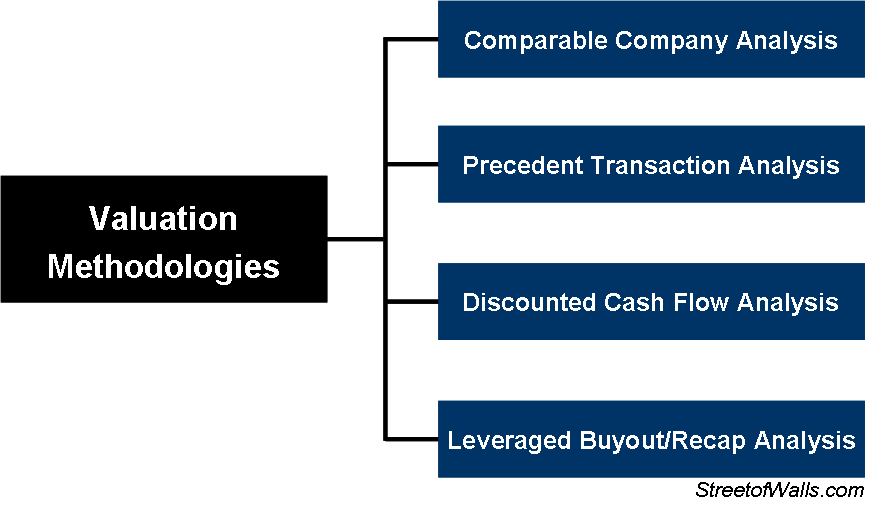

Investment Banking Valuations Street Of Walls

https://www.streetofwalls.com/wp-content/uploads/2011/09/Investment-Banking-Valuations.png

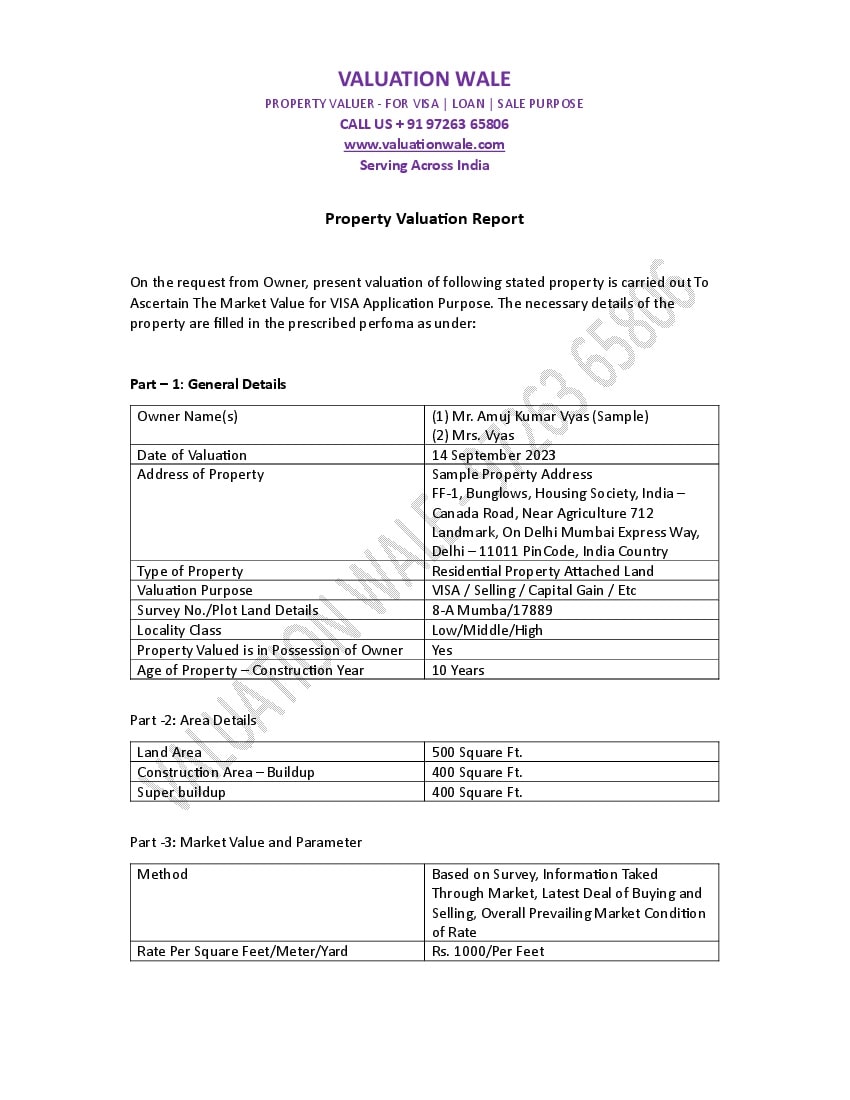

Property Valuation Report Format Property Valuer Report Sample

https://valuationwale.com/wp-content/uploads/2023/09/Property-Valuation-Report-Sample-Page-1.jpg

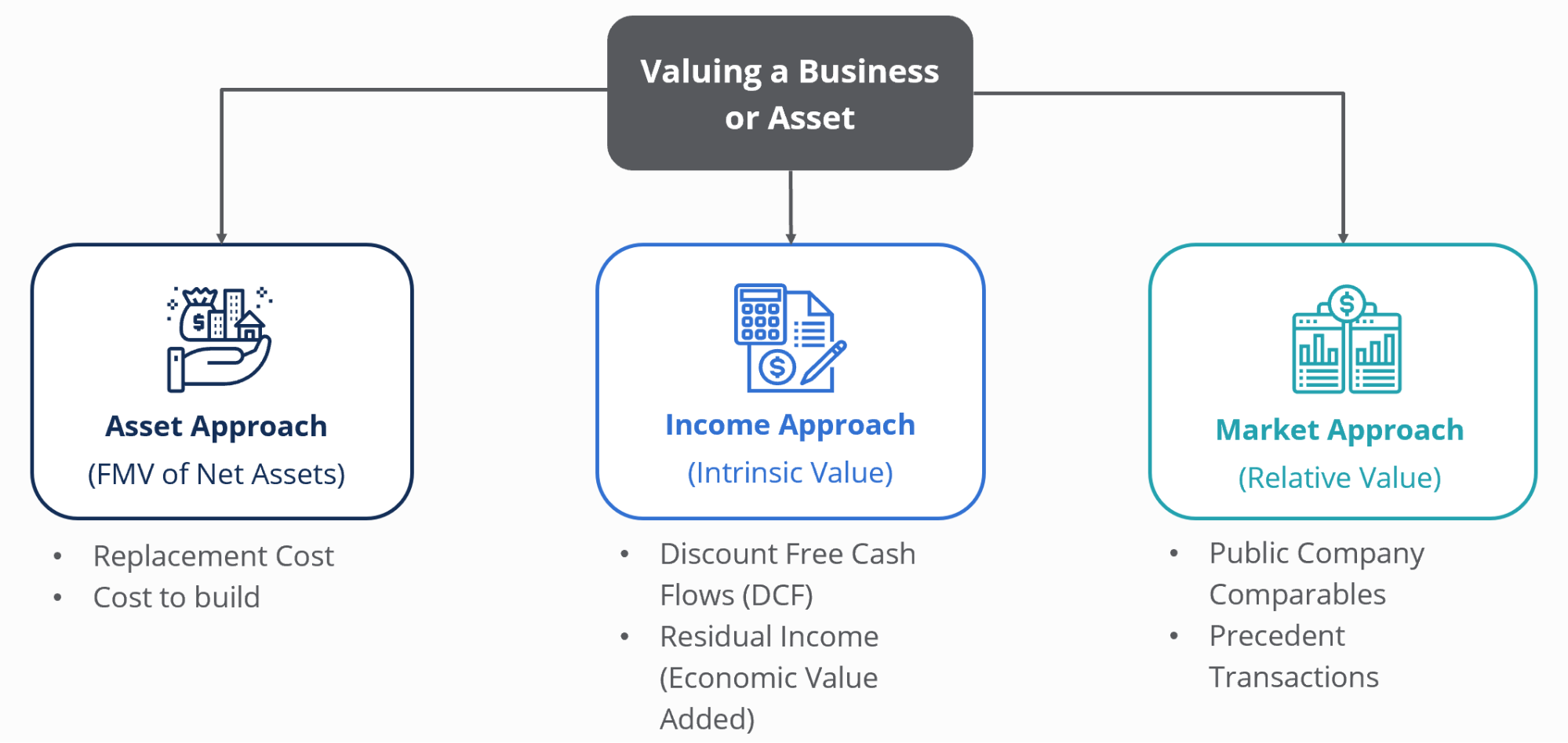

What are Valuation Principles Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value divorce litigation and The market approach is a valuation method used to determine the appraisal value of a business intangible asset business ownership interest or security by

The EBITDA multiple is a financial ratio that compares a company s Enterprise Value to its annual EBITDA Business Valuation Glossary This business valuation glossary covers the most important concepts to know in valuing a company This guide is part of CFI s Business Valuation

More picture related to What Is Valuation In Investment Banking

:max_bytes(150000):strip_icc()/business-valuation_final-081359e950444aaaa0326a3b512310c1.png)

Company Business

https://www.investopedia.com/thmb/z5Tr6xskUdhJLvdUqF5rL9yWNWc=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/business-valuation_final-081359e950444aaaa0326a3b512310c1.png

Benefits Of The Valuation Football Field ONEtoONE Corporate Finance

https://www.onetoonecf.com/wp-content/uploads/sites/10/2022/06/Valuation-Football-Field.jpg

Discounted Cash Flow DCF Sutton Capital

https://cdn.substack.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/0cfd85db-8e9c-4fec-9d62-5fec8108cd8d_1180x820.png

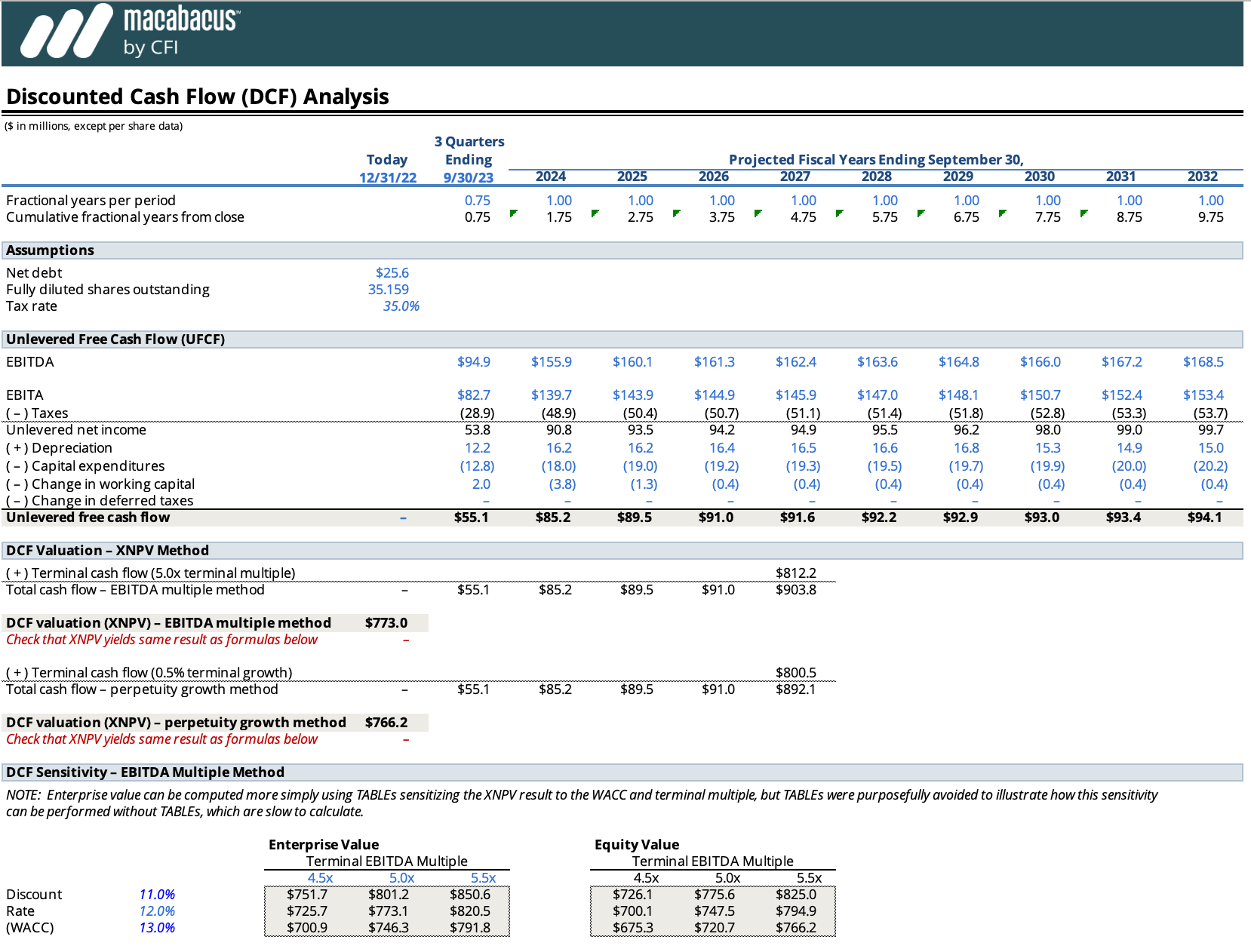

The comparable multiples valuation modeling approach in Excel is very different from that of a DCF model With this method instead of determining a company s intrinsic value as above An equity research report is a document prepared by an analyst that provides a recommendation for investors to buy hold or sell shares of a company

[desc-10] [desc-11]

Business Valuations Fundamentals Techniques And Theory DerivBinary

https://cdn.corporatefinanceinstitute.com/assets/valuation-business-asset.png

Cashflow Excel Template

https://macabacus.com/assets/2021/11/discounted-cash-flow-template.png

What Is Valuation In Investment Banking - The market approach is a valuation method used to determine the appraisal value of a business intangible asset business ownership interest or security by