What Is Expanded Notation For Grade 4 Feb 3 2024 nbsp 0183 32 In the email Amazon state the following UK VAT on eCommerce legislation live since 1 Jan 2021 requires Amazon to collect and remit VAT on all B2CUK sales performed by non established selling partners to customer in the UK

Jan 21 2021 nbsp 0183 32 Before deduction of Amazon fee Fee is a service charge from Amazon subject either to Input Vat if a Vat invoice is available from Amazon UK but more likely the Reverse Charge as charge probably emanates from Amazon EU Aug 1 2021 nbsp 0183 32 Amazon and VAT invoices Amazon and VAT invoices Sometimes Amazon does not provide a VAT invoice and you cannot even request it However their order summary provides the net figures VAT figure and gross figure details of what has

What Is Expanded Notation For Grade 4

What Is Expanded Notation For Grade 4

https://members.kidpid.com/wp-content/uploads/2023/04/1-Math-expanded-form-worksheets-for-grade-1.png

Expanded Notation Poster Without Components Edgalaxy Teaching Ideas

https://i.pinimg.com/originals/94/7d/79/947d7944c9f9a6440ee624d04e7b08f8.jpg

Expanded Notation Of A Number Mathematics Grade 4 Periwinkle YouTube

https://i.ytimg.com/vi/GjGoqqGYRjo/maxresdefault.jpg

Sep 5 2023 nbsp 0183 32 I generally buy my office supplies from Amazon Business Often items are sold by quot Amazon EU Sarl UK Branch quot UK VAT number with VAT at 20 which I have assumed perhaps incorrectly means they are UK standard rated supplies The VAT invoice for my latest purchase of a Moleskin weekly diary for 2024 supplied by Amazon shows VAT at 8 Jul 25 2025 nbsp 0183 32 Personal expense on company credit card statement I was looking at my employer s latest credit card statement and have identified what appears to be a payment for a personal Amazon Prime Video subscription 163 4 99

Mar 7 2014 nbsp 0183 32 In my vat returns i have been putting the following using a basic example i acrued only 163 10 of amazon fees and nothing else in a quarter Box 1 2 Box 2 0 Box 3 2 Box 4 2 Box 5 0 Box 6 10 Box 7 10 Box 8 0 Box 9 0 Am i correct this is what HMRC told me to do If indeed i am correct here what do i do in sage Feb 16 2024 nbsp 0183 32 We sell zero rated products online specifically plant seeds to grow food at home and these are definitely all Zero rated for VAT purposes We are thinking about setting up a subscription service on a monthly basis that in return for a monthly subscription the member will receive a bundle of these

More picture related to What Is Expanded Notation For Grade 4

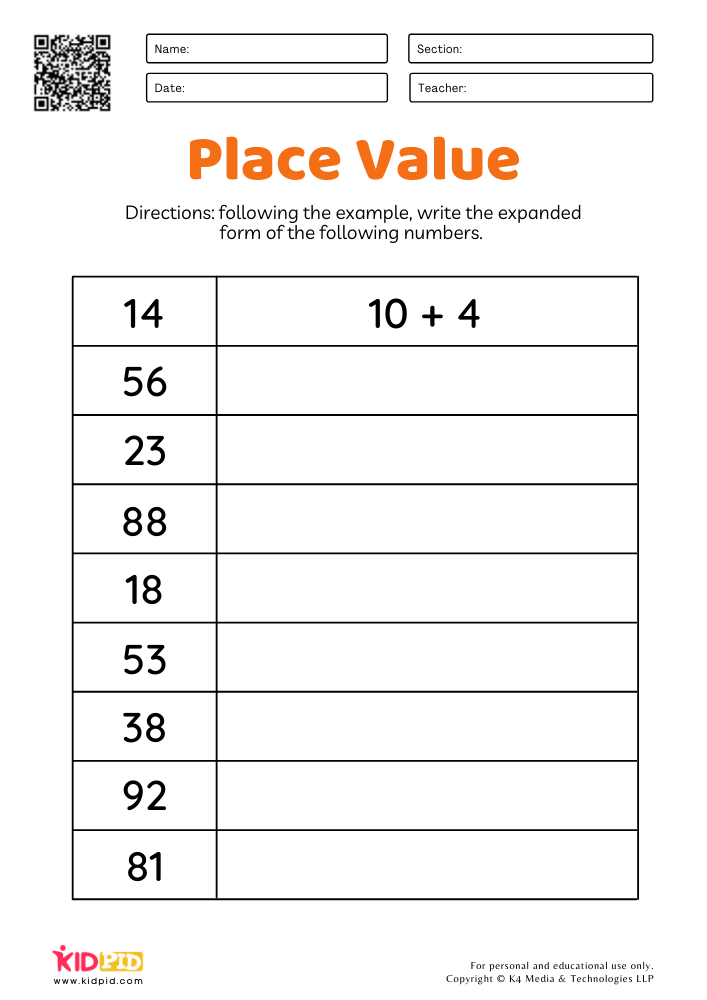

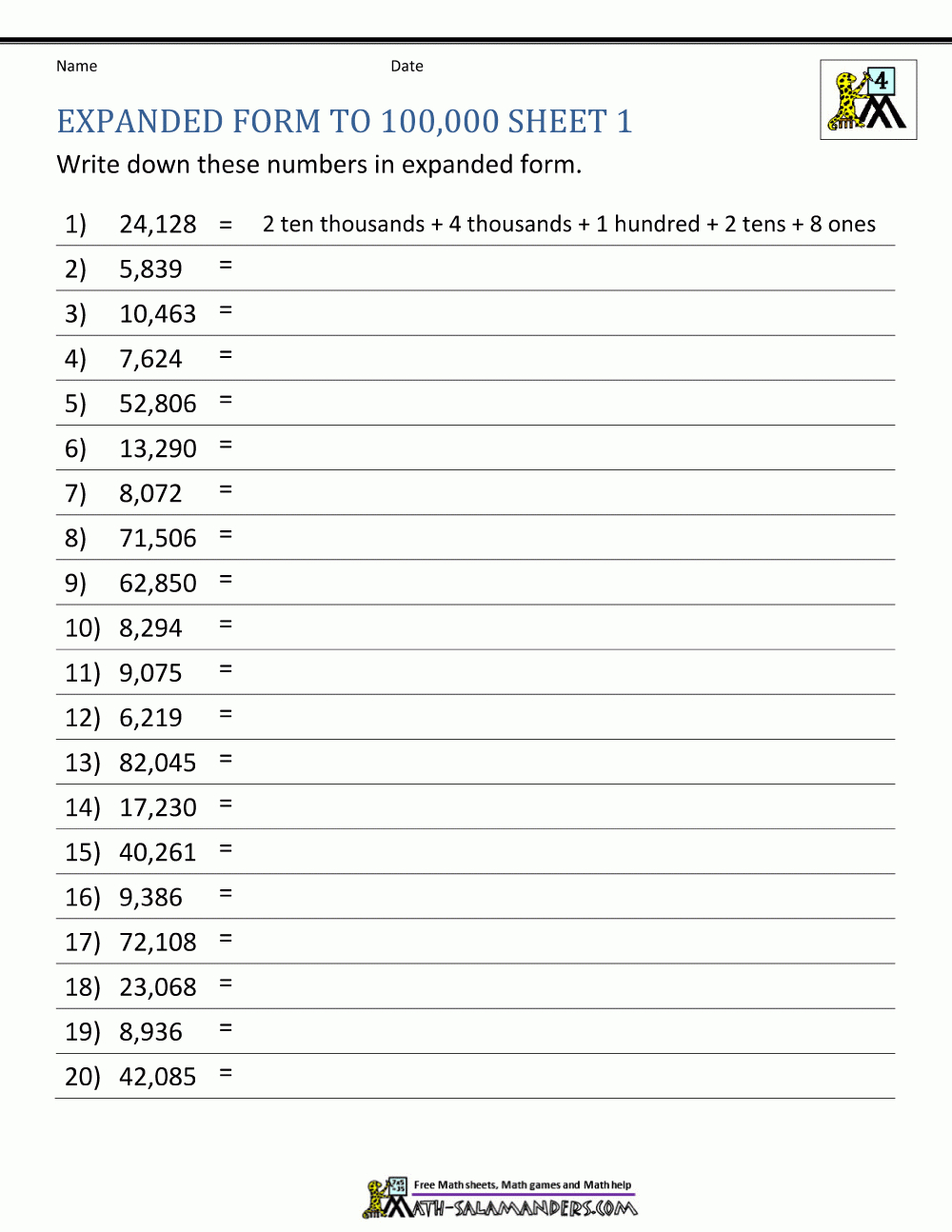

Write Numbers In Expanded Form Worksheet

https://i.pinimg.com/originals/7f/e9/68/7fe9684cabb850819535dbe846fe91b6.gif

Writing Decimals In Expanded Notation

https://i.pinimg.com/736x/91/d7/00/91d7009805967ac34a1c81e1e0b3a06e--decimal-place-values-decimal-places.jpg

Writing In Expanded Form Worksheets

https://free-printable-az.com/wp-content/uploads/2019/06/expanded-form-to-100000-1-homeschool-for-me-expanded-form-math-free-printable-expanded-notation-worksheets.gif

Oct 16 2024 nbsp 0183 32 Didn t find your answer Hi all I ve been researching this quite a bit and also have an open query with Amazon support but they dont seem to understand what I think is a basic query how do the invoices Amazon UK raise to our company for FBA fees Seller Fees etc reconcile to the payments they deduct from the money paid to our customers Feb 4 2020 nbsp 0183 32 Definitely bought only for business as company needed special spec one for a new piece of business Cost 163 2 6K Business is home based but he has ipad and laptop for personal use Bought personally because he used his own Amazon prime account and there isn t a company one Probably didn t give much thought at time because the company wasn t

[desc-10] [desc-11]

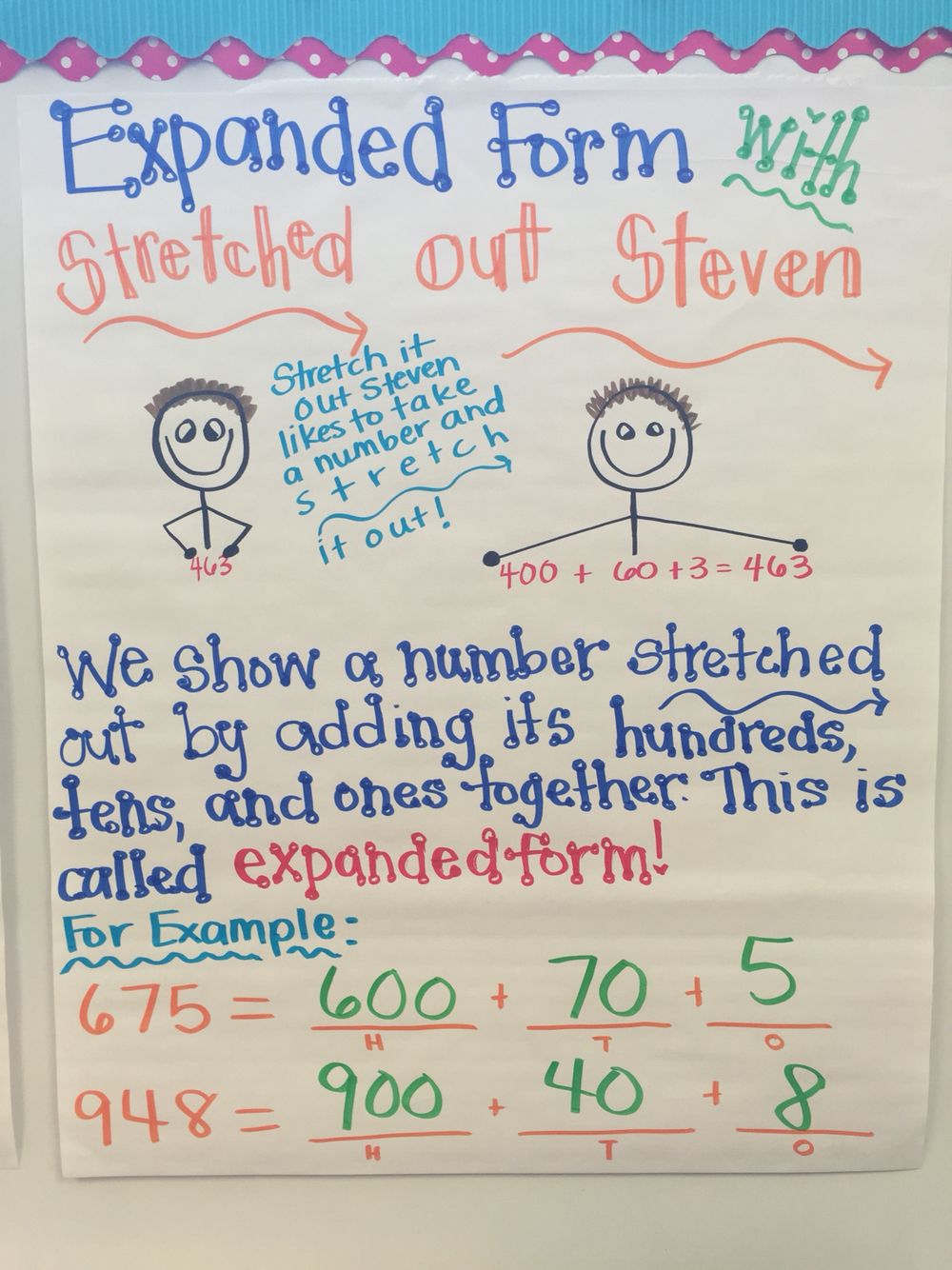

A Sign That Says Expanded Form With An Image Of Two People On One Side

https://i.pinimg.com/originals/66/a2/04/66a20470590e64e3477f60e22806cde2.jpg

Expanded Form Vs Expanded Notation Anchor Chart Math Anchor Charts

https://i.pinimg.com/originals/52/08/97/5208971d1378ec828bd838b7f69c7a5d.jpg

What Is Expanded Notation For Grade 4 - Sep 5 2023 nbsp 0183 32 I generally buy my office supplies from Amazon Business Often items are sold by quot Amazon EU Sarl UK Branch quot UK VAT number with VAT at 20 which I have assumed perhaps incorrectly means they are UK standard rated supplies The VAT invoice for my latest purchase of a Moleskin weekly diary for 2024 supplied by Amazon shows VAT at 8