What Income Is Considered Low Socioeconomic Status The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income

Feb 24 2025 nbsp 0183 32 Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by Your income It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year 86 912 for

What Income Is Considered Low Socioeconomic Status

What Income Is Considered Low Socioeconomic Status

https://helpfulprofessor.com/wp-content/uploads/2022/11/social-factors-1024x724.jpg

Systemic Discrimination Definition Types Examples 2025

https://helpfulprofessor.com/wp-content/uploads/2023/06/systemic-discrimination.jpg

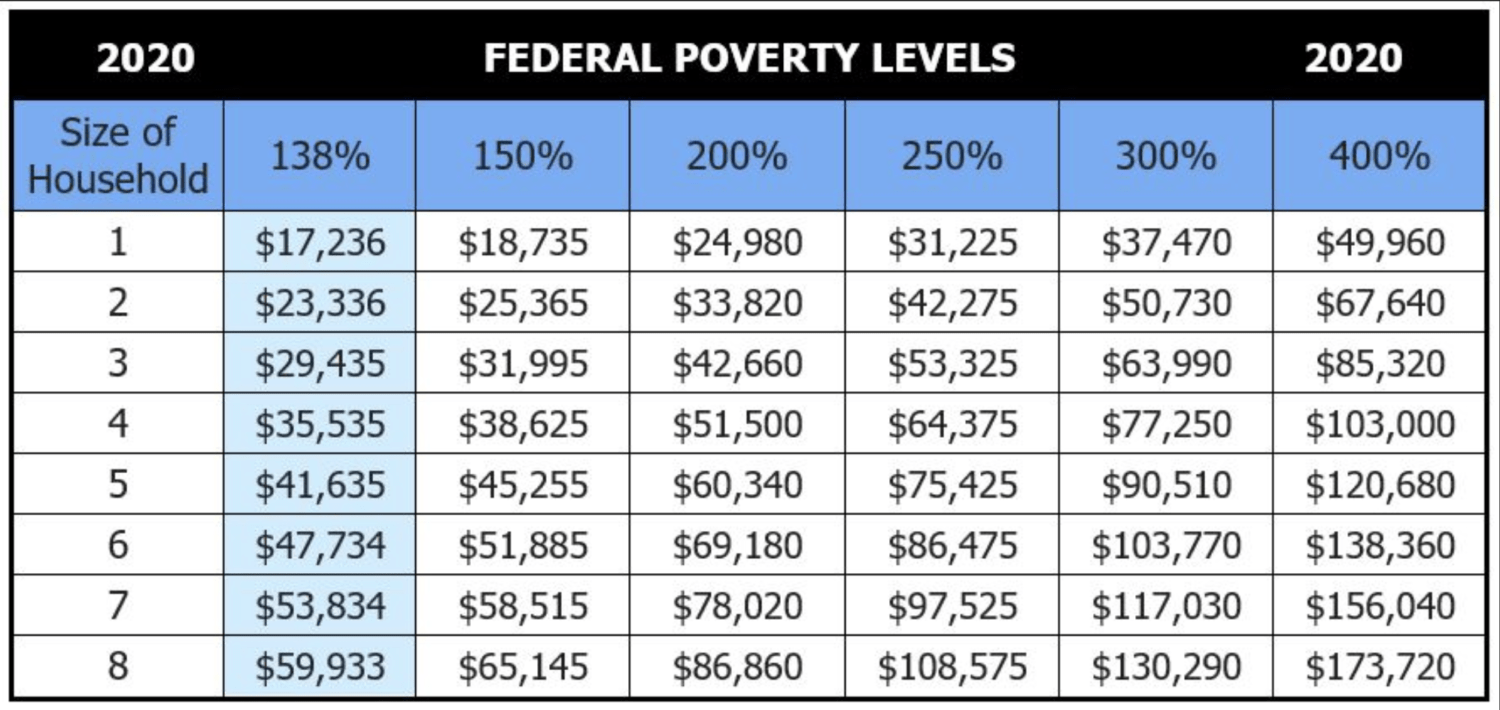

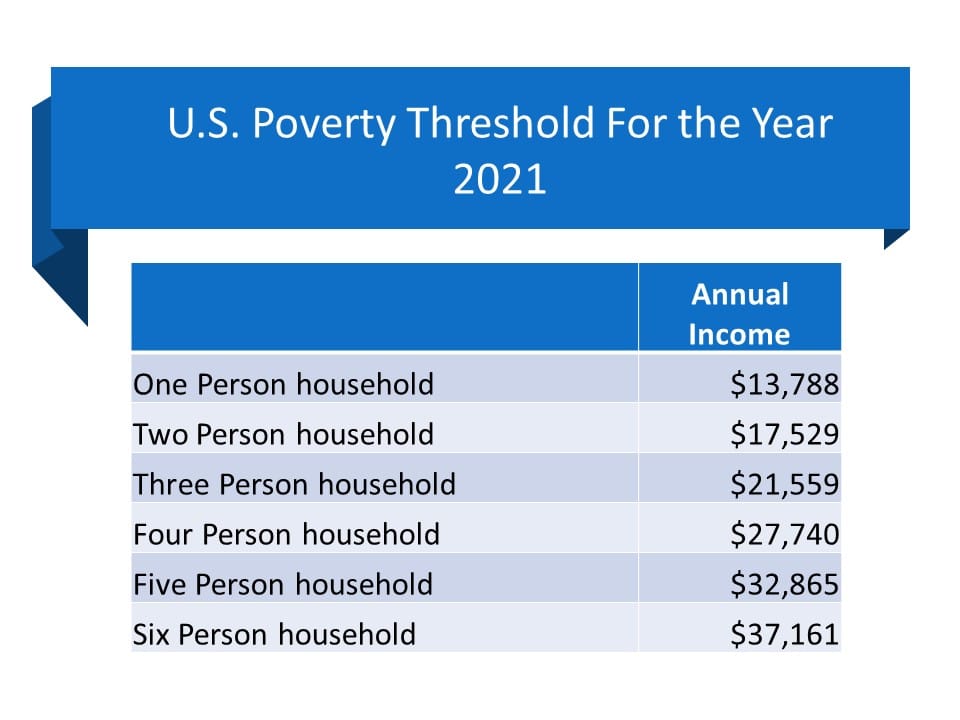

Poverty Line Florida 2024 Myrna Trescha

https://comradefinancialgroup.com/wp-content/uploads/2020/09/2020-Federal-Poverty-Level-Chart--1500x710.png

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was General information for corporations on how to complete page 3 of the T2 Corporation Income Tax Return

Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year How does the recovery tax deduction work Once your Old Age Security Return of Income form is received the net world income you report is used to estimate your Old Age Security OAS

More picture related to What Income Is Considered Low Socioeconomic Status

Socioeconomic Factors

https://helpfulprofessor.com/wp-content/uploads/2022/12/socioeconomic-status-definition-examples-1024x724.jpg

Factor Definition

https://helpfulprofessor.com/wp-content/uploads/2022/11/social-factors.jpg

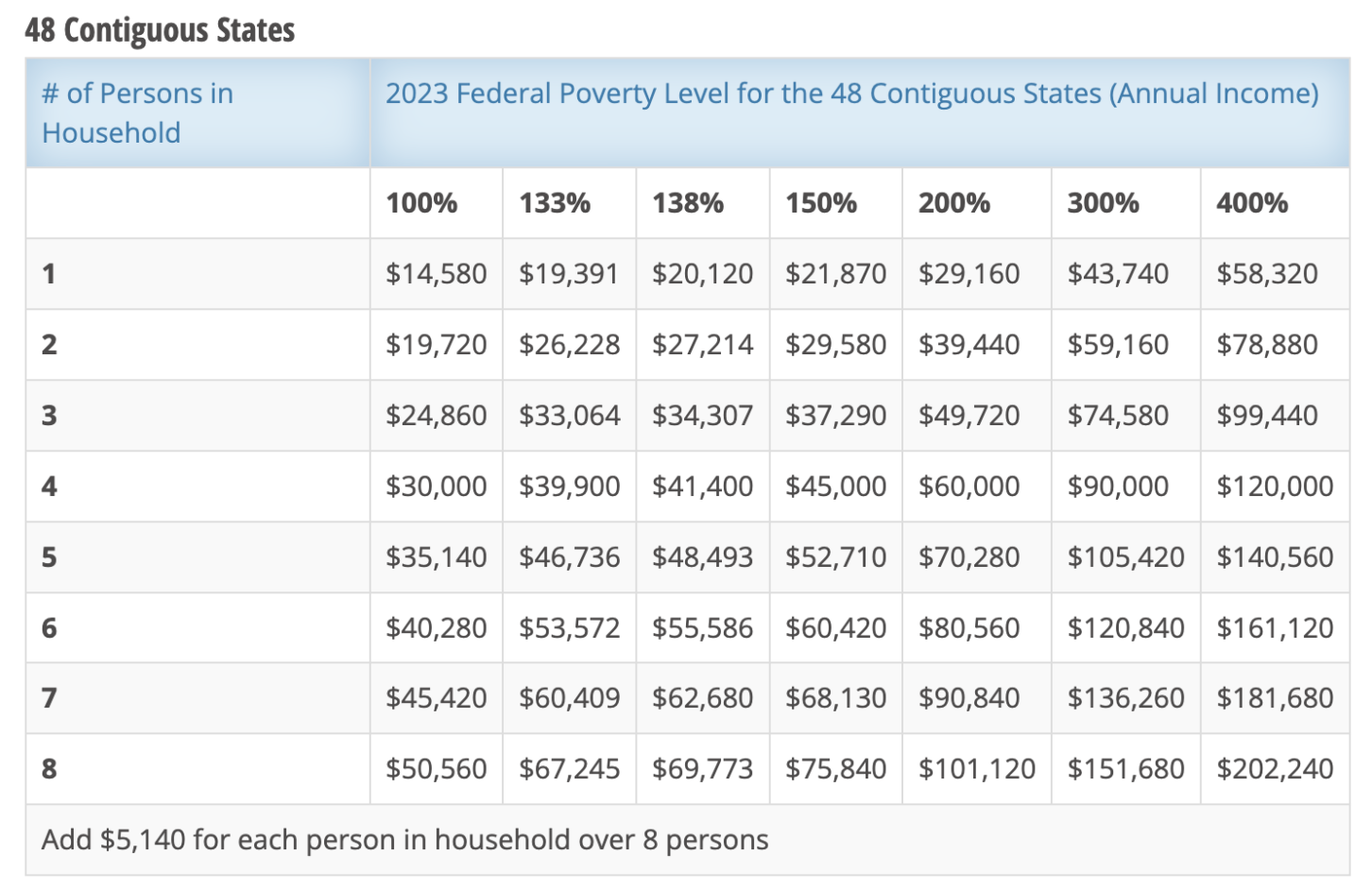

Poverty Level Guidelines 2024 Ray Leisha

https://www.immi-usa.com/wp-content/uploads/2023/02/Screen-Shot-2023-02-14-at-2.58.02-PM-1452x941.png

If you receive federal benefits including some provincial territorial benefits you will receive payment on these dates If you set up direct deposit payments will be deposited in your This Chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in Canada focusing on dividends received by individuals and corporations who are

[desc-10] [desc-11]

Income Poverty Line 2025 Esperanza Brooke

https://federalsafetynet.com/wp-content/uploads/2022/09/Poverty-statistics-2021p11.jpg

Low Socioeconomic Status

https://pgc.edu/wp-content/uploads/2021/06/How-Does-Socioeconomic-Status-Affect-Education.jpg

What Income Is Considered Low Socioeconomic Status - How does the recovery tax deduction work Once your Old Age Security Return of Income form is received the net world income you report is used to estimate your Old Age Security OAS