What Expenses Can I Claim As A Sole Trader Find out which deductions credits and expenses you can claim to reduce the amount of tax you need to pay

The expenses are related to the performance of their employment duties step 2 If the allowance or reimbursement you provide to your employee for travel expenses does not meet all of the Expenses section of form T2125To determine whether the income you earned from a short term rental is from a property or business consider the number and types of services you provide

What Expenses Can I Claim As A Sole Trader

What Expenses Can I Claim As A Sole Trader

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/what-expenses-can-i-claim-as-a-sole-trader_447110-1.jpg

The Big List Of Small Business Tax Deductions 2024

https://i.pinimg.com/originals/fa/6d/6b/fa6d6b3bac989a358a1959e67b988cd5.png

Expense Form Template In Excel For Credit Card Expenses

https://i.pinimg.com/originals/77/3b/5c/773b5c7e433ba6fe9d676dcedf74c22f.jpg

If you provide an allowance or reimbursement to your employee to compensate them for expenses paid for the use of their own automobile or motor vehicle in the course of their Jan 30 2025 nbsp 0183 32 Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later

Completing your tax return To claim home accessibility expenses complete the chart for line 31285 using your Federal Worksheet and enter the result on line 31285 of your return A Dec 30 2024 nbsp 0183 32 Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit rates that will apply in 2025

More picture related to What Expenses Can I Claim As A Sole Trader

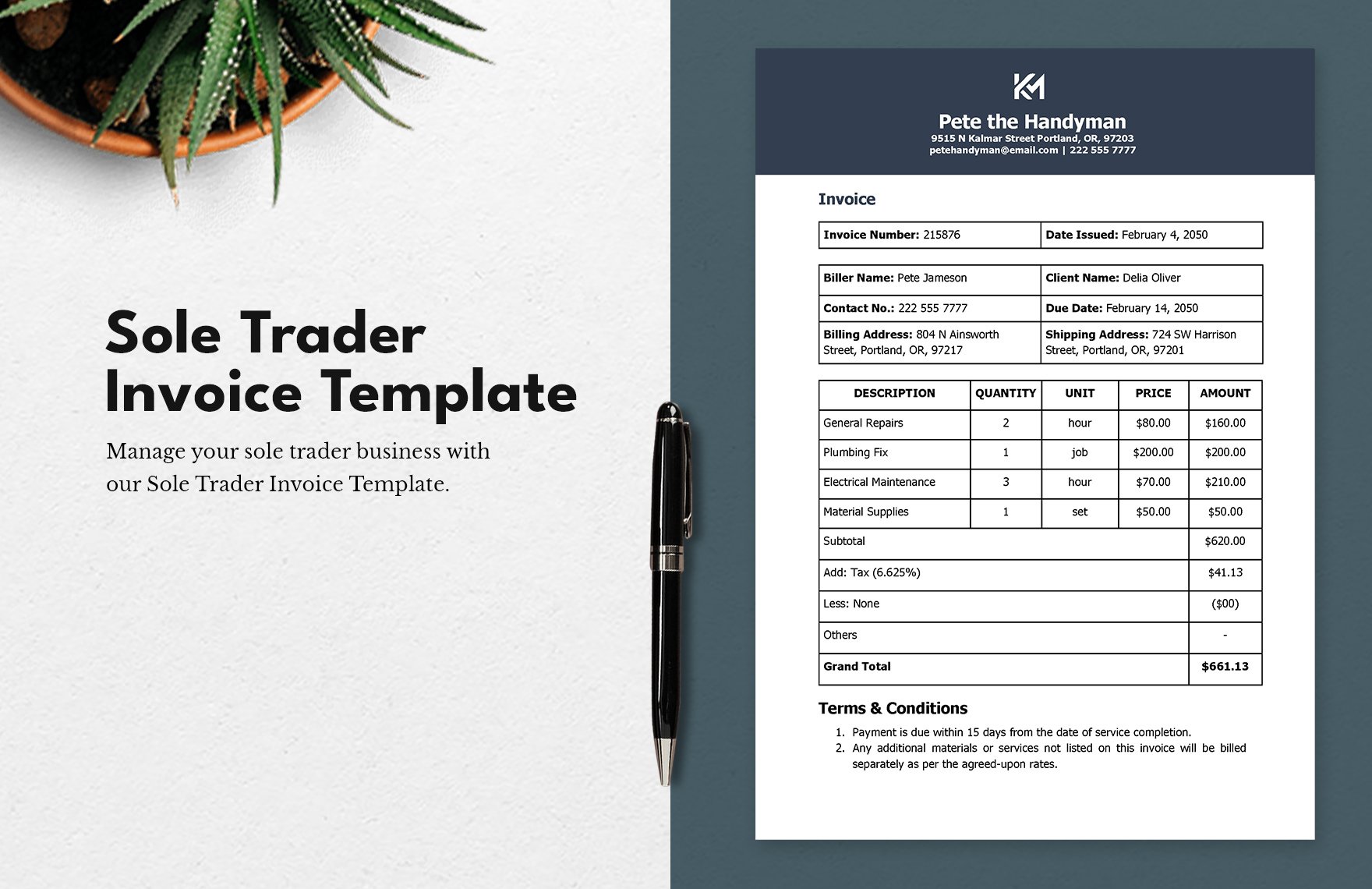

Free Commercial Invoice Templates Editable And Printable

https://images.template.net/139286/sole-trader-invoice-template-s5b7i.jpg

Sole Trader Invoice Example Invoice Template Ideas

https://simpleinvoice17.net/wp-content/uploads/2017/07/sole-trader-invoice-example-download-sole-trader-invoice-template-rabitah-861-x-1111.png

Self Employed Allowable Expenses Accounting Basics Best Accounting

https://i.pinimg.com/originals/de/81/c7/de81c7177a75fa53363d95cb5e077283.png

Calculating motor vehicle expenses If you use a motor vehicle or a passenger vehicle for both business and personal use you can deduct only the portion of the expenses that relates to Line 8523 Meals and entertainmentOn this page Claiming food and beverage expenses Long haul truck drivers Extra food and beverages consumed by self employed foot and bicycle

[desc-10] [desc-11]

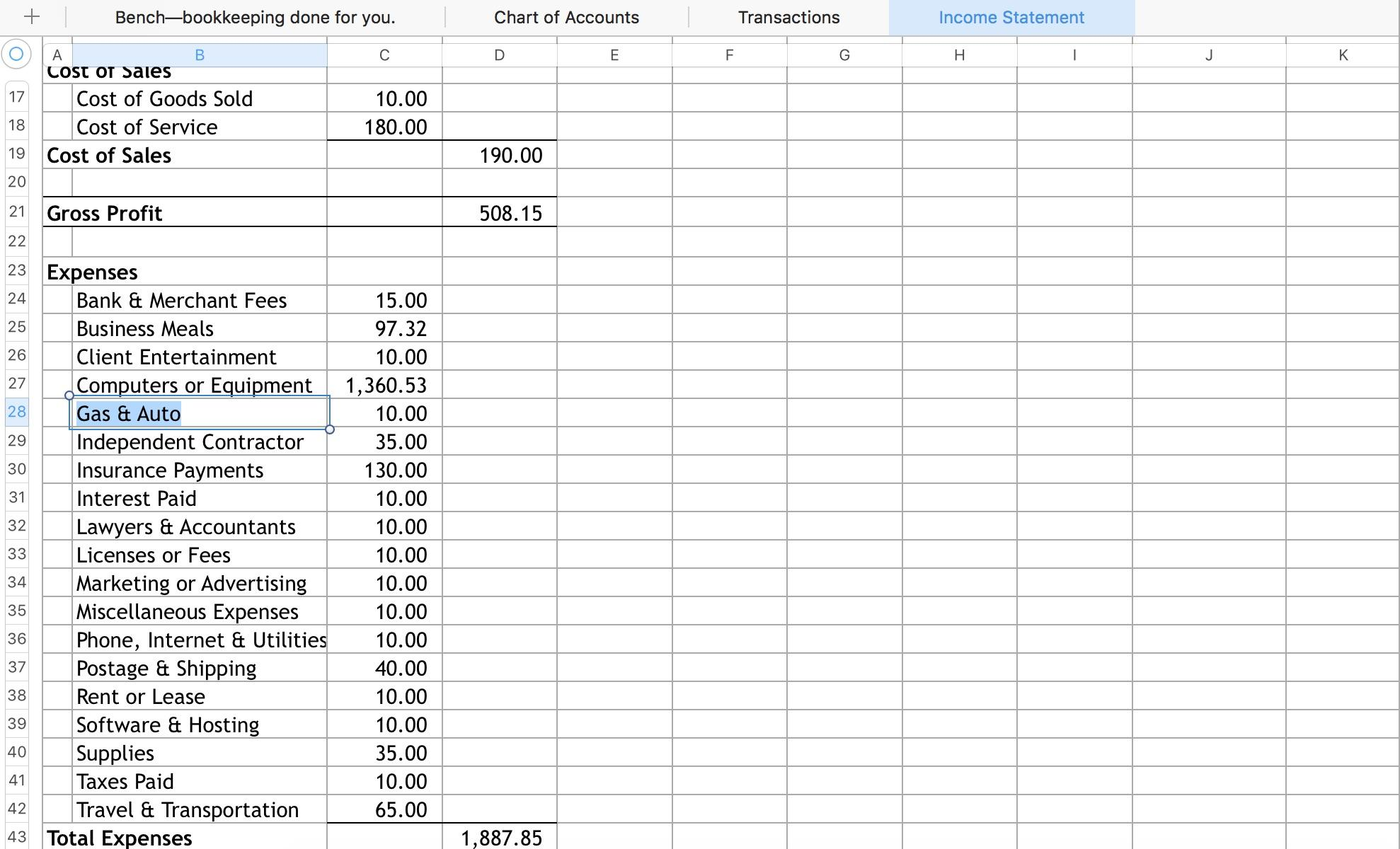

Expense Trackers The Top 6 Tools For Small Businesses Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/4YZTnk6Kv20hdUNgkt60lc/e4148669b50768645e2773364dc98891/Bench_Income_statement_template.png

How To Write A Tax Write Off Cheat Sheet Business Tax Tax Write Offs

https://i.pinimg.com/originals/be/e7/77/bee77730885a120393f775018b8e99f9.jpg

What Expenses Can I Claim As A Sole Trader - If you provide an allowance or reimbursement to your employee to compensate them for expenses paid for the use of their own automobile or motor vehicle in the course of their