What Expenses Are Tax Deductible For Investment Property Find out which deductions credits and expenses you can claim to reduce the amount of tax you need to pay

The expenses are related to the performance of their employment duties step 2 If the allowance or reimbursement you provide to your employee for travel expenses does not meet all of the conditions above the allowance or reimbursement is generally taxable Situation You provide an allowance to your employee who is a member of the Canadian Expenses section of form T2125To determine whether the income you earned from a short term rental is from a property or business consider the number and types of services you provide for your tenants The more services you provide the greater the chance that your rental operation is a business For more information see Interpretation Bulletin IT 434 Rental of Real Property by

What Expenses Are Tax Deductible For Investment Property

What Expenses Are Tax Deductible For Investment Property

https://i.ytimg.com/vi/P48fUNs0Md8/maxresdefault.jpg

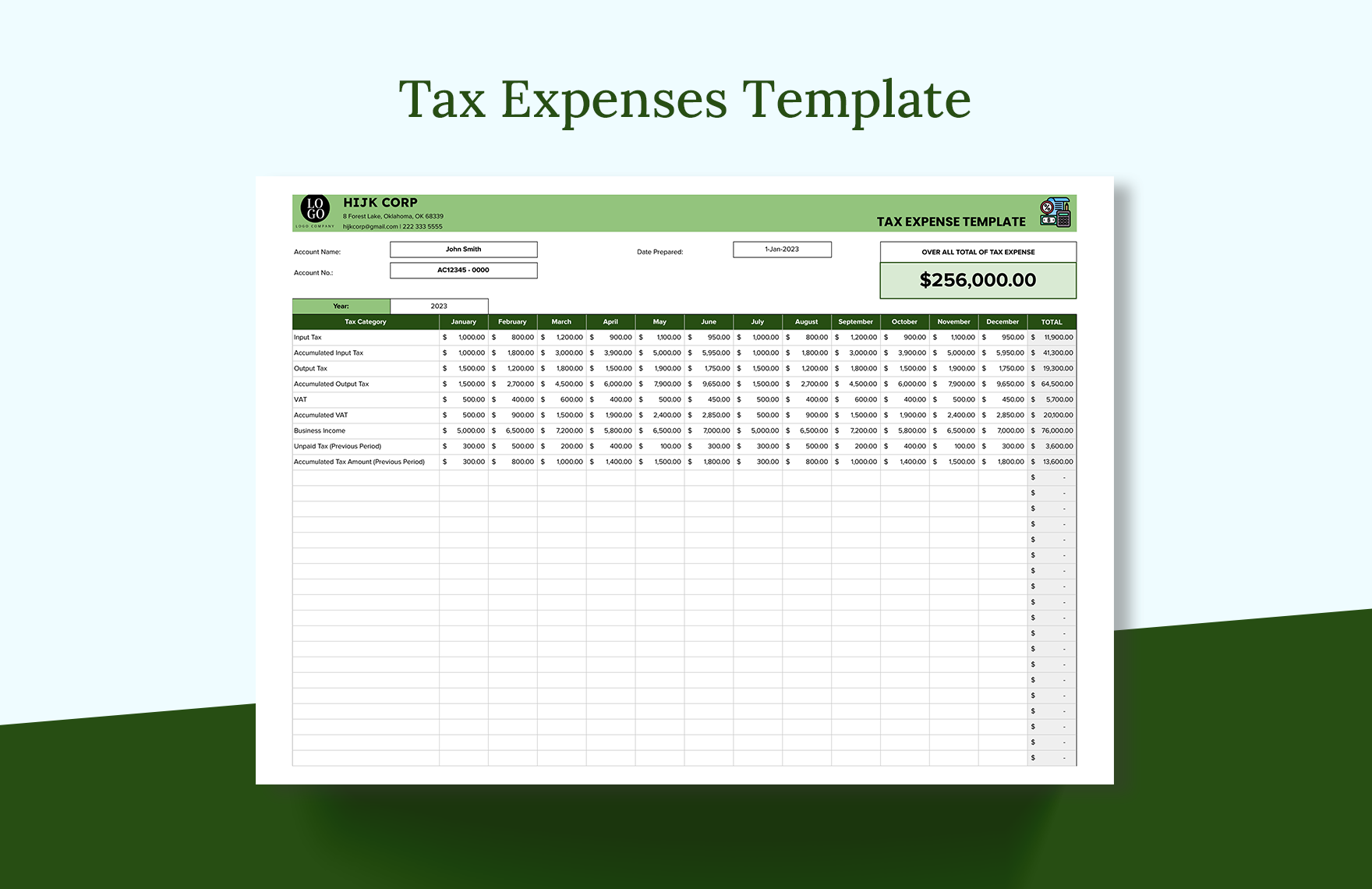

Tax Expenses Template Excel Google Sheets Template

https://images.template.net/136131/tax--expenses-template-lcwmc.png

Deductible Maryland Health Connection

https://www.marylandhealthconnection.gov/wp-content/uploads/2016/06/MHC_Deductible_Chart.png

If you provide an allowance or reimbursement to your employee to compensate them for expenses paid for the use of their own automobile or motor vehicle in the course of their employment duties your employee should keep records of the number of kilometres travelled for business employment related driving made with their own vehicle Jan 30 2025 nbsp 0183 32 Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later

Completing your tax return To claim home accessibility expenses complete the chart for line 31285 using your Federal Worksheet and enter the result on line 31285 of your return A qualifying individual can claim up to 20 000 per year in eligible expenses Dec 30 2024 nbsp 0183 32 Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit rates that will apply in 2025

More picture related to What Expenses Are Tax Deductible For Investment Property

What Is The 2024 Part B Deductible Image To U

https://i.ytimg.com/vi/e-cEceE6v_Q/maxresdefault.jpg

Business Expenses

https://fitsmallbusiness.com/wp-content/uploads/2023/05/Thumbnail_IRS_Business_Expense_Categories_2023.jpg

2025 Business Auto Deduction Mauricio Vanhernandez

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Calculating motor vehicle expenses If you use a motor vehicle or a passenger vehicle for both business and personal use you can deduct only the portion of the expenses that relates to earning business income However you can deduct the full amount of parking fees related to your business activities and supplementary business insurance for your motor vehicle or passenger Line 8523 Meals and entertainmentOn this page Claiming food and beverage expenses Long haul truck drivers Extra food and beverages consumed by self employed foot and bicycle couriers and rickshaw drivers Claiming food and beverage expenses The maximum amount you can claim for food beverages and entertainment expenses is 50 of the lesser of the following amounts

[desc-10] [desc-11]

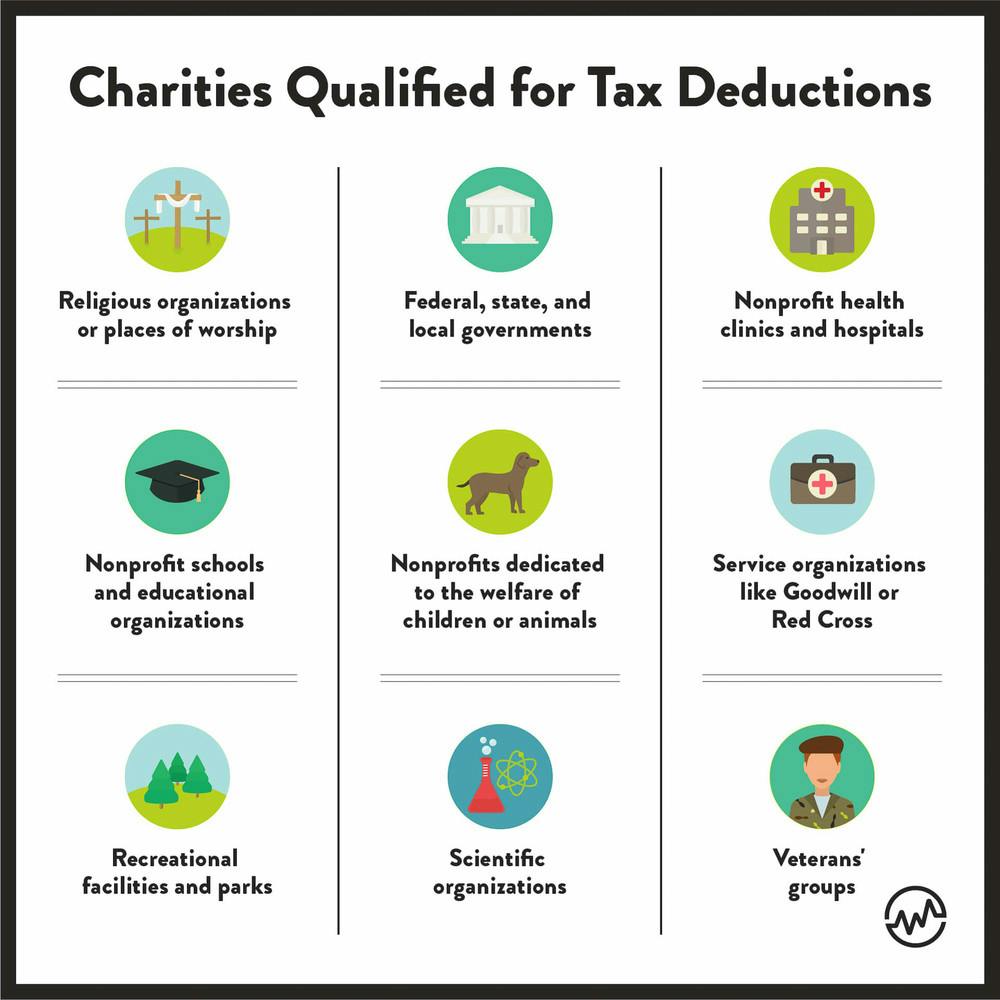

Donation Letter For Taxes Sample And Examples Word

https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/Donation-Letter-for-Taxes.jpg?fit=1414%2C2000&ssl=1

Business Charitable Deductions 2025 Ray D Mattson

https://images.prismic.io/wealthfit-staging/6c4dff5e8f000e8b664bb80e4577267e647b8ba9_01-maximize-charitable-deductions.jpg?auto=compress

What Expenses Are Tax Deductible For Investment Property - [desc-12]