Valuation Techniques For Mergers And Acquisitions Explore CFI s valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth

Asset based valuation is a form of valuation in business that focuses on the value of a company s assets or the fair market value of its total assets after deducting liabilities Assets are What are Valuation Principles Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value divorce litigation and

Valuation Techniques For Mergers And Acquisitions

Valuation Techniques For Mergers And Acquisitions

https://singhania.in/admin/blogimages/513138.jpg

Equity Valuation Models MyWealth Investments

https://www.mywealthinvestments.co.za/wp-content/uploads/2019/12/valuation-methods-diagram.png

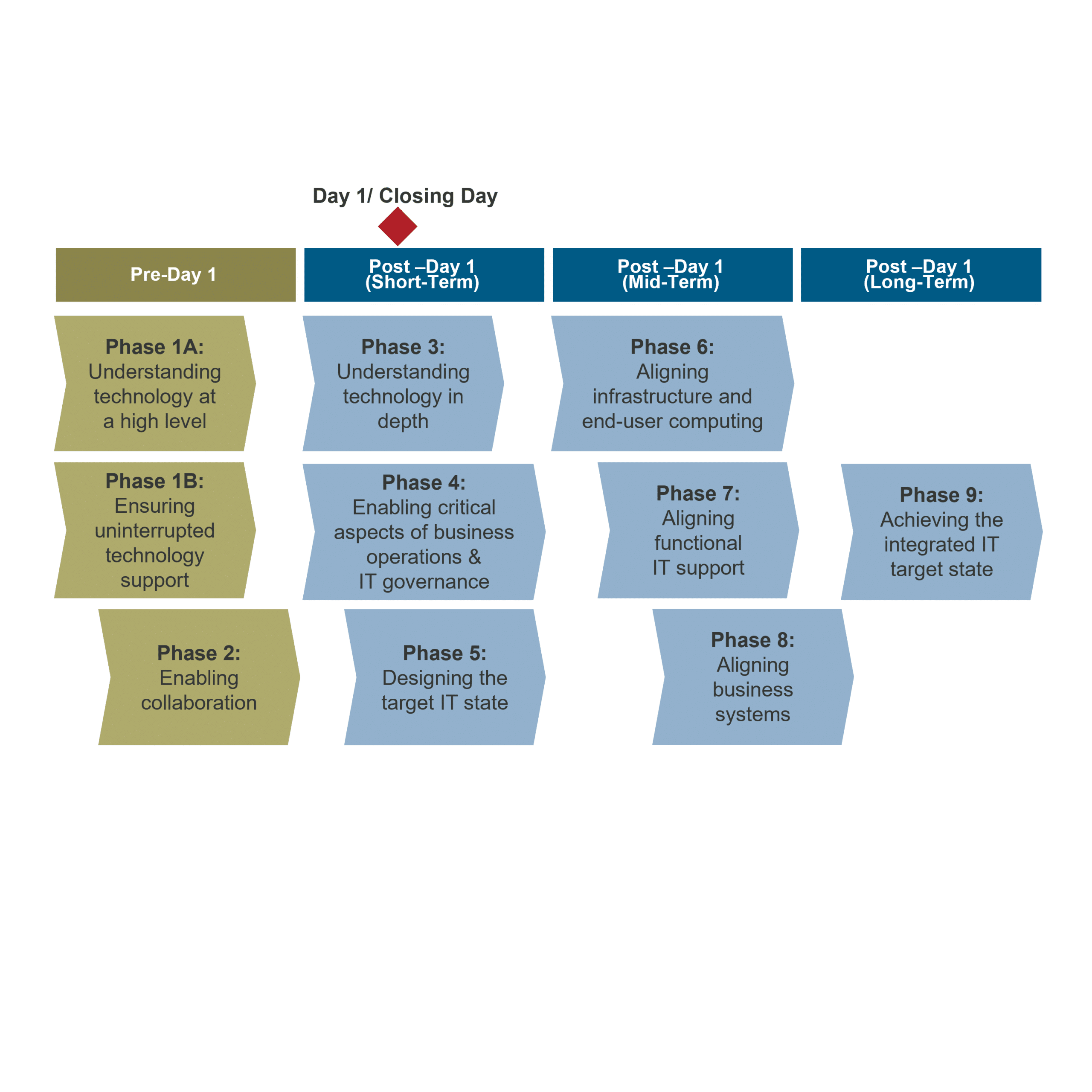

Company Acquisition

https://s3.amazonaws.com/thinkific/file_uploads/163260/images/44d/558/f64/M_A_case_interview_example_framework.jpeg

FMVA 174 Program Overview CFI s Financial Modeling amp Valuation Analyst FMVA 174 Certification imparts vital financial analysis skills emphasizing constructing effective financial models for The EBITDA multiple is a financial ratio that compares a company s Enterprise Value to its annual EBITDA

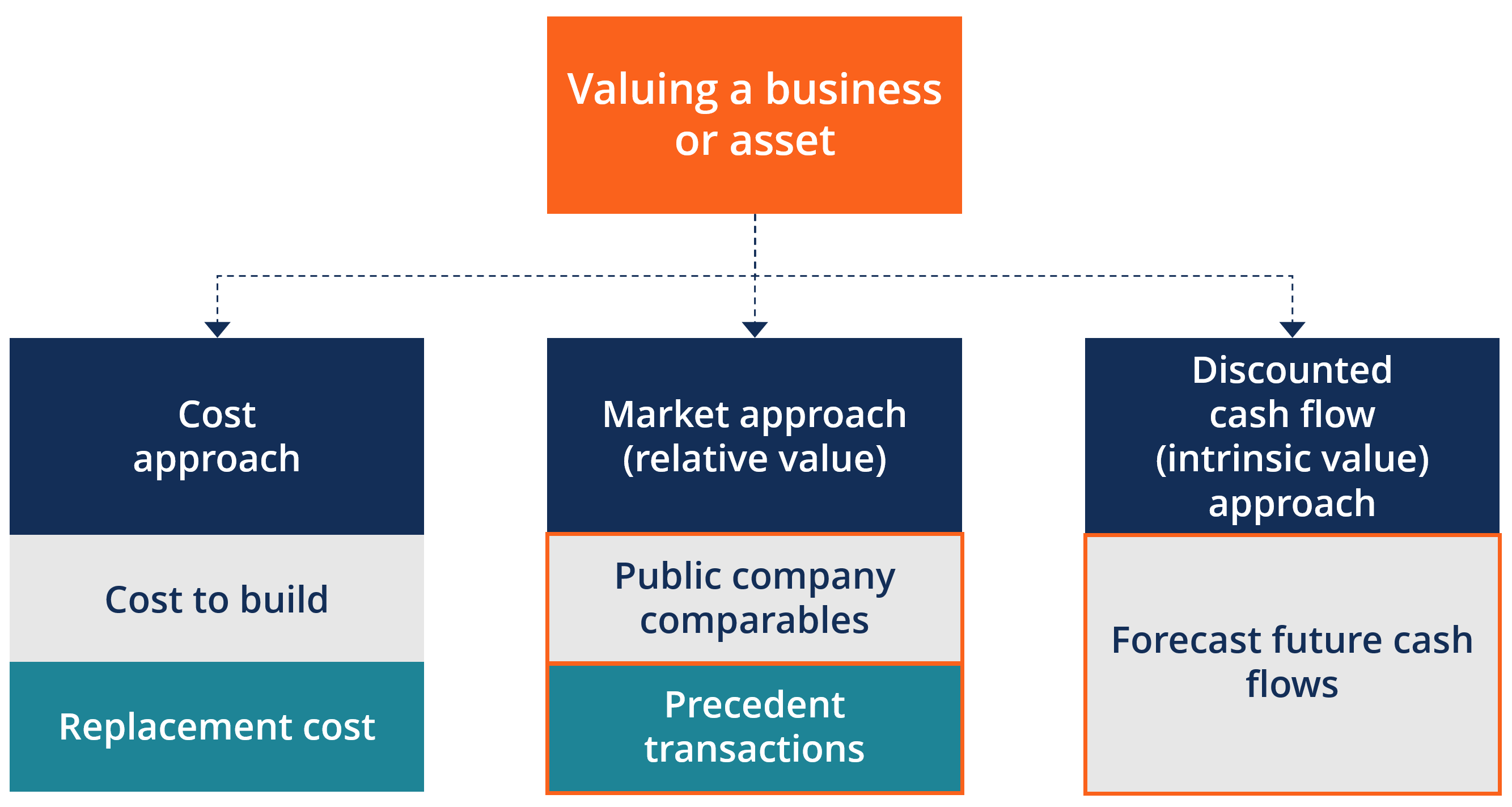

The market approach is a valuation method used to determine the appraisal value of a business intangible asset business ownership interest or security by What is Asset Valuation Asset valuation simply pertains to the process to determine the value of a specific property including stocks options bonds buildings machinery or land that is

More picture related to Valuation Techniques For Mergers And Acquisitions

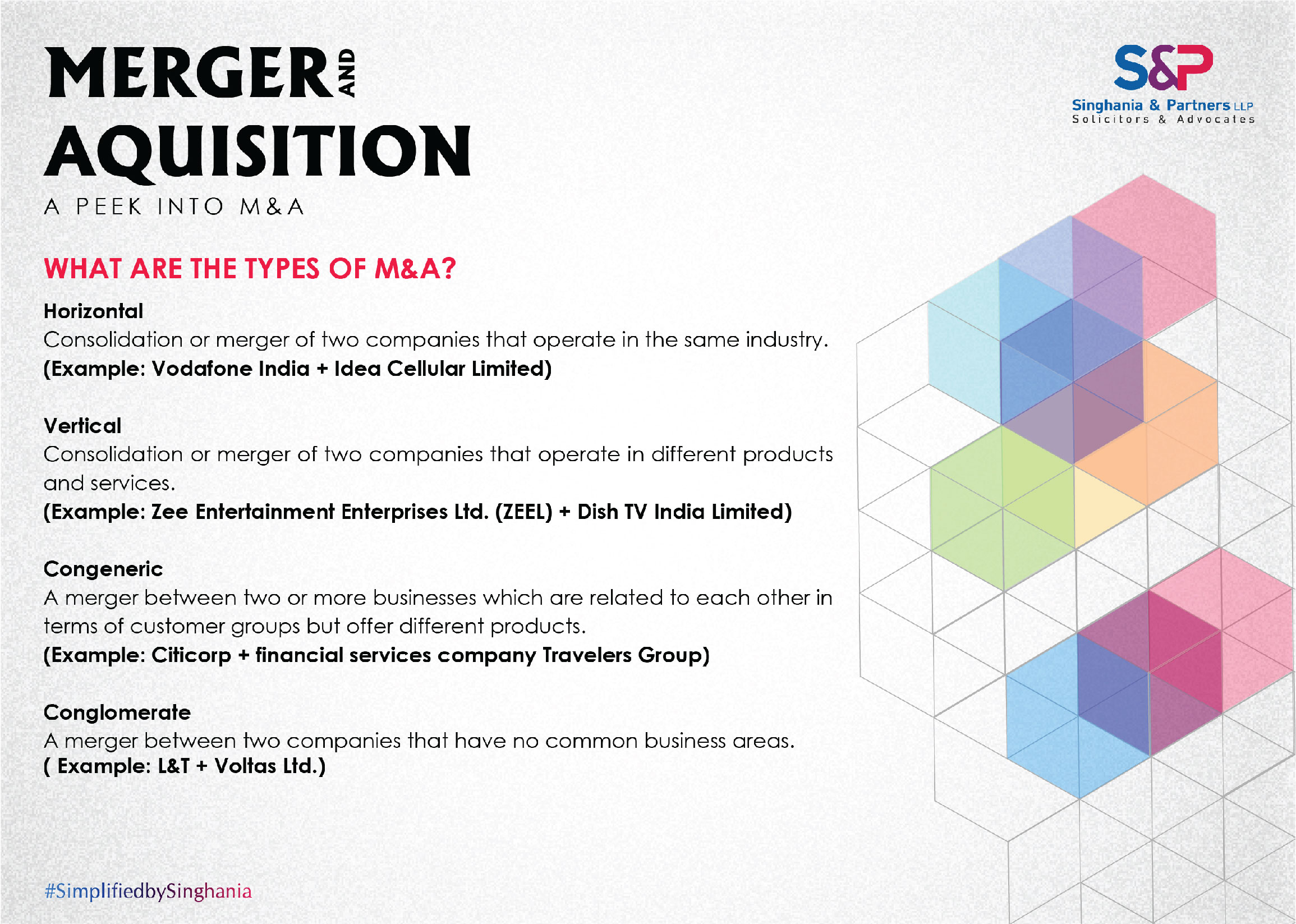

Merge Company

https://singhania.in/admin/blogimages/90053.jpg

Business Mergers

https://burniegroup.com/wp-content/uploads/2023/04/9-Key-Phases-of-IT-Integration-in-Mergers-and-Acquisitions-feature-image-1.png

Mergers And Acquisitions PowerPoint Template Slidebazaar

https://slidebazaar.com/wp-content/uploads/2022/11/merger-and-acquisitions-process.jpg

Thus valuation is an important part of mergers and acquisitions M amp A as it guides the buyer and seller to reach the final transaction price Below are three major valuation methods that are Business Valuation Glossary This business valuation glossary covers the most important concepts to know in valuing a company This guide is part of CFI s Business Valuation

[desc-10] [desc-11]

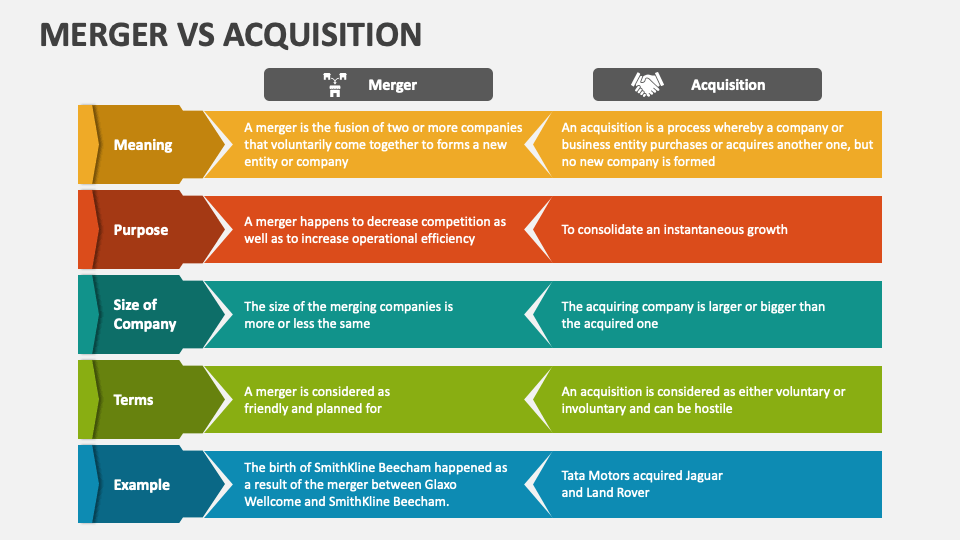

Merger Vs Acquisition PowerPoint And Google Slides Template PPT Slides

https://www.collidu.com/media/catalog/product/img/c/6/c6fd5cb2bc901f6aa8ea77b9ef5864456b8d7ea25fc32215d089706ed65caa4b/merger-vs-acquisition-slide1.png

M A Deal 2024 Faun Cariotta

https://global-uploads.webflow.com/5a710020b54d350001949426/628d45c6d847e44f995aa0aa_M&A-Activities.jpeg

Valuation Techniques For Mergers And Acquisitions - [desc-14]