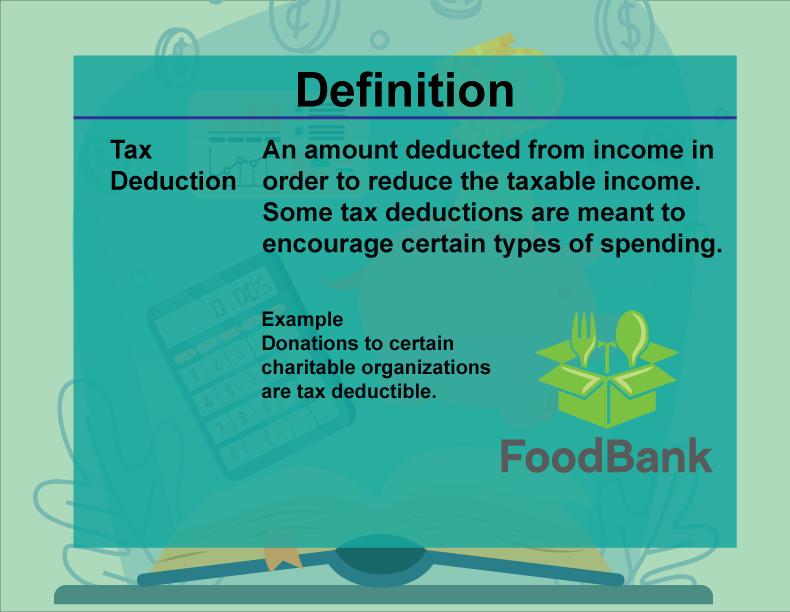

Tax Deductible Meaning What is a Tax Deductible A tax deductible expense is any expense that is considered ordinary necessary and reasonable and that helps a business to generate income It is usually deducted from the company s income before taxation

The meaning of TAX DEDUCTIBLE is allowed to be subtracted from the total amount of a person s income before calculating the tax he or she is required to pay allowable as a deduction from taxes How to use tax deductible in a sentence TAX DEDUCTIBLE definition 1 If an amount of money that you spend is tax deductible it can be taken away from the total Learn more

Tax Deductible Meaning

Tax Deductible Meaning

https://i.ytimg.com/vi/wJxlQtd1ndA/maxresdefault.jpg

What Are Itemized Deductions Definition How To Claim 42 OFF

https://www.media4math.com/sites/default/files/library_asset/images/Definition--FinancialLiteracy--TaxDeduction.png

Deductible Maryland Health Connection

https://www.marylandhealthconnection.gov/wp-content/uploads/2016/06/MHC_Deductible_Chart.png

Feb 2 2023 nbsp 0183 32 Tax deductible is an expense that can be subtracted from the taxpayer s gross income to get adjustable gross income reducing the tax liability When taxable income is reduced you pay less tax If an expense or loss is tax deductible it can be paid out of the part of your income on which you do not pay tax so that the amount of tax that you pay is reduced The interest is tax deductible so the interest cost is less than the tax free gain on the house price

Mar 11 2025 nbsp 0183 32 Understand what tax deductible expenses are how they reduce taxable income and the requirements for claiming them while staying compliant These expenses known as tax deductions reduce taxable income potentially lowering the total tax owed Let s clear up a common misconception tax deductible does NOT mean free I hate to be the bearer of bad news but Uncle Sam isn t covering your business expenses dollar for dollar Instead tax deductible expenses lower your taxable income which in

More picture related to Tax Deductible Meaning

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

Master Of Social Work License Tax Deduction Store Dakora co

https://www.investopedia.com/thmb/oKXX_-0E_rQHs8wwWj84rYvCC7o=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png

What Is A Tax Deduction

http://taxreceipts.com/wp-content/uploads/2012/03/what-is-a-deduction.jpg

Deductions For Business Expenses 2025 Magnus E Schou

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Jul 12 2023 nbsp 0183 32 Tax deductibility refers to the process of reducing an individual s or a business s taxable income by accounting for certain allowable expenses known as tax deductions These deductions can be claimed when filing a federal income tax return effectively lowering the overall amount of income subject to tax When an expense is tax deductible it means you can deduct its cost from your total taxable income This deduction lowers your taxable income which in turn reduces your tax liability Expenses can be fully tax deductible partially deductible or not deductible at all

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

Understanding Tax Deductions Itemized Vs Standard Deduction Deductions

https://www.investopedia.com/thmb/x2U_NiK4z21E42fnjc_GzSBg7Mw=/750x0/filters:no_upscale():max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png

List Of Tax Deductions 2025 Eva Bon T

https://files.taxfoundation.org/20200714164745/Tax-Basics-How-Is-Tax-Liability-Calculated.png

Tax Deductible Meaning - Mar 11 2025 nbsp 0183 32 Understand what tax deductible expenses are how they reduce taxable income and the requirements for claiming them while staying compliant These expenses known as tax deductions reduce taxable income potentially lowering the total tax owed