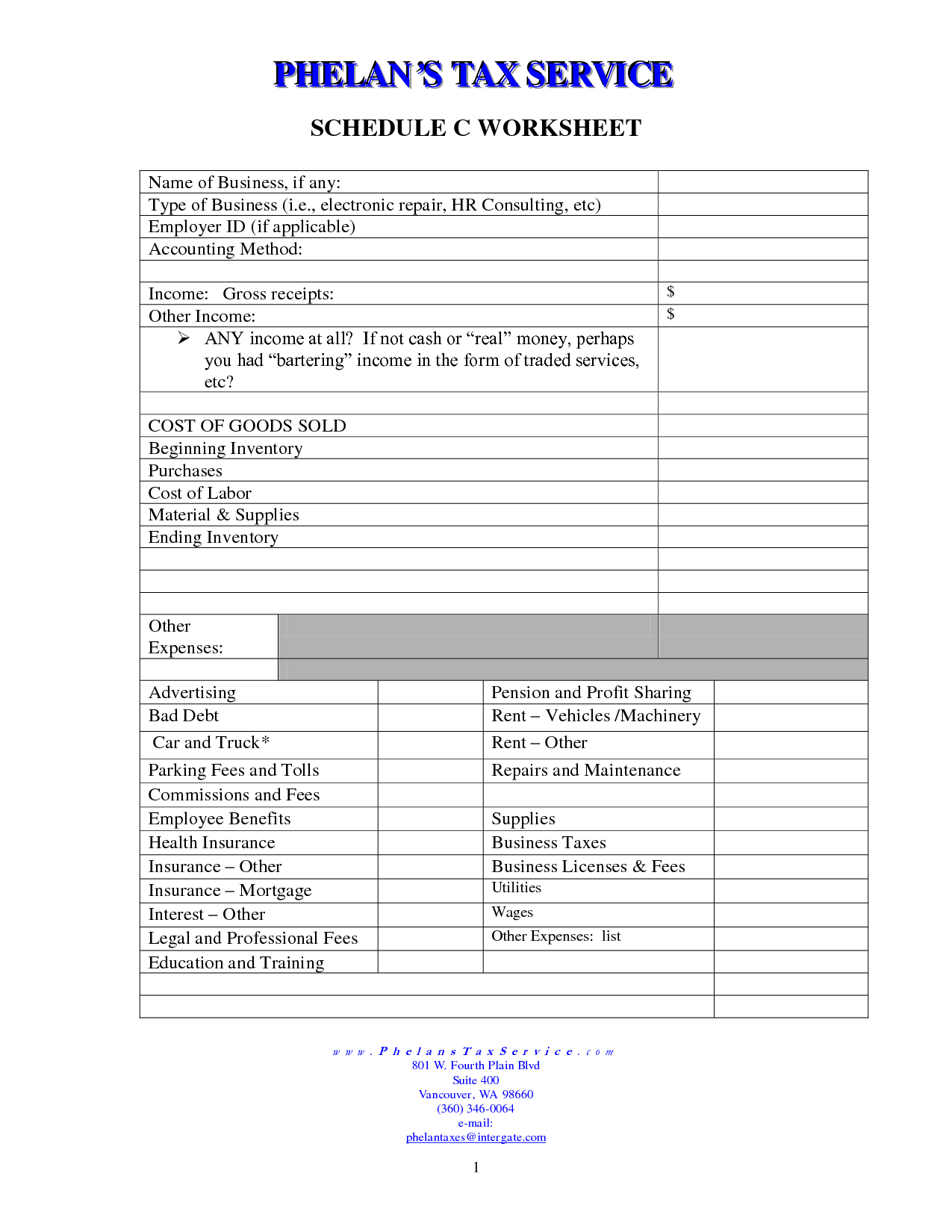

Schedule C Worksheet Amount Jun 6 2019 nbsp 0183 32 You have a Other Miscellaneous expense description entered in your business section of TurboTax without a corresponding amount You can enter the amount in the check entry screen if you know what expense doesn t have an amount

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file Dec 16 2024 nbsp 0183 32 Schedule C is used to report self employment income and business expenses like supplies and software costs Anyone earning income outside of a W 2 such as freelancers gig workers and sole proprietors needs to fill out this form

Schedule C Worksheet Amount

Schedule C Worksheet Amount

https://www.worksheeto.com/postpic/2013/05/schedule-c-worksheet_177805.png

5 Letter C Printable Worksheets Letter Worksheets Letter C

https://i.pinimg.com/736x/fe/5d/a5/fe5da5b9361ab08f460b7e5aebc1be96.jpg

Schedule C What Is It How To Fill Example Vs Schedule E

https://www.wallstreetmojo.com/wp-content/uploads/2022/12/image-3-1.jpg

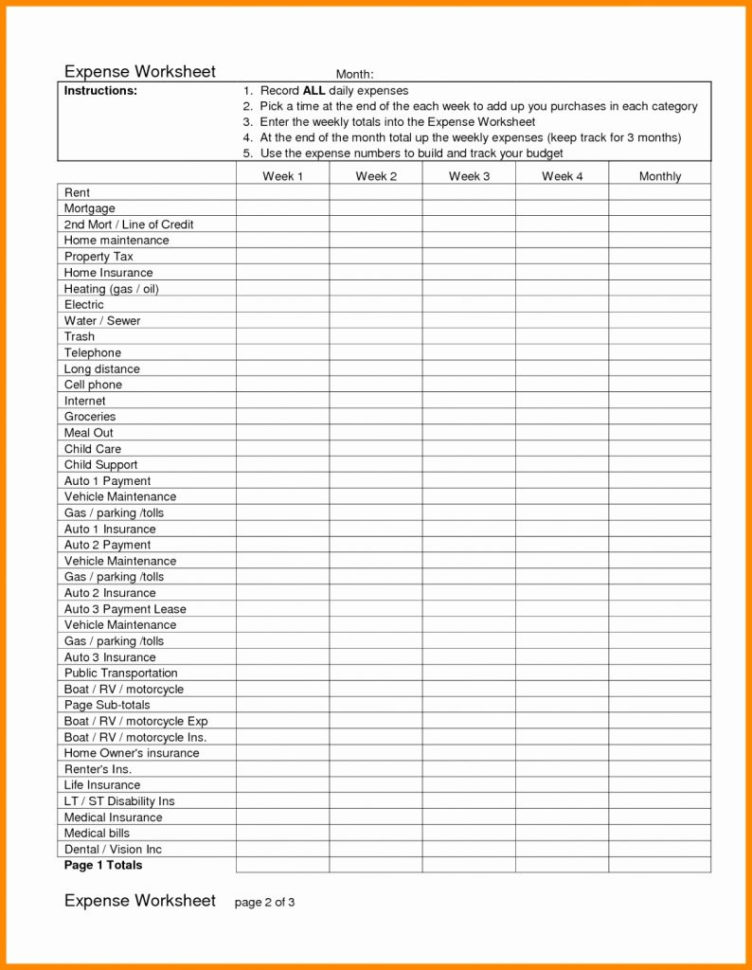

Apr 17 2023 nbsp 0183 32 On the screen titled Your 2020 self employed work summary select edit to the right of the applicable business activity On the next page you will be able to edit expenses Scroll down to and select Edit to the right of Miscellaneous expenses Dec 21 2023 nbsp 0183 32 Using the worksheet ensures all deductible expenses are claimed and accurately reported on Schedule C Complete it periodically and reconcile with receipts bank statements and accounting records A properly maintained worksheet simplifies filling out Schedule C while minimizing errors

Jan 9 2023 nbsp 0183 32 Our team at Blue Fox created this handy Schedule C Worksheet for your profit or loss record keeping pleasure If you re wondering how to fill out the Schedule C Form 1040 this easy to use tool will get your financial ducks in a row Schedule C Worksheet for Self Employed Businesses and or Independent Contractors IRS requires we have on file your own information to support all Schedule C s Business Name if any Total Gross Business Income not necessarily amount shown on 1099 s Retail Businesses ONLY

More picture related to Schedule C Worksheet Amount

IRS Schedule C Instructions Schedule C Form Free Download

https://new-img.movavi.com/pages/0013/03/9274989e911252d4856acafaecd2f45ebd54a31b.gif

Schedule C Worksheet Misc Exp Other WorksSheet List

https://lh6.googleusercontent.com/proxy/byeZ2dL6q8ZuZflXXP1dO73geGJ0fPBQCvMhIQ4q83vufyI6EIONaDrGuJ8tAQyulCHm3azDdjNAYDSD7syZ1yQ9eeTelwZ0l2IwBGckQUyeby05G-yWV0W6hk4wqWhM=w1200-h630-p-k-no-nu

Schedule C Expenses Spreadsheet Download Laobing Kaisuo Db excel

https://db-excel.com/wp-content/uploads/2019/09/schedule-c-expenses-spreadsheet-download-laobing-kaisuo-750x970.jpg

Schedule C Business Worksheet General Information Principal business or profession Business Name Business Address City State amp Zip Code Income Gross receipts or sales Returns and allowances Other Income Description Amount Total Income Cost of Goods Sold Inventory at beginning of year Purchases Cost of items for personal use Cost SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service Profit or Loss From Business Sole Proprietorship Attach to Form 1040 1040 SR 1040 SS 1040 NR or 1041 partnerships must generally file Form 1065 Go to www irs gov ScheduleC for instructions and the latest information OMB No 1545 0074 2024 Attachment Sequence

[desc-10] [desc-11]

Schedule C Spreadsheet Google Spreadshee 1040 Schedule C Spreadsheet

http://db-excel.com/wp-content/uploads/2019/01/schedule-c-spreadsheet-pertaining-to-schedule-c-expenses-spreadsheet-car-and-truck-worksheet-752x970.jpg

Schedule C Worksheet Amount Misc Exp Other

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/09/the-car-truck-expenses-worksheet-schedule-c-review-1-831x970.jpg

Schedule C Worksheet Amount - Dec 21 2023 nbsp 0183 32 Using the worksheet ensures all deductible expenses are claimed and accurately reported on Schedule C Complete it periodically and reconcile with receipts bank statements and accounting records A properly maintained worksheet simplifies filling out Schedule C while minimizing errors