Pf Tax Exemption Meaning Under Section 10 11 of the Income Tax Act the entire withdrawal amount from a recognized Provident Fund is exempt from tax This means that if you withdraw

Apr 18 2020 nbsp 0183 32 Provisions of section 10 11 of the Income Tax Act exempts any payment received from the Statutory Provident Fund whereas provisions of section 10 12 of the Income Tax Nov 5 2024 nbsp 0183 32 Under the old tax regime EPF enjoyed a Triple E status Exempt on contributions Exempt on interest earned and Exempt on the maturity

Pf Tax Exemption Meaning

Pf Tax Exemption Meaning

https://i.ytimg.com/vi/tidrsFRjgkI/maxresdefault.jpg

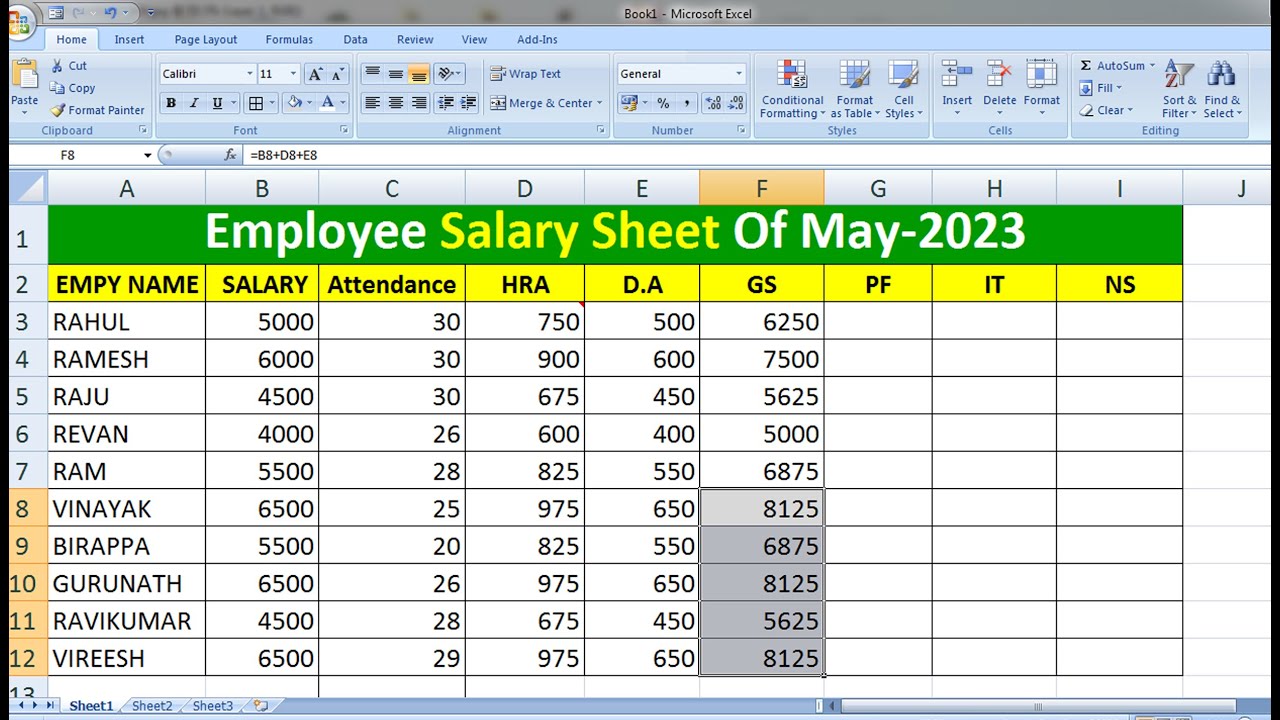

Salary Sheet In Excel D A HRA PF ESI IT NS GROSS SALARY

https://i.ytimg.com/vi/gzHU4djimww/maxresdefault.jpg

Exemption Meaning In Hindi Exemption Ka Matlab Kya Hota Hai YouTube

https://i.ytimg.com/vi/gJIPVsv9D24/maxresdefault.jpg

May 27 2025 nbsp 0183 32 Government Employees PF receipts on retirement are fully exempt from tax Non Government Employees PF amounts received from a recognised PF are exempt only if the Jun 10 2025 nbsp 0183 32 Is employee PF contribution taxable under the new tax regime for FY26 Understand what s changed what s retained and how it impacts your take home pay and long

Tax on provident fund provides exemptions under the Income tax act Learn more about income tax on PF in this detailed guide May 15 2025 nbsp 0183 32 The EPF contributions made by the employer towards the employee s EPF account are exempt from tax Similarly the interest earned on

More picture related to Pf Tax Exemption Meaning

Exemption Meaning In Hindi Exemption Ka Matlab Kya Hota Hai Word

https://i.ytimg.com/vi/y8DGIfj21qk/maxresdefault.jpg

PF Form 11 Composite Declaration Form

https://i.ytimg.com/vi/0jvw-6BocCI/maxresdefault.jpg

Payslip Sample Template Paysliper 55 OFF

https://emailer.tax2win.in/assets/guides/salary-slip/salary-slips-format.jpg

Apr 21 2025 nbsp 0183 32 The EPF withdrawal is exempt from tax when an employee withdraws the amount after 5 years of continuous service Rates of TDS TDS is deducted 10 on EPF balance if From the employer s side a contribution up to 12 of the employee s salary is exempt from tax How is EPF taxed currently Any interest on an amount of EPF contribution with

Under Section 10 11 of the Income Tax Act the entire withdrawal amount from a recognized Provident Fund is exempt from tax This means that if you withdraw Feb 12 2025 nbsp 0183 32 Employee Provident Fund or EPF is an EEE Exempt Exempt Exempt investment scheme for salaried employees in India This means you don t pay tax at all three

Maryland Terrapins The Underrated Powerhouse

https://logos-world.net/wp-content/uploads/2022/12/Maryland-Terrapins-Logo.png

What Did Crip Mac Do 03

https://megaphone.imgix.net/podcasts/8fea7dd6-6ecd-11ee-87fe-638d829420cb/image/0ec6a3.jpeg?ixlib=rails-4.3.1&max-w=3000&max-h=3000&fit=crop&auto=format,compress

Pf Tax Exemption Meaning - Jun 10 2025 nbsp 0183 32 Is employee PF contribution taxable under the new tax regime for FY26 Understand what s changed what s retained and how it impacts your take home pay and long