Paid Parental Leave Adjusted Taxable Income Jan 26 2025 nbsp 0183 32 To accurately report paid family leave benefits on federal tax returns taxpayers must include the total amount received in the Income section of Form 1040 This contributes

This document explains how customers claiming Parental Leave Pay PPL need to provide their adjusted taxable income ATI for a previous financial year If they have not lodged their tax Parental Leave Pay is taxable income and you need to include it in your tax return You may need to pay a Medicare levy If your employer provides your Parental Leave Pay they ll apply the

Paid Parental Leave Adjusted Taxable Income

Paid Parental Leave Adjusted Taxable Income

https://advantage.cu.edu/sites/default/files/2023-01/paid-parental-leave-uccs-112922.svg

CU Anschutz CU Advantage

https://advantage.cu.edu/sites/default/files/2023-01/ovia-121622.svg

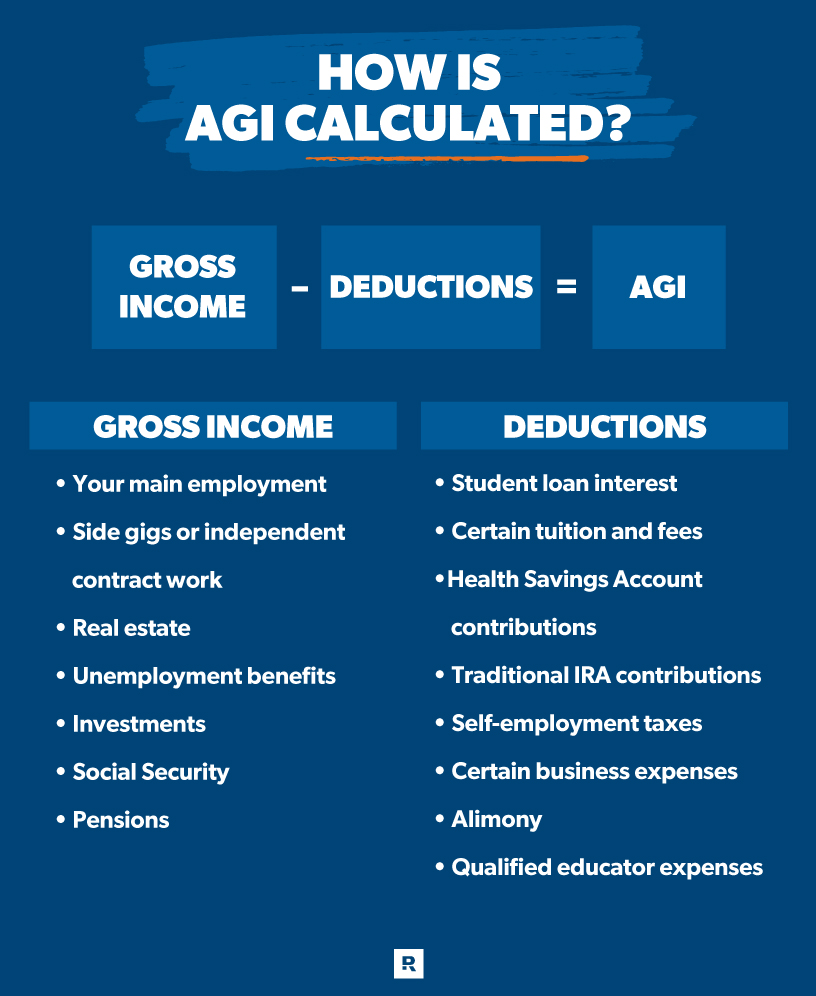

What Is Adjusted Gross Income AGI Does My Snapshot On Tax Act Have The

https://cdn.ramseysolutions.net/media/blog/taxes/personal-taxes/how-is-agi-calculated.jpg

Jan 23 2025 nbsp 0183 32 Understand the tax implications of paid family leave including federal and state variations reporting requirements and potential impacts on your taxes This document outlines the components of adjusted taxable income ATI used for Family Tax Benefit FTB Child Care Subsidy CCS Stillborn Baby Payment SBP and Parental Leave

Customers must estimate their and their partner s adjusted taxable income ATI for the full financial year A partner s ATI is included in the customer s combined ATI only for the period Jul 1 2023 nbsp 0183 32 1 1 A 40 Adjusted taxable income ATI Definition For the purposes of PLP an individual s ATI for the reference income year is the sum of the following amounts for that year

More picture related to Paid Parental Leave Adjusted Taxable Income

CollegeInvest 529 Savings Plan CU Advantage

https://advantage.cu.edu/sites/default/files/2023-01/savi-cu_advantage.svg

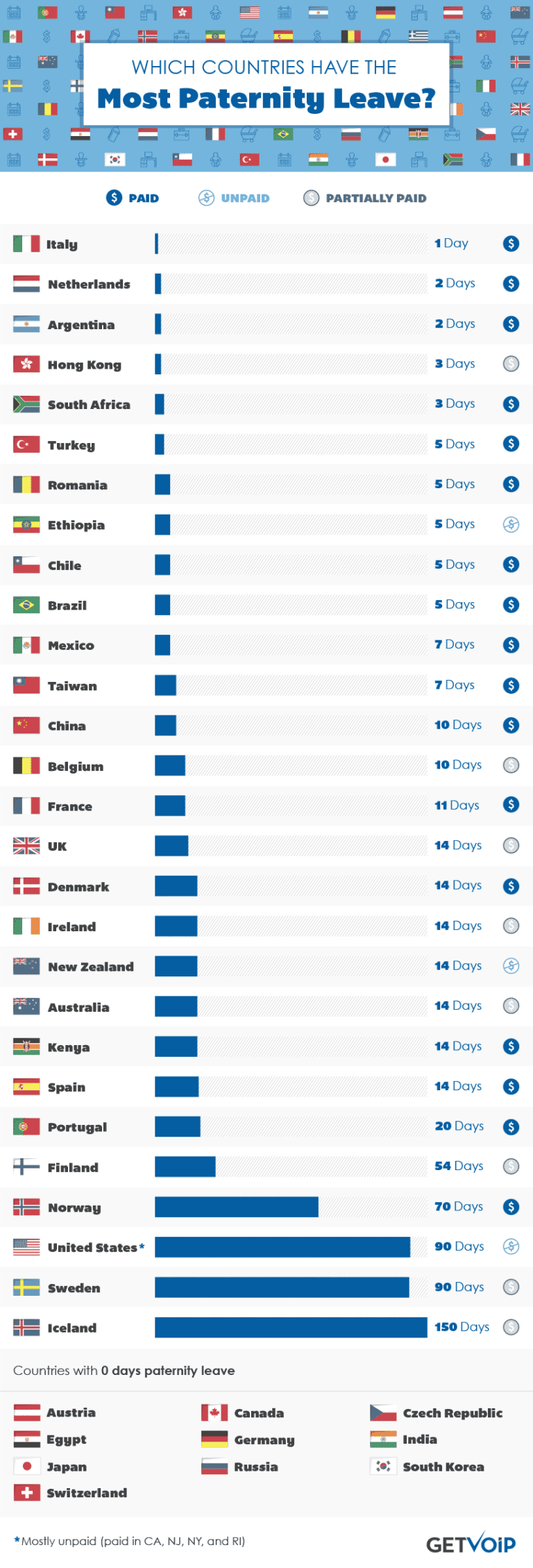

Which Countries Have The Most Parental Leave

https://getvoip.com/uploads/Paternity-Leave-768x2258.png

CollegeInvest 529 Savings Plan CU Advantage

https://advantage.cu.edu/sites/default/files/2023-01/public-service-loan-forgiveness-112922_0.svg

Meet the Paid Parental Leave income test 175 788 in FY24 for the birth parent or 364 350 as a couple This is based on adjusted taxable income which includes fringe benefits additional super contributions and adds back Jul 1 2023 nbsp 0183 32 We use your adjusted taxable income to work out your eligibility for some payments concessions or services Adjusted taxable income may include different types of income

Apr 6 2024 nbsp 0183 32 Under the family income test an individual can qualify for government PPL if their combined adjusted taxable income along with that of their partner is 350 000 or less not be working on parental leave pay days Jul 1 2023 nbsp 0183 32 While the income tests are different for the PPL scheme and family assistance payments such as FTB and CCS ATI is used to assess eligibility for each payment An

Fed Tax Rates 2025 Calculator Jasper E Skuthorp

https://www.taxpolicycenter.org/sites/default/files/publication/137756/01_6.png

Is Paid Parental Leave Taxable Your Family Budget

https://yourfamilybudget.com.au/wp-content/uploads/2018/08/Making-Sense-of-Paid-Parental-Leave-6.png

Paid Parental Leave Adjusted Taxable Income - Jul 1 2023 nbsp 0183 32 To get Parental Leave Pay for a child born or adopted before 1 July 2023 you must meet an income test To get Parental Leave Pay you must have an individual adjusted taxable