Llc Profits Interest Vs Capital Interest May 1 2025 nbsp 0183 32 What Is a Limited Liability Company LLC A limited liability company LLC is a business structure in the U S that protects the assets of its owners from lawsuits and creditors

Jul 9 2025 nbsp 0183 32 What is a limited liability company A limited liability company is a business designation that limits the personal responsibility of its owners for their company s debts and Jun 5 2024 nbsp 0183 32 LLCs offer legal protection of personal assets and pass through taxation through a separate entity that isn t limited to a specific number of shareholders or heavy regulation

Llc Profits Interest Vs Capital Interest

Llc Profits Interest Vs Capital Interest

https://cohenhandler.com.au/wp-content/uploads/2021/08/58160514.jpeg

Profits Interest Vs Capital Interest Whats The Difference Evolution

https://secureservercdn.net/104.238.68.130/ymp.bd4.myftpupload.com/wp-content/uploads/2019/03/people-3192204_1920-e1555095488855.jpg?time=1643820769

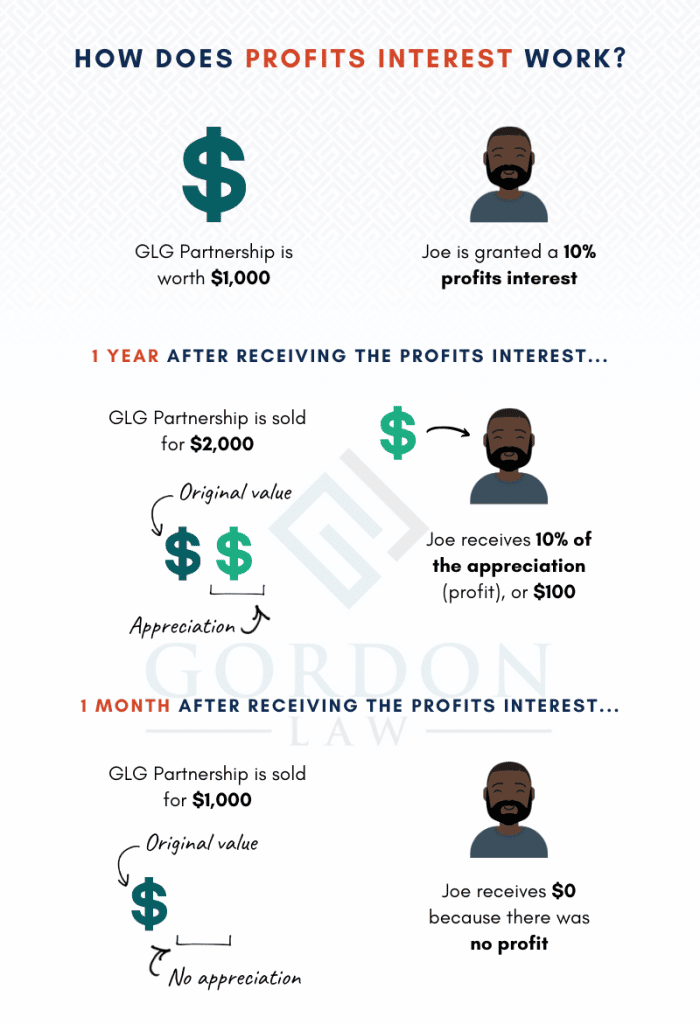

Profits Interest Grant Employees A Piece Of The Pie Gordon Law Group

https://gordonlaw.com/wp-content/uploads/2021/03/profits-interest-1200x630-1.png

Aug 11 2025 nbsp 0183 32 Review information about a Limited Liability Company LLC and the federal tax classification process Aug 15 2024 nbsp 0183 32 Typically LLCs are highly advantageous for business owners They provide the same liability protection as corporations without requiring board meetings corporate

Aug 16 2024 nbsp 0183 32 A Limited Liability Company LLC is a business entity that can have one or more owners who are protected from personal liability for business debts and claims What is a Limited Liability Company LLC A limited liability company LLC is a business structure for private companies in the United States one that combines aspects of partnerships

More picture related to Llc Profits Interest Vs Capital Interest

10 Ways To Boost Profits Without Making More Sales

https://myob-gm-digital-production-blog-assets.s3.amazonaws.com/uploads/2015/02/10-ways-to-increase-profit-margins-blog.jpg

Profits Interest Grant Employees A Piece Of The Pie Gordon Law Group

https://gordonlaw.com/wp-content/uploads/2021/03/profits-interest-how-it-works-infographic-700x1024.png

What Is Interest On Capital Profit Loss Appropriation Goodwill

https://i.ytimg.com/vi/pWtW7fnR3ME/maxresdefault.jpg

Aug 21 2025 nbsp 0183 32 Review information about the Limited Liability Company LLC structure and the entity classification rules related to filing as a corporation or partnership We are proud to have been awarded the title for Best Accounting Service Provider for the fourth time in the category of large accounting firms Thus

[desc-10] [desc-11]

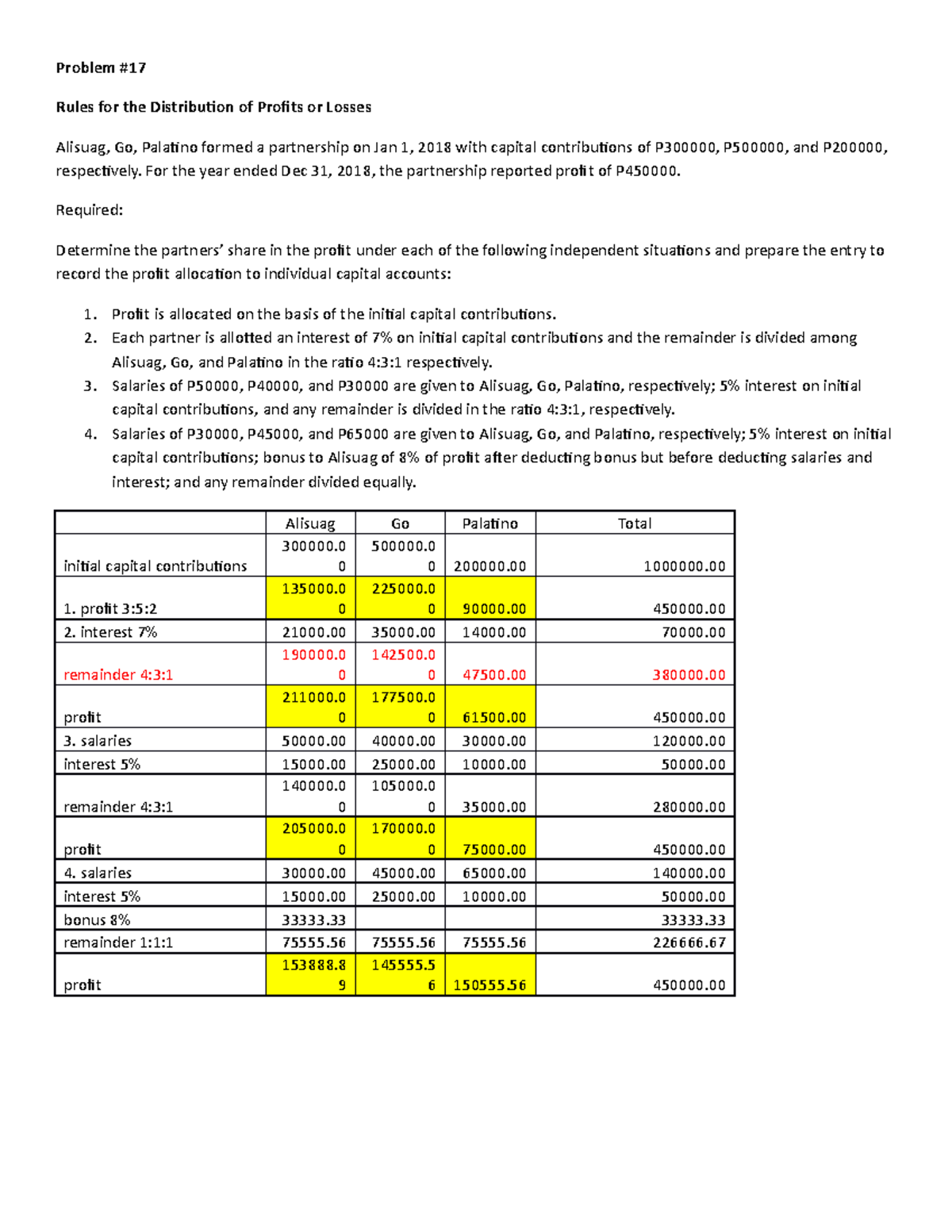

Chapter 2 17 Accounting Problem Rules For The Distribution Of

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8b28735758b697e28d80ab74e3d8cc64/thumb_1200_1553.png

:max_bytes(150000):strip_icc()/net-profits-interest_recirc_Final-f7b6273fdbd146df86db0478af8f088a.png)

Net Profits Interest What It Means How It Works Example

https://www.investopedia.com/thmb/_X8ek3ejECtMRVbf4vStE1A-FPM=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/net-profits-interest_recirc_Final-f7b6273fdbd146df86db0478af8f088a.png

Llc Profits Interest Vs Capital Interest - Aug 15 2024 nbsp 0183 32 Typically LLCs are highly advantageous for business owners They provide the same liability protection as corporations without requiring board meetings corporate