Is Vacation Payout Taxed At A Higher Rate Jun 27 2024 nbsp 0183 32 Vacation payouts may be subject to different taxes than the tax on your wage particularly if it is given to you in the form of a lump sum The good news for companies is that they can choose to charge a fixed tax rate on these

Feb 21 2024 nbsp 0183 32 Is vacation payout taxed at a higher rate The way that you take out federal income taxes depends on whether or not you ve already withheld taxes from the employee s normal wages over the past year Nov 21 2022 nbsp 0183 32 the IRS treats a lump sum payout of unused vacation as supplemental wages subject to Social Security and Medicare taxes according to the IRS Publication 15 Circular E

Is Vacation Payout Taxed At A Higher Rate

Is Vacation Payout Taxed At A Higher Rate

https://hi-static.z-dn.net/files/df6/b2cf49097dd2f636e87c02117a06c0a5.png

Payment Sum Telegraph

https://learn.financestrategists.com/wp-content/uploads/Lump_Sum_vs_Annuity_s_revised.png

Which Situation Could This Graph Represent A Graph Has Time On The X

https://us-static.z-dn.net/files/d46/b8c4e52b7a2776d67729ad687f062f85.jpg

Feb 3 2025 nbsp 0183 32 Receiving a vacation payout can impact your tax liability potentially pushing you into a higher bracket or increasing the taxes owed Strategically managing this windfall is Under IRS rules lump sum payments are considered supplemental wages and are subject to Social Security and Medicare taxes even if your maximum contribution limit is greater than your

PTO payout is when you compensate employees for the unused vacation or sick days they ve accumulated but haven t taken For example an employee has been hustling all year and by the end of it they ve still got a chunk of leave days left If you are an employee who is entitled to vacation time you may wonder if your vacation payout will be taxed at a higher rate than your regular income The short answer is no but let s dive

More picture related to Is Vacation Payout Taxed At A Higher Rate

Maximum Social Security 2025 Richard I Steinberg

http://seniorsleague.org/assets/TSCL_SocialSecurity_Chart.jpg

Bonus Pay Tax Rate 2024 Vera Allison

https://cdn.minafi.com/wp-content/uploads/2018/09/03194927/How-Are-Bonuses-Taxed_-Blog-1200x675.png

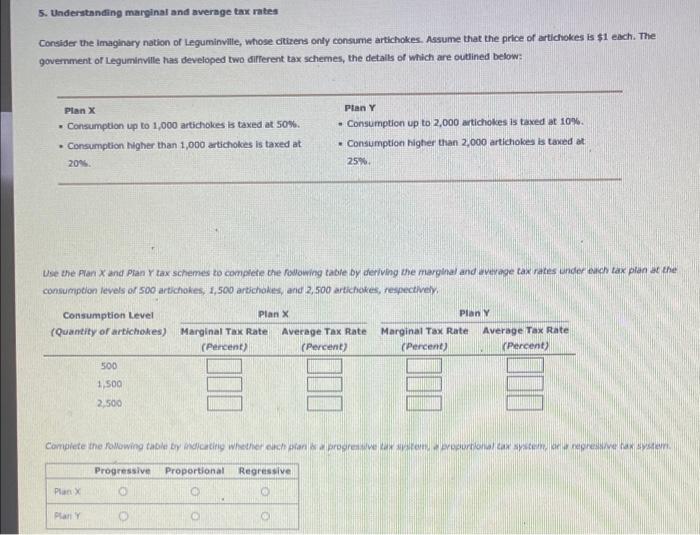

Solved Need Help 5 5 Understanding Marginal And Average

https://media.cheggcdn.com/study/4dd/4dde2fab-17c8-4e05-afed-211394379e61/image

Is Vacation Payout Taxable Yes vacation payout is taxable income This means that it should be reported on your tax return and will be subject to federal and state income tax withholding Feb 16 2025 nbsp 0183 32 Vacation payout is typically taxed at the same rate as regular income However the total amount of the payout may push you into a higher tax bracket resulting in a higher tax

Jan 17 2023 nbsp 0183 32 This article explains why vacation pay is taxed at a higher rate than regular wages including implications for employers and employees differences in taxation across countries Taxation of PTO Payout In most states earned PTO vacation sick time or both is considered to be a form of wages The IRS taxes payout of accrued vacation and other PTO at the

Is Vacation Payout Taxed Exploring The Tax Implications Of Taking A

https://www.tffn.net/wp-content/uploads/2023/01/is-vacation-payout-taxed.jpg

Is Vacation Payout Taxed Exploring The Tax Implications Of Taking A

https://www.lihpao.com/images/illustration/is-vacation-payout-taxed-2.jpg

Is Vacation Payout Taxed At A Higher Rate - Jan 15 2023 nbsp 0183 32 Generally speaking vacation payouts are subject to both federal and state taxes In addition certain other taxes may also apply such as Social Security and Medicare taxes