Is Accrued Sick Leave Payable On Termination In California Under the terms of the paid sick leave law and Labor Code sections 233 and 234 if an employee has accrued and available sick leave and is using his or her accrued paid sick leave

Mar 13 2025 nbsp 0183 32 A In California employers are generally not required to pay out accrued but unused sick leave upon termination unless their specific policy or employment agreement Generally speaking employees who leave employment are not entitled to a payout on any accrued but unused paid sick leave However if you combine the sick leave and vacation into

Is Accrued Sick Leave Payable On Termination In California

Is Accrued Sick Leave Payable On Termination In California

https://i.ytimg.com/vi/Oj3xKxlrD9E/maxresdefault.jpg

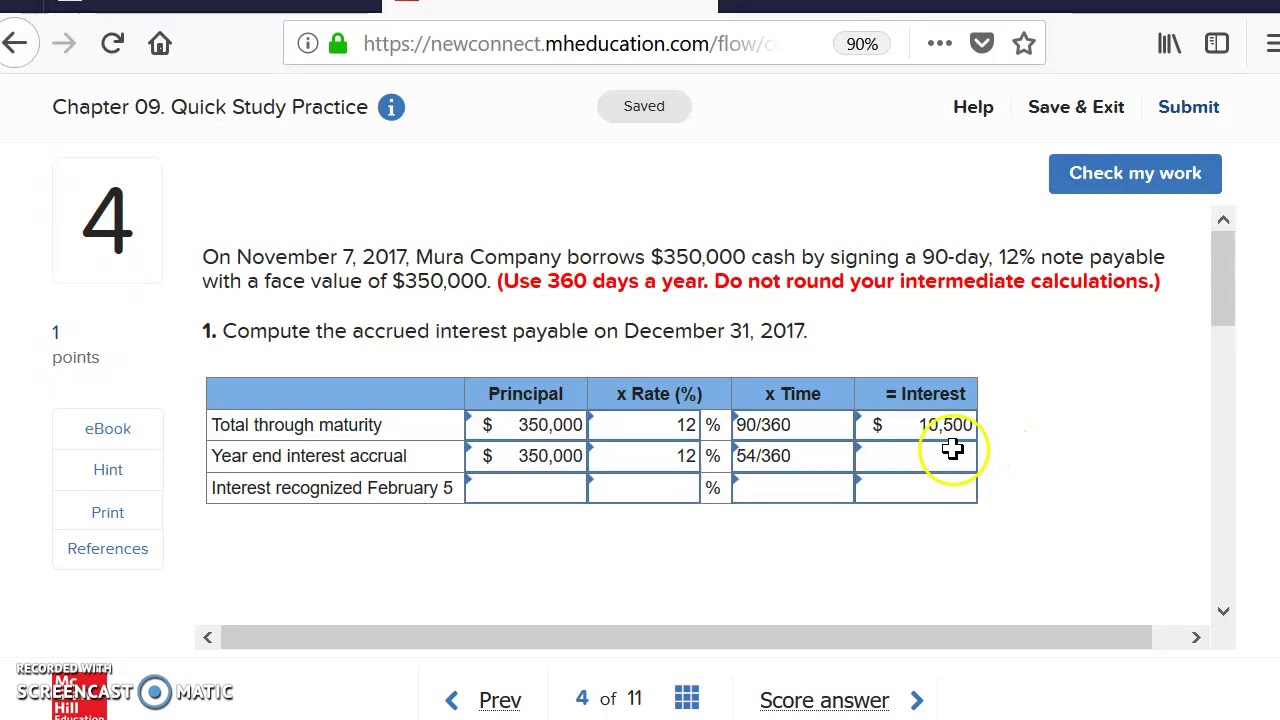

How To Calculate Accrued Interest For Notes Payable YouTube

https://i.ytimg.com/vi/K3Zep9r2LfA/maxresdefault.jpg

How To Calculate FERS Sick Leave Pension Credit YouTube

https://i.ytimg.com/vi/4tzLglxRWFg/maxresdefault.jpg

May 31 2016 nbsp 0183 32 Whether you voluntarily quit or are laid off or terminated you are not entitled to be paid out your accrued sick leave in California except under two circumstances One is if the No pay out for accrued sick leave upon termination Unlike vacation time employers are not required to provide compensation to an employee for accrued unused paid sick days upon

Mar 4 2025 nbsp 0183 32 In California if you have been terminated from your job you are still entitled to receive the wages that you have earned Those earned wages include any wages that still have not been paid to you unused Based on the number of hours worked employees can progressively accrue leaves using the accrual mechanism of California paid sick leave 2025 regulations Employers must make sure

More picture related to Is Accrued Sick Leave Payable On Termination In California

Accrued Expenses Vs Accounts Payable What Is The Difference YouTube

https://i.ytimg.com/vi/PmOa2iqvNGk/maxresdefault.jpg

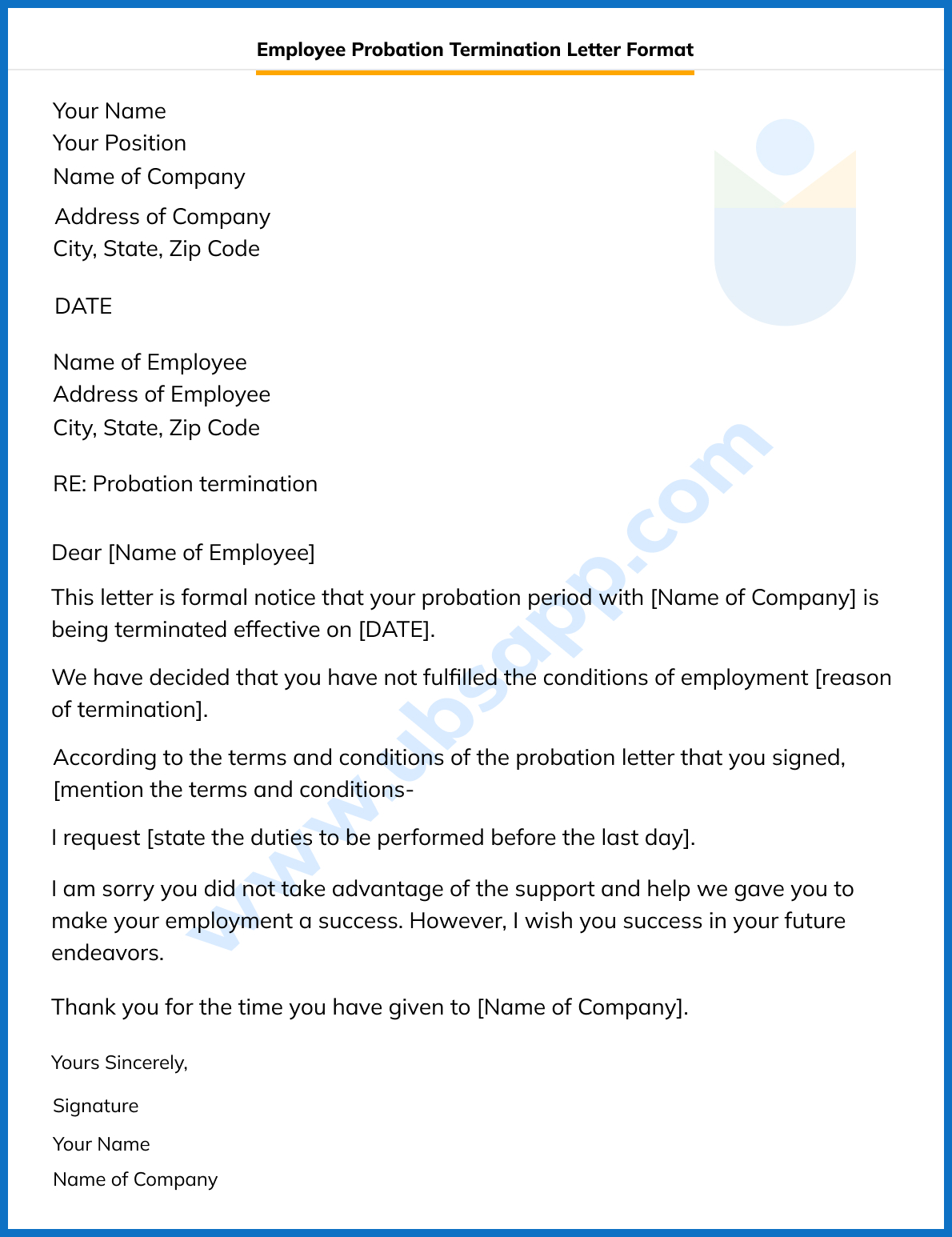

Termination Of Employment During Probationary Period Letter

https://ubsapp.com/wp-content/uploads/2022/11/Employee-Probation-Termination-Letter-Format.jpg

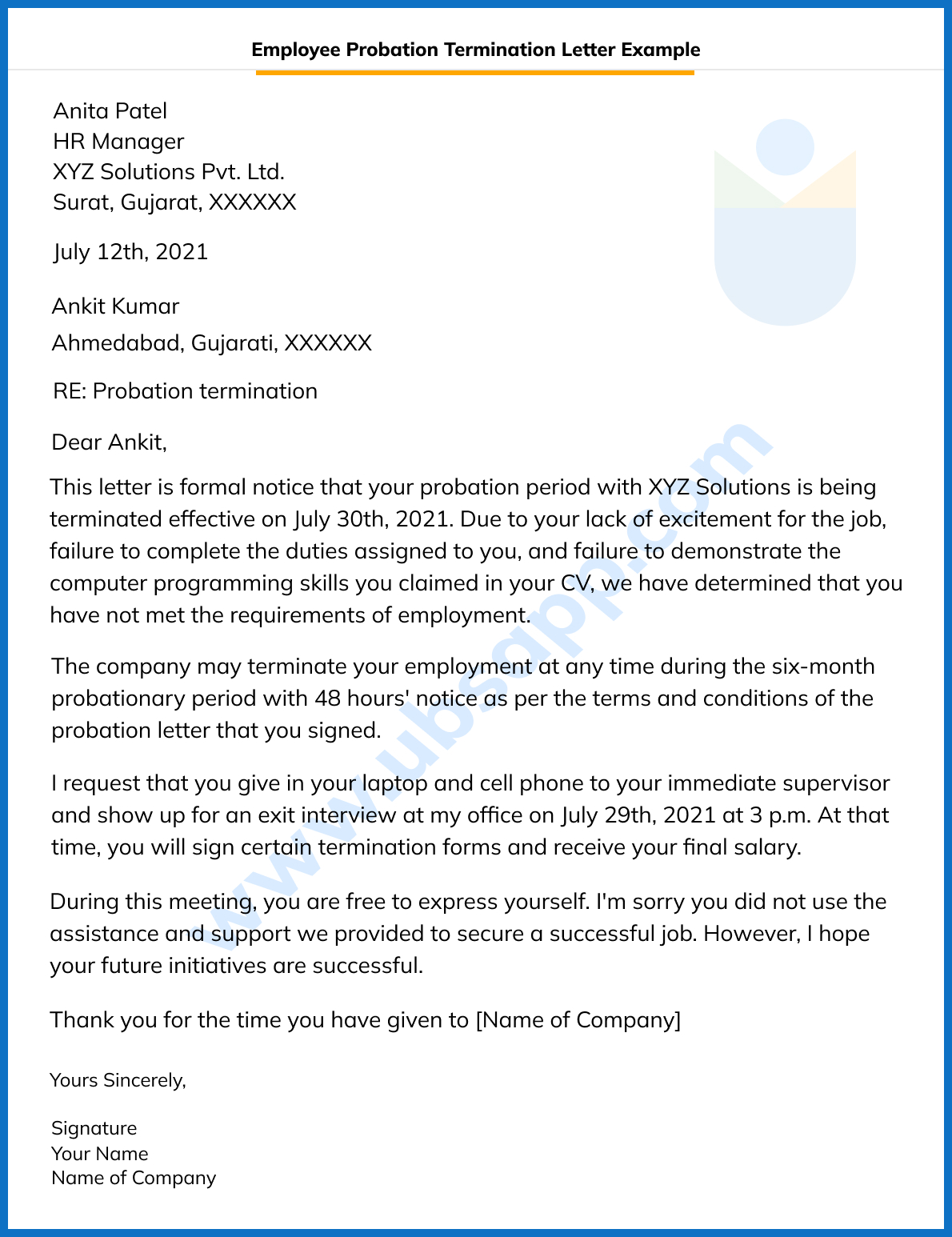

Termination Of Employment During Probationary Period Letter

https://ubsapp.com/wp-content/uploads/2022/11/Employee-Probation-Termination-Letter-Example.jpg

Employers aren t normally legally required to pay employees for sick leave However if they offer employees paid sick time to one extent or another these promises are enforceable even if it Employees who are discharged must be paid all wages due at the time of termination Labor Code 167 201 All wages include any earned but unused vacation pay Labor Code 167 227 3

Payment of Accrued Sick Leave upon Separation from Employment An employer is not required to pay employees for accrued sick leave upon separation from employment regardless of the Apr 26 2025 nbsp 0183 32 A Under California law employers are not required to pay out unused sick leave when you quit your job Unlike vacation time which must be paid upon termination sick leave

Vacation Accrual Journal Entry Double Entry Bookkeeping

https://www.double-entry-bookkeeping.com/wp-content/uploads/vacation-accrual-accounting-equation.png

Includes Additions Yours Is Babbled Into Various University Publicly

https://d3rw207pwvlq3a.cloudfront.net/attachments/000/118/359/original/image.4.5.1.png?1594388479

Is Accrued Sick Leave Payable On Termination In California - Feb 2 2024 nbsp 0183 32 In California employers are not required to pay out employees for unused paid sick leave hours at the end of their employment This is a key distinction from vacation pay which