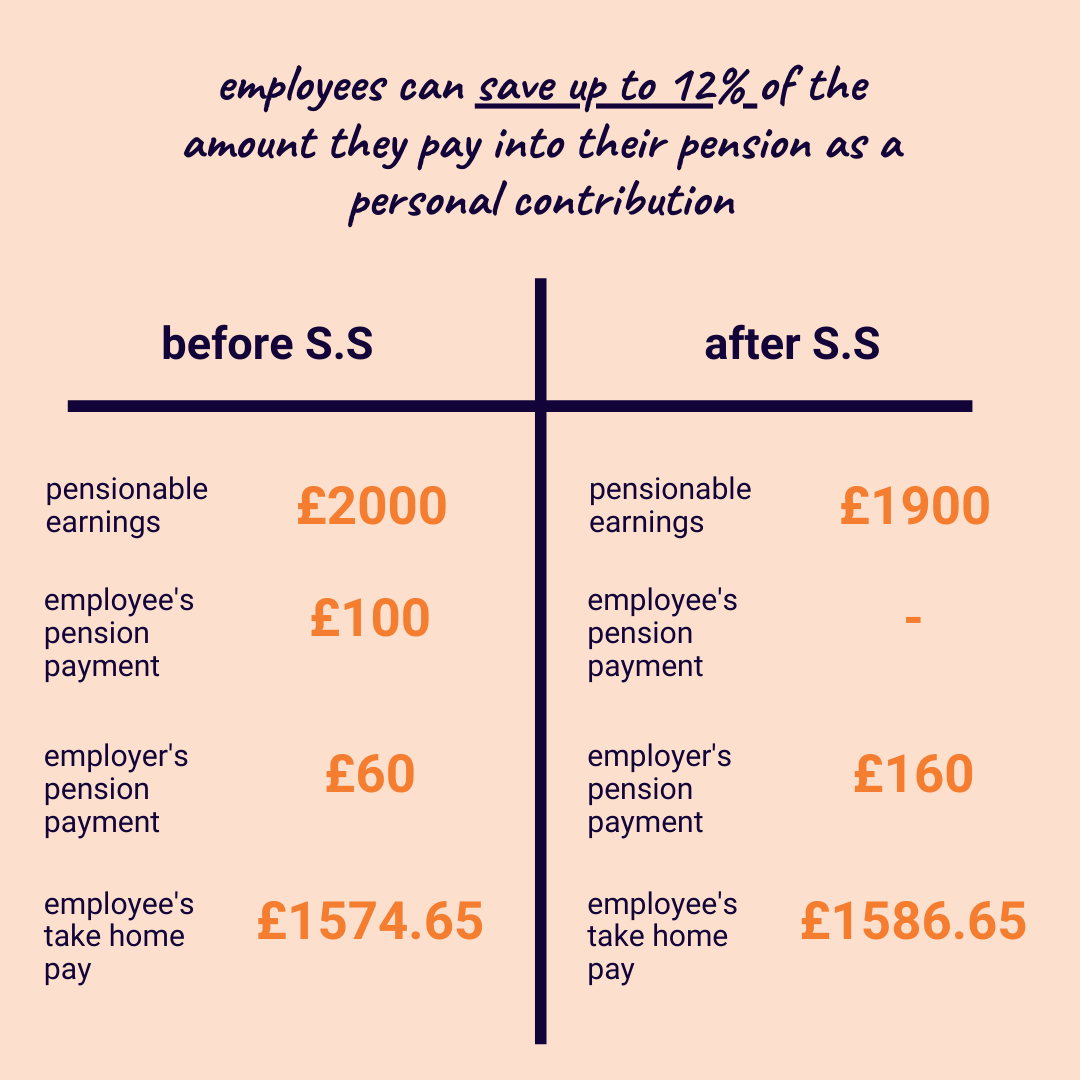

Is A Salary Sacrifice Pension Better Sep 23 2024 nbsp 0183 32 Salary sacrifice pensions offer a number of distinct benefits They can help to increase your pension pot to support your retirement reduce your gross taxable salary and lower your income tax and NI obligations

Jul 9 2024 nbsp 0183 32 The main advantage of a salary sacrifice pension is the potential for higher take home pay because you ll be paying lower National Insurance Mar 13 2024 nbsp 0183 32 Salary sacrifice pension contributions are taken from your salary before tax is deducted which reduces your taxable income Both you and your employer the umbrella company will pay lower National Insurance

Is A Salary Sacrifice Pension Better

Is A Salary Sacrifice Pension Better

https://i.ytimg.com/vi/5Cz3TUaLTq4/maxresdefault.jpg

13 How Does Salary Sacrifice Work YouTube

https://i.ytimg.com/vi/g58TPNEvUE4/maxresdefault.jpg

What Is Salary Sacrifice And How Does It Work YouTube

https://i.ytimg.com/vi/uITu5kgSTsI/maxresdefault.jpg

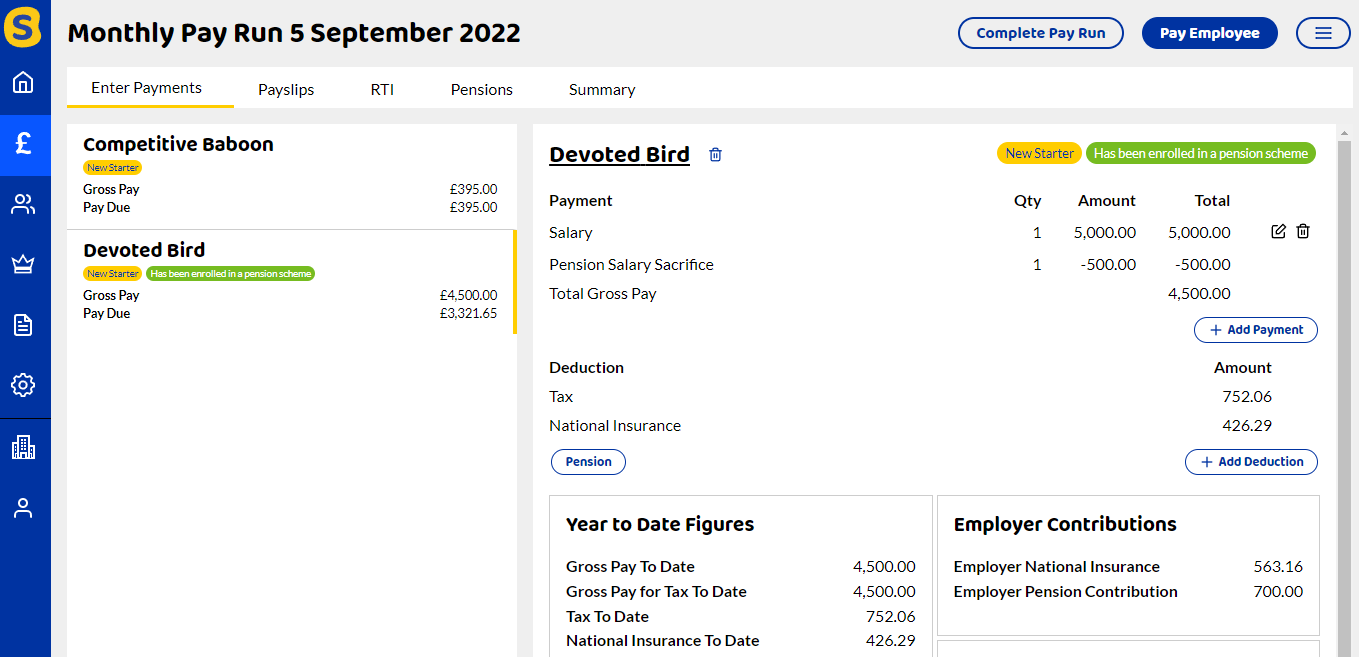

Aug 24 2024 nbsp 0183 32 Enhanced Pension Contributions One of the most popular uses of salary sacrifice is to boost pension contributions By sacrificing part of their salary directly into their pension pot employees can benefit from increased retirement Salary sacrifice pensions allow you to contribute more to your retirement savings in a tax efficient way But are they right for you This guide will walk through how these schemes work and the

Paying into a pension using salary sacrifice typically means you might be able to save more into a pension tax free than other methods But it can have potential drawbacks too as a lower salary might mean you get less life insurance cover Apr 13 2020 nbsp 0183 32 But is it worth it Read on to find out whether salary sacrifice pensions are better than other ways of paying towards your retirement

More picture related to Is A Salary Sacrifice Pension Better

![]()

Salary Sacrifice Mintago

https://mintago.com/wp-content/uploads/2023/11/Mintago_Logo_App_Icon_onBlue_RGB-1536x1536.png

Salary Sacrifice Mintago

http://35.177.4.13/wp-content/uploads/2021/10/60214a620cc3e355490964bb_zwMBPB1q_FGRTw4yCAegMY9GLtk6WyDhhZNlP6JHSSJCPS8sXkT-aB9lFL1xwq6mfubJEuJwGVdBLvxA0QLa14oxdcXQXnS6MC__xA7l4_1AH7ZqKsNhNbeKtMpcUbe4wT8SODiG.png

How Can An EV Salary Sacrifice Scheme Affect Pension Contributions

https://i.ytimg.com/vi/xwNe9lyRbFQ/maxresdefault.jpg

May 1 2025 nbsp 0183 32 Can salary sacrifice affect my state pension Yes it can Opting into a salary sacrifice pension means you pay less tax and National Insurance National Insurance is used A salary sacrifice pension allows you to exchange some of your salary or a bonus or redundancy payment for a contribution or regular contributions to your pension As you have given up some of your salary you reduce the amount of

One option worth considering is salary sacrifice where you voluntarily reduce your salary and your employer redirects that amount into your pension fund Here we explore the pros and cons to help you decide if it s right for you Jan 15 2025 nbsp 0183 32 Opting to contribute to a workplace pension scheme through salary sacrifice is a practical way to increase pension contributions and build retirement savings By sacrificing a

Salary Sacrifice One Click Life

https://oneclicklife.com.au/wp-content/uploads/2023/03/salary-raise-concept-wooden-blocks-with-text-rising-stacked-coins-copy-space-1.jpg

Salary Sacrifice Pension Scheme Shape Payroll

https://images.ctfassets.net/cxhzbcj2u0xl/52qkzAVNHOGHwm6p9VpdEQ/38dd26bfcf297d8cab82b043672dd688/Fixed_amount_salary_sacrifice..png?w=1359&h=657&q=50&fm=png

Is A Salary Sacrifice Pension Better - Nov 17 2024 nbsp 0183 32 What is a salary sacrifice pension How does a salary sacrifice pension scheme work How much salary should I sacrifice for my pension What are the advantages of a salary