Income Tax Credit Explained Feb 24 2025 nbsp 0183 32 Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by this date By filing on time you will begin or continue to receive the benefit and credit payments you are eligible for and you

It s never been easier to do your taxes online In fact online filing gets you access to the benefits credits and refunds you may be eligible for even faster Last year approximately 93 of Canadians filed their income tax and benefit returns online 6 days ago nbsp 0183 32 The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide

Income Tax Credit Explained

Income Tax Credit Explained

https://i.ytimg.com/vi/CB6B0PfJdRc/maxresdefault.jpg

R D Tax Credit Explained Video YouTube

https://i.ytimg.com/vi/_Q1ohu3_rco/maxresdefault.jpg

Understanding The Earned Income Tax Credit EITC YouTube

https://i.ytimg.com/vi/gJdWQ4_sUG0/maxresdefault.jpg

How does the recovery tax deduction work Once your Old Age Security Return of Income form is received the net world income you report is used to estimate your Old Age Security OAS pension repayment amount for the following tax year The repayment amount is then divided monthly and deducted from your OAS pension payments as a recovery tax Apr 30 2025 nbsp 0183 32 Personal income tax How to file a tax return You may choose to do your own taxes or have someone else do them for you using tax software or on paper If eligible you may be able to get your taxes done for free by invitation or at a free tax clinic

Jul 9 2025 nbsp 0183 32 NETFILE service in tax software that allows most people to submit a personal income tax return electronically to the Canada Revenue Agency Net Income Income ps Profit Gross Profit Net Profit

More picture related to Income Tax Credit Explained

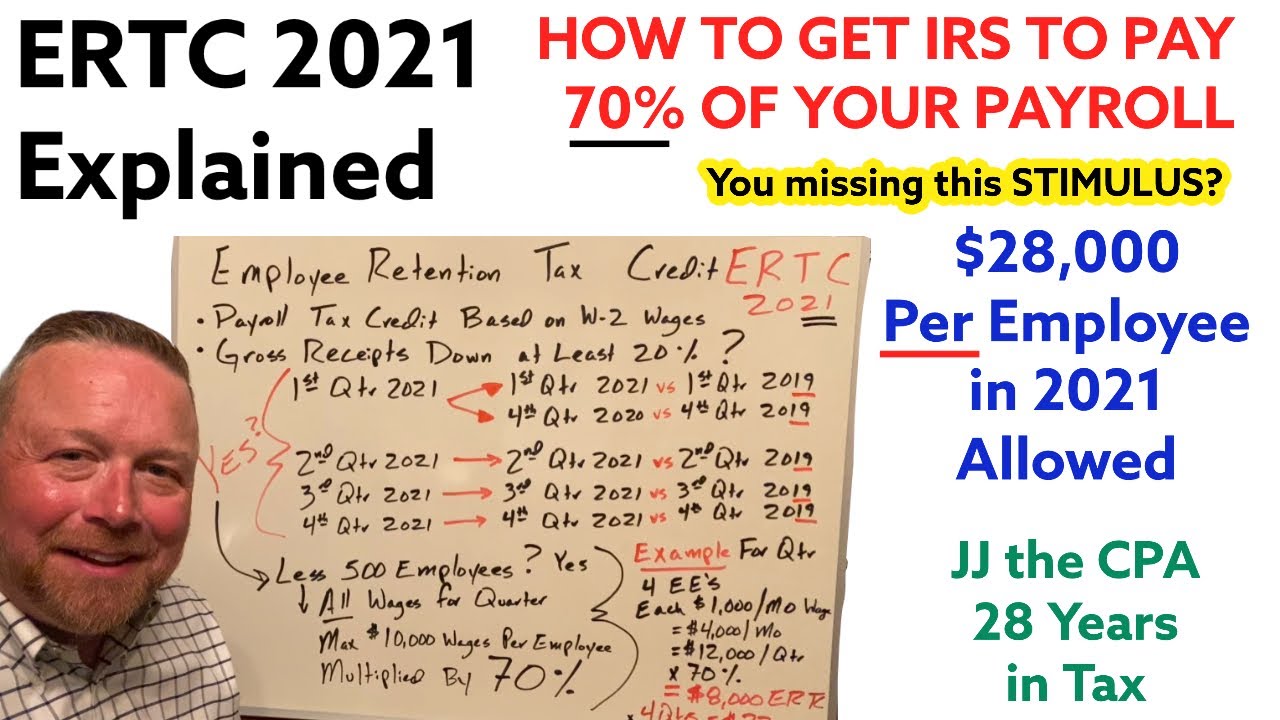

ERC 2021 Employee Retention Tax Credit Explained Understand What Is

https://i.ytimg.com/vi/h2ZwRN1GQVI/maxresdefault.jpg

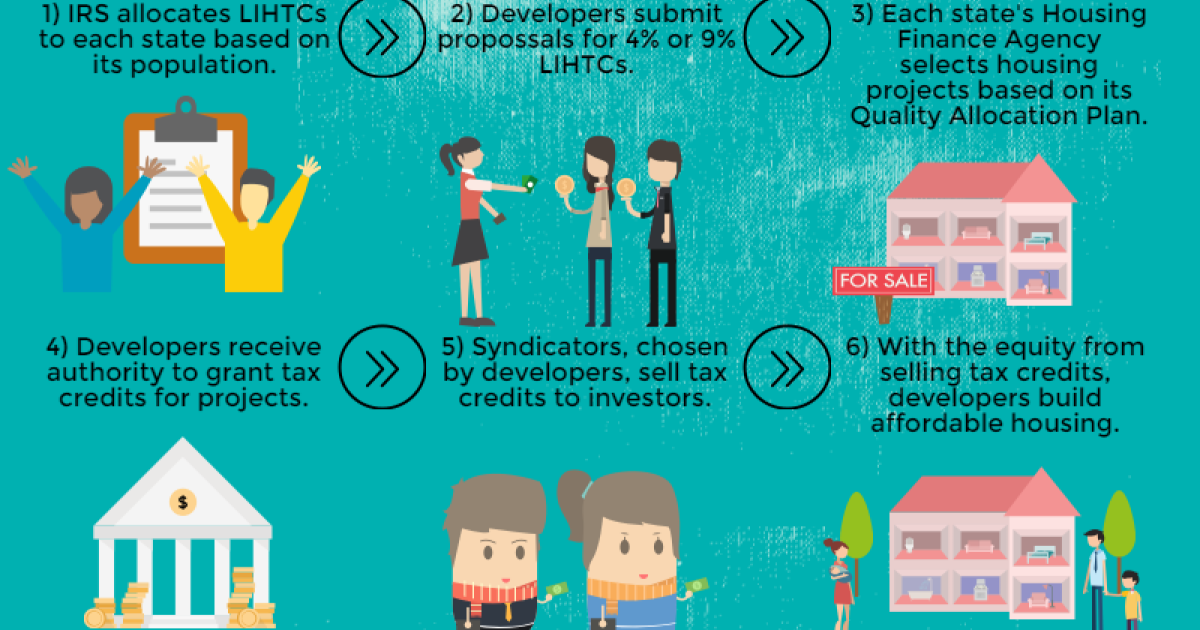

Infographic The Low Income Housing Tax Credit Program How 47 OFF

https://www.wilsoncenter.org/sites/default/files/styles/og_image/public/media/images/article/lihtc-mechanism-chart.png

Tax Brackets 2024

https://districtcapitalmanagement.com/wp-content/uploads/Tax-Bracket-scaled.jpg

You may request changes to an assessed income tax and benefit return if you need to correct amounts or forgot to include information on your return You must wait until you receive your notice of assessment NOA before you can request a change to your return The return must have been filed by you Feb 13 2025 nbsp 0183 32 Keep these dates in mind for tax season February 24 2025 You can start filing your 2024 income tax and benefit return online April 30 2025 Deadline for most individuals to file their income tax and benefit return and pay any taxes owed By filing and paying on time you will avoid late filing penalties and interest June 15 2025 You generally have to file your

[desc-10] [desc-11]

Individual Federal Tax Rates 2024 Image To U

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

October 2021 Child Tax Credit Payment Kept 3 6 Million Children From

https://images.squarespace-cdn.com/content/v1/610831a16c95260dbd68934a/1642741593352-71GIM9GJXM0IWTIS4V3C/Oct-monthly-poverty-data-2021+%281%29.PNG

Income Tax Credit Explained - How does the recovery tax deduction work Once your Old Age Security Return of Income form is received the net world income you report is used to estimate your Old Age Security OAS pension repayment amount for the following tax year The repayment amount is then divided monthly and deducted from your OAS pension payments as a recovery tax