Income Statement Variance Analysis Example May 27 2025 nbsp 0183 32 Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

Feb 24 2025 nbsp 0183 32 Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by It s never been easier to do your taxes online In fact online filing gets you access to the benefits credits and refunds you may be eligible for even faster Last year approximately 93 of

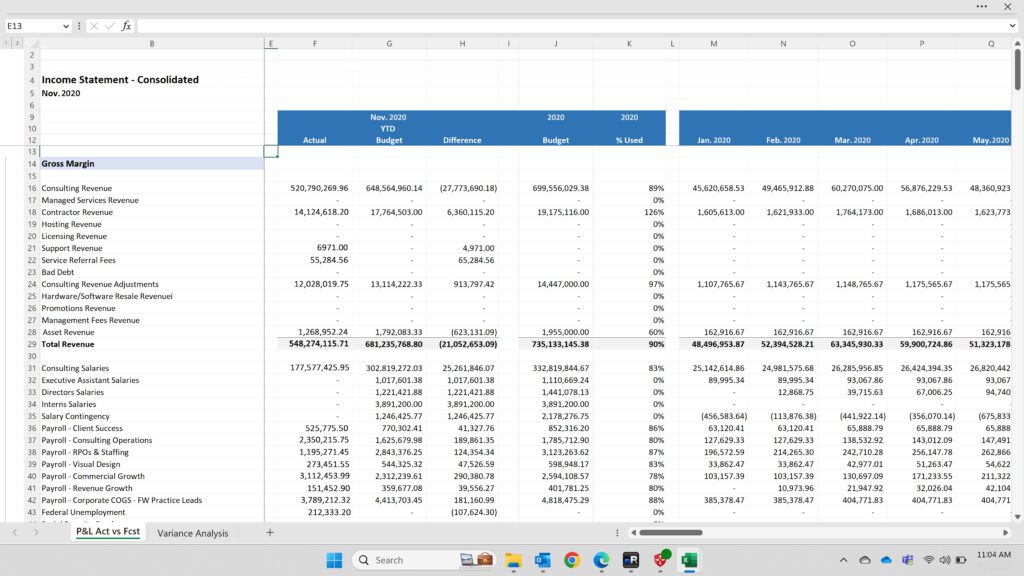

Income Statement Variance Analysis Example

Income Statement Variance Analysis Example

https://i.ytimg.com/vi/kMkH7HsPMwE/maxresdefault.jpg

Income Statement Variance Analysis YouTube

https://i.ytimg.com/vi/Vo9ceXGokRM/maxresdefault.jpg

Variance Analysis vs Budget And Prior Year YouTube

https://i.ytimg.com/vi/DofWQDUeEpg/maxresdefault.jpg

How income affects your benefit amount The Canada Disability Benefit is an income tested benefit which means the benefit amount will start to decrease after your adjusted family net Personal income tax Reporting income Find out what you need to report as income and how to enter these amounts on your tax return

Review all types of income you need to report on your income tax and benefit return Jul 1 2025 nbsp 0183 32 The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income tax

More picture related to Income Statement Variance Analysis Example

Standard Costing Overhead Variance Analysis Example batch level

https://i.ytimg.com/vi/AfvzReXdBJg/maxresdefault.jpg

Pin On FIN

https://i.pinimg.com/originals/80/be/7c/80be7c8fbf9162300fdab729355d7b4d.jpg

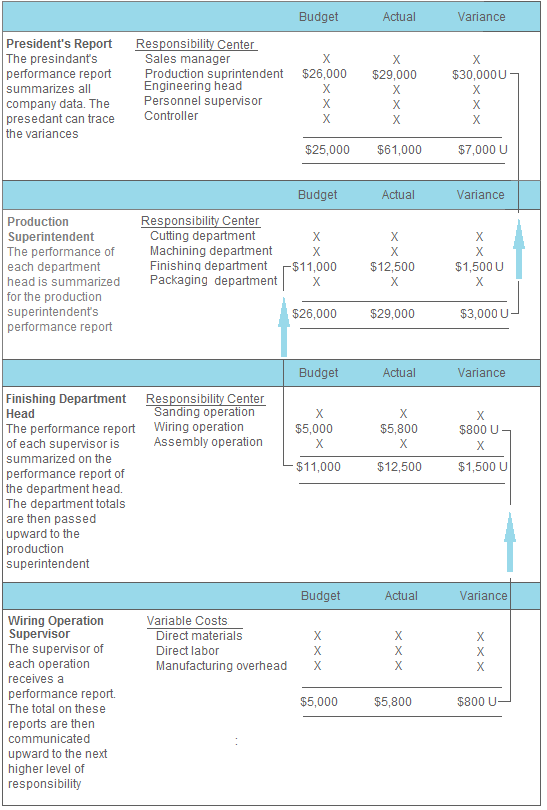

Variance Performance Report Explanation And Example Accounting For

https://www.accountingformanagement.org/wp-content/uploads/2012/08/variance-performance-report1.png

Income requirements for the sponsorIncome requirements for the sponsor To be a sponsor you must have enough money to support all of the people you ll be financially responsible for Personal income tax Who should file a tax return how to get ready and file taxes payment and filing due dates reporting income and claiming deductions and how to make payments or

[desc-10] [desc-11]

Accounting Notes Accounting Education Accounting Basics Accounting

https://i.pinimg.com/originals/38/ca/6b/38ca6b2f503964310d51ba1a7a440c0e.png

Templates Reports DeFacto Global Inc

https://defactoglobal.com/wp-content/uploads/2023/04/WMP-Variance-AnalysisEDIT-1024x576.jpg

Income Statement Variance Analysis Example - [desc-14]