How To Calculate Tax On Long Service Leave Cash Out Apr 30 2020 nbsp 0183 32 When making a payment of unused long service leave on termination of employment you need to calculate certain payment components that have different withholding

Jun 10 2025 nbsp 0183 32 If you are paying an employee annual leave or long service leave for a period greater than one pay period you can use the online tax withheld calculator or appropriate tax Jun 16 2024 nbsp 0183 32 If you pay leave loading as a lump sum use Schedule 5 Tax table for back payments commissions bonuses and similar payments to calculate withholding If you pay

How To Calculate Tax On Long Service Leave Cash Out

How To Calculate Tax On Long Service Leave Cash Out

https://media.geeksforgeeks.org/wp-content/uploads/20221216182245/Income-Tax-on-Salary-3.png

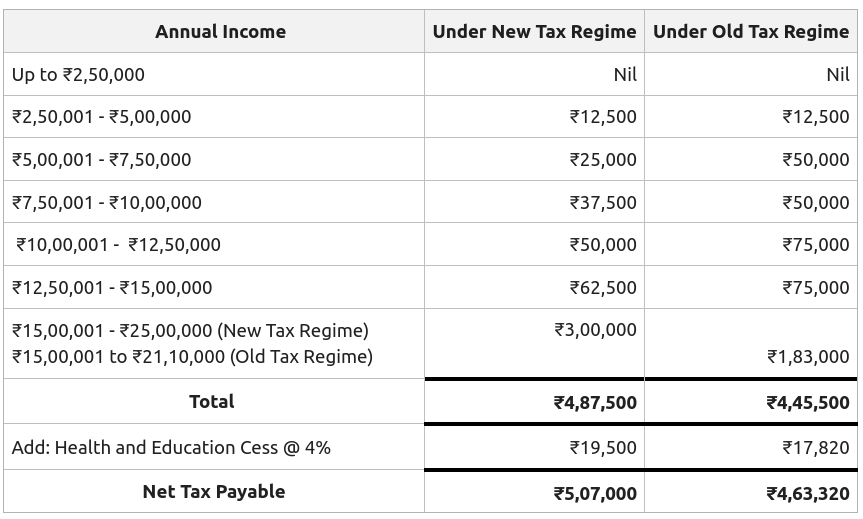

How To Calculate Tax On Salary Sale Online Www pennygilley

https://assets-global.website-files.com/641d54fdcc011edcca41c54a/652908237667f8c8658b01d2_Tax calculation from salary with example.png

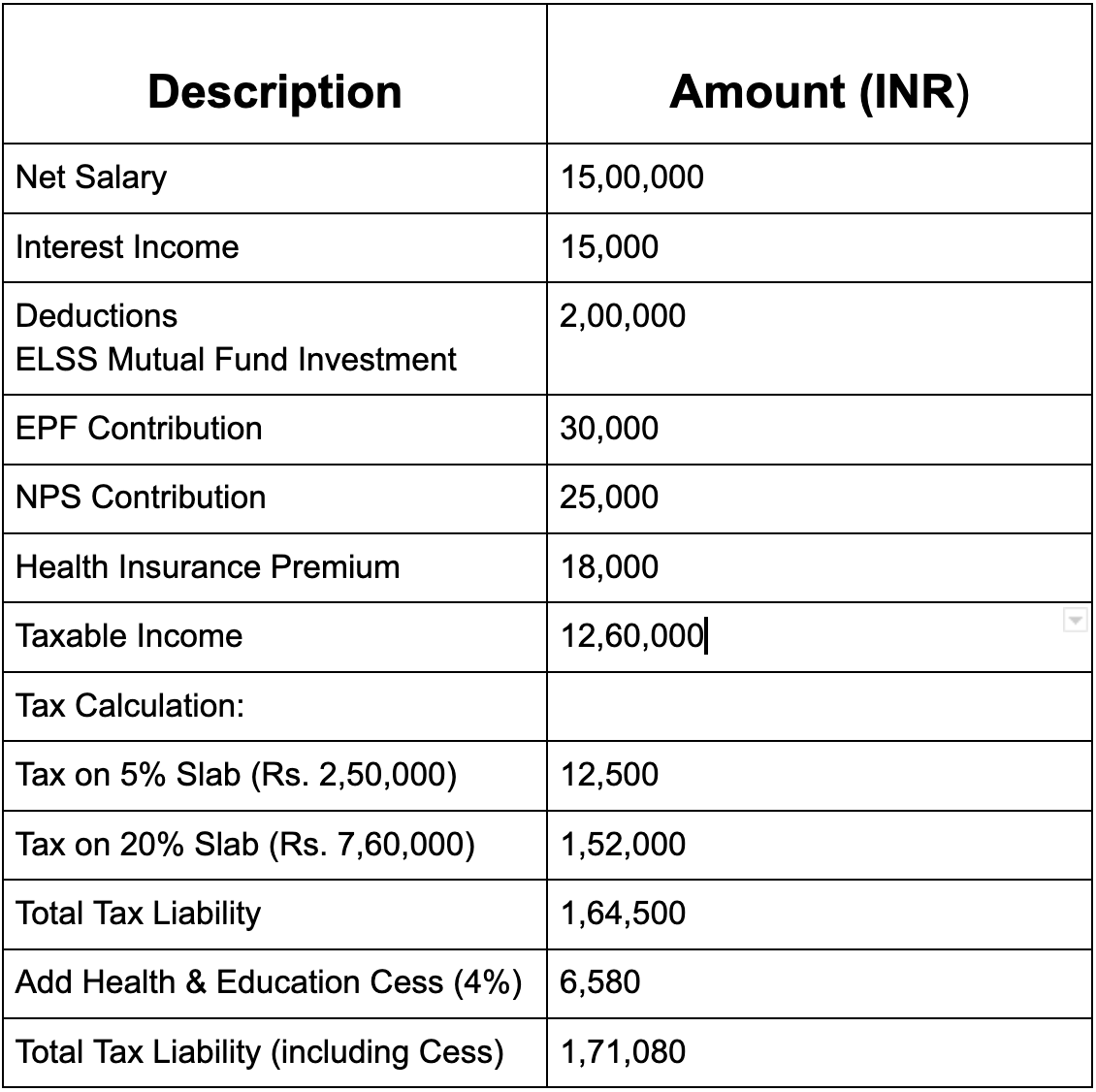

Tax Calculator 2025 Kay Sarajane

https://oneclicklife.com.au/wp-content/uploads/2023/04/Budget-Tax-Rates-Threshold-01-scaled-e1681366579595.jpg

How much an employee is paid for long service leave depends on where they get their entitlement On this page Pay rates for long service leave Payment of long service leave at Apr 30 2020 nbsp 0183 32 To calculate the correct amount to be withheld from a payment of unused annual leave you need to know what the payment is for why it was accrued or paid and in some

Oct 12 2020 nbsp 0183 32 Unused leave payments on termination of employment or office include annual leave holiday pay leave loading leave bonuses long service leave Before calculating the Apr 22 2022 nbsp 0183 32 On completion of ten years continuous service a worker and their employer can agree to a cash payment in lieu of long service leave for either

More picture related to How To Calculate Tax On Long Service Leave Cash Out

Live From AJ s Request A Song Www mysetmusic ajs online

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=481995197500508&get_thumbnail=1

Tax Calculator 2025 Salary M Clayton Johnson

https://fincalc-blog.in/wp-content/uploads/2023/02/how-to-calculate-income-tax-2023-24-excel-income-tax-calculation-examples-video-1024x576.webp

Tax Calculator 2025 In Excel Johnny A Woodward

https://cdn.educba.com/academy/wp-content/uploads/2019/08/Calculate-Income-Tax-in-Excel-1-1024x640.png

Oct 5 2023 nbsp 0183 32 If a continuing employee receives a payment for unused leave with or without leave loading use Tax table for back payments commissions bonuses and similar payments The Aug 29 2017 nbsp 0183 32 We talk to our clients about the capped tax rate that applies when leave is taken as a lump sum such as cashing out their long service leave Long Service Leave taken as a

Oct 6 2022 nbsp 0183 32 Tax is paid at your marginal tax rate Your employer may deduct more tax than normal if paying in a lump sum though they shouldn t there are guides available on the ATO Jun 12 2023 nbsp 0183 32 Ensure your Payroll system is flagged to calculate tax and superannuation appropriately The ATO reporting category for this transaction in payroll is Type C Cash out

Tax Return Estimate 2024 Gale Halimeda

https://assets-global.website-files.com/5cdcb07b95678daa55f2bd83/6437a5743c70c97a75b24d3a_salarytax.png

Online Tax Calculator 2025 Jeanna Muriel

https://indianexpress.com/wp-content/uploads/2025/02/income-tax-slab.jpeg

How To Calculate Tax On Long Service Leave Cash Out - 2 days ago nbsp 0183 32 Primark product staff have been told they will have to return to the office four days a week from September The update which is effective from 15 September applies to