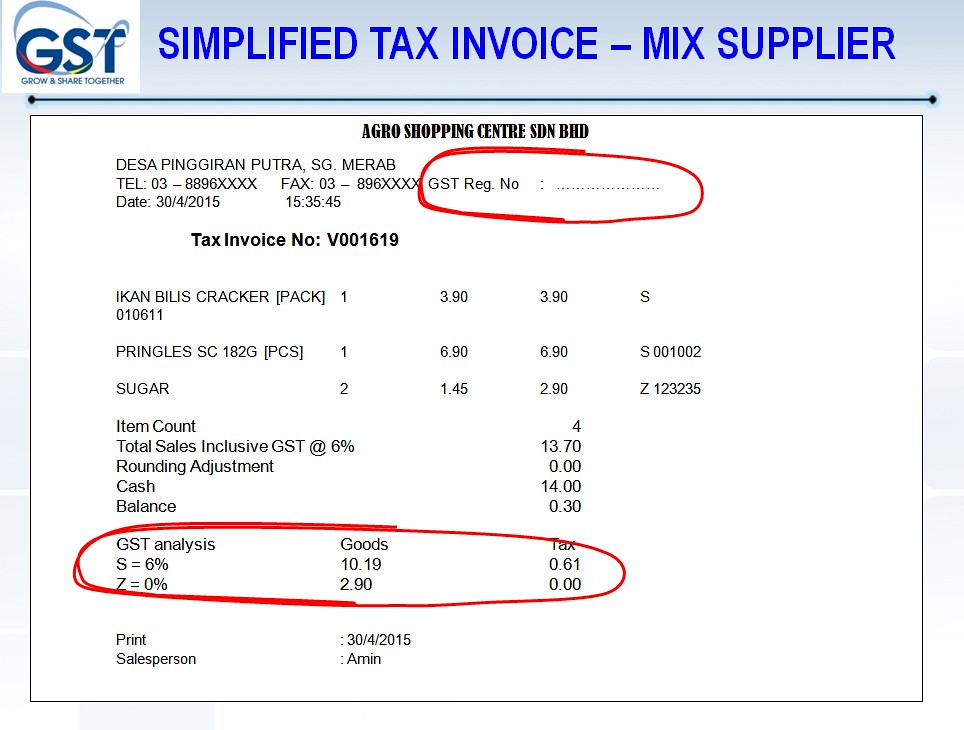

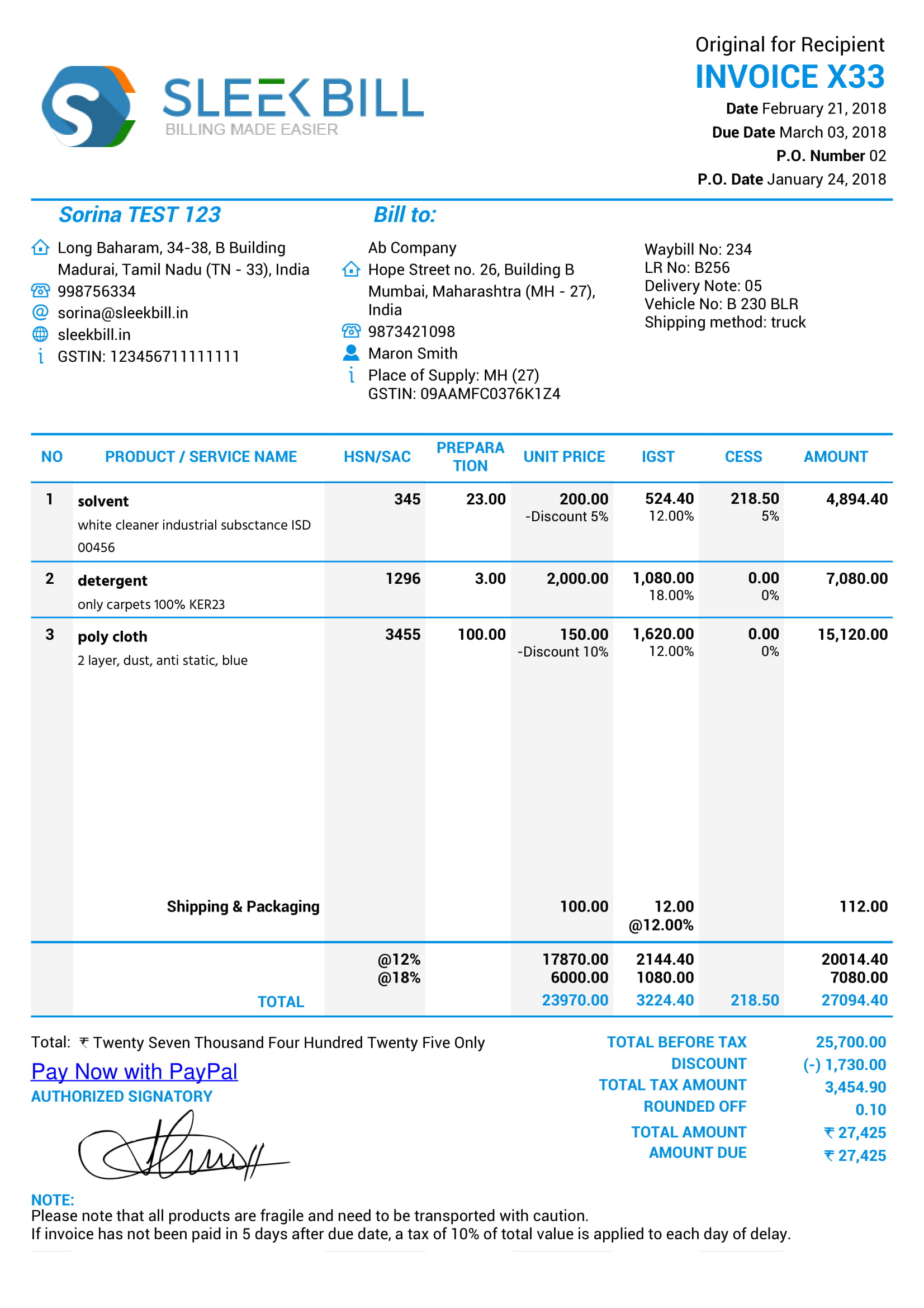

Gst Tax Invoice Number Rules TAX INVOICE CREDIT AND DEBIT NOTES 1 Tax invoice Subject to rule 7 a tax invoice referred to in section 31 shall be issued by the registered person containing the following

Jul 27 2020 nbsp 0183 32 The tax invoice number shall consist of a consecutive serial number not exceeding sixteen characters in one or multiple series containing alphabets or numerals or Jan 2 2025 nbsp 0183 32 An invoice number is the reference number of an invoice Every business should assign a unique number for each invoice issued for easy tracking As per GST law it is

Gst Tax Invoice Number Rules

Gst Tax Invoice Number Rules

https://img.indiafilings.com/learn/wp-content/uploads/2017/05/12010523/GST-Invoice-Format.png

Gst Tax Invoice Number Rules Templates Printable Free

https://live.staticflickr.com/8711/16898124666_d9f7436d26_b.jpg

GST Invoicing GST Invoice Rules Types Of Invoices

https://www.gstnregistration.com/wp-content/uploads/2019/03/customising-your-tax-invoices-1024x892.png

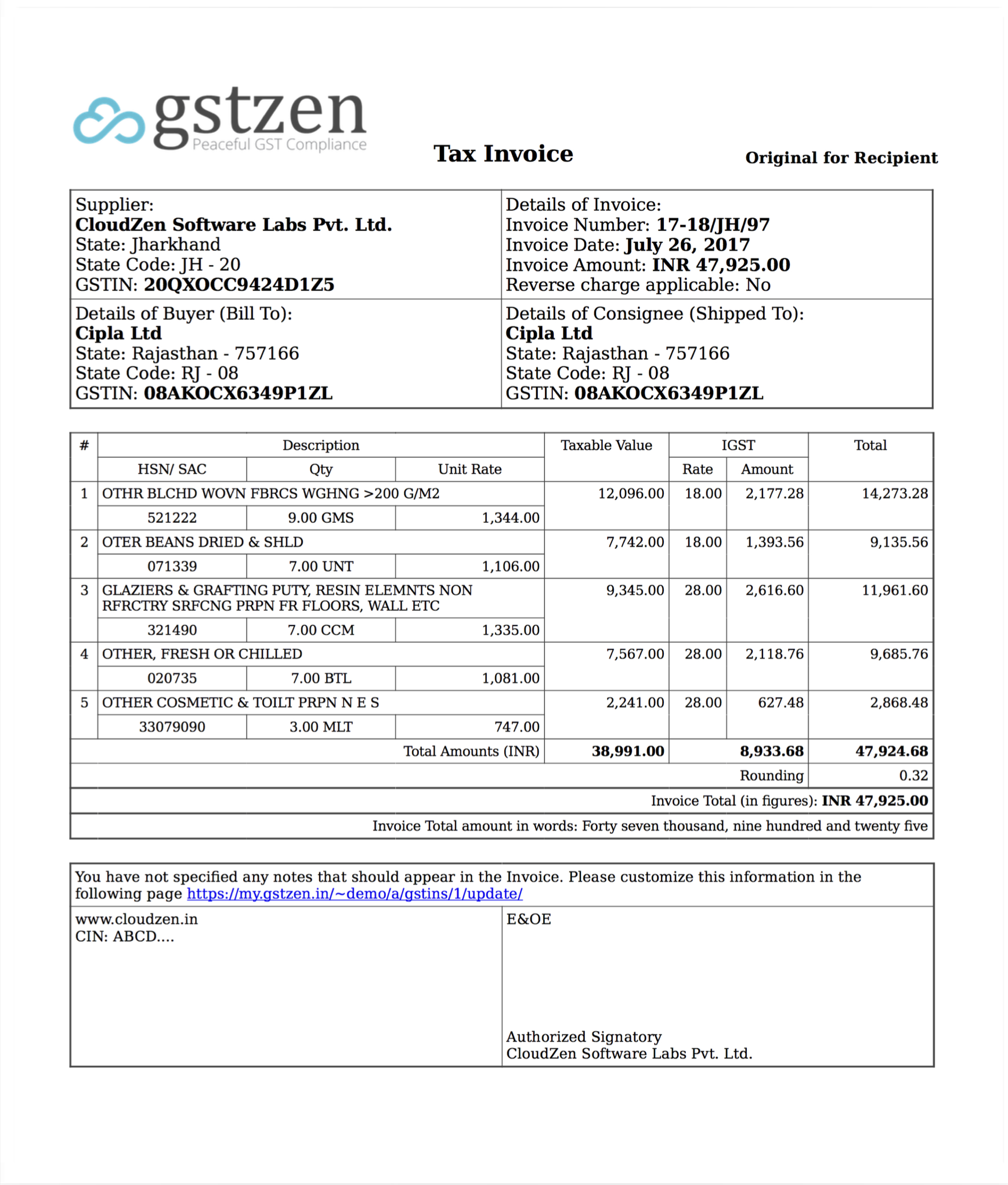

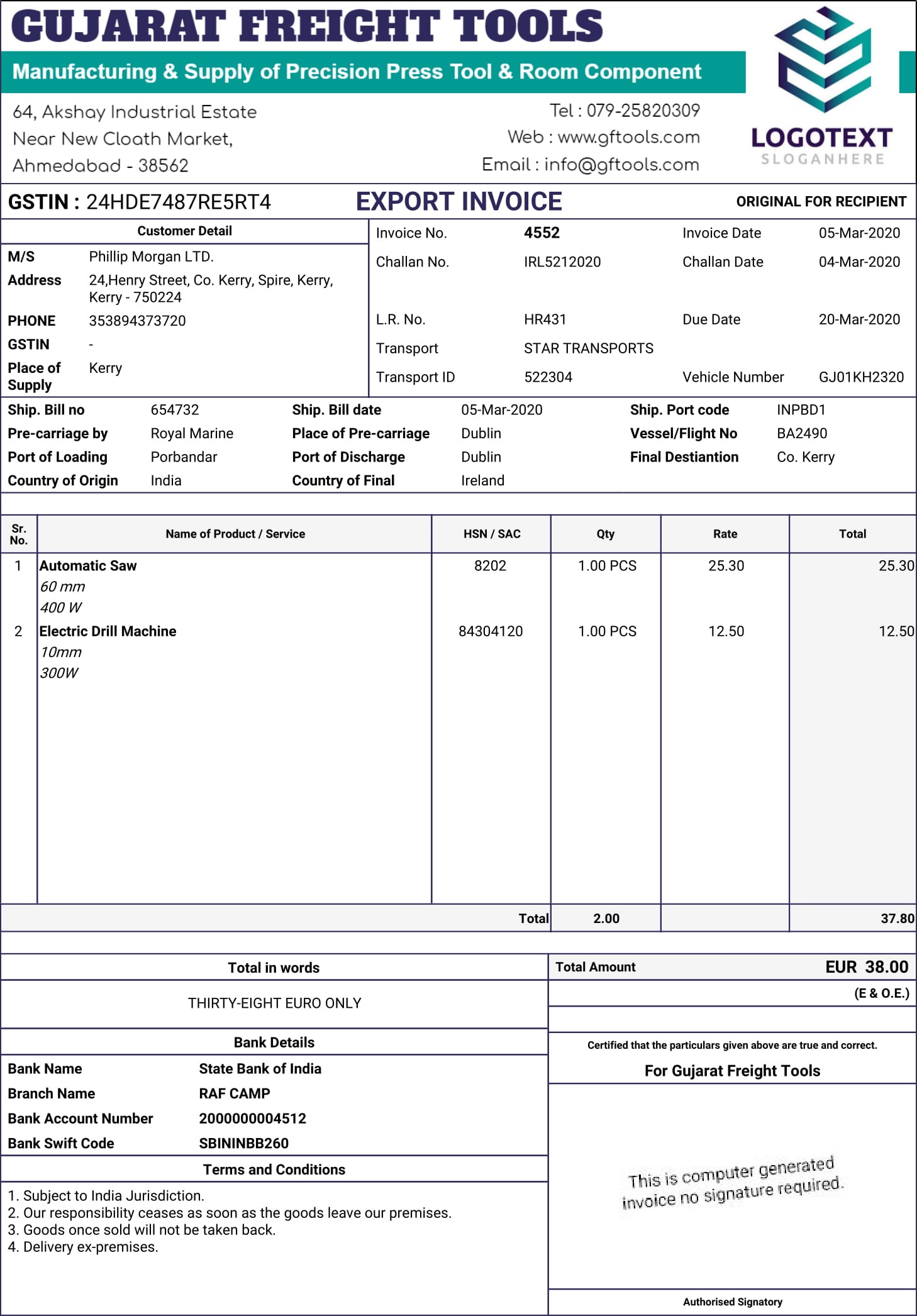

Rule 46 Tax invoice Subject to rule 54 a tax invoice referred to in section 31 shall be issued by the registered person containing the following particulars namely a name address and Jan 24 2024 nbsp 0183 32 The length of the GST invoice number should not exceed 16 characters according to rule 46 of the Central Goods and Service Tax Rules 2017 which means that the GST invoice number can only be 16 digits long

Oct 31 2024 nbsp 0183 32 Subject to rule 54 a tax invoice referred to in section 31 shall be issued by the registered person containing the following particulars namely a name address and Goods Aug 26 2017 nbsp 0183 32 GST Invoice Find the details of invoicing under GST format of GST Invoice Understand how to do invoicing details to be covered in GST invoice

More picture related to Gst Tax Invoice Number Rules

GST Invoice Service Tax Invoice Rules

https://emailer.tax2win.in/assets/guides/gst/GST-Invoice.jpg

Invoice 2024 25 Tamra Lauree

https://img-www.gstzen.in/articles/gst/writings/invoice-sample-copy.png

GST Export Invoice Format In India 100 Free GST Billing Software For

https://gogstbill.com/wp-content/uploads/2020/03/Invoice_4552-1.jpg

Apr 28 2025 nbsp 0183 32 GST invoice is required to be issued by a registered taxpayer The taxable invoice will only entitle the purchaser or receiver to claim input tax credit ITC There is no specified or fixed format for the invoice but certain Feb 16 2023 nbsp 0183 32 Following are the mandatory rules while providing serial numbers in an invoice The invoice numbers must be sequential or consecutive in

Feb 8 2025 nbsp 0183 32 Learn the mandatory details for a tax invoice under Rule 46 of CGST including GSTIN invoice number HSN SAC codes tax rates and compliance penalties Dec 16 2024 nbsp 0183 32 What are the mandatory fields a GST Invoice should have A tax invoice is generally issued to charge the tax and pass on the ITC A GST Invoice must have the following

GST Invoice Format

https://www.billingsoftware.in/images/articles/invis1.jpg

What Details Are Required For A Tax Invoice Under GST Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2019/02/Sample-Tax-Invoice-1024x1011.jpg

Gst Tax Invoice Number Rules - GST Invoice easy guide rules and format on every sale purchase an invoice is issued by the supplier person making the sale