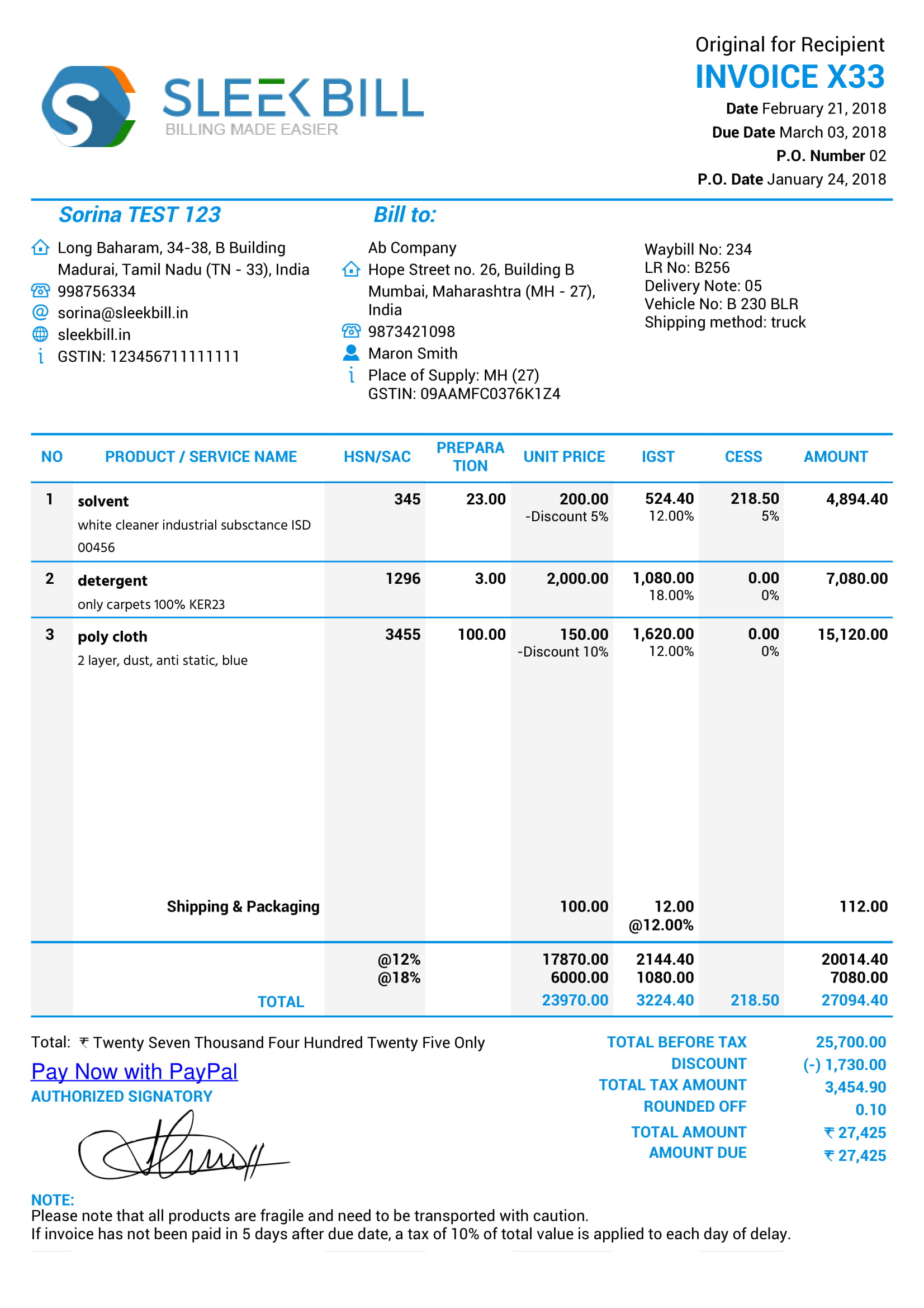

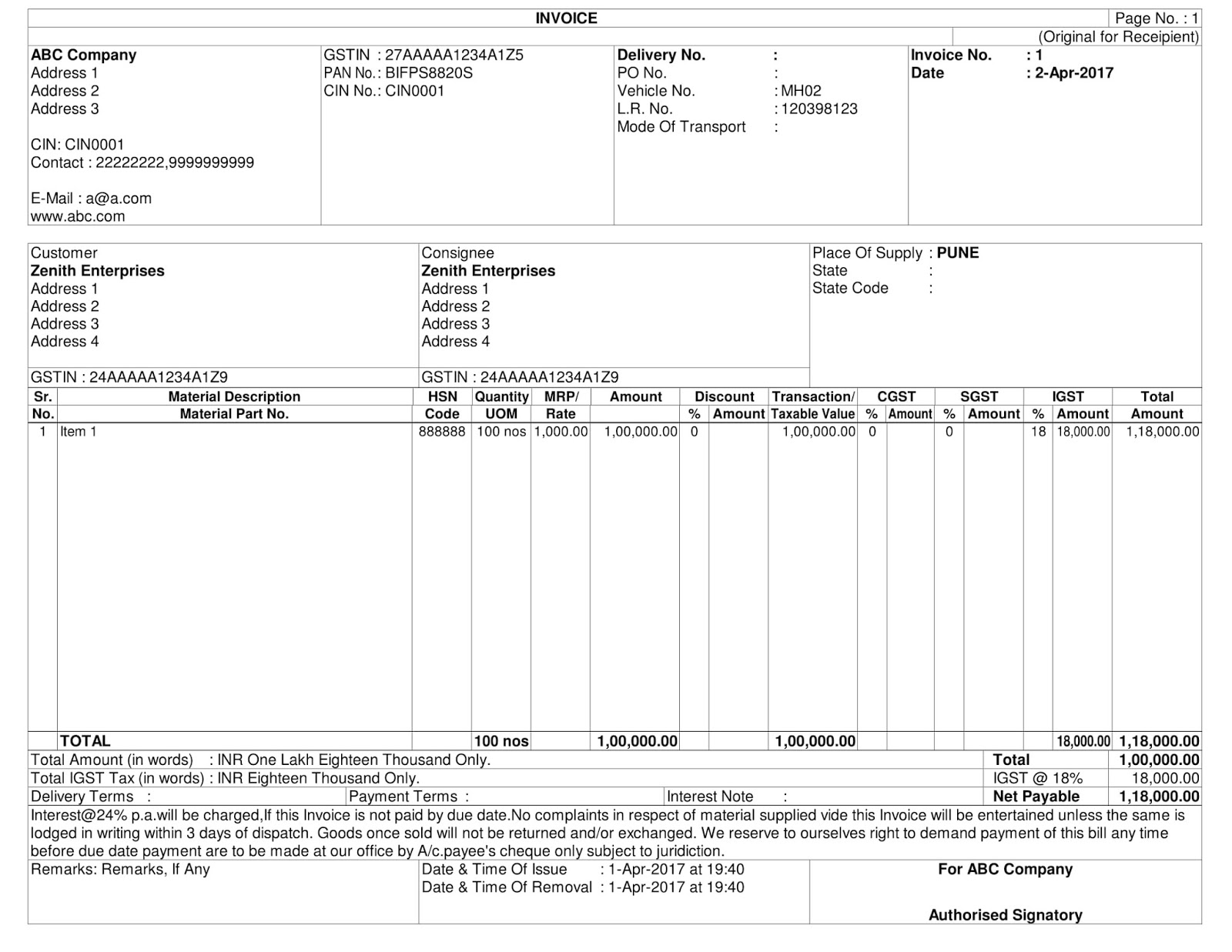

Gst Invoice Rules Pdf Under the GST regime an invoice or tax invoice means the tax invoice referred to in section 31 of the CGST Act 2017 This section mandates issuance of invoice or a bill of supply

Considering the significance of the provisions related to invoicing the GST amp Indirect Taxes Committee published a Handbook on Invoicing under GST in the year May 2020 along with Sec 31 of the CGST Act 2017 mandates the issuance of an invoice or a bill of supply for every supply of Goods or Services 2 Tax Invoice in respect of Goods A registered person supplying

Gst Invoice Rules Pdf

Gst Invoice Rules Pdf

https://www.billingsoftware.in/images/articles/invis1.jpg

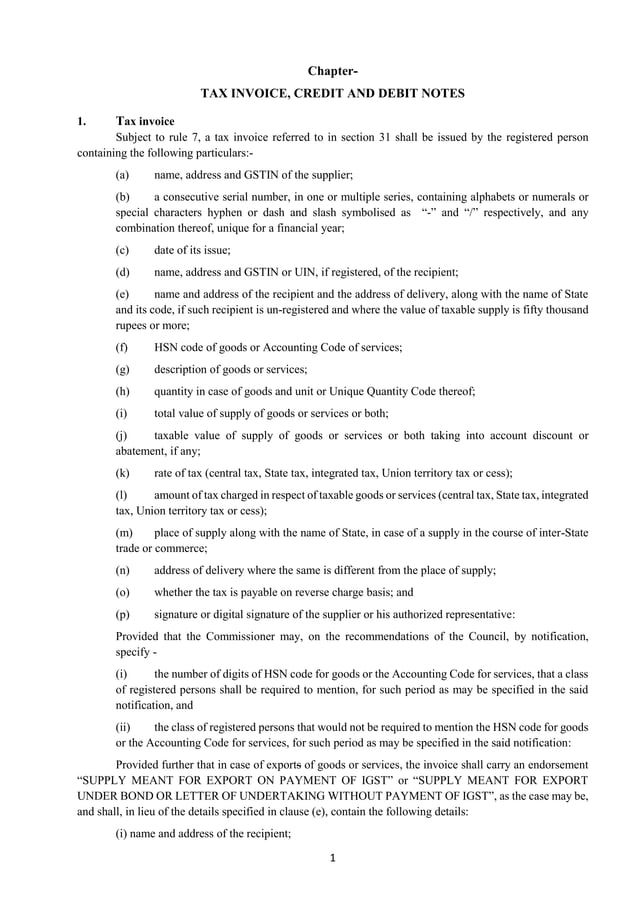

GST INVOICE Rules PDF

https://image.slidesharecdn.com/gst-31-170919052024/85/GST-INVOICE-Rules-1-638.jpg

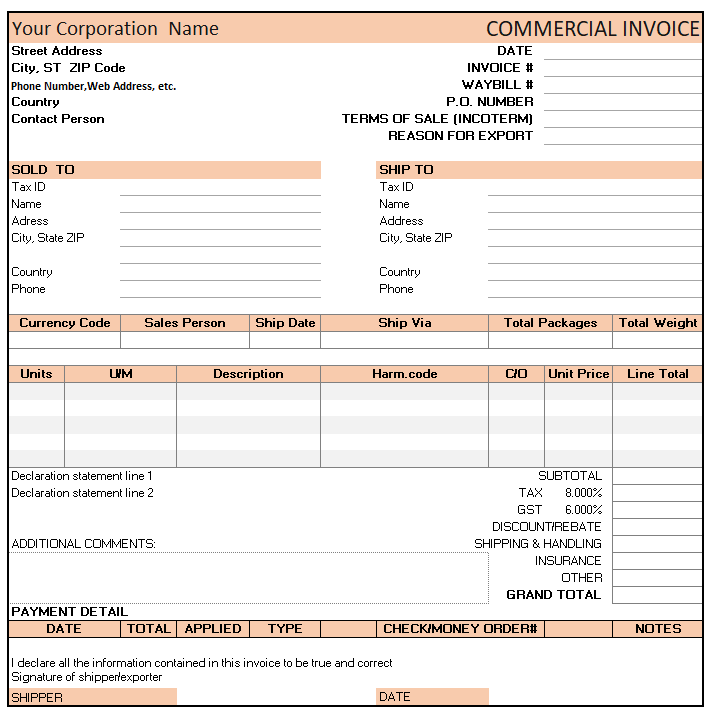

Export Invoice Format Under GST Free Download Formats

https://mybillbook.in/s/wp-content/uploads/2023/03/sample-of-export-invoice-format.png

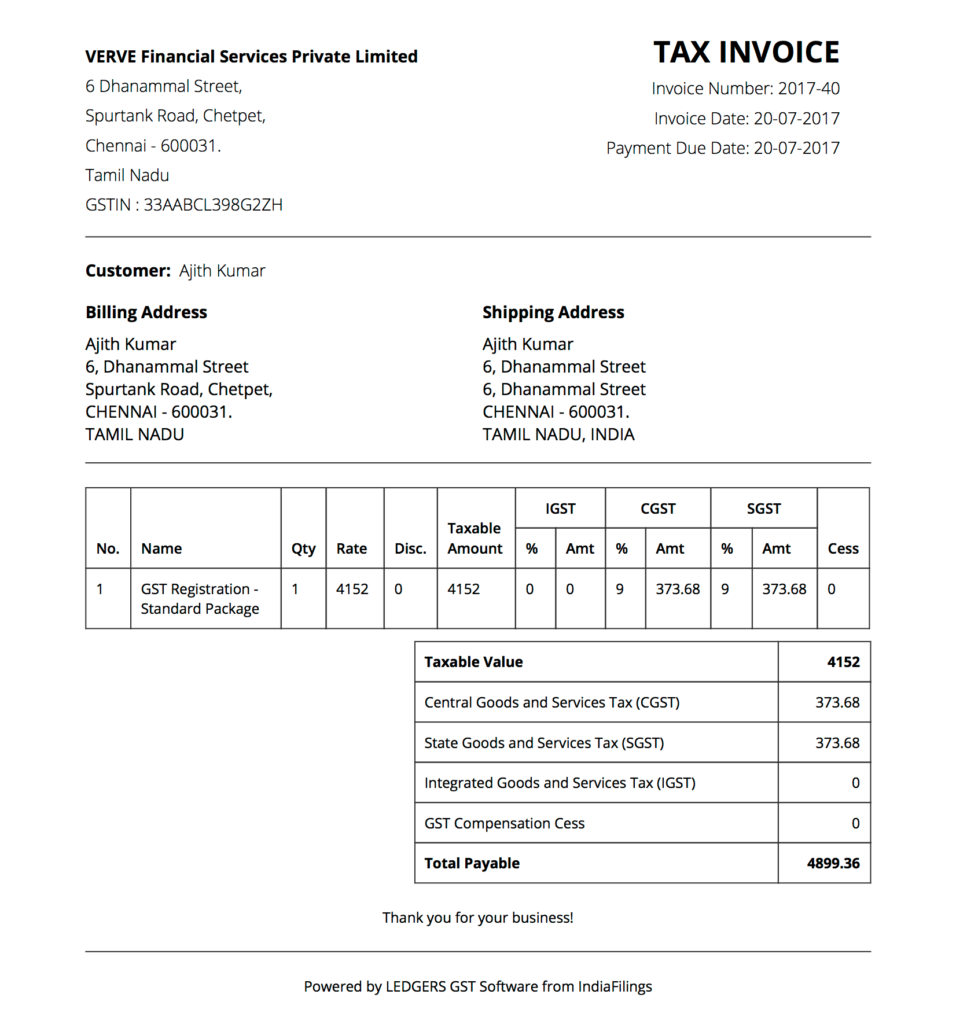

May 16 2021 nbsp 0183 32 GST Billing format in Excel PDF and Word amp Time of Supply These are the standard formats You can download the GST Bill format in excel or other formats and edit it as per your own terms and conditions GST Invoice 1 Tax invoice 1 Subject to rule 5 a tax invoice referred to in section 23 shall be issued by the supplier containing the following details a name address and GSTIN of the supplier b a

Form GST INV 1 See Rule Application for Electronic Reference Number of an Invoice 1 GSTIN 2 Name 3 Address 4 Serial No of Invoice 5 Date of Invoice Details of Receiver Apr 9 2025 nbsp 0183 32 Explains when to provide a tax invoice what it must include and dealing with non taxable sales and rounding If a customer asks for a tax invoice you must provide one within 28 days unless it is for a sale of 82 50 including

More picture related to Gst Invoice Rules Pdf

Gst Invoice Bill Format Invoice Rules Tally Solutions Vrogue co

https://3.bp.blogspot.com/-GpSzTNQPRmY/WXIEbkJ5jYI/AAAAAAAAAbE/H-MT7XGNT3cDxXSt5Mj4YlxjdQeYfjXTwCEwYBhgL/s1600/Invoice%2BFormat2.jpg

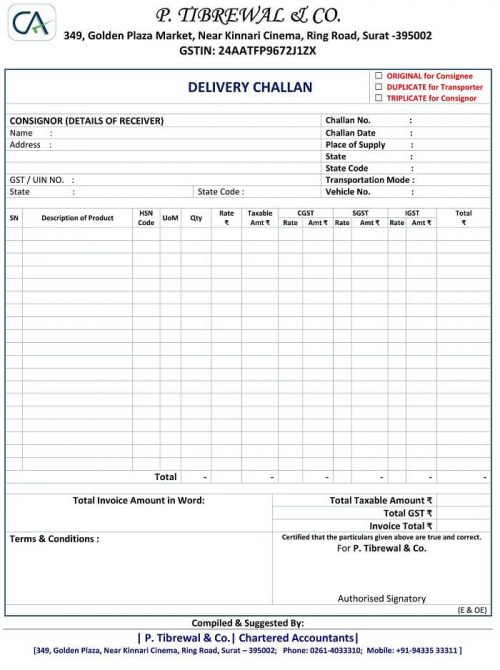

GST Delivery Challan Format In PDF

https://www.club4ca.com/formats/wp-content/uploads/2017/07/GST-delivery-challan-format-e1499852705287.jpg

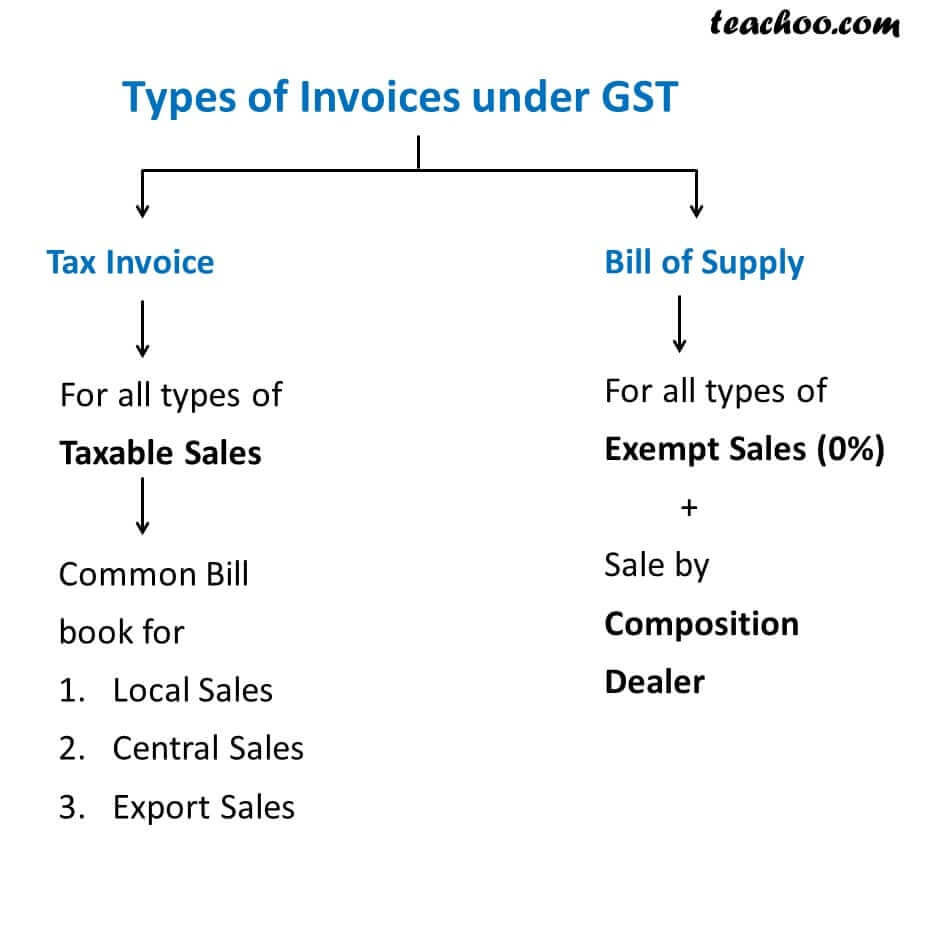

Download Excel Format Of Tax Invoice In GST GST Invoice Format

https://d1avenlh0i1xmr.cloudfront.net/81211912-da30-40eb-83b8-3f3127eb3156/1-types-of-invoices-under-gst---tax-invoice-bill-of-supply.jpg

As per Rule 48 4 of CGST Rules notified class of registered persons have to prepare invoice by uploading specified particulars of invoice in FORM GST INV 01 on Invoice Registration Portal E invoice has many advantages for businesses such as Auto reporting of invoices into GST return auto generation of e way bill where required e invoicing will also facilitate

All registered persons other than supplier of exempted goods or exempted service and composite dealer shall be liable to issue Tax Invoice a registered person supplying exempted goods or Tax invoice is the document issued by a registered person to effect taxable supply of goods or services or both In case there is some amendment in supply transaction then either debit

GST Invoice Format In Excel Word PDF JPEG 1 Invoice 41 OFF

https://instafiling.com/wp-content/uploads/2023/03/Excel-invoice-format.png

HSN Code On Invoice

https://img.indiafilings.com/learn/wp-content/uploads/2017/07/12010427/Sample-GST-Invoice-956x1024.png

Gst Invoice Rules Pdf - May 16 2021 nbsp 0183 32 GST Billing format in Excel PDF and Word amp Time of Supply These are the standard formats You can download the GST Bill format in excel or other formats and edit it as per your own terms and conditions GST Invoice