Gst Bill Rules And Regulations 3 days ago nbsp 0183 32 Finance Minister Nirmala Sitharaman announced significant GST rate cuts following the 56th GST Council meeting implementing a two tier structure of 5 and 18 effective September 22 The rate

May 1 2024 nbsp 0183 32 The Goods and Services Tax GST is a value added tax levied on most goods and services sold for domestic consumption 3 days ago nbsp 0183 32 The GST Council may announce new GST rates by 22nd September 2025 Explore the proposed changes across key sectors and understand how they could affect your business

Gst Bill Rules And Regulations

Gst Bill Rules And Regulations

https://i.ytimg.com/vi/zLOxxl9iuZY/maxresdefault.jpg

GST Invoice Kaise Banaye How To Make GST Bill In Excel Gst Invoice

https://i.ytimg.com/vi/5sIHXhfuNUw/maxresdefault.jpg

Rules And Regulations Implementing The Interior And Local Government

http://library.region1.dilg.gov.ph/img/book_placeholder.png

Nov 28 2023 nbsp 0183 32 Learn about the Goods and Services Tax GST Find out its meaning purpose key components advantages challenges and the economic impact it holds 3 days ago nbsp 0183 32 New GST rates to come into effect from Sept 22 Your top questions answered The GST Council s 56th meeting has notified sweeping changes effective September 22 impacting goods and services from milk and medicines to cars coal and casinos The revised rates on most goods and services apply from September 22 2025

The Goods and Services Tax GST is a type of indirect tax which is successor to multiple indirect taxes prevailing in India before 1 July 2017 for example VAT Service Tax Central Excise Duty Entertainment Tax Octroi etc on the supply of goods and services It is a comprehensive multistage destination based tax comprehensive because it has subsumed almost all the Oct 10 2023 nbsp 0183 32 GST is a destination based consumption tax as it is charged at every stage wherever some value is added to the goods or services and the supplier of the good or service off sets the charge on its inputs of the previous stages

More picture related to Gst Bill Rules And Regulations

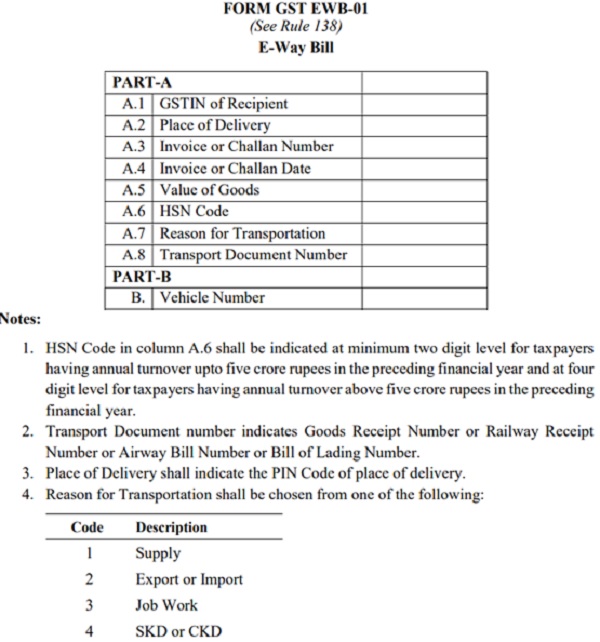

What Is EWay Bill How To Download The EWay Bill In PDF 54 OFF

https://taxguru.in/wp-content/uploads/2023/02/E-Way-Bill.jpg

Laws Regulations Clark Simson Miller

https://clarksimsonmiller.com/wp-content/uploads/2019/10/laws-regulations-7.jpg

GST Council Legacy IAS Academy

https://www.legacyias.com/wp-content/uploads/2022/06/image-25.png

Apr 4 2025 nbsp 0183 32 GST or goods and services tax is a value added tax levied on most goods and services sold for domestic consumption It is typically charged at each stage of the supply chain from production to final sale with the tax amount included in the price paid by the consumer Apr 3 2023 nbsp 0183 32 Learn about the benefits and implementation of the Goods and Services Tax GST system worldwide Discover key differences between GST and sales tax systems

[desc-10] [desc-11]

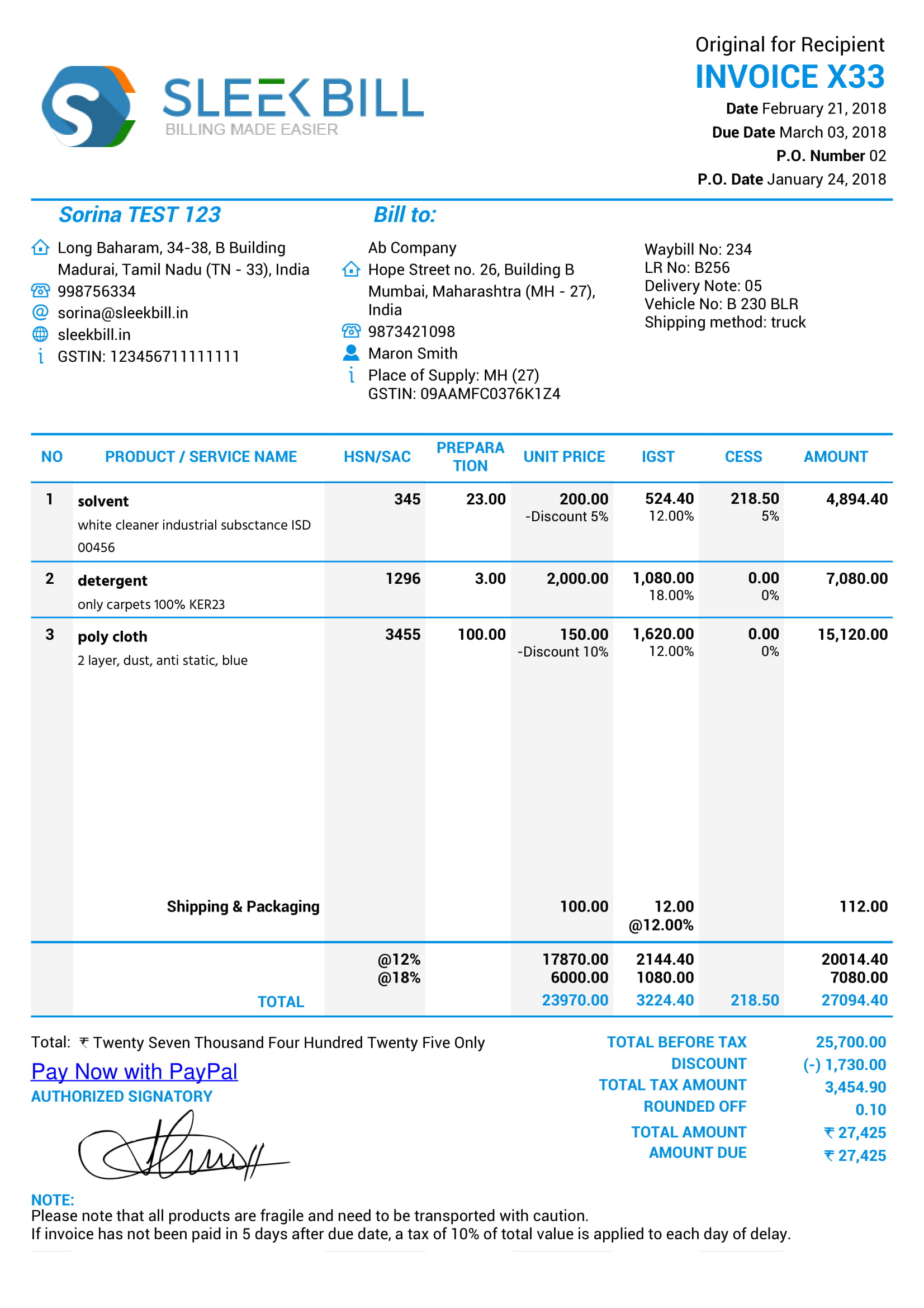

GST Invoice Rules And Guidelines

https://www.billingsoftware.in/images/invoice-rules.png

GST Invoice Format

https://www.billingsoftware.in/images/articles/invis1.jpg

Gst Bill Rules And Regulations - Nov 28 2023 nbsp 0183 32 Learn about the Goods and Services Tax GST Find out its meaning purpose key components advantages challenges and the economic impact it holds