Expenses Vs Bills Zoho Books Jun 30 2025 nbsp 0183 32 When you claim the GST HST you paid or owe on your business expenses as an input tax credit reduce the amounts of the business expenses by the amount of the input tax

Changes to the income tax rules now deny income tax deductions related to non compliant short term rentals after 2023 Oct 1 2023 nbsp 0183 32 The excessive interest and financing expenses limitation EIFEL rules limit the deductibility of interest and financing expenses by affected corporations and trusts The rules

Expenses Vs Bills Zoho Books

Expenses Vs Bills Zoho Books

https://i.ytimg.com/vi/BuKGWveWfko/maxresdefault.jpg

How To Book Expenses And Reimbursement Of Expenses In Zoho Books 3rd

https://i.ytimg.com/vi/kr79eMVCF8Q/maxresdefault.jpg

Zoho SRG DIGI WORLD

https://srgdigiworld.com/wp-content/uploads/2023/05/zohopage-_illustartion-111.gif

Feb 3 2025 nbsp 0183 32 Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later Use this form if you are an employee and your employer requires you to pay expenses to earn your employment income

Accrual expenses in the Fall Economic Statement are on a gross basis meaning the revenues are included in the accrual based revenue forecast while they are netted against expenditures Detailed breakdown To claim attendant care expenses paid to a facility such as a retirement home you have to send us a detailed breakdown from the facility The breakdown must clearly

More picture related to Expenses Vs Bills Zoho Books

Zoho Blog Insights On Growth Software And Business Page 82

https://blog.zoho.com/sites/zblogs/images/cliq/cliq-projects-integration-blog-2019-05.gif

Kansas Vs Bills

https://static1.anpoimages.com/wordpress/wp-content/uploads/2023/12/bills-vs-chiefs.jpg

Insert Data From Images Zoho Sheet

https://zohowebstatic.com/sites/default/files/ogimage/sheet-logo.png

Calculating motor vehicle expenses If you use a motor vehicle or a passenger vehicle for both business and personal use you can deduct only the portion of the expenses that relates to Jan 1 2024 nbsp 0183 32 The allowance is used to pay GST HST taxable other than zero rated expenses and at least 90 of the expenses are incurred in Canada or the allowance is for the use of a

[desc-10] [desc-11]

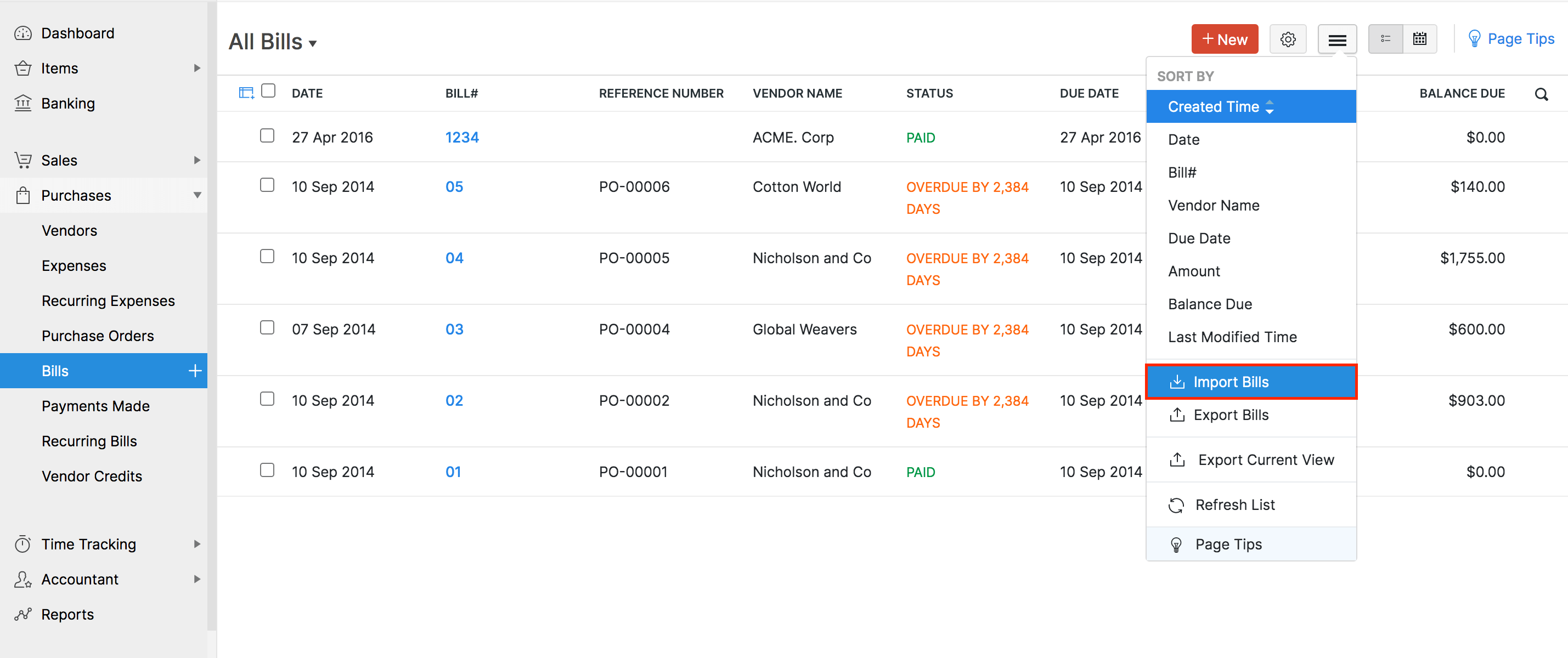

Import Transactions FAQ Zoho Books

https://www.zoho.com/books/kb/images/contacts/import-purchase-transactions.png

Invoice Templates Zoho Books

https://www.zoho.com/books/images/invoice-template.png

Expenses Vs Bills Zoho Books - Feb 3 2025 nbsp 0183 32 Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later