Excise Tax Definition Nov 2 2020 nbsp 0183 32 The IRS determines the amount of tax an individual or business owes by dividing their income into tax brackets A tax bracket is a range of incomes that the government taxes

Aug 12 2020 nbsp 0183 32 An income tax applies to John s income of 100 000 Let s say it works out to 14 which means he pays 14 000 in taxes this year If however the government applies a wealth Aug 12 2020 nbsp 0183 32 How Does a Flat Tax Work Let s assume that you had 100 000 of taxable income last year Under a progressive tax system you might be taxed 0 on the first 25 000

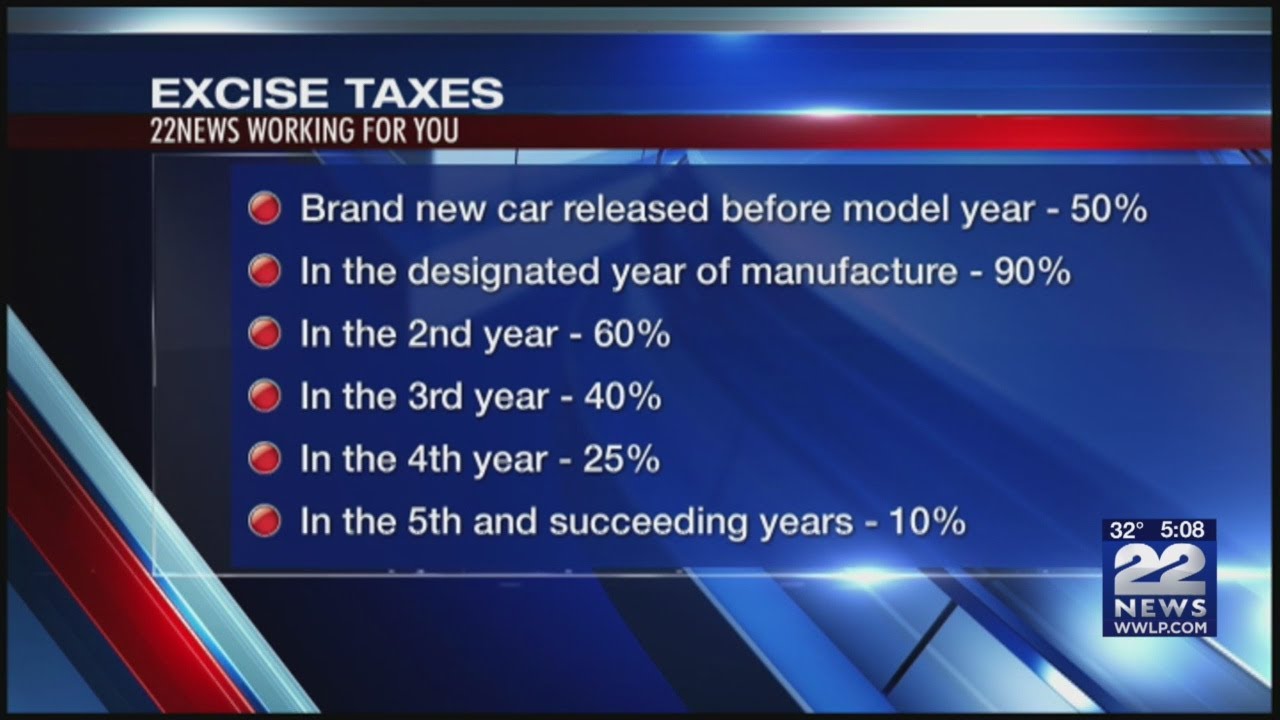

Excise Tax Definition

Excise Tax Definition

https://images.inkl.com/s3/article/lead_image/17993285/excise-tax-2.png

Excise Tax Meaning YouTube

https://i.ytimg.com/vi/-l4vGZCKiOA/maxresdefault.jpg

Excise Duty Full Detail In Hindi YouTube

https://i.ytimg.com/vi/MAVr8HaDCDE/maxresdefault.jpg

Aug 12 2020 nbsp 0183 32 Some retirement vehicles such as 401 k s and IRAs allow investors to buy and sell assets within these vehicles without becoming subject to capital gains tax This tax deferral Sep 29 2020 nbsp 0183 32 Title II amends the Internal Revenue Code IRC by adding various requirements for a pension plan to qualify for tax exempt status as well as creating individual retirement

5 days ago nbsp 0183 32 EBIDA Definition Earnings Before Interest Depreciation and Amortization Excise Tax Executor Jul 14 2020 nbsp 0183 32 The current income tax system is a progressive tax system designed to take a larger portion of taxes from higher income earners Costly New Tax Collection System

More picture related to Excise Tax Definition

Excise Tax What It Is And How It Works YouTube

https://i.ytimg.com/vi/WYFLBOz7hOU/maxresdefault.jpg

Excise Tax What It Is How It s Calculated YouTube

https://i.ytimg.com/vi/VEHH9edCAds/maxresdefault.jpg

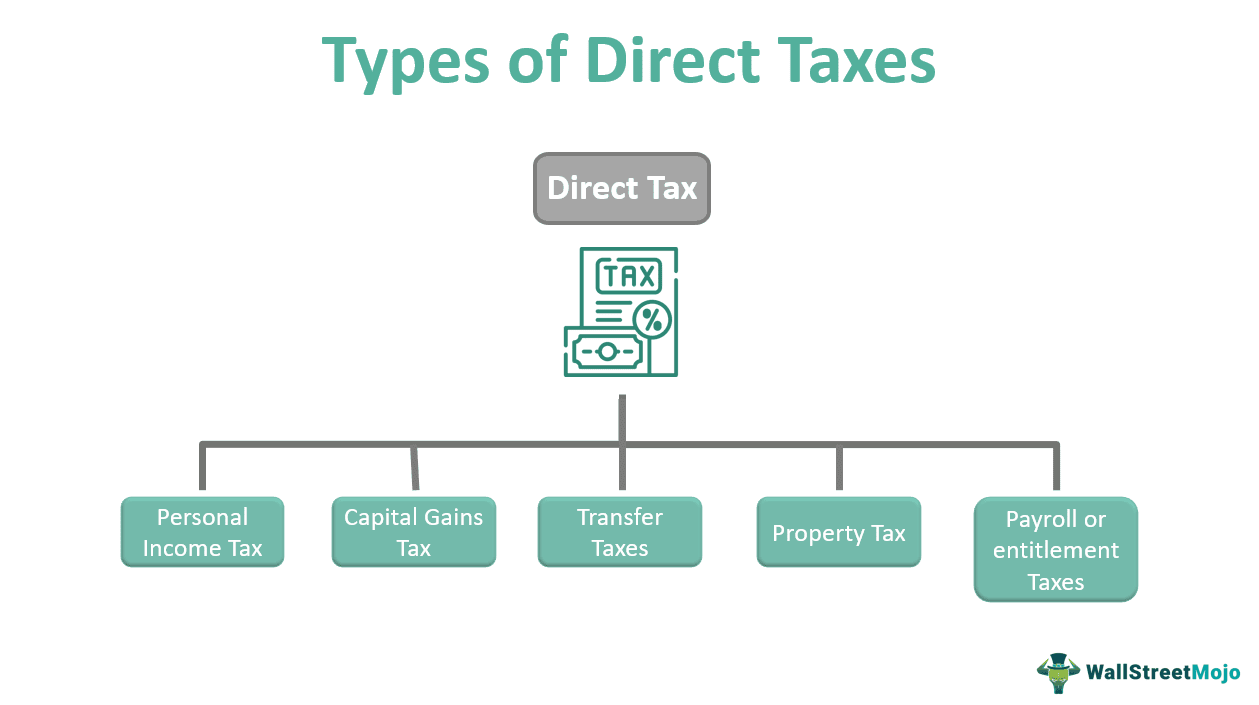

Direct Tax Definition Explained Types Features Examples 57 OFF

https://www.wallstreetmojo.com/wp-content/uploads/2023/01/Types-of-Direct-Taxes.png

Go back to your previous page or try using our site search to find something specific 169 2025 InvestingAnswers Inc Oct 1 2019 nbsp 0183 32 A duty is a federal tax on imports or exports For example Americans who travel abroad can bring back a certain number of dollars worth of items without paying a duty on

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/Taxation_updated2-dfd2ae499d314d05972225d3f743f8aa.png)

What Is A Progressive Tax Advantages And Disadvantages 47 OFF

https://www.investopedia.com/thmb/VxltrrZ3zSPp5lFRkVV8oSWZmcU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Taxation_updated2-dfd2ae499d314d05972225d3f743f8aa.png

3 3 Excise Taxes Impact Of An Excise Tax Ppt Download

https://slideplayer.com/slide/15978341/88/images/1/3.3+Excise+Taxes+Impact+of+an+Excise+Tax.jpg

Excise Tax Definition - [desc-13]