Depreciation As Per Schedule Iii Jun 16 2023 nbsp 0183 32 Depreciation is an accounting method that spreads the cost of an asset over its expected useful life

Mar 6 2023 nbsp 0183 32 Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life Capital assets such as buildings machinery and equipment are Feb 6 2023 nbsp 0183 32 Disposal of fixed assets journal entries required to reflect the gain or loss on disposal of a fixed asset by a business

Depreciation As Per Schedule Iii

Depreciation As Per Schedule Iii

https://i.ytimg.com/vi/LSEBFBTMHEc/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGBEgWyhyMA8=&rs=AOn4CLBKLXjeX1t5WKdw5TtTMYZ1p36btA

How To Calculate Depreciation As Per Companies ACT 2013 Depreciation

https://i.ytimg.com/vi/B06-w2YI6Rg/maxresdefault.jpg

2nd PUC Accountancy Profit Loss Appropriation Account 6 Marks Problem

https://i.ytimg.com/vi/K7pZtImix74/maxresdefault.jpg

Mar 22 2014 nbsp 0183 32 Depreciation is a reduction in the value of a tangible fixed asset due to normal usage wear and tear new technology or unfavourable market conditions Unlike amortization Aug 4 2025 nbsp 0183 32 OBBBA updates include new Section 168 n for expensing qualified production property and an increase in Section 179 expensing limits

Guide to Depreciation Formula Here we discuss calculation of depreciation expense using top 4 methods examples amp a downloadable excel template Reducing Balance Depreciation Another depreciation method is the reducing balance method This method may be suitable when the Fixed Asset will be gradually losing its value but its

More picture related to Depreciation As Per Schedule Iii

Tricks To Learn Profit And Loss Format As Per Schedule III

https://i.ytimg.com/vi/8YKP7X4CUTU/maxresdefault.jpg

STATEMENT OF PROFIT AND LOSS AS PER SCHEDULE III OF COMPANIES ACT 2013

https://i.ytimg.com/vi/8_VsomhjUqg/maxresdefault.jpg

Depreciation Chart As Per Companies Act 2013 Calculate 57 OFF

https://i.ytimg.com/vi/Wk3ZkykuoYY/maxresdefault.jpg

Mar 30 2024 nbsp 0183 32 La d 233 pr 233 ciation correspond 224 une moins value en comptabilit 233 Depreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property It is an allowance for the wear and tear

[desc-10] [desc-11]

Final Accounts Profit And Loss Account Of Companies As Per Schedule

https://i.ytimg.com/vi/NG8qjF1_QNs/maxresdefault.jpg

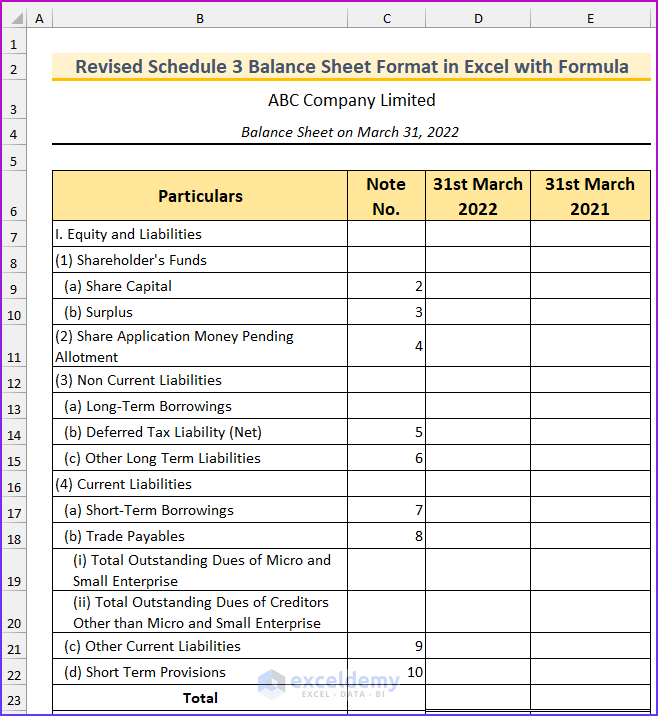

Asrm 2024 Schedule Iii Erica Jacinda

https://www.exceldemy.com/wp-content/uploads/2022/10/Revised-Schedule-3-Balance-Sheet-Format-in-Excel-with-Formula-1.png

Depreciation As Per Schedule Iii - Mar 22 2014 nbsp 0183 32 Depreciation is a reduction in the value of a tangible fixed asset due to normal usage wear and tear new technology or unfavourable market conditions Unlike amortization