Checks And Balances System Worksheet Answers Discover Talent s income tax calculator tool and find out what your payroll tax deductions will be in Malaysia for the 2025 tax year

It takes into account your salary Employee Provident Fund EPF contributions and other tax reliefs to estimate how much tax you will owe By using this tool you can easily see your net salary after tax deductions and make informed decisions about your finances Calculate your Malaysian salary after EPF SOCSO EIS and income tax deductions Plan your finances with our accurate Malaysian salary calculator

Checks And Balances System Worksheet Answers

Checks And Balances System Worksheet Answers

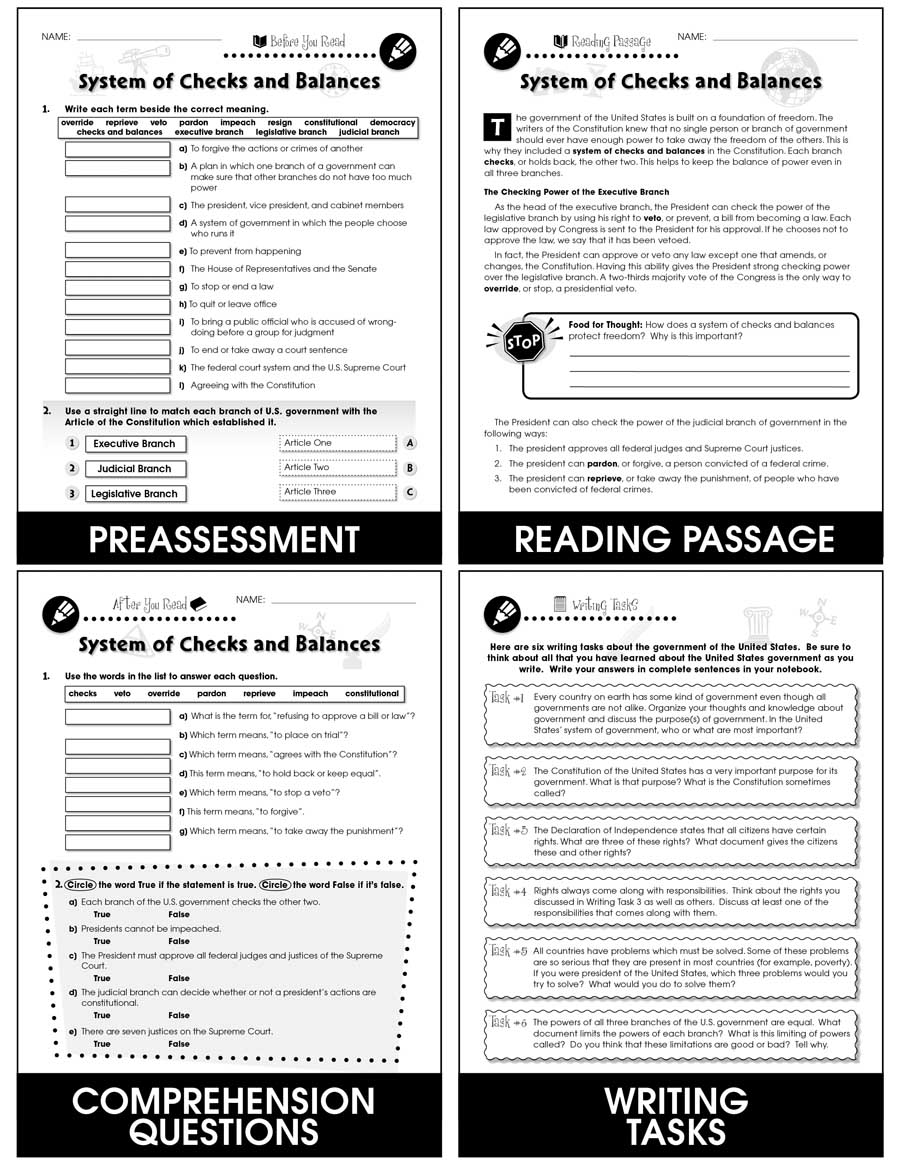

https://ccpinteractive.com/cfiles/WEB_IMAGES_XLARGE/CCP5757-5_sample1.jpg

Checks And Balances Worksheet

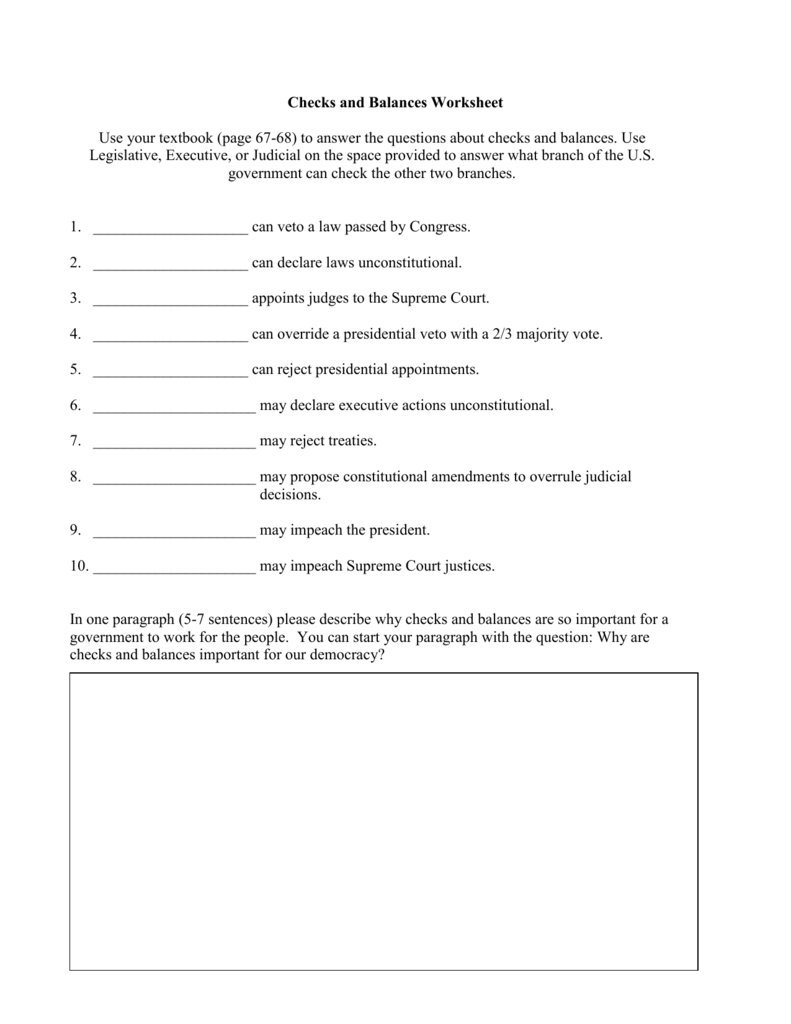

https://s3.studylib.net/store/data/008991689_1-55bb24cd4a5c3406cb718820884a5892.png

Checks And Balances Worksheet And Graphic Organizer Checks And

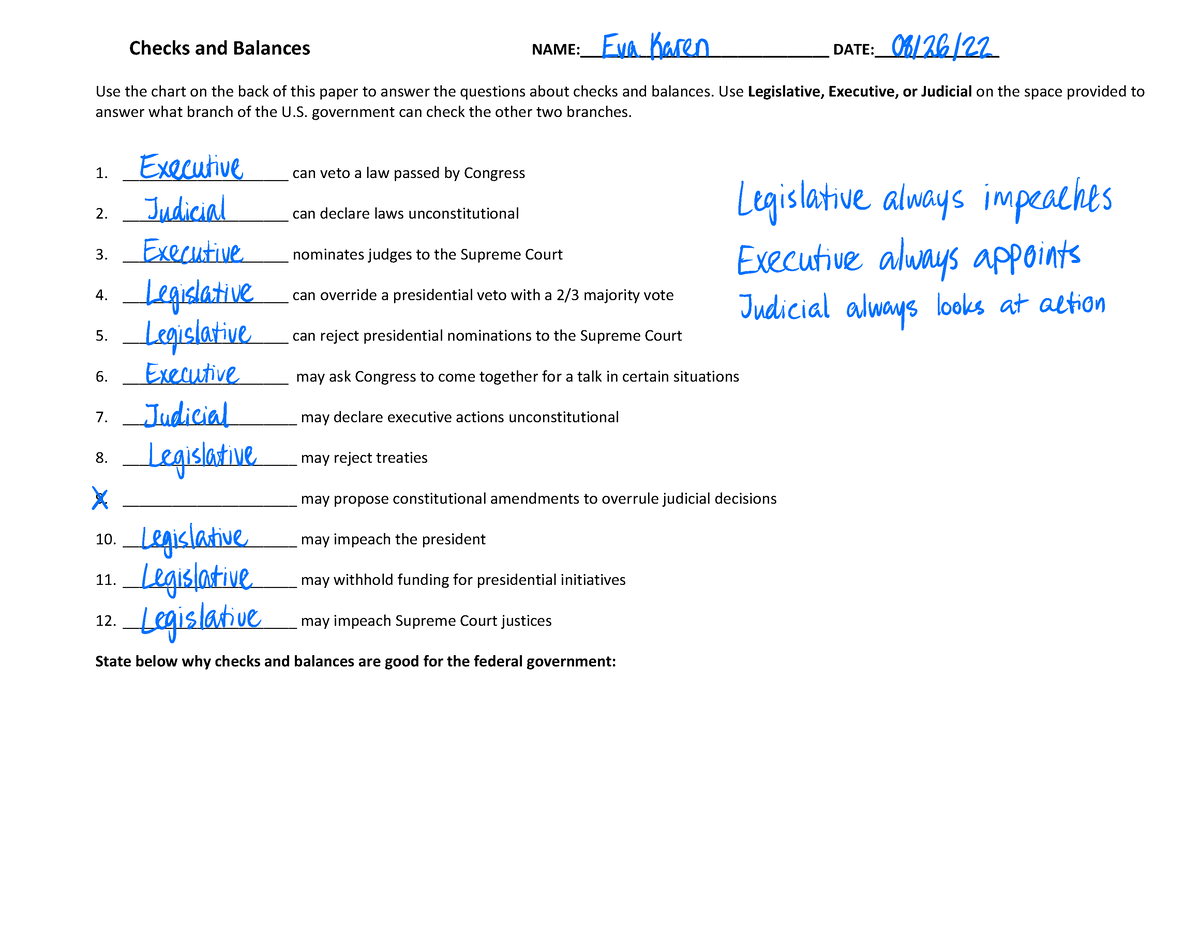

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/46347b5a2dc20065da7ec93c8f6bb89f/thumb_1200_928.png

After accounting for EPF contributions 11 and SOCSO deductions an individual earning minimum wage would take home approximately MYR 1 510 monthly Employees earning minimum wage are typically exempt from income tax due to the tax free threshold of For employees who receive wages salary of RM5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13

Easily calculate your monthly tax deductions with the Monthly Income Tax Deduction Calculator Malaysia Plan your finances and stay compliant for 2025 Get accurate estimates of your net salary after EPF SOCSO and tax deductions for 2025 2026

More picture related to Checks And Balances System Worksheet Answers

Checksand Balances Reading Comprehension Worksheet Branchesof

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4dff59e25085485de071f60e85644f31/thumb_1200_1600.png

Checks And Balances Worksheets By Teach Simple

https://teachsimplecom.s3.us-east-2.amazonaws.com/images/checks-and-balances-worksheets/image-1652722968228-2.jpg

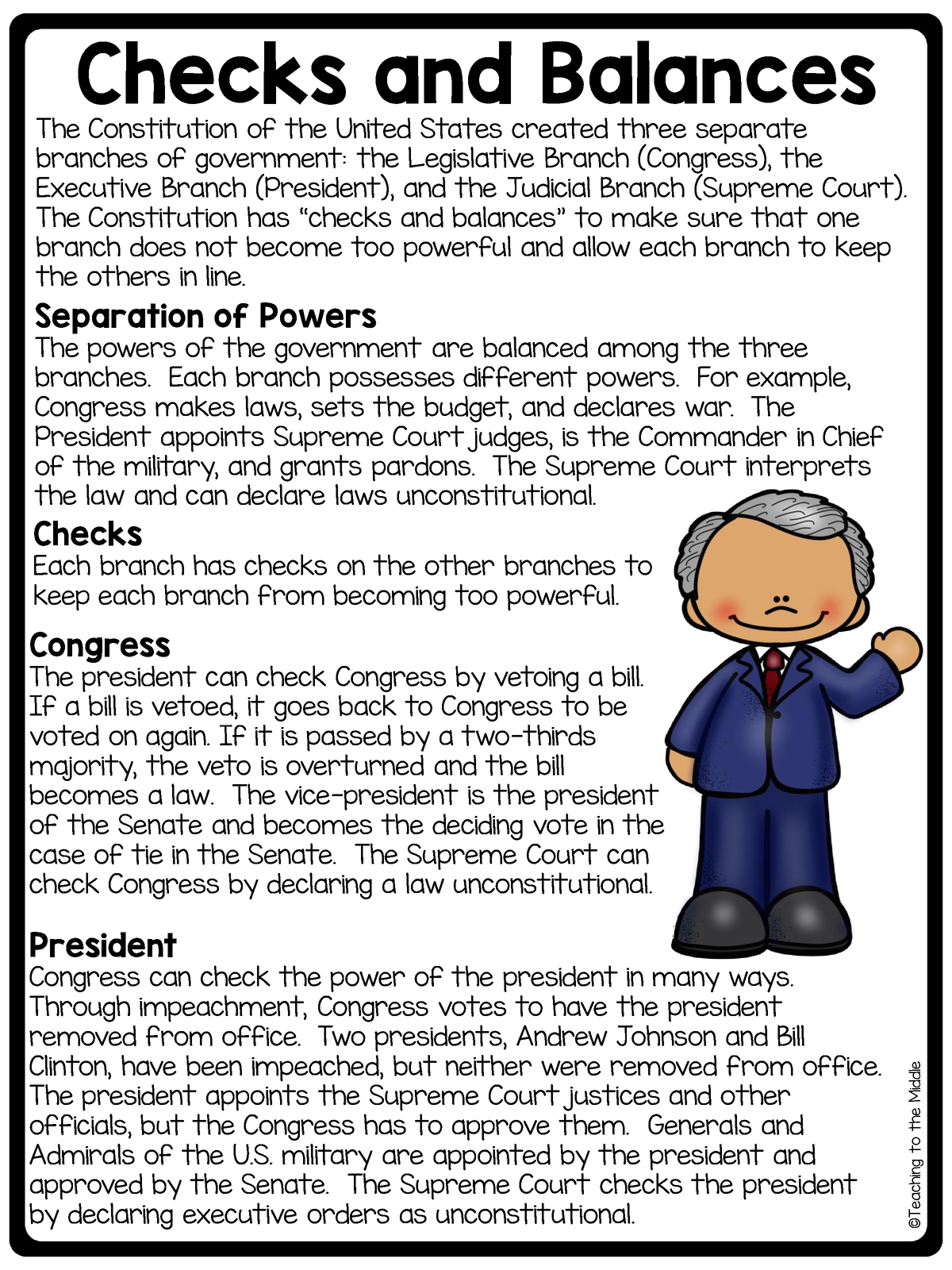

Checks And Balances TKG Academy

http://www.tkgacademy.com/wp-content/uploads/2014/02/image-41.jpeg

May 22 2025 nbsp 0183 32 Malaysia tax calculator allows you to accurately calculate your Malaysia NET salary and taxes for 2025 and compare to other countries live Discover the Malaysia tax tables for 2025 including tax rates and income thresholds Stay informed about tax regulations and calculations in Malaysia in 2025

[desc-10] [desc-11]

Checks And Balances Worksheets By Teach Simple

https://teachsimplecom.s3.us-east-2.amazonaws.com/images/checks-and-balances-worksheets/image-1652722966580-1.jpg

Checks And Balances System Civils360 IAS

https://civils360.com/wp-content/uploads/2020/12/Checks-and-Balances-System.jpg

Checks And Balances System Worksheet Answers - Get accurate estimates of your net salary after EPF SOCSO and tax deductions for 2025 2026