Withholding Tax Singapore For Foreign Workers Mar 7 2025 nbsp 0183 32 Learn about withholding tax in Singapore reporting requirements and how they apply for foreign owned businesses

2025 guide to Singapore s withholding taxes applicable rates mechanism residency rules filing deadlines and more in our article Apr 17 2025 nbsp 0183 32 As an employer you must withhold all monies including reimbursements allowances overtime and leave pays lump sum payments and gratuities due to the employee from the date you become aware of their

Withholding Tax Singapore For Foreign Workers

Withholding Tax Singapore For Foreign Workers

https://i.ytimg.com/vi/UL9jQkZW0RQ/maxresdefault.jpg

How To Get Visa Sponsored Jobs And Work Permit Advert Video raw

https://i.ytimg.com/vi/Ez_gKiGNr-Y/maxresdefault.jpg

PU 425 424 423 Globe And 502 501 500 Globe Enhancements

https://www.exactsoftware.com/docs/DocBinBlob.aspx?ID=3c2656a5-c47a-472d-bb78-8fdff16f01f4

As a foreign worker in Singapore understanding income tax system is essential for financial planning and compliance This article offers a clear explanation of Singapore income tax for foreign workers and we hope you can be understand Overview of how withholding tax works and what are the rates for non residents in Singapore including employees business partners and overseas agents

Mar 14 2024 nbsp 0183 32 However upon cessation of employment for non Singapore citizen employees the employer is required to pay for the employee s taxes by withholding his salary Any monies withheld in excess of the employee s tax Singapore withholding tax may apply to payments due to foreign entities that provide management services or help you manage your business These fees are subject to certain conditions such as double taxation agreements and if your

More picture related to Withholding Tax Singapore For Foreign Workers

Foreigners Jobs VisaSponsorshipJob

https://visasponsorshipjob.com/wp-content/uploads/2023/06/LMIA-Approved-Companies-in-Canada-for-Foreigners-2023.jpg

Athenna Crosby SAM Foundation Charity Gala In Westminster 12 01 2022

https://celebmafia.com/wp-content/uploads/2022/12/athenna-crosby-sam-foundation-charity-gala-in-westminster-12-01-2022-0.jpg

Federal Withholding For 2024 Manya Karola

https://www.taxuni.com/wp-content/uploads/2020/04/Federal-Withholding-Tables.jpg

Are your non Singapore citizen employees leaving the company or leaving Singapore for more than three months Check how to file tax clearance here Oct 25 2024 nbsp 0183 32 As part of our commitment to supporting your business we want to educate you on two important compliance requirements under Singapore s tax regulations withholding tax for payments made to non residents and the filing

Sep 17 2021 nbsp 0183 32 Singapore s standard non treaty withholding tax rates are zero for dividends 15 percent for interest and 10 percent for royalties Singapore has tax treaties with several countries many of which lower withholding tax rates Jul 8 2024 nbsp 0183 32 Withholding tax in Singapore represents a critical consideration for international businesses engaging in transactions involving Singapore Proper understanding and

Personal Income Tax

https://aurapartners.com.sg/wp-content/uploads/2023/04/Personal-income-tax-singapore-2023.png

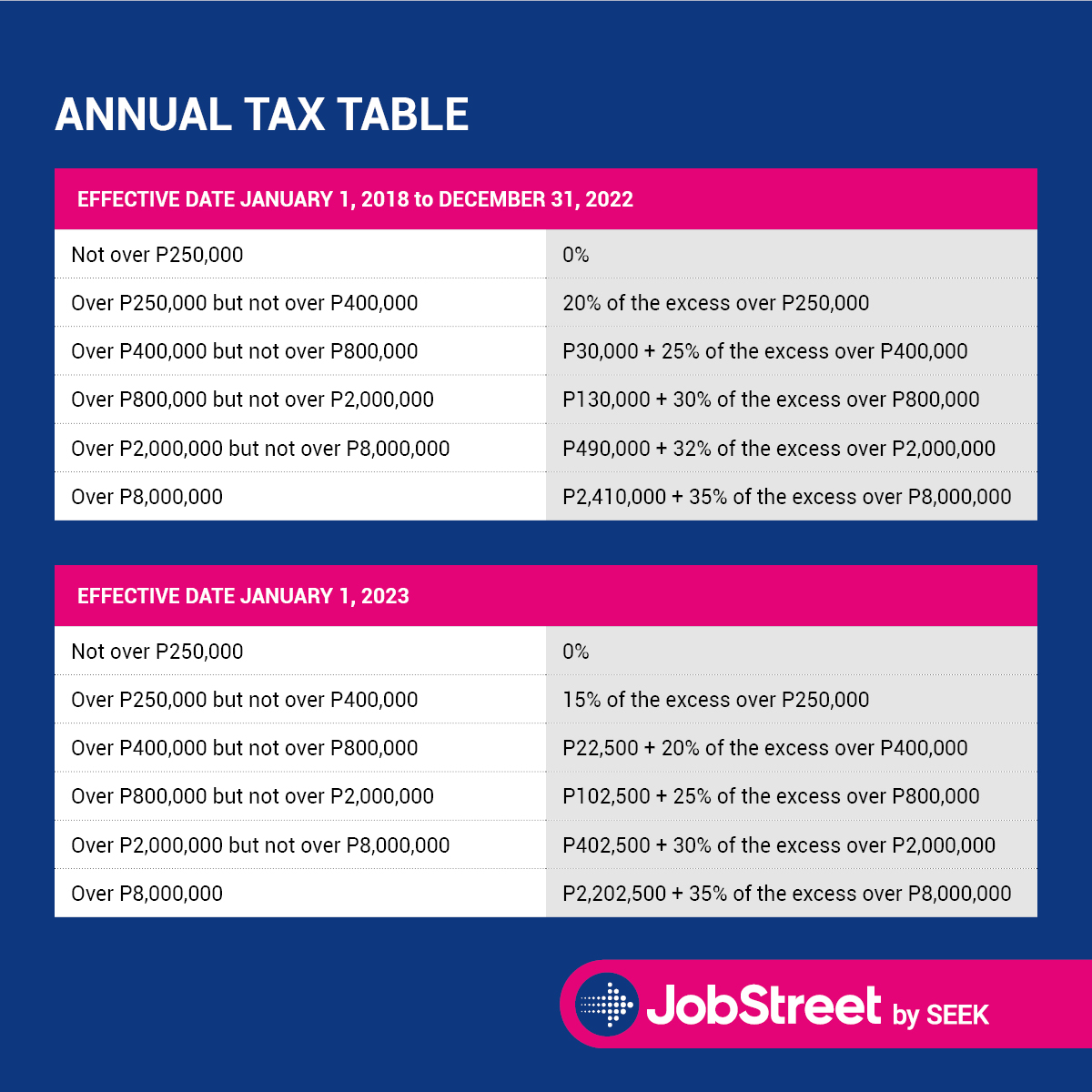

Tax Table For 2024 Philippines 2024 Lyndy Stephenie

https://media.graphassets.com/zkQtgDGSQWqbGox1KGuo

Withholding Tax Singapore For Foreign Workers - As a foreign worker in Singapore understanding income tax system is essential for financial planning and compliance This article offers a clear explanation of Singapore income tax for foreign workers and we hope you can be understand