Withholding Tax Rate Philippines 2024 Easily determine accurate withholding tax amounts for salaries services and other income types

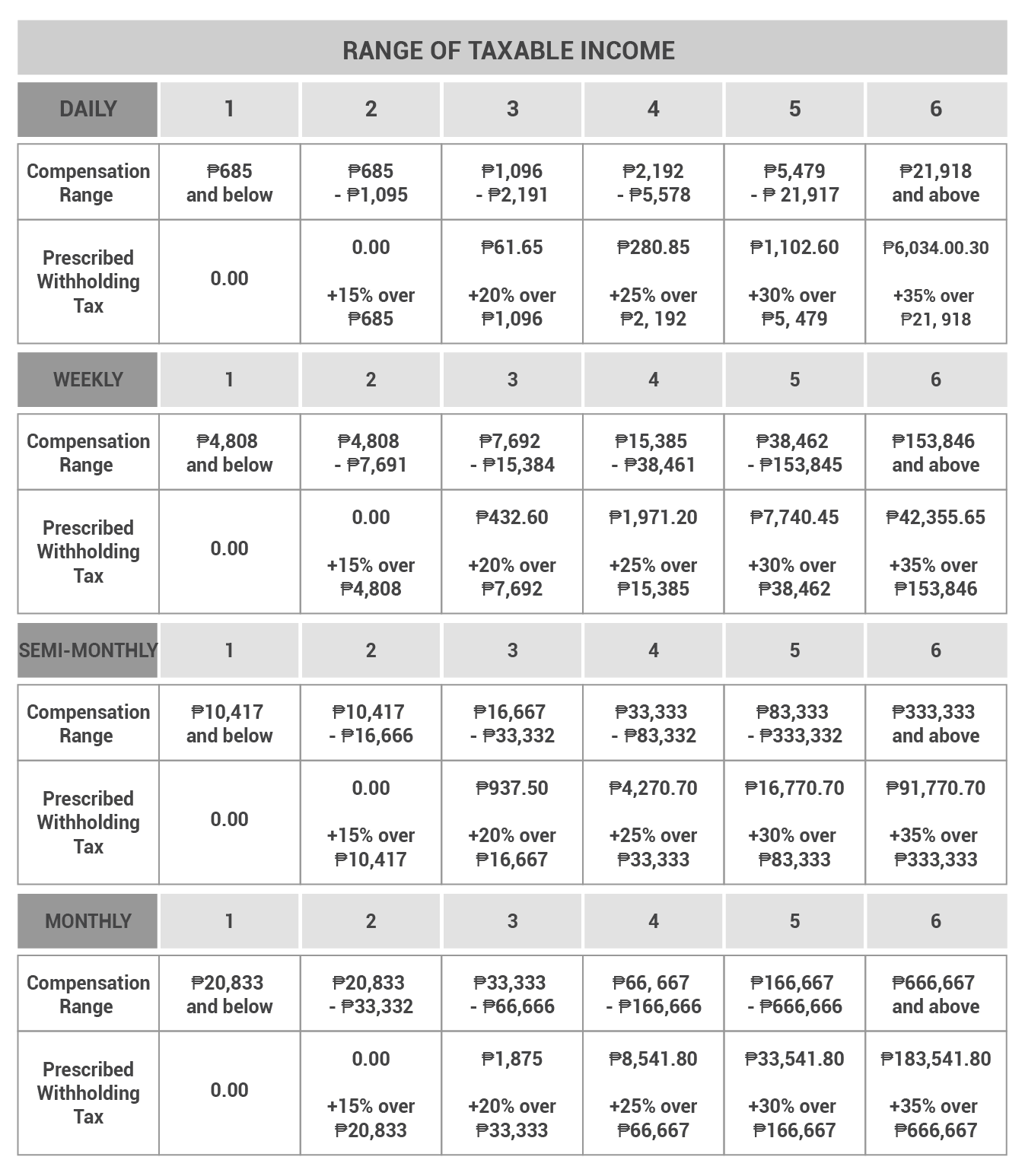

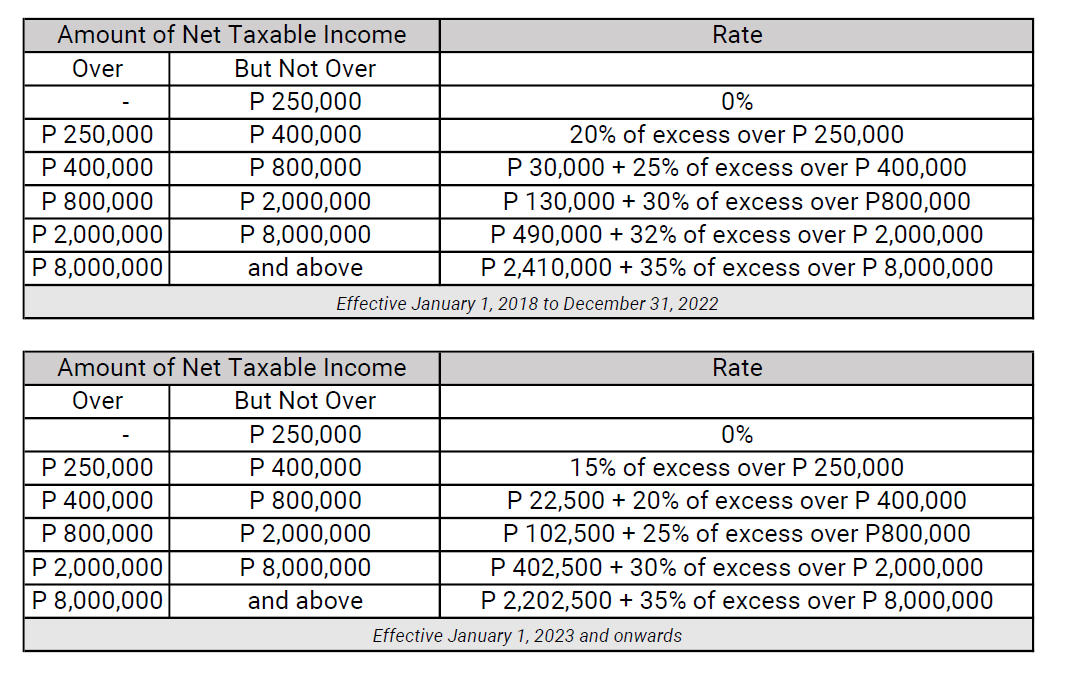

Feb 27 2024 nbsp 0183 32 Withholding Tax Table for 2023 2024 The provisions of TRAIN law extend beyond December 31 2022 BIR also released the following tables to serve as a reference for withholding tax computation at Dec 25 2023 nbsp 0183 32 As we kick off the new year it s time to get a grip on the latest update in finances the 2024 BIR Income Tax Table in the Philippines Whether you re an individual or a

Withholding Tax Rate Philippines 2024

Withholding Tax Rate Philippines 2024

https://kittelsoncarpo.com/wp-content/uploads/2023/02/TAX-SSS-PHIC-UPDATES_TABLES-02-min.png

Individual Income Tax Rates 2023 In Singapore Image To U

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?w=1526&ssl=1

Income Tax Table For 2024 Philippines Image To U

http://governmentph.com/wp-content/uploads/2018/12/2020-Revised-Withholding-Tax-Table.jpg

Apr 1 2024 nbsp 0183 32 The schedule also affects the rate of withholding taxes on employees purely compensation income This is the 2024 Revised Withholding Tax Table Taxable Income 21 rows nbsp 0183 32 The return shall be filed and tax paid on or before the tenth 10th day of the month following the month in which withholding was made except for taxes withheld for December

Feb 1 2024 nbsp 0183 32 Employees with annual income up to PHP 250 000 or PHP 20 833 monthly are still exempt from paying income tax Employees with annual earnings above PHP 250 000 to PHP Jan 23 2024 nbsp 0183 32 This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income The Tax Caculator

More picture related to Withholding Tax Rate Philippines 2024

Tax Bracket Philippines 2025 Stella Zoya

http://media.philstar.com/images/the-philippine-star/infographics/20171222/incometaxtable.jpg

Tax 2024 Philippines Zonda Lorilee

https://emcw7g93bqt.exactdn.com/wp-content/uploads/sites/5/2022/07/Revised-withholding-tax-table-Philippines-2022-768x527.jpg?strip=all&lossy=1&ssl=1

How To Compute Monthly Salary Withholding Tax Printable Online

https://www.philippinetaxationguro.com/wp-content/uploads/2022/07/Screen-Shot-2022-07-12-at-7.53.17-AM.png

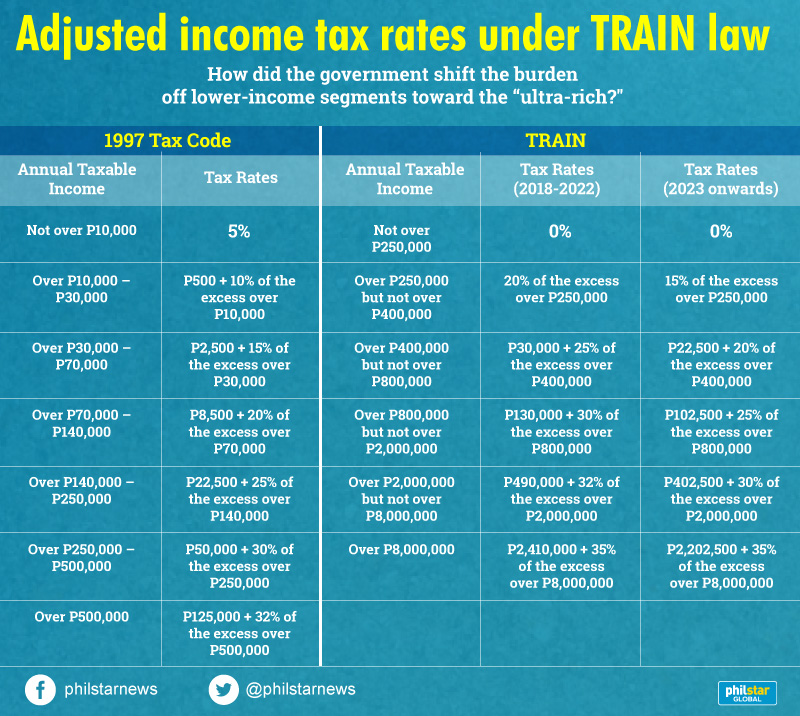

In general a corporation or individual engaged in business must withhold the appropriate amount of tax on any income payment to non residents generally set at 25 However the Philippines Effective January 2025 the new and updated Income Tax Table in the Philippines BIR Tax Table 2025 will follow the revised rates following the new BIR TRAIN Tax Reform for Acceleration and Inclusion Act

With the signing of the Ease of Paying Taxes EoPT Act Republic Act No 11976 taxpayers expect to benefit from improvements in the manner of tax filing and payment as well as in the withholding of taxes The Bureau of The Bureau of Internal Revenue BIR Website www bir gov ph is a transaction hub where the taxpaying public can conveniently access anytime anywhere updated information on the

Tax Calculator 2025 Philippines Yuto Vanjonge

https://mpm.ph/wp-content/uploads/2023/08/image.png

Tax Bracket 2024 Philippines Withholding Marys Sheilah

https://www.pinoymoneytalk.com/wp-content/uploads/2020/06/income-tax-tables-train-philippines-2018-2022.png

Withholding Tax Rate Philippines 2024 - Apr 1 2024 nbsp 0183 32 The schedule also affects the rate of withholding taxes on employees purely compensation income This is the 2024 Revised Withholding Tax Table Taxable Income