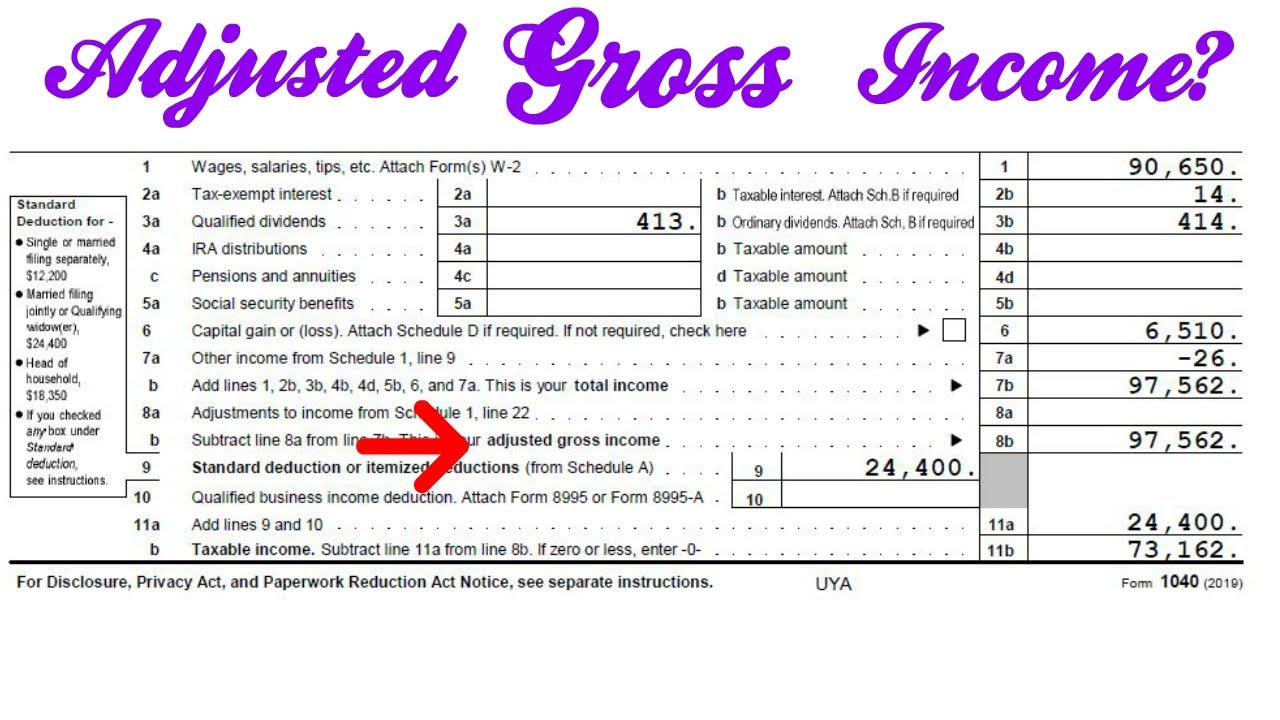

What Line Is Total Income On Tax Return Aug 1 2023 nbsp 0183 32 All income except those income items that Congress chooses not to tax equals total income line 9 on Form 1040 or what Welch refers to as gross income Next you ll need to get a

Aug 28 2021 nbsp 0183 32 Note that total income on Line 9 of your 1040 1040 SR will not include tax exempt income the non taxable amount of income from certain retirement benefits etc Gross Taxable income is the total amount of income used to calculate an individual s income tax It includes wages salaries bonuses commissions tips and other forms of compensation as well as income from businesses investments and

What Line Is Total Income On Tax Return

What Line Is Total Income On Tax Return

https://i.ytimg.com/vi/ByI_RRbKZ1U/maxresdefault.jpg

Form 1040 Earned Income Credit Child Tax Credit YouTube

https://i.ytimg.com/vi/z_1q37Cdxnw/maxresdefault.jpg

The Ari Hoffman Show A Big Beautiful Day What s In The Big

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=4051940238394506&get_thumbnail=1

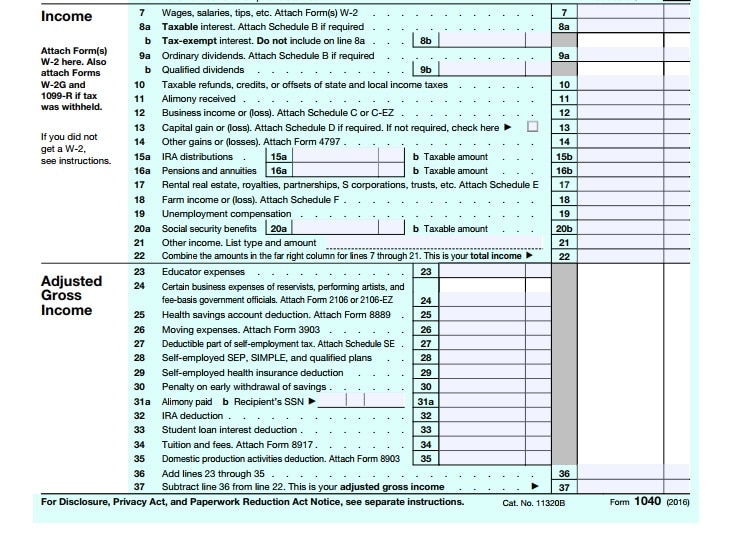

Aug 23 2010 nbsp 0183 32 For 1040 form 2009 year this should be line 37 on your tax return otherwise known as quot adjusted gross income quot or AGI This allows you to subtract from your income quot above Nov 10 2022 nbsp 0183 32 Your gross annual income appears on line 9 of the IRS Form 1040 tax return as of tax year 2021 the return you d file in 2022 The IRS periodically makes adjustments to Form

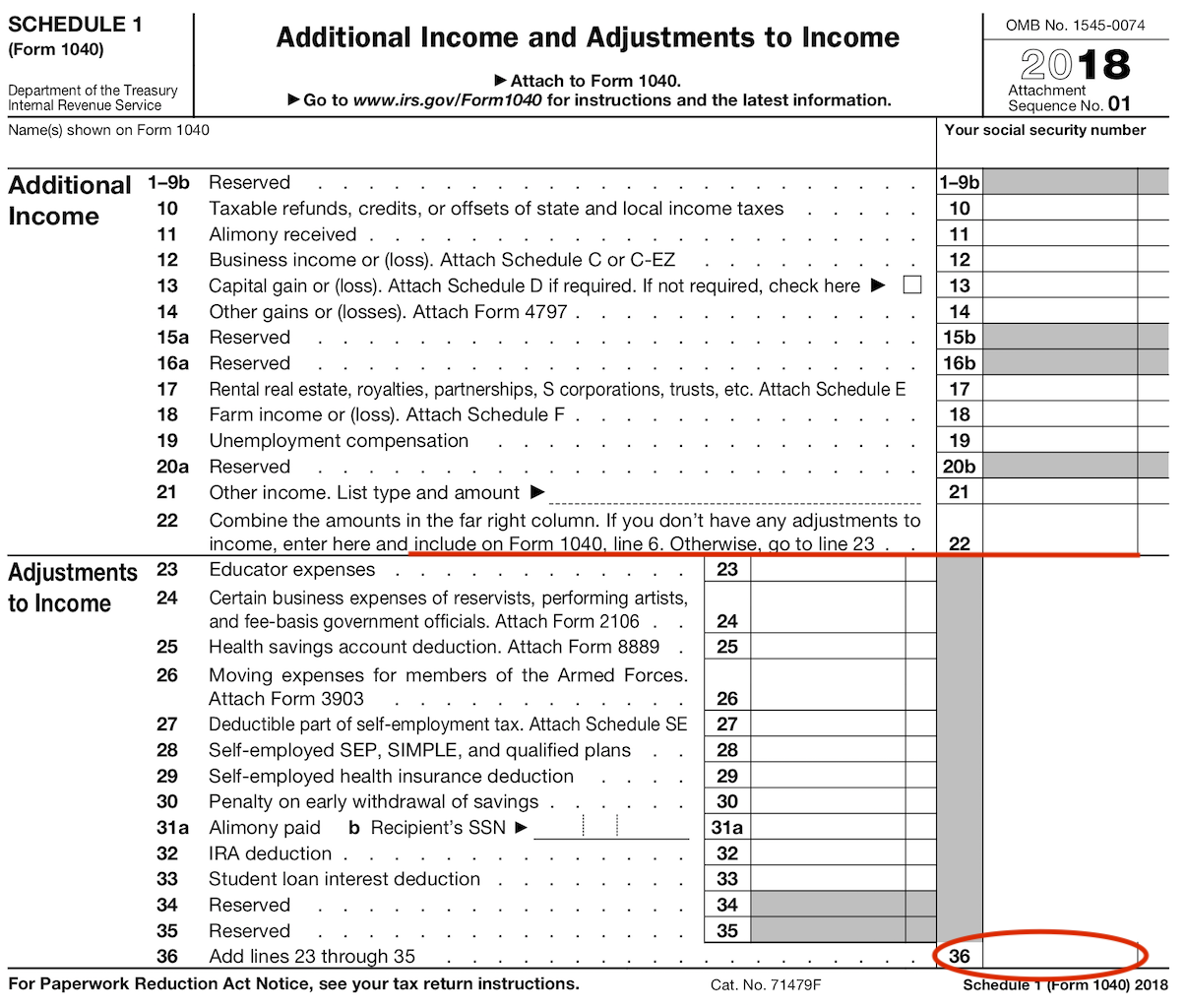

Mar 27 2021 nbsp 0183 32 Line 9 is your total income Line 10 is adjustments to your income such as from Schedule 1 which includes things like educator expenses health savings account deductions deductible part of self employment tax self Mar 4 2024 nbsp 0183 32 Possibly the most important line on your Form 1040 is the line that reports your adjusted gross income For 2023 AGI is reported on Form 1040 Line 11 It includes all taxable items of

More picture related to What Line Is Total Income On Tax Return

2025 Form 1040 Yvonne C Russell

https://d3pbdh1dmixop.cloudfront.net/pdfexpert/content_pages/mac_how-to-fill-1040-form/tax-forms-941-rs-tax-form-1040-20232x.png

Tax Return Deadline 2025 Levi Daniyal

https://thecollegeinvestor.com/wp-content/uploads/2024/01/TCI_-_2024-TAX-REFUND-CALENDAR-Updated-1.png

:max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg)

Declaration Of Income 2023 Image To U

https://www.investopedia.com/thmb/DPa_w90U8Wx_lL-et-1ESMTYzwY=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg

Feb 2 2025 nbsp 0183 32 It begins with Line 9 which displays total income This line combines various sources such as wages dividends and capital gains as reported on accompanying Sep 22 2021 nbsp 0183 32 Bookmark Icon DoninGA Level 15 The Total Income on a federal tax return Form 1040 is shown on Line 9

Jan 22 2025 nbsp 0183 32 Line 9 on Form 1040 is a critical component in determining your total income forming the foundation for calculating taxable income This line consolidates various income Nov 3 2023 nbsp 0183 32 To find the annual net income you will need to look at the Income section specifically Line 37 Adjusted Gross Income or AGI The AGI is calculated by subtracting

What Is AGI Adjusted Gross Income ExcelDataPro

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2017/11/Federal-Tax-Form-1040.jpg

.png)

Schedule 1 Line 10 2025 Tacoma Helen S Boyd

https://images.squarespace-cdn.com/content/v1/579a29a5414fb501f0e42ef7/1544798928544-NG6XNBY33IL53MY39TWM/2018+Schedule+1+(Form+1040).png

What Line Is Total Income On Tax Return - Mar 27 2021 nbsp 0183 32 Line 9 is your total income Line 10 is adjustments to your income such as from Schedule 1 which includes things like educator expenses health savings account deductions deductible part of self employment tax self