What Is The Tax Rate On Commercial Rental Income nternet Vergi dar si qtisadiyyat Nazirliyi yan nda D 246 vl t Vergi Xidm ti

How to start a business After planning the business in detail before starting entrepreneurial activity the entrepreneur must first be registered with the tax authority as a taxpayer More Funds allocated and spent to the extra budgetary fund of tax authorities Statistics and some approaches to administrative complaints Applications for preliminary determination of tax

What Is The Tax Rate On Commercial Rental Income

What Is The Tax Rate On Commercial Rental Income

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?w=1526&ssl=1

Assume Real Income Increased In The United States Draw A Correctly

https://us-static.z-dn.net/files/d8a/7bb837e9d30d1a0d8a4dd084abaa0b56.jpg

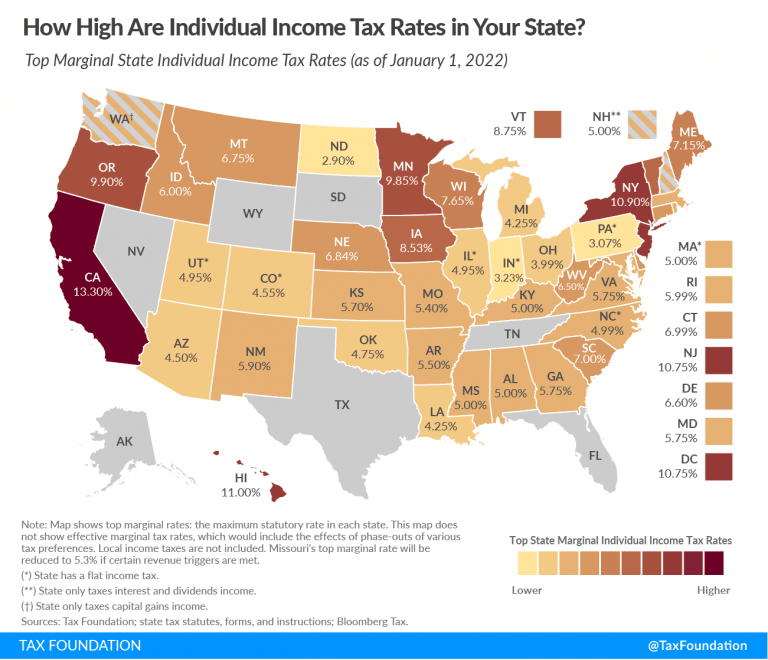

Individual Income Tax Rates 2026

https://s.yimg.com/ny/api/res/1.2/9OoVAtst.kBuEKSi3_7vLA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MA--/https://s.yimg.com/os/creatr-uploaded-images/2023-01/256761a0-9a65-11ed-b57b-4f397ac4ee71

The Tax Code stipulates payment of taxes based on a simplified system for enterprises or sole entrepreneurs not registered as value added tax VAT payers and whose cumulative gross Jun 30 2025 nbsp 0183 32 Withholding tax WHT rates WHT at the following rates is withheld from specified Azeri source income Dividends 5 Interest currently interest paid for bank deposits is not

Simple tax returns 100 free 37 of filers qualify Simple Form 1040 returns only no schedules except for Earned Income Tax Credit Child Tax Credit and student loan interest The tax legislation of Azerbaijan is comprised by the Constitution of Azerbaijan Republic the Tax Code and legal standards which are adopted herewith The taxes levied in Azerbaijan can be

More picture related to What Is The Tax Rate On Commercial Rental Income

Capital Gains Rate 2025 Rina Dewal

https://rwncdn.s3.amazonaws.com/wp-content/uploads/Long-term-Capital-Gains-Tax-Rates-Infographic-1024x536.png

Michigan State Income Tax Rate 2025 Joyce M Hahn

https://arnoldmotewealthmanagement.com/wp-content/uploads/2019/06/2022-state-income-tax-rate-map-768x660.png

2025 Tax Rates Single Taxpayer Elisa M Fernandez

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

Jun 30 2025 nbsp 0183 32 Tax returns The following persons are liable for the filing of the annual PIT return to the tax authorities no later than 31 March of the following year Residents having taxable A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures

[desc-10] [desc-11]

Individual Income Tax Brackets 2024 Printable Forms Free Online

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2023/03/new-versus-old-singles-tax-rate.png

California State Income Tax Brackets 2024 2024 Janka Marilin

https://files.taxfoundation.org/20230217151820/2023-state-individual-income-tax-rates-2023-state-income-taxes-by-state.png

What Is The Tax Rate On Commercial Rental Income - The Tax Code stipulates payment of taxes based on a simplified system for enterprises or sole entrepreneurs not registered as value added tax VAT payers and whose cumulative gross