What Is Tax Slab For Salaried Person The Canada Revenue Agency CRA administers tax laws for the government providing contacts services and information related to payments taxes and benefits for individuals and businesses

Filing through a tax preparer If you don t do your taxes on your own an EFILE certified tax preparer like an accountant can file your income tax and benefit return for you Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper Aug 15 2025 nbsp 0183 32 Today the Minister of Finance and National Revenue the Honourable Fran 231 ois Philippe Champagne released for consultation draft legislative proposals that would implement a range of previously announced and other tax measures including measures that would Today the Minister of Finance and

What Is Tax Slab For Salaried Person

What Is Tax Slab For Salaried Person

https://i.ytimg.com/vi/MlFOZ1aCtrc/maxresdefault.jpg

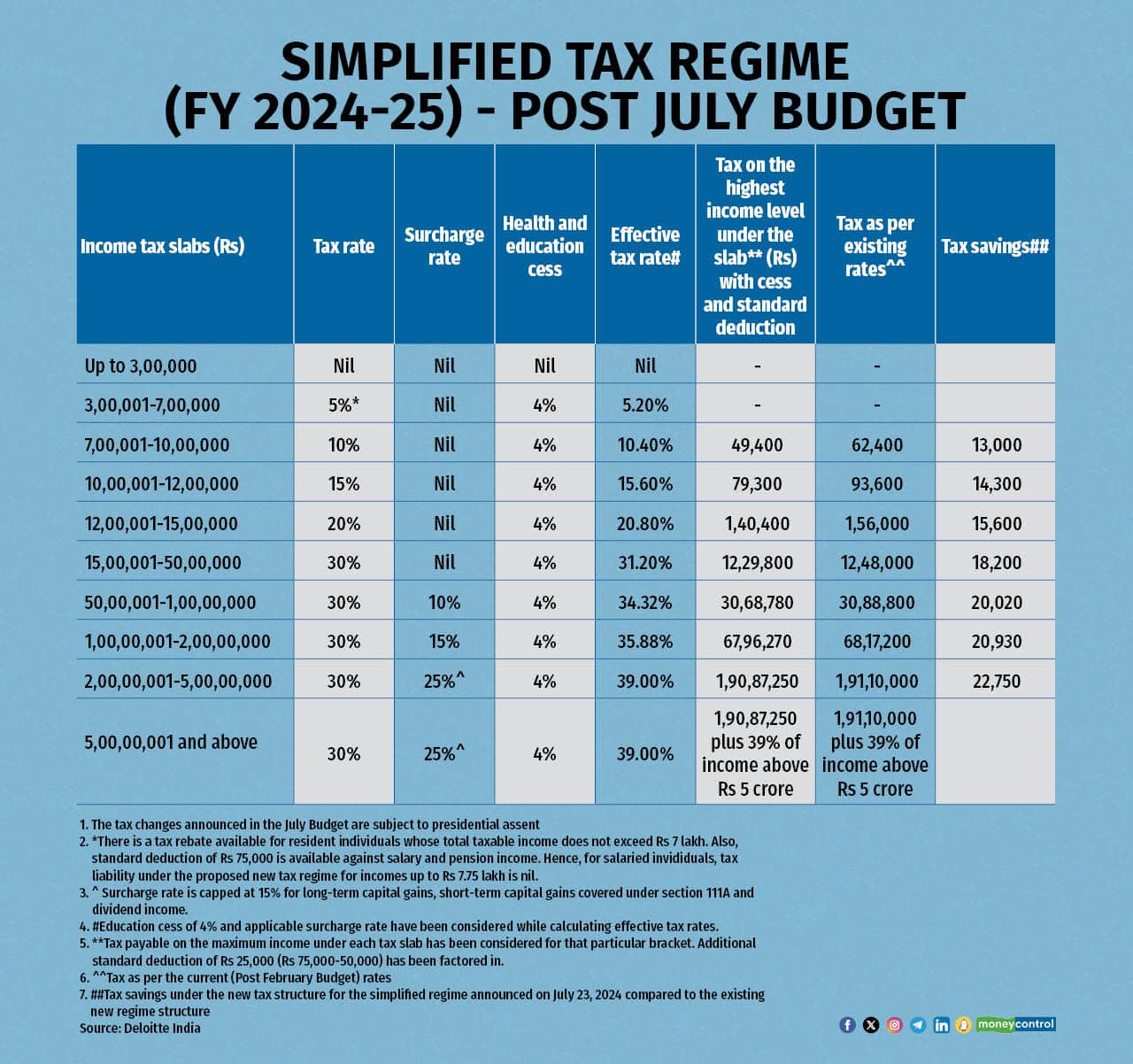

Income Tax Slab Rate FY 2023 24 AY 2024 25 In Budget 2023 49 OFF

https://i.brecorder.com/primary/2023/06/261441140911e3a.jpg

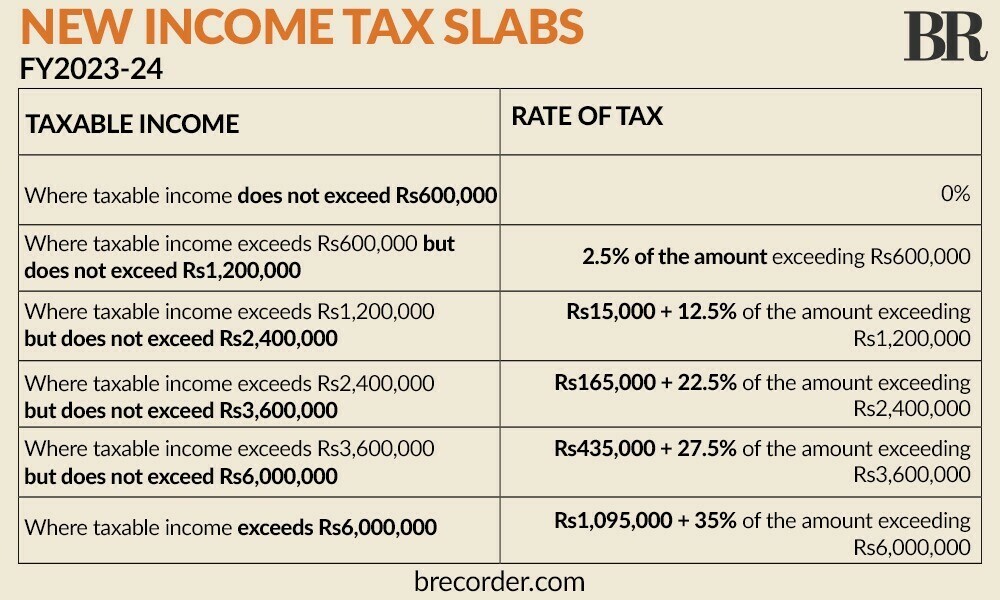

New Income Tax Slabs CPA Pakistan

https://icpap.com.pk/wp-content/uploads/2022/11/new-income-tax-slabs-22-23-scaled.jpg

Jul 9 2025 nbsp 0183 32 NETFILE service in tax software that allows most people to submit a personal income tax return electronically to the Canada Revenue Agency Jan 15 2025 nbsp 0183 32 This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a Client portals with a single sign in

Tax assessment or reassessment This section provides a summary of the key line numbers and amounts used to assess or reassess your tax return If changes were made to your return an explanation of the changes is provided Summary Shows the line numbers and amounts used to calculate your refund or balance owing on your assessed tax return Jan 28 2025 nbsp 0183 32 The payment may include a related provincial or territorial benefit amount Tax filing and payment deadline The tax filing deadline for most individuals is April 30 2025 This is also the deadline to make a payment if you owe taxes By filing your tax return on time you will avoid delays or interruptions to your benefit and credit payments

More picture related to What Is Tax Slab For Salaried Person

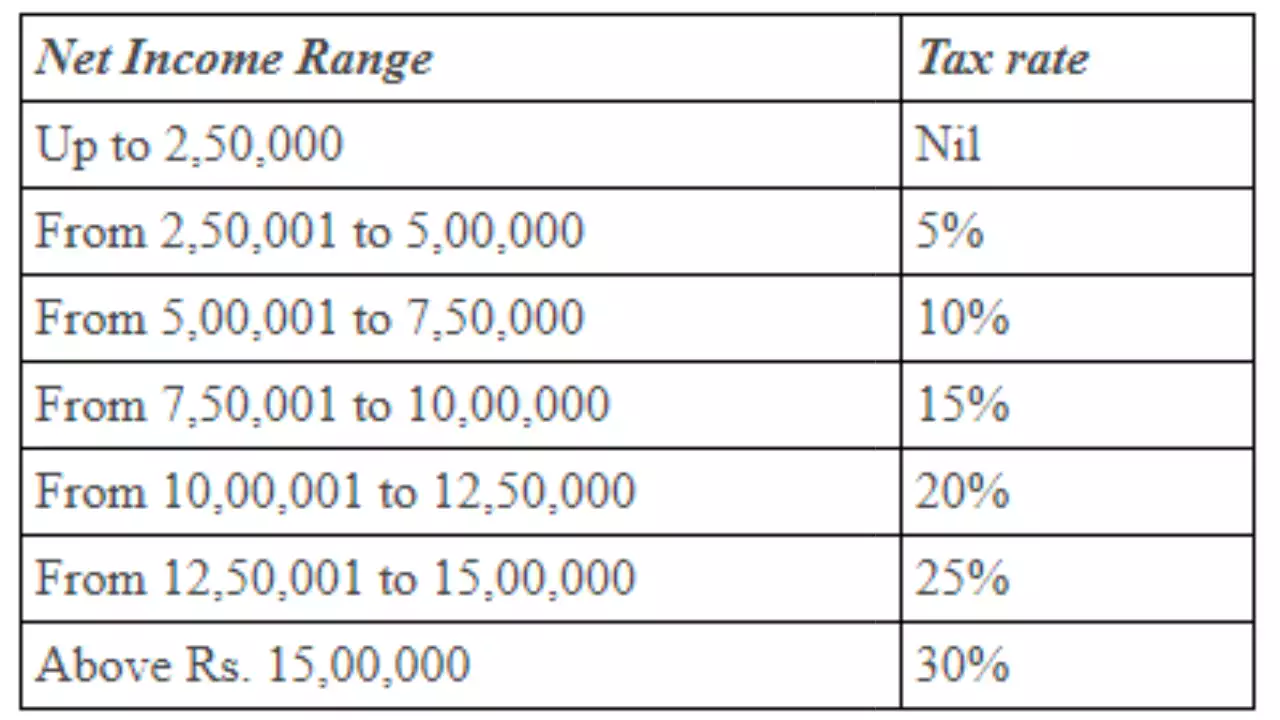

2024 2025 Tax Slab

https://static.tnn.in/photo/msid-107317246/107317246.jpg

Income Tax Income Tax News Big Change In Slab Check The New Slab

https://www.basunivesh.com/wp-content/uploads/2025/02/Budget-2025-New-Income-Tax-Slab-Rates-For-2025-26-AY-2026-27-1.jpg

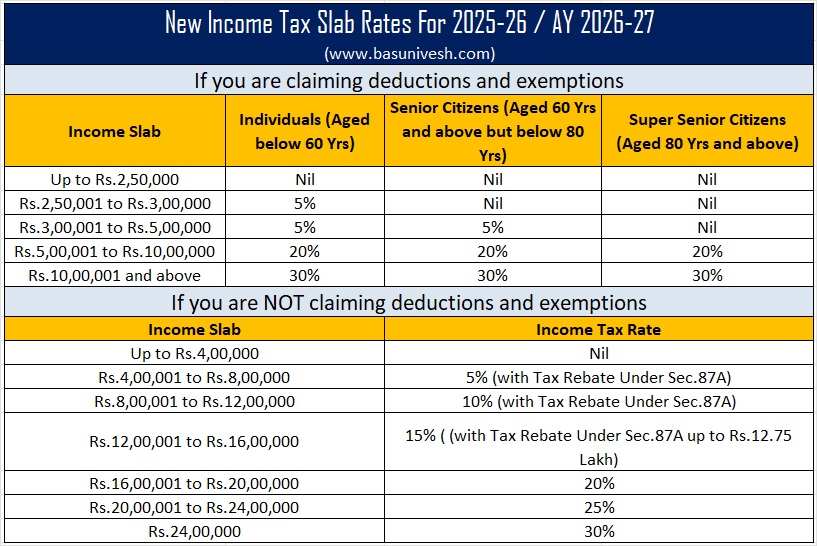

Tax Slabs For Fy 2024 25 For Senior Citizen

https://images.moneycontrol.com/static-mcnews/2024/07/20240723120114_Simplified-Tax-Regime-FY-2024-25-Post-July-Budget-R2.jpg

3 days ago nbsp 0183 32 Learn how to file your GST HST return using the online NETFILE form and whether this method meets your needs Mar 1 2024 nbsp 0183 32 How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund or Preservation Fund as a cash lump sum The first R550 000 of your retirement lump sum is tax free as of 1 March 2024 Any previous withdrawals or retirement lump sums you ve taken will

[desc-10] [desc-11]

Budget 2025 New Income Tax Slab Rates FY 2025 26

https://www.basunivesh.com/wp-content/uploads/2025/02/Budget-2025-New-Income-Tax-Slab-Rates-For-2025-26-AY-2026-27-800x535.jpg

[img_title-8]

[img-8]

What Is Tax Slab For Salaried Person - Tax assessment or reassessment This section provides a summary of the key line numbers and amounts used to assess or reassess your tax return If changes were made to your return an explanation of the changes is provided Summary Shows the line numbers and amounts used to calculate your refund or balance owing on your assessed tax return