What Is Schedule C Misc Exp Other Jun 6 2019 nbsp 0183 32 Type in Schedule C in the Search box and click on Jump to Schedule C This will bring up your Schedule C business Click Edit next to the business you are getting the error for Click continue until you reach expenses

Apr 17 2023 nbsp 0183 32 To delete or correct your Misc Exp on your Schedule C in TurboTax Online please follow these steps Deana3769 April 17 2023 4 00 PM 2 ERROR MESSAGES 1 Schedule C Other expenses text is invalid May 31 2022 nbsp 0183 32 Miscellaneous expenses are defined as other expenses These expenses are not specific but are still considered ordinary and necessary Therefore they are deductions that can be included on your Schedule C

What Is Schedule C Misc Exp Other

What Is Schedule C Misc Exp Other

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

Fillable Online Schedule C Worksheet Amount Misc Exp Other Schedule

https://www.pdffiller.com/preview/679/312/679312979/large.png

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)

Schedule C Printable Guide

https://www.investopedia.com/thmb/st7P9DHU5c0MafugWTXlKMNol0s=/2200x1700/filters:no_upscale():max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png

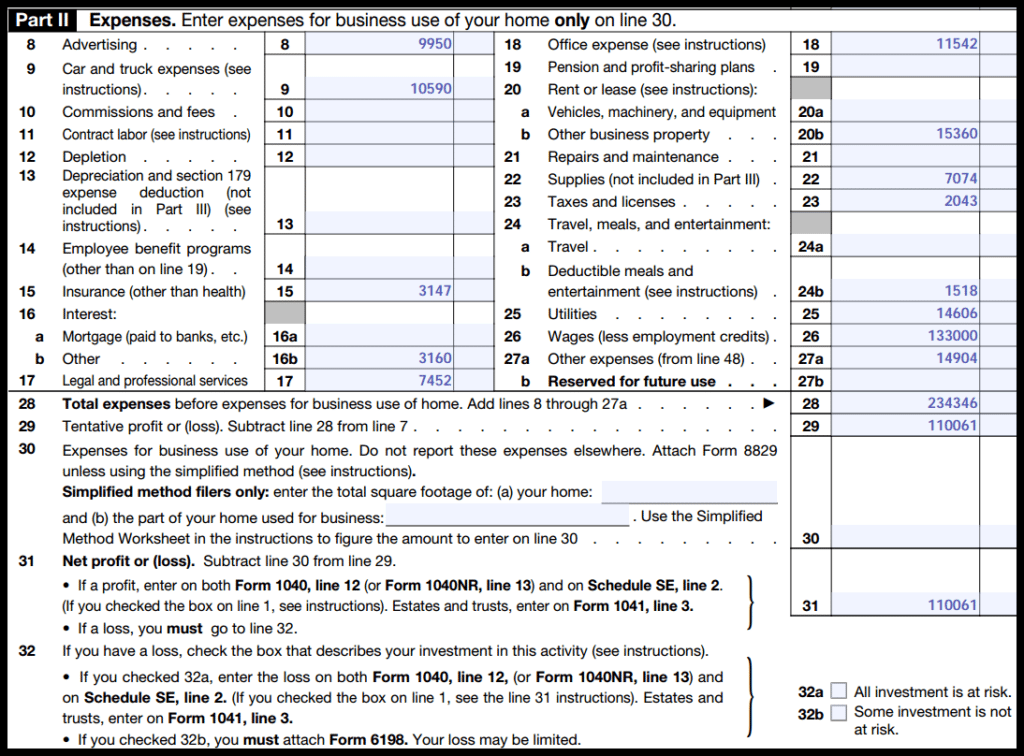

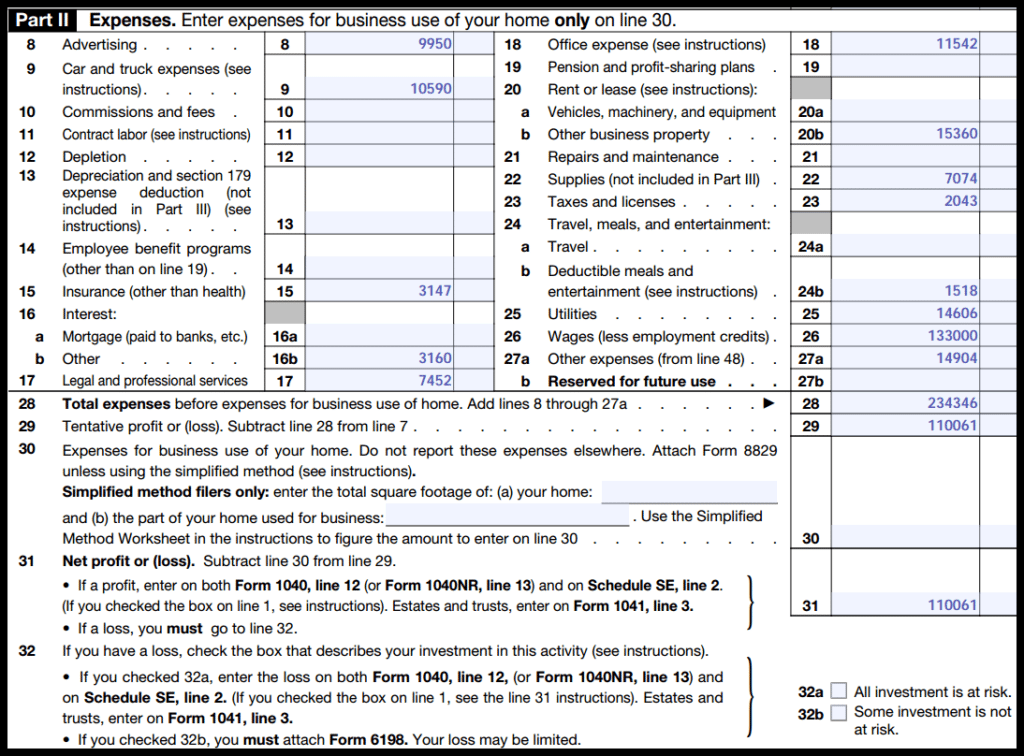

Taxpayers can deduct these as other expenses A breakdown of other expenses must be listed on line 48 of Form 1040 Schedule C The total is then entered on line 27 Amortization of What do the Expense entries on the Schedule C mean The IRS divides the Schedule C into five parts Each section reports important information about your income and deductions

Schedule C has Common expenses and then lines for your own quot Miscellaneous Expenses quot How important is it to use Common when applicable as opposed to classifying as Misc Does Jun 1 2019 nbsp 0183 32 Schedule C Other Expenses requires a description and amount for each line on the supplemental schedule Return to your Business Summary page update Other Common

More picture related to What Is Schedule C Misc Exp Other

Schedule C Income Tax Calculator

https://1044form.com/wp-content/uploads/2020/08/irs-schedule-c-instructions-step-by-step-including-c-ez-4.png

Understanding The Schedule C Tax Form

https://images.ctfassets.net/kwu941wcctu4/6HWqQtXH90UbIFt9GXB0l4/d4a9e567927cf547a2d29a7f699b72f5/hero_-_Understanding_the_Schedule_C_Tax_Form.png

Schedule C Worksheet Misc Exp Other WorksSheet List

https://lh6.googleusercontent.com/proxy/byeZ2dL6q8ZuZflXXP1dO73geGJ0fPBQCvMhIQ4q83vufyI6EIONaDrGuJ8tAQyulCHm3azDdjNAYDSD7syZ1yQ9eeTelwZ0l2IwBGckQUyeby05G-yWV0W6hk4wqWhM=w1200-h630-p-k-no-nu

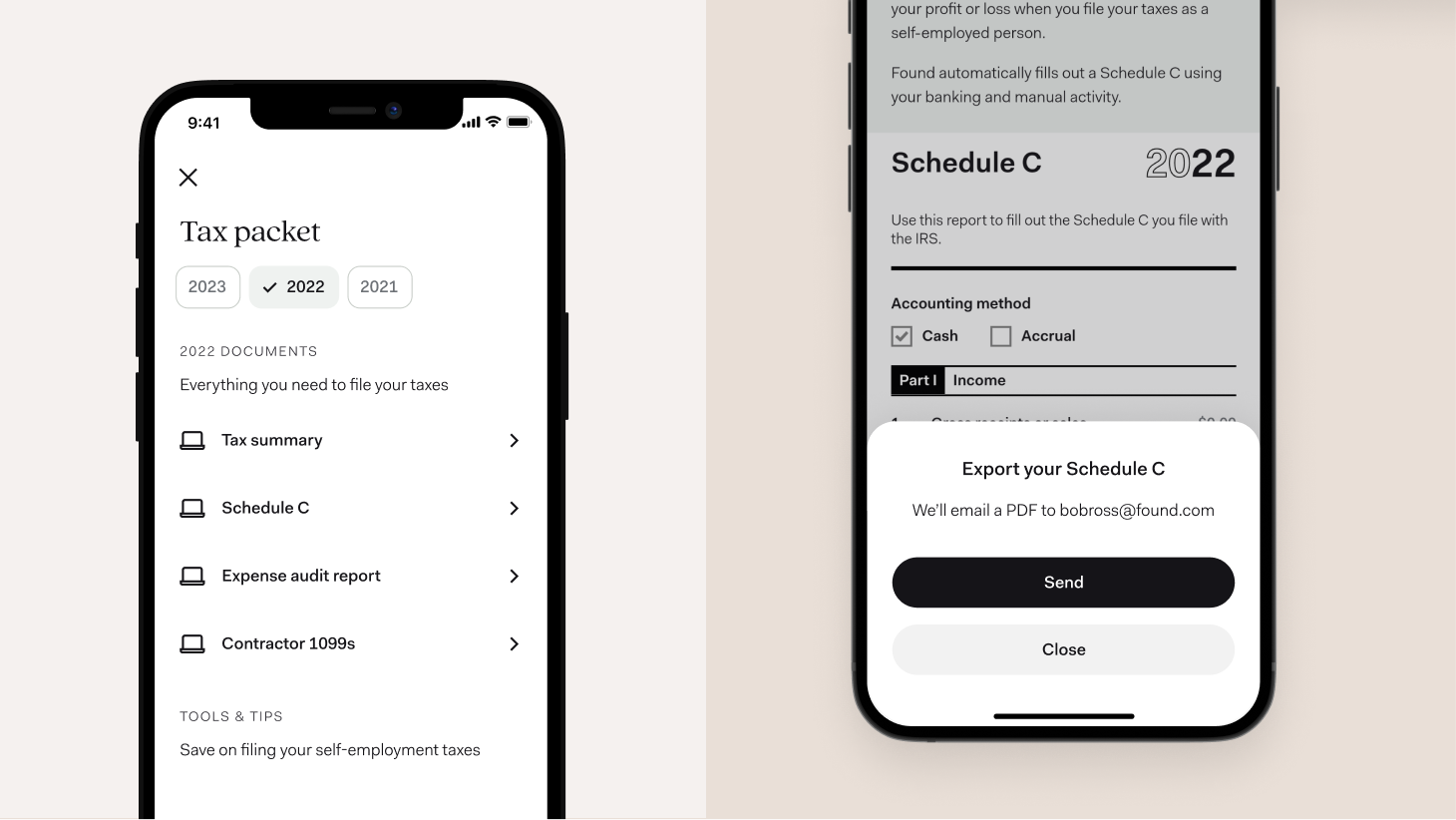

Dec 16 2024 nbsp 0183 32 Schedule C is a form used to report self employment income on a personal return Self employment income is how we describe all earned income derived from non W 2 sources This could be income from your small Oct 10 2024 nbsp 0183 32 For more Schedule C resources check out our Tax topics page for Schedule C where you ll find answers to the most commonly asked questions Entering self employed

Qualified Expenses relating to your business income can be deducted in the expenses section of your Schedule C To enter your expenses for your business go to Federal Income Profit or Mar 2 2021 nbsp 0183 32 What is Schedule C Schedule C is the form used to report income and expenses from self employment This can encompass owning a digital or brick and mortar small

What Income Is Reported On Schedule C

http://fitsmallbusiness.com/wp-content/uploads/2016/11/schedule-c-part-2-1024x756.png

Self Employed Here s How Schedule C Taxes Work Pinewood Consulting LLC

https://images.squarespace-cdn.com/content/v1/5bbb6068840b16a82382374f/1622838036785-E6NIIUOFPJIO1AJ6EVVD/Schedule+C+3.PNG?format=1500w

What Is Schedule C Misc Exp Other - Schedule C Business Worksheet General Information Business Address City State amp Zip Code Income Gross receipts or sales Returns and allowances Other Income Description