What Is Provisional Tax For the purpose of calculating the Provisional Tax for each Quarterly Payment Date QPD clients are required to estimate the annual tax due and calculate the respective percentage of tax to

Apr 11 2024 nbsp 0183 32 Provisional tax is paid by people who earn income other than a salary traditional remuneration from an employer If you earn non salary income for example rental income from Feb 8 2025 nbsp 0183 32 Unlike traditional systems with annual payments provisional tax requires multiple payments during the fiscal year easing cash flow and preventing large lump sum payments at

What Is Provisional Tax

What Is Provisional Tax

https://kiwitax.co.nz/wp-content/uploads/2022/08/What-is-Prov-tax-image..jpg

.png)

What Is Provisional Tax

https://www.zeeliepasa.co.za/img/blog/406/Provisional_tax_(1).png

What Is A Provisional Tax Code Beautiful One Day By Day Account Efecto

https://i.pinimg.com/originals/9f/51/3d/9f513dc91c072b1f8be461dc2be2d5aa.jpg

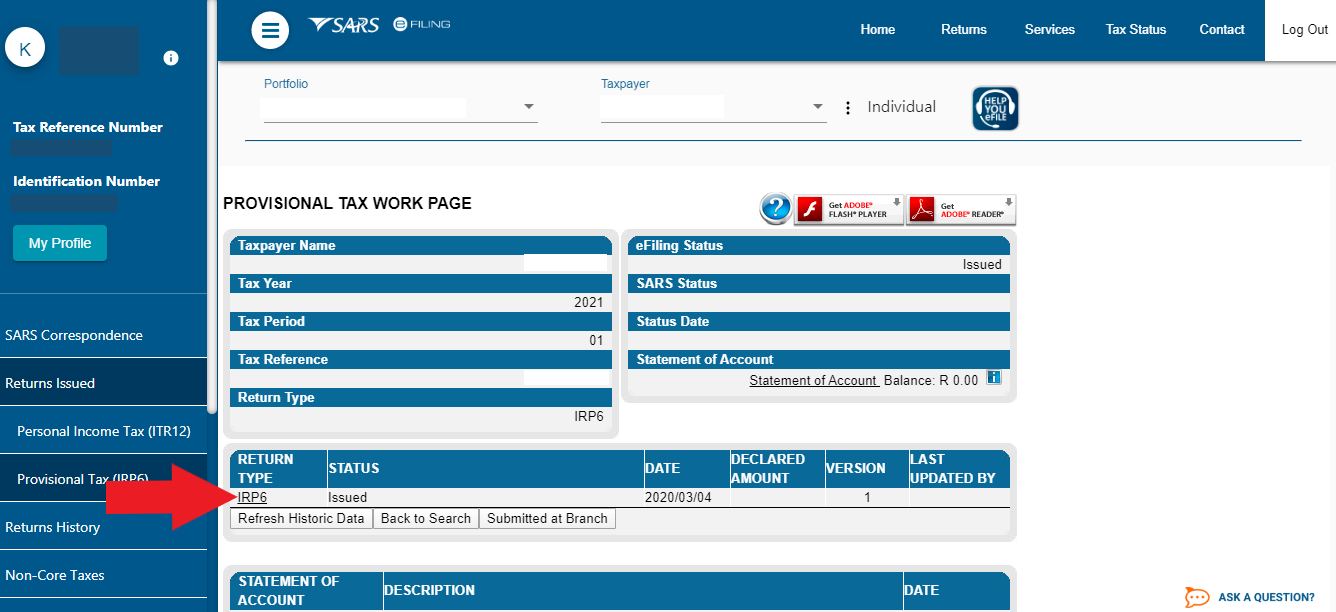

C Provisional Tax is not a separate tax but merely a mechanism to pay the normal Income Tax liability during the tax year and is therefore an advance payment of a taxpayer s normal tax Nov 10 2024 nbsp 0183 32 Provisional income is an IRS threshold above which social security income is taxable The base from 167 86 of the Internal Revenue Code IRC triggers the taxability of social

Provisional tax is a method of fulfilling income tax liabilities ahead of time to mitigate the possibility of large tax debts As a result provisional tax is not seen as separate from income tax but Provisional tax is a system that ensures you declare and pay income tax during a tax year and not only when your income tax return is assessed at the end of the tax year As an employee

More picture related to What Is Provisional Tax

What Is Provisional Tax In New Zealand Pulse Accountants

https://images.squarespace-cdn.com/content/v1/5e7d530e06fbf51b7f6b8523/1724105720078-APZNKVSNEWUFL5STAYB6/097A3685.jpeg

![]()

What Is Provisional Tax And How Does It Work Accounting Insights

https://accountinginsights.org/wp-content/uploads/2024/01/cropped-ai6icon.png

What Is Provisional Tax How And When Do I Pay It TaxTim SA

https://www.taxtim.com/za/images/media-za/Six1.png

Provisional tax is not a separate tax from income tax It is designed to help taxpayers settle their income tax in advance think of it as a pre payment to ensure that taxpayers don t get saddled Aug 16 2020 nbsp 0183 32 WHO IS A PROVISIONAL TAXPAYER Any person who receives income or accrues income other than a salary is a provisional taxpayer Most salary earners are

[desc-10] [desc-11]

What Is Provisional Tax How And When Do I Pay It TaxTim SA

https://www.taxtim.com/za/images/media-za/Three2.png

What Is Provisional Tax How And When Do I Pay It TaxTim SA

https://www.taxtim.com/za/images/media-za/One2.png

What Is Provisional Tax - C Provisional Tax is not a separate tax but merely a mechanism to pay the normal Income Tax liability during the tax year and is therefore an advance payment of a taxpayer s normal tax