What Is Hmrc Self Assessment Tax Return For Tax Year 2022 To 2023 Feb 28 2025 nbsp 0183 32 Once HMRC has details of dividends from Close Companies the Government will finally be able to solve the IR35 problem It can just make close company dividends liable to

Apr 17 2025 nbsp 0183 32 From HMRC s tax calculation guidance notes page TCSN35 Class 2 NICs You pay Class 2 contributions if you re self employed Class 2 contributions are 163 3 45 a week or May 20 2025 nbsp 0183 32 However with HMRC s many rules and updates understanding how this process operates can be confusing for both you and your employees This blog aims to offer a complete

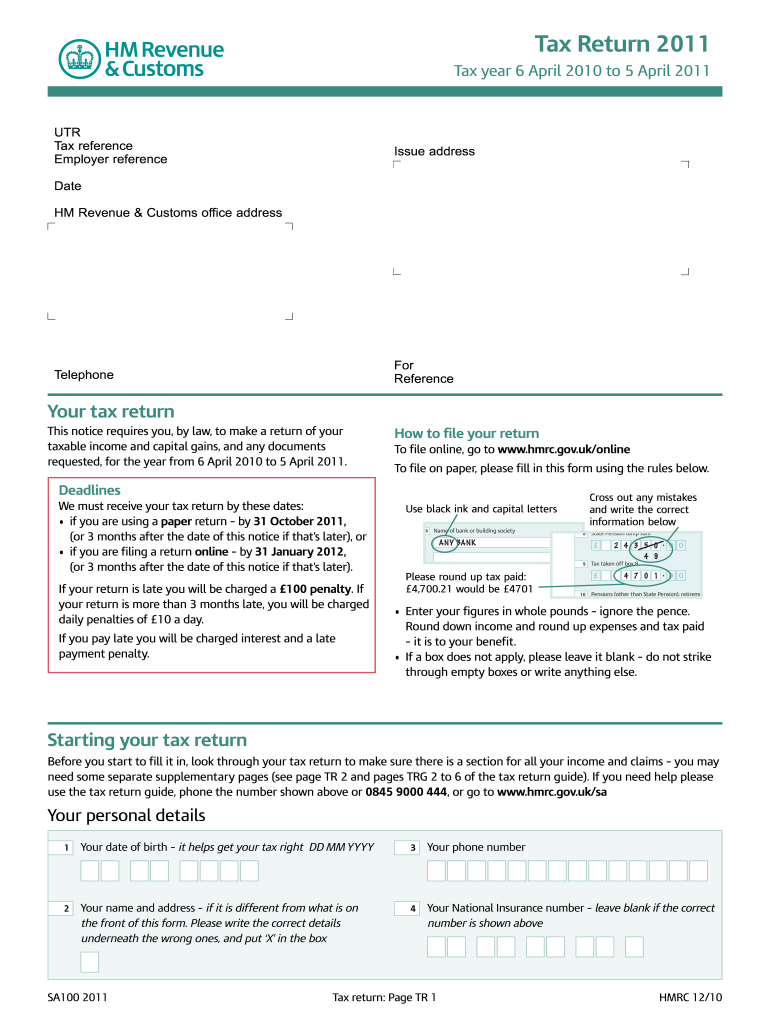

What Is Hmrc Self Assessment Tax Return For Tax Year 2022 To 2023

What Is Hmrc Self Assessment Tax Return For Tax Year 2022 To 2023

https://i.ytimg.com/vi/LXw9ily9rTo/maxresdefault.jpg

Any Thoughts On This HMRC Compliance Letter 45 OFF

https://images.ctfassets.net/zkj4qptctbba/45TAGl6hQLtTmb35gZONJf/c23376fb026057394fface8488268f6f/2022-09-REGISTER-FOR-SELF-ASSESSMENT-BLOG.png

Hmrc Image To U

https://media.thebestof.co.uk/v2/rule/blog_gallery/resource_page/2/59/70/5970c497c6a71175580024a2_1520957248/HMRC-logo-1.png

Jul 18 2025 nbsp 0183 32 HMRC are saying the exemption for this not submtting a 60 day CGT return stopped and are requesting a 60 day on line return is now done Question is will HMRC charge Aug 4 2025 nbsp 0183 32 Anyone else unable to file at HMRC Tried SA and CT both via taxCalc and both failed Of course the HMRC service availability page states no issues

Jul 24 2025 nbsp 0183 32 HMRC recently published draft legislation for MTD for income tax Emma Rawson walks us through the main changes and highlights some unanswered questions Jun 4 2025 nbsp 0183 32 How to report subsistence allowance spending to HMRC Reporting subsistence allowance to HMRC is fairly straightforward and follows the same process as reporting other

More picture related to What Is Hmrc Self Assessment Tax Return For Tax Year 2022 To 2023

HMRC ZanthiaNyla

https://logos-world.net/wp-content/uploads/2021/08/HMRC-Logo.png

Letter Template Hmrc Penalty Appeal Letter Example 3 Easy Ways To

https://i.pinimg.com/originals/00/af/13/00af13d1bf0247b153754c492ecfafce.jpg

Hmrc Income Tax Rates 2023 2024 Image To U

https://www.pdffiller.com/preview/100/75/100075241/large.png

Jun 19 2024 nbsp 0183 32 This vehicle is crying out for a Court ruling or some HMRC quot guidance quot Clearly it is constructed for the conveyance of goods but given the limited load space is this primarily Jul 16 2025 nbsp 0183 32 Have you found this content useful Use the button above to save it to your profile Making Tax Digital MTD for Income Tax represents HMRC s digital transformation of the UK

[desc-10] [desc-11]

HMRC Self Assessment

https://www.qualityformationsblog.co.uk/wp-content/uploads/2020/01/HMRC-Self-Assessment-image.jpg

Hmrc Pay Scales 2023 Image To U

https://cms-admin.kingsbridge.co.uk/app/uploads/2023/02/OPW-Letter_Redacted-watermarked_Page_1-1.png

What Is Hmrc Self Assessment Tax Return For Tax Year 2022 To 2023 - Aug 4 2025 nbsp 0183 32 Anyone else unable to file at HMRC Tried SA and CT both via taxCalc and both failed Of course the HMRC service availability page states no issues