What Is Deferred Tax Asset And Liability Jun 16 2007 nbsp 0183 32 So what is the rationale for allowing stocks to trade on a deferred settlement basis I notice it normally happens when there is an IPO I ve also noticed stocks are not just traded

Mar 14 2007 nbsp 0183 32 I m looking at SPN and their dividends are 5 776c 0 872C FRANKED 30 3 288C TAX DEFERRED according to ASX au What implication does the quot tax deferred quot Jan 26 2016 nbsp 0183 32 In the vein of starting more stock related discussions I asked this on the VLT thread but never got an answer How does the accounting work for quot deferred revenue quot I get

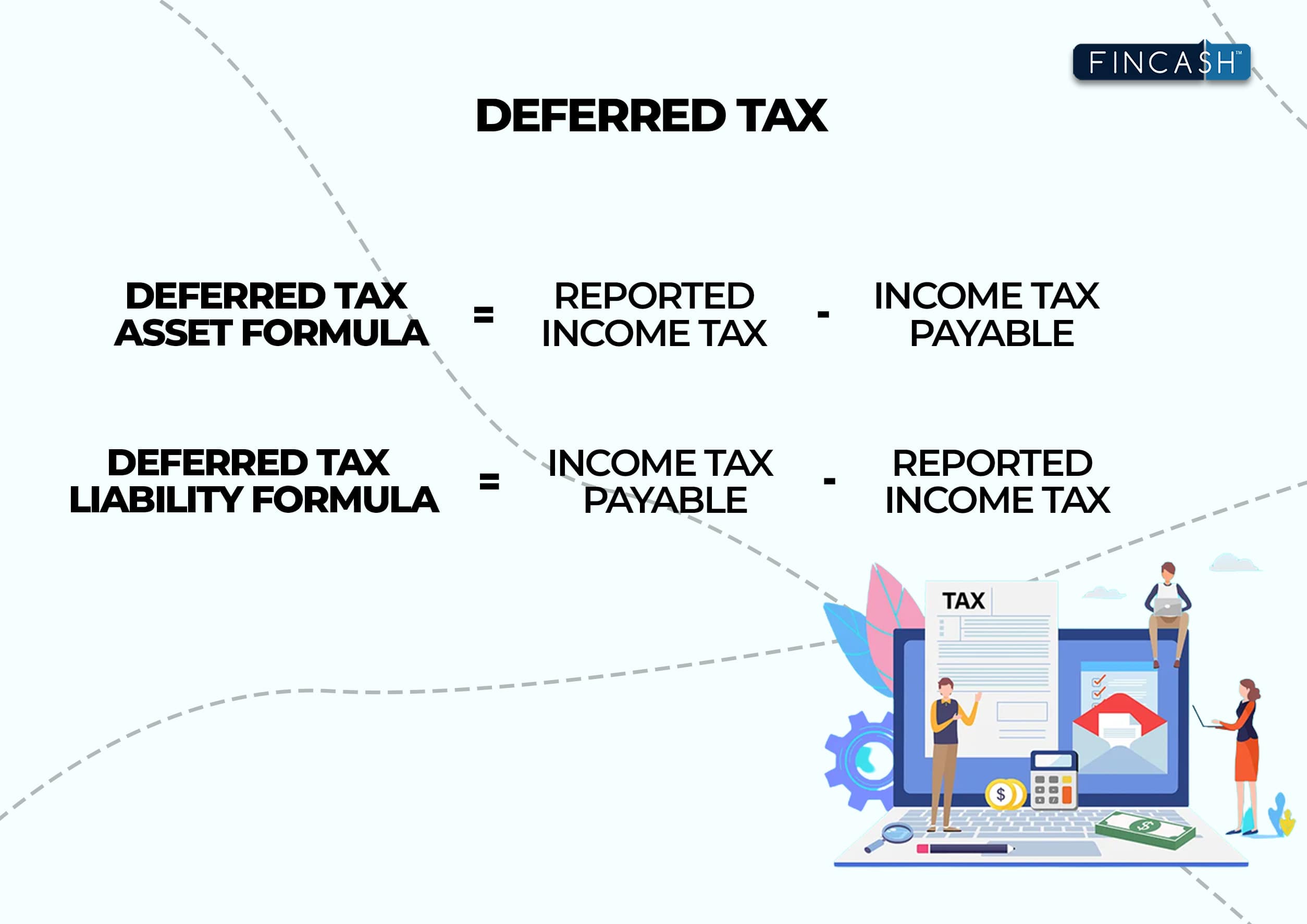

What Is Deferred Tax Asset And Liability

What Is Deferred Tax Asset And Liability

https://i.ytimg.com/vi/RGpQldmfuHw/maxresdefault.jpg

Deferred Tax Asset What It Is And How To Calculate And Use 41 OFF

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=10155016833580916

Deferred Tax Deferred Tax In Accounting Standards

https://cdn.educba.com/academy/wp-content/uploads/2020/09/Deferred-Tax.jpg

Jul 30 2004 nbsp 0183 32 Deferred management Fees Another great business opportunity made by and for Macquarie Bank and a host of other financial leeches The short story Ghoti is that the BIG Jan 31 2024 nbsp 0183 32 as expected due to the grinding of values in these financial tools 26 April 2024 Market Announcements Office ASX Limited Unit consolidation Betashares Australian

May 28 2004 nbsp 0183 32 Good afternoon everyone and welcome to the March 2025 stock tipping competition entry thread The March 2025 stock tipping competition is proudly sponsored by Dec 9 2008 nbsp 0183 32 If the shares were transfered to a company in which you re GF and or yourself is a director then there is also the possibility of a Deferred Tax Asset DTA or a Deferred Tax

More picture related to What Is Deferred Tax Asset And Liability

Deferred Tax Double Entry Bookkeeping

https://www.double-entry-bookkeeping.com/wp-content/uploads/deferred-taxation-accounting-equation.png

Income Tax Expense Silopevital

https://image1.slideserve.com/3506718/example-deferred-tax-liability-l.jpg

Income Tax Brackets Rates For FY 2024 25 Fincash

https://d28wu8o6itv89t.cloudfront.net/images/DeferredTaxminjpg-1684824721547.jpeg

Jun 1 2013 nbsp 0183 32 The 100 tax deferred amount comes off your purchase price when calculating the capital gain so your gain is 7500 5000 100 2600 Apply your 50 reduction for holding Apr 21 2025 nbsp 0183 32 A quick recap of the rules for those not familiar with them 1 Each entrant may choose one ASX listed stock or ETF Options warrants and deferred settlement shares are not

[desc-10] [desc-11]

Brian Feroldi On Twitter Plain English Company A Buys Company

https://pbs.twimg.com/media/FTc_hASXsAEgMaY?format=jpg&name=4096x4096

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

https://www.footnotesanalyst.com/wp-content/uploads/2019/06/DT-example-1-1.png

What Is Deferred Tax Asset And Liability - May 28 2004 nbsp 0183 32 Good afternoon everyone and welcome to the March 2025 stock tipping competition entry thread The March 2025 stock tipping competition is proudly sponsored by