What Is A Disregarded Entity Name May 31 2022 nbsp 0183 32 It refers to an entity that as the name implies will be disregarded or ignored for federal income tax purposes The most common disregarded entity for federal income tax

Aug 2 2023 nbsp 0183 32 A disregarded entity is a business that the IRS taxes by including its income and expenses directly on the owner s tax return The most common disregarded entity is a single member limited liability company LLC that does Apr 1 2025 nbsp 0183 32 What Is a Disregarded Entity The term disregarded entity refers to a business entity that s a separate entity from its owner but that is considered to be one in the same as

What Is A Disregarded Entity Name

What Is A Disregarded Entity Name

https://i.ytimg.com/vi/x7Lo0DDCKYI/maxresdefault.jpg

Rev Rul 99 6 Situation 1 Partnership To Disregarded Entity YouTube

https://i.ytimg.com/vi/ONYGun66LD0/maxresdefault.jpg

The Hierarchy Of Business Entity Types YouTube

https://i.ytimg.com/vi/Qz5MHzXzKv4/maxresdefault.jpg

A disregarded entity DE is a tax accounting term used to denote a business that is disregarded by the IRS for tax purposes Rather than being subject to corporate tax business income will be taxed as the owner s personal income Apr 17 2025 nbsp 0183 32 A disregarded entity DE is one that is separate or distinct from the business owner but for federal tax purposes that entity is disregarded as a separate entity from the business owner by the Internal Revenue Service

Oct 9 2021 nbsp 0183 32 A disregarded entity LLC is a separate business entity that is ignored for the purpose of taxation in a given tax year These LLCs are created at the state level as separate entities but for both state and federal taxes the A disregarded entity is a business entity that has a single owner and has not elected to be taxed as a separate entity by the Internal Revenue Service IRS This means taxes owed by this type of business are paid as part of the owner s

More picture related to What Is A Disregarded Entity Name

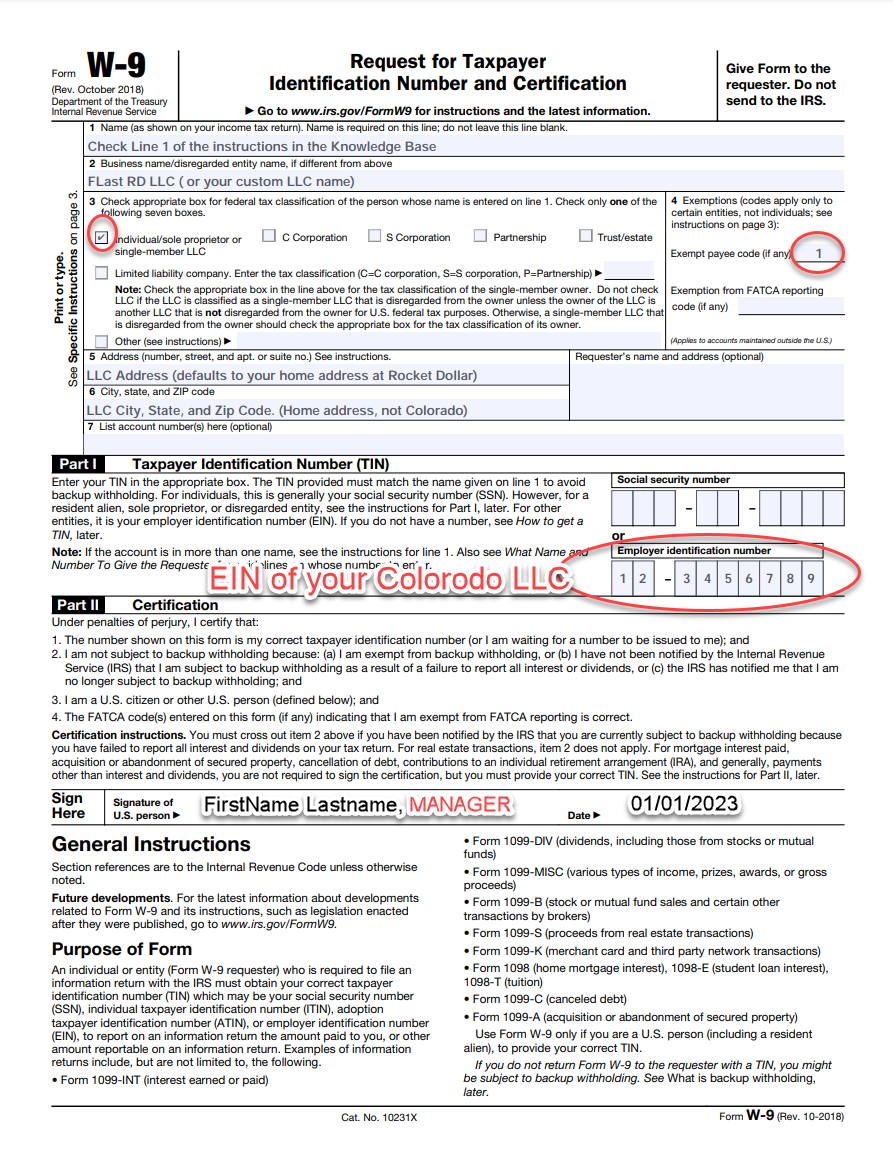

2025 W9 Instructions Justin S Leitch

https://learn.rocketdollar.com/hc/article_attachments/9758718030867/W9_KB_Sept_2022.png

Getting Started Xometry s Manufacturing Community

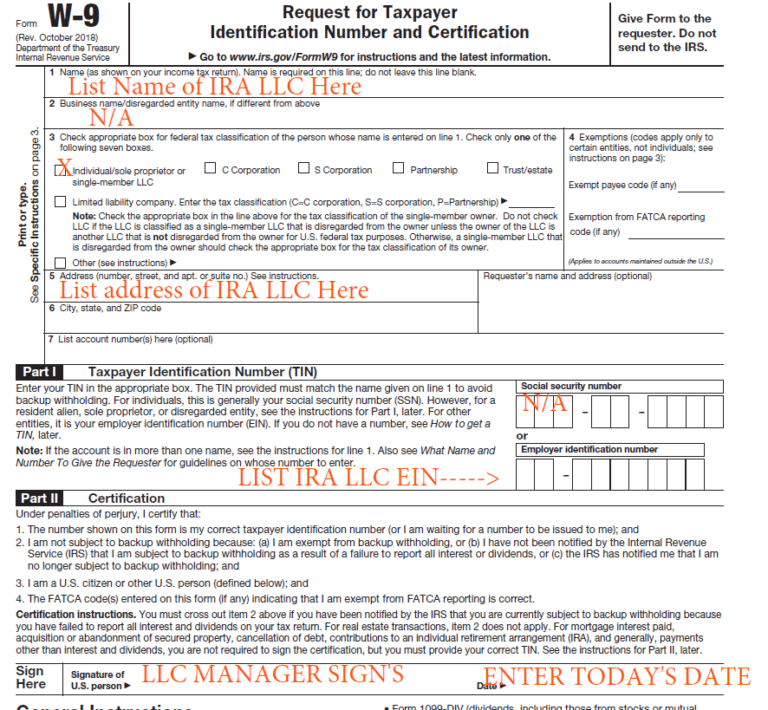

https://us.v-cdn.net/6032202/uploads/6BMGM8PQE3DF/w-9-example.png

W 9 2025 Fillable W9 James S Carr

https://www.mysolo401k.net/wp-content/uploads/2020/01/IRA-LLC-W-9-768x710.png

A disregarded entity is a tax classification used by the IRS to describe businesses that exist legally but which are ignored as a separate entity from their owner for income tax purposes Oct 27 2024 nbsp 0183 32 A Disregarded Entity is a business structure typically a single member LLC that is legally separate from its owner but not recognized as separate for federal tax purposes

Feb 10 2025 nbsp 0183 32 Here s how to fill out a W 9 for an LLC classified as a disregarded business entity Line 1 Name On Line 1 write your full legal name exactly as it appears on your personal tax A disregarded entity is a one person business structure that s taxed separately from its owner Here s everything business owners need to know about disregarded entities

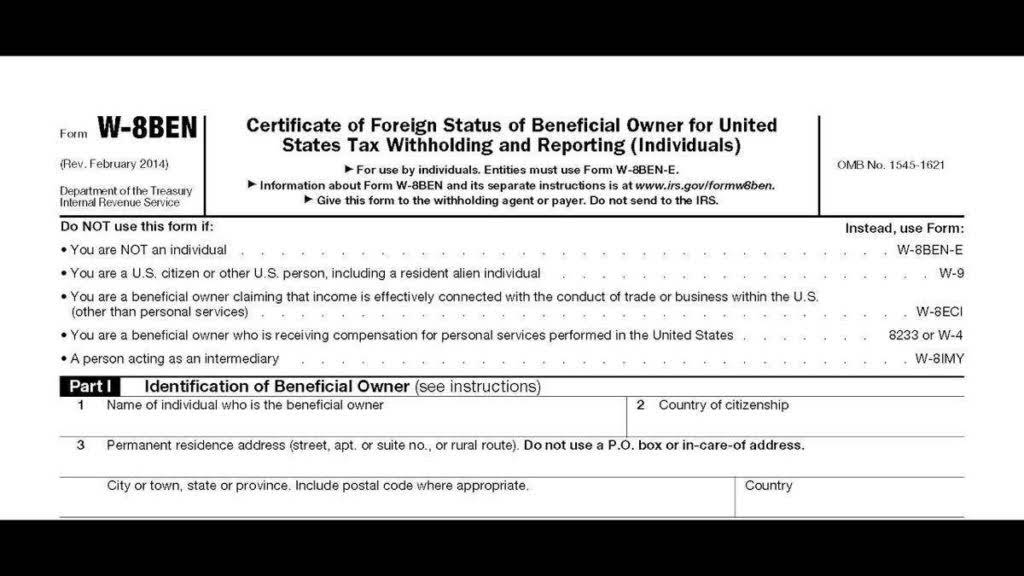

What Is A W 8 Form Definition And Meaning Bookstime

https://www.bookstime.com/wp-content/uploads/2020/09/1-43-min-1-1024x576.jpg

What Is A Disregarded Entity Shortlister

https://www.myshortlister.com/app/uploads/2023/01/pexels-leeloo-thefirst-8962475-1024x684.jpg

What Is A Disregarded Entity Name - Oct 9 2021 nbsp 0183 32 A disregarded entity LLC is a separate business entity that is ignored for the purpose of taxation in a given tax year These LLCs are created at the state level as separate entities but for both state and federal taxes the