What Expenses Can Be Deducted From Capital Gains Tax Businesses incur various types of expenses An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income

Expenses are costs that do not acquire improve or prolong the life of an asset For example a person who buys a new truck for a business would be making a capital expenditure because He took me out to lunch on expenses I usually travel standard class on the train even when on expenses

What Expenses Can Be Deducted From Capital Gains Tax

What Expenses Can Be Deducted From Capital Gains Tax

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Long-Term_Capital_Gains_Tax_Brackets_1600x684.png

Arizona Capital Gains Tax 2025 Charles S Merewether

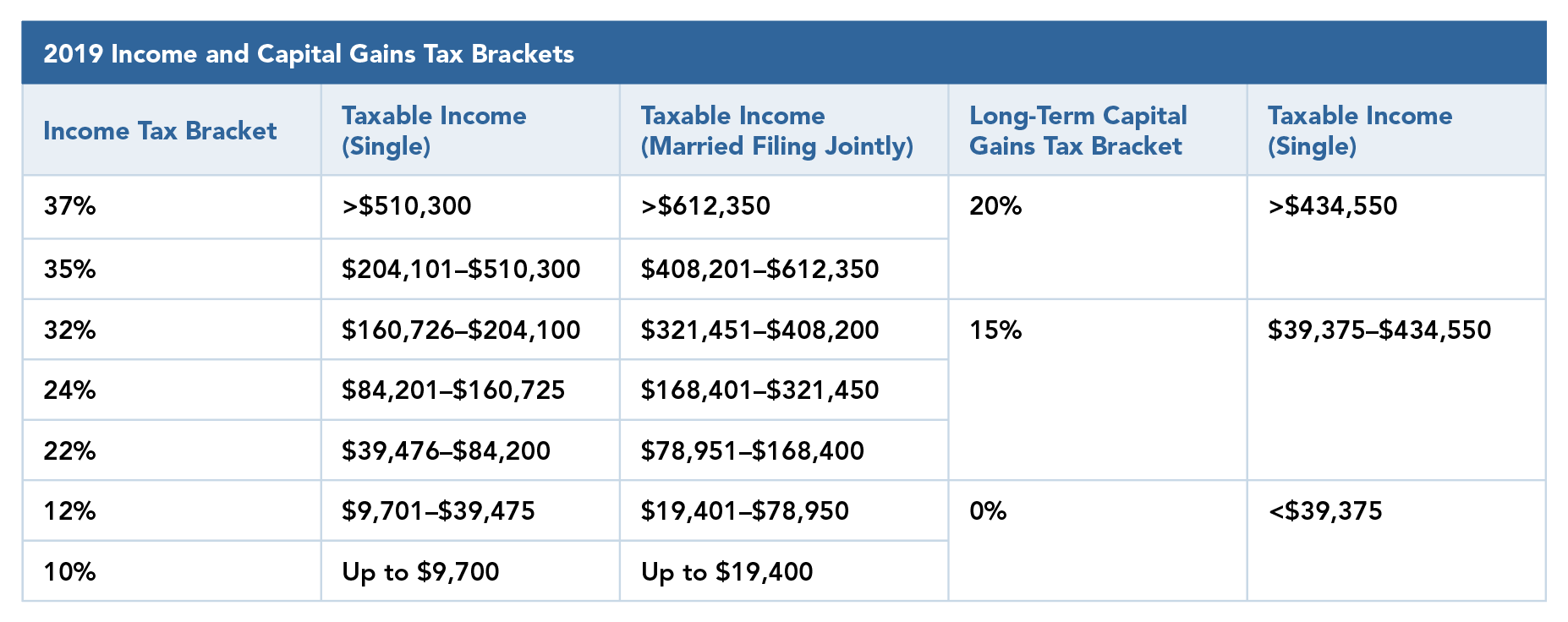

https://blog.commonwealth.com/hs-fs/hubfs/Images_Blog/Understanding the Capital Gains Tax - Chart.png?width=1854&name=Understanding the Capital Gains Tax - Chart.png

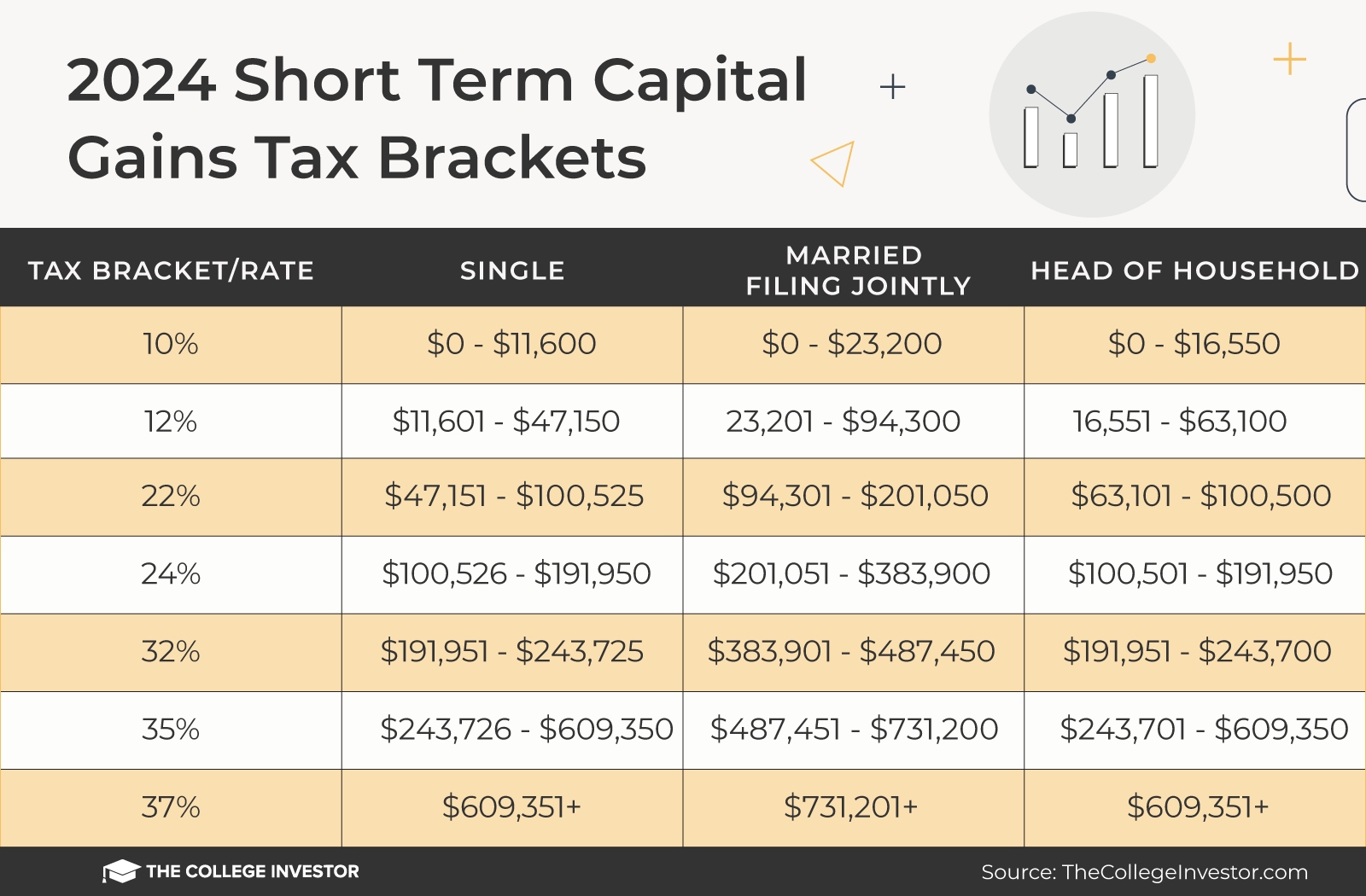

Us Tax Brackets 2025

https://thecollegeinvestor.com/wp-content/uploads/2023/11/TCI-_2024_Short_Term_Capital_Gains_Tax_Brackets.png

Apr 24 2023 nbsp 0183 32 Learn about expenses from definitions to examples and how they are categorized Also find out the tips and tricks on managing your business s expenses Aug 3 2022 nbsp 0183 32 Expenses are the costs a business has to pay for to operate and make money Every business has expenses and in some cases these costs can be deducted from your

Jun 12 2025 nbsp 0183 32 Operating expenses are the day to day costs incurred in running a business such as rent utilities and salaries These expenses are essential for core business operations but Expense is a decrease in the net assets over an accounting period except for such decreases caused by the distributions to owners Common types of expenses include employee benefits

More picture related to What Expenses Can Be Deducted From Capital Gains Tax

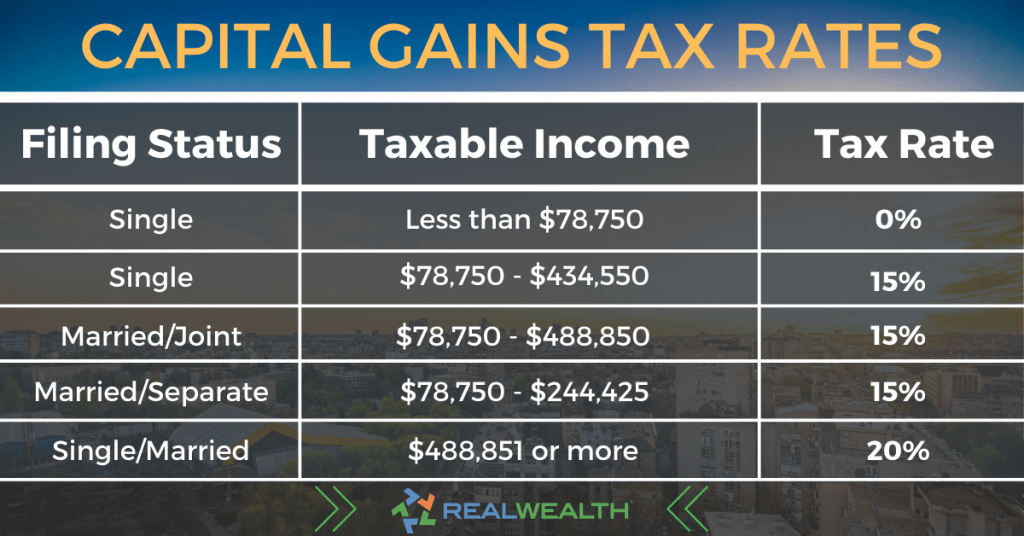

Capital Gains Tax Rate 2025 Chart Zara B McKivat

https://rwncdn.s3.amazonaws.com/wp-content/uploads/Long-term-Capital-Gains-Tax-Rates-Infographic-1024x536.png

Tax Deductions For Seniors 2025 Lilian C Bullen

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

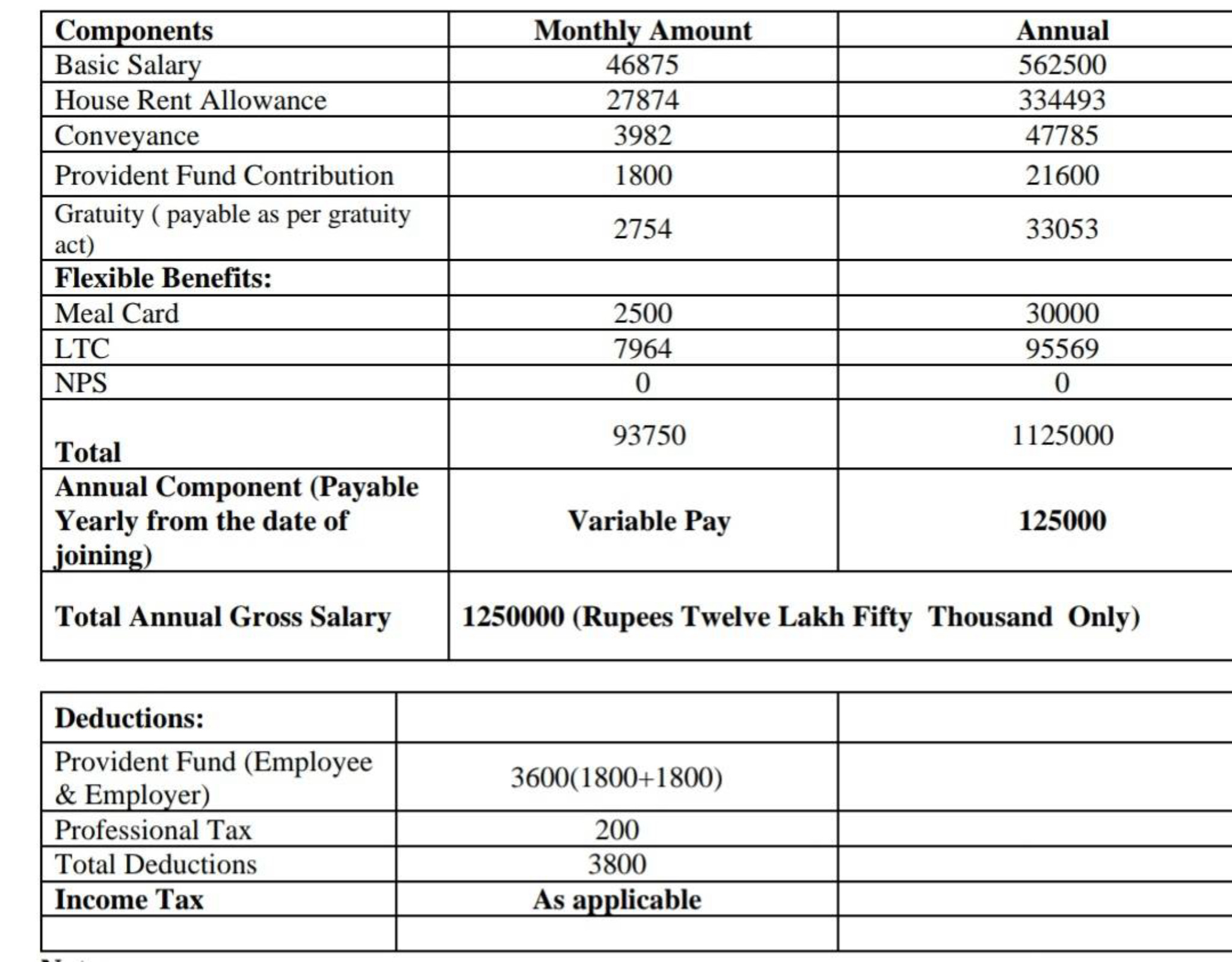

How Much Tax Is Deducted From Annual Leave Payout Printable Online

https://dslntlv9vhjr4.cloudfront.net/posts_images/fIUjzl6VNs2HG.jpg

May 5 2023 nbsp 0183 32 Expenses are usually the costs associated with running a business Learn more about the types of expenses and how they are reported Aug 2 2022 nbsp 0183 32 Expenses can be defined as Any cost that a business incurs in an attempt to maximize its revenues and thereby its profits It is a cost to sustain and excel in business and

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg)

Capital Gains Tax 202454 Diane Gwyneth

https://www.investopedia.com/thmb/7lgVTwV_8orWVzN3kOsup-hL478=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg

Capital Gains Tax On Stocks 2025 Kenneth Morgan

https://images.livemint.com/r/LiveMint/Period2/2018/07/10/Photos/Processed/ltcg.jpg

What Expenses Can Be Deducted From Capital Gains Tax - Expense is a decrease in the net assets over an accounting period except for such decreases caused by the distributions to owners Common types of expenses include employee benefits