What Expenses Are Tax Deductible Canada Jun 30 2025 nbsp 0183 32 This page discusses the more common expenses you might incur to earn income from your activities Incur means you paid or will pay the expense You cannot claim expenses you incur to buy capital property However as a rule you can deduct any reasonable current expense you incur to earn income The

Changes to the income tax rules now deny income tax deductions related to non compliant short term rentals after 2023 If you rented out a residential property for short periods these changes may affect you A residential property is all or any part of T2SCH130 Excessive Interest and Financing Expenses Limitation 2023 and later tax years

What Expenses Are Tax Deductible Canada

What Expenses Are Tax Deductible Canada

https://i.ytimg.com/vi/ejVkvGo8_XU/maxresdefault.jpg

Tax Deductions Are The Expenses For LLC Preparations Deductible Tax

https://i.ytimg.com/vi/P48fUNs0Md8/maxresdefault.jpg

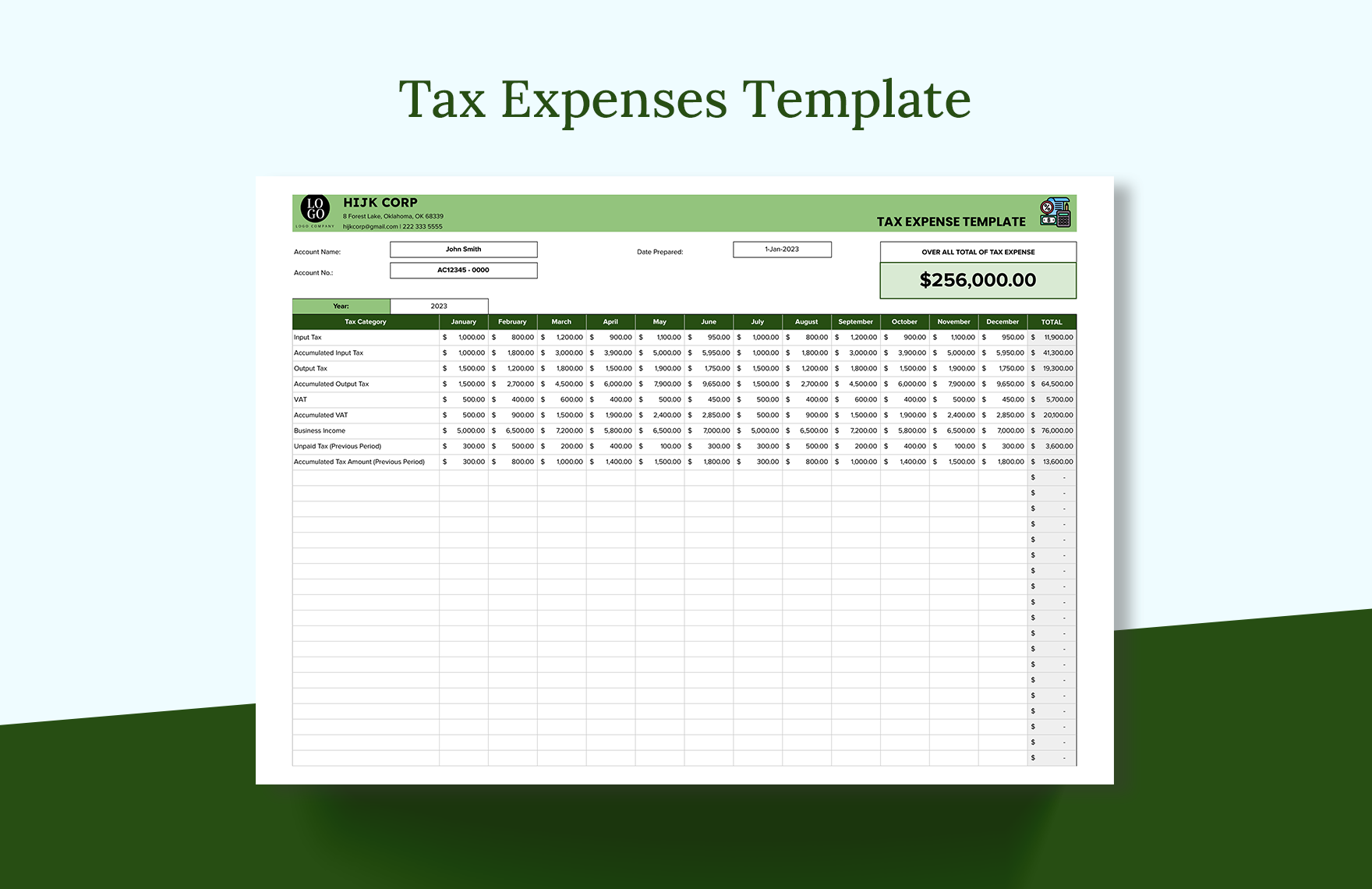

Tax Expenses Template Excel Google Sheets Template

https://images.template.net/136131/tax--expenses-template-lcwmc.png

Oct 1 2023 nbsp 0183 32 The excessive interest and financing expenses limitation EIFEL rules limit the deductibility of net interest and financing expenses by certain corporations and trusts Use this form if you are an employee and your employer requires you to pay expenses to earn your employment income

Detailed breakdown To claim attendant care expenses paid to a facility such as a retirement home you have to send us a detailed breakdown from the facility The breakdown must clearly show the amounts paid for staff salaries that apply to the attendant care services listed under Salaries and wages Expenses you can claim Calculating motor vehicle expenses If you use a motor vehicle or a passenger vehicle for both business and personal use you can deduct only the portion of the expenses that relates to earning business income However you can deduct the full amount of parking fees related to your business activities and supplementary business insurance for your motor vehicle or passenger

More picture related to What Expenses Are Tax Deductible Canada

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

Master Of Social Work License Tax Deduction Store Dakora co

https://www.investopedia.com/thmb/oKXX_-0E_rQHs8wwWj84rYvCC7o=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png

Are You Unsure What Expenses Are Deductible For You Business This

https://i.pinimg.com/originals/3a/27/53/3a2753d733fe3cf534ae873ce9531a64.jpg

Save Yourself A Lot Of Money And Get This List This Cheat Sheet Has

https://i.pinimg.com/originals/8d/81/e0/8d81e0464430c01ba243468c905bdd81.jpg

Accrual expenses in the Fall Economic Statement are on a gross basis meaning the revenues are included in the accrual based revenue forecast while they are netted against expenditures in the Estimates Jan 1 2024 nbsp 0183 32 The CRA will permit GST HST registrants to use factors for calculating ITCs on expenses charged to procurement cards and corporate credit cards provided they satisfy certain conditions For more information on expenses charged to procurement cards see GST HST NOTICE199 Procurement cards Documentary Requirements for Claiming Input Tax Credits

[desc-10] [desc-11]

What Are Deductibles Blue Ridge Risk Partners

https://static.fmgsuite.com/media/InlineContent/originalSize/188232ce-b664-4ca9-8454-080b4eb59d4d.jpg

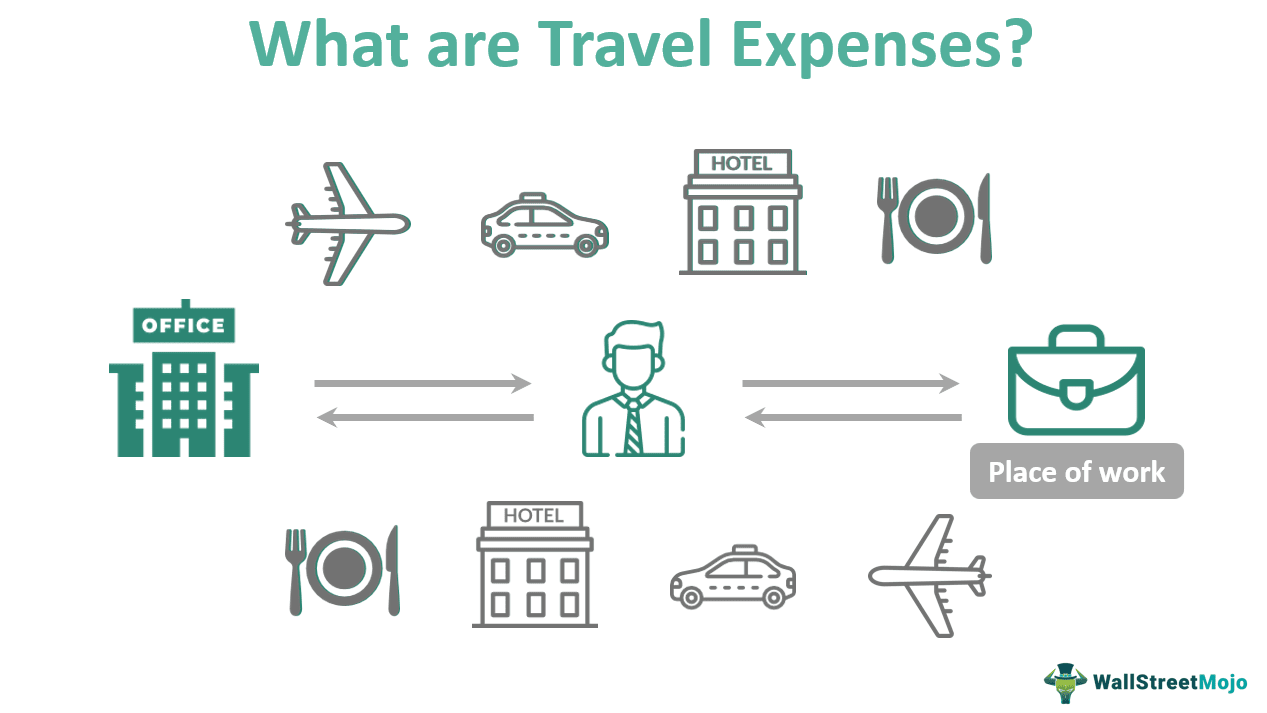

Travel Expenses Definition Business Examples Reimbursement

https://wallstreetmojo.com/wp-content/uploads/2023/01/What-are-Travel-Expenses.png

What Expenses Are Tax Deductible Canada - [desc-12]