What Expenses Are Not Deductible For Rental Property You can also deduct expenses you had for bookkeeping services audits of your records and preparing financial statements You may be able to deduct fees and expenses for advice and

Find out which deductions credits and expenses you can claim to reduce the amount of tax you need to pay The expenses are related to the performance of their employment duties step 2 If the allowance or reimbursement you provide to your employee for travel expenses does not meet all of the

What Expenses Are Not Deductible For Rental Property

What Expenses Are Not Deductible For Rental Property

https://i.pinimg.com/originals/d5/41/e8/d541e8b4fe96ef2a5c2529146b767407.jpg

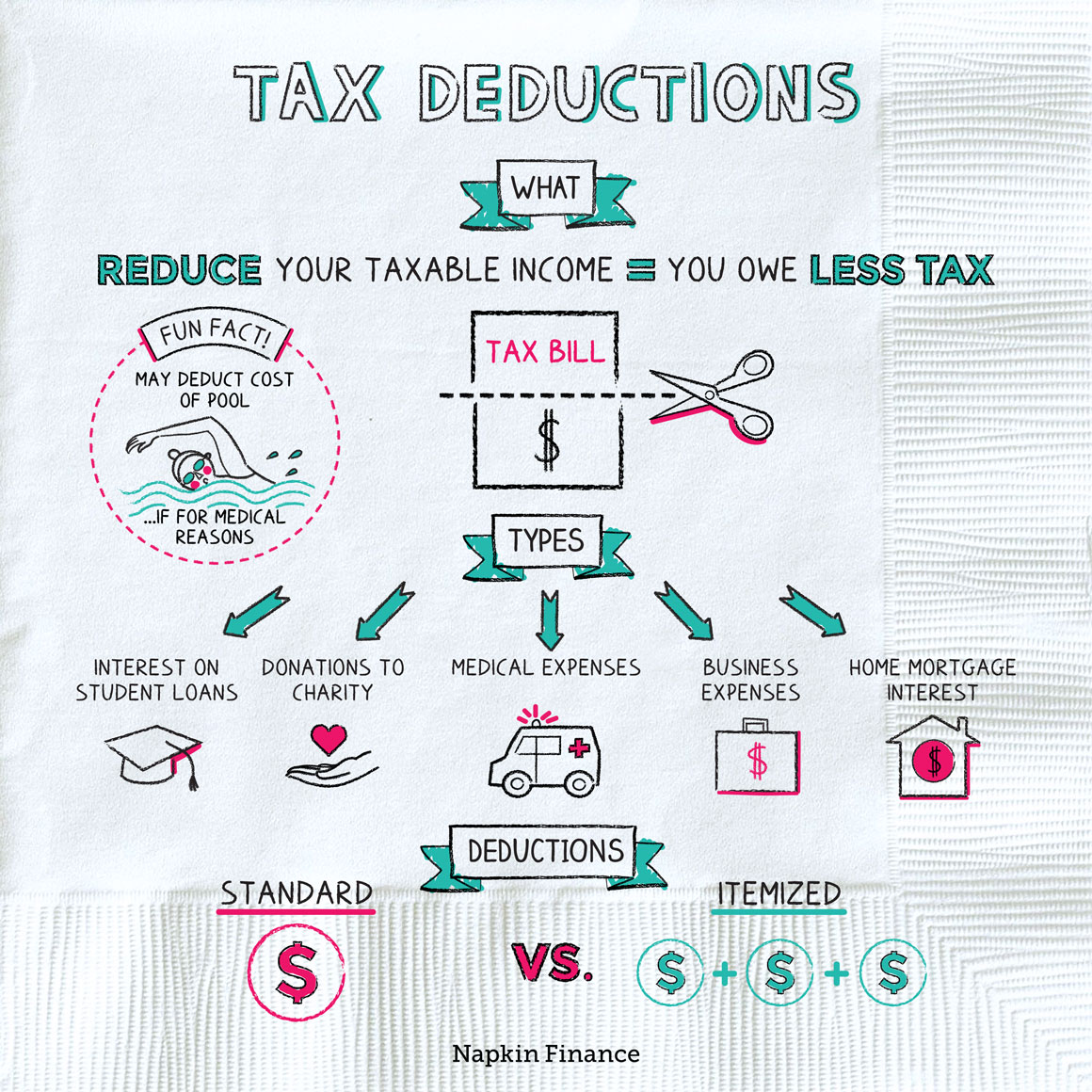

What Are Tax Deductions Napkin Finance

https://napkinfinance.com/wp-content/uploads/2019/01/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05.jpg

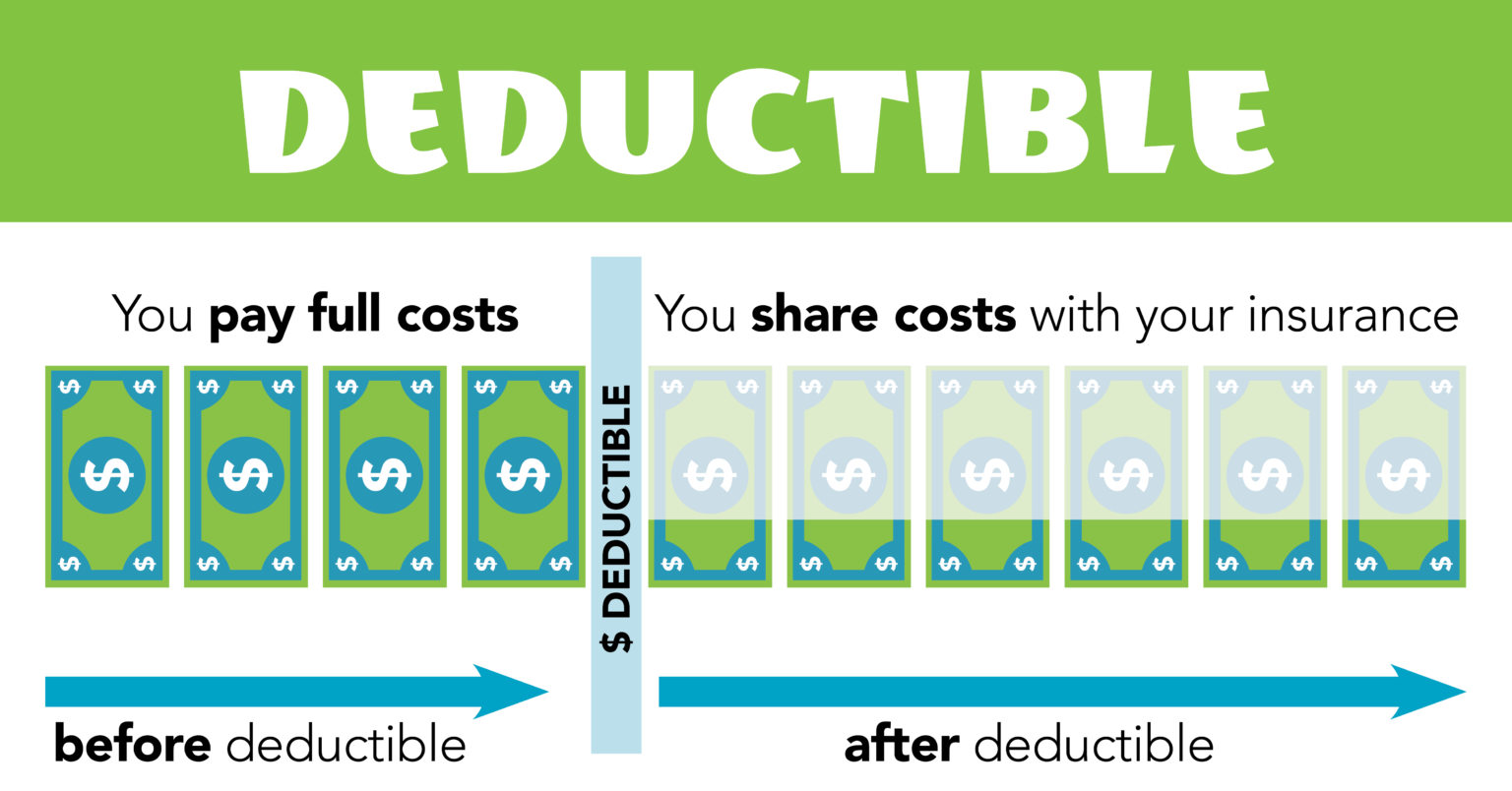

What Are Deductibles Blue Ridge Risk Partners

https://static.fmgsuite.com/media/InlineContent/originalSize/188232ce-b664-4ca9-8454-080b4eb59d4d.jpg

Jan 21 2025 nbsp 0183 32 Work space in the home expenses If you meet the eligibility criteria you can claim a portion of certain expenses related to the use of a work space in your home Commission The rc4065 is for persons with medical expenses and their supporting family members The guide gives information on eligible medical expenses you can claim on your tax return

Expenses section of form T2125To determine whether the income you earned from a short term rental is from a property or business consider the number and types of services you provide Jan 30 2025 nbsp 0183 32 Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later

More picture related to What Expenses Are Not Deductible For Rental Property

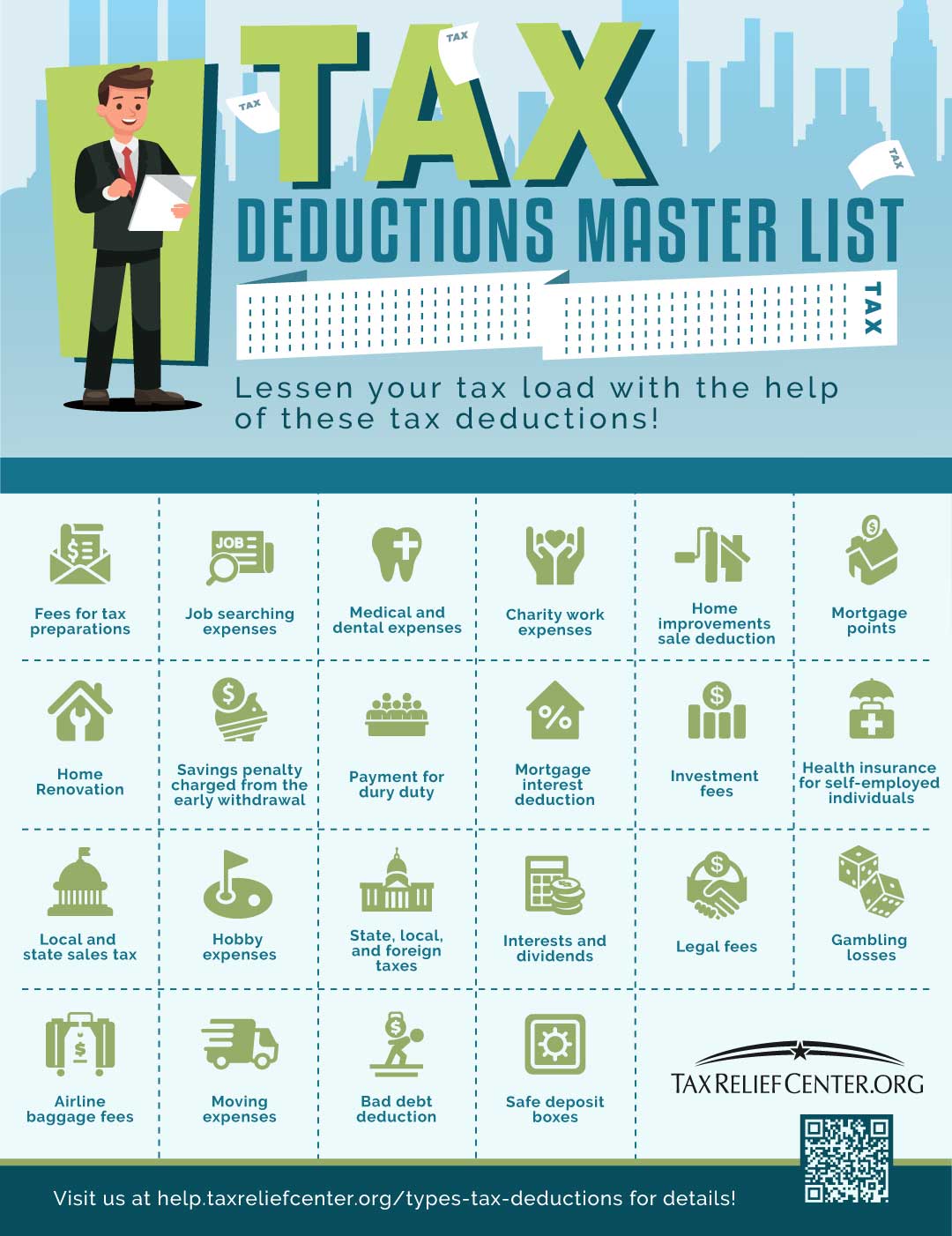

List Of Tax Deductions 2025 Lola X Enderby

https://files.taxfoundation.org/20200714164745/Tax-Basics-How-Is-Tax-Liability-Calculated.png

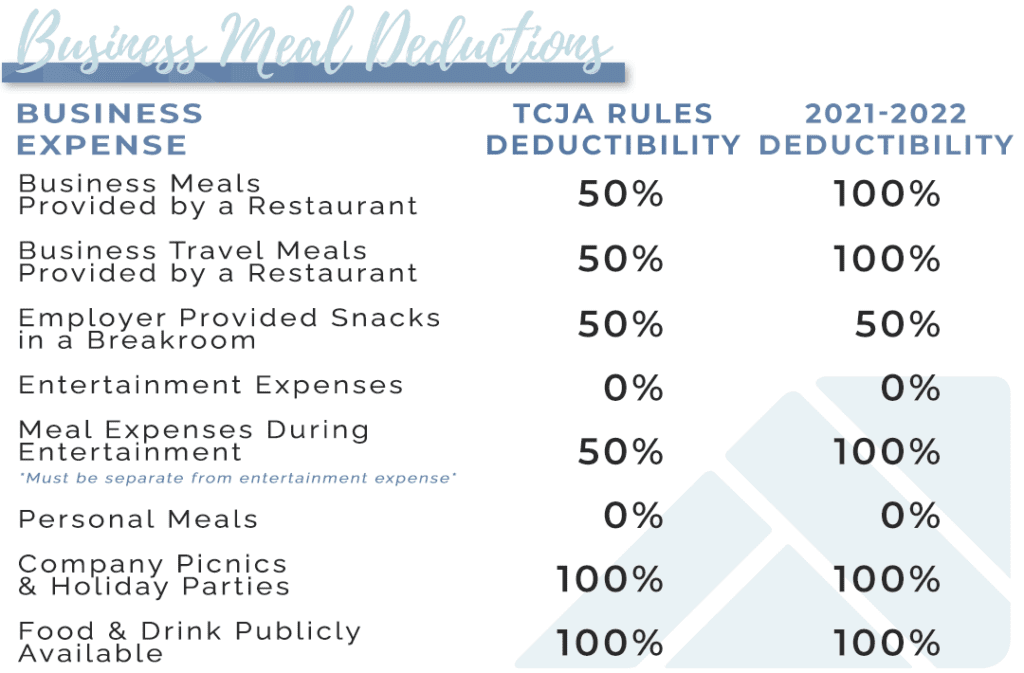

Are Business Meals Deductible In 2025 Aurora Cooper

https://alloysilverstein.com/wp-content/uploads/2021/04/Meal-100-graph-1024x673.png

![]()

California Medicaid Fee Schedule 2025 Stephanie H Jauncey

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_1680,h_1202/https://www.medicareplanfinder.com/wp-content/uploads/2019/10/2020-Medicare-Supplement-Plan-Benefits-Medicare-Plan-Finder-01-1.jpg

Completing your tax return To claim home accessibility expenses complete the chart for line 31285 using your Federal Worksheet and enter the result on line 31285 of your return A If you provide an allowance or reimbursement to your employee to compensate them for expenses paid for the use of their own automobile or motor vehicle in the course of their

[desc-10] [desc-11]

2024 Tax Deductions Alicia Kamillah

https://help.taxreliefcenter.org/wp-content/uploads/2018/06/Tax-Relief-Center-Types-of-Tax-Deductions.jpg

Minimum Deductible For Hdhp 2024 Leona Ninetta

https://etrustedadvisor.com/wp-content/uploads/sites/44/2020/04/MHC_Deductible_Chart-1536x804.png

What Expenses Are Not Deductible For Rental Property - [desc-14]