What Expenses Are Deductible On Form 1041 Find out which deductions credits and expenses you can claim to reduce the amount of tax you need to pay

The expenses are related to the performance of their employment duties step 2 If the allowance or reimbursement you provide to your employee for travel expenses does not meet all of the Jan 30 2025 nbsp 0183 32 Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later

What Expenses Are Deductible On Form 1041

What Expenses Are Deductible On Form 1041

https://i.ytimg.com/vi/0wED--eLrJg/maxresdefault.jpg

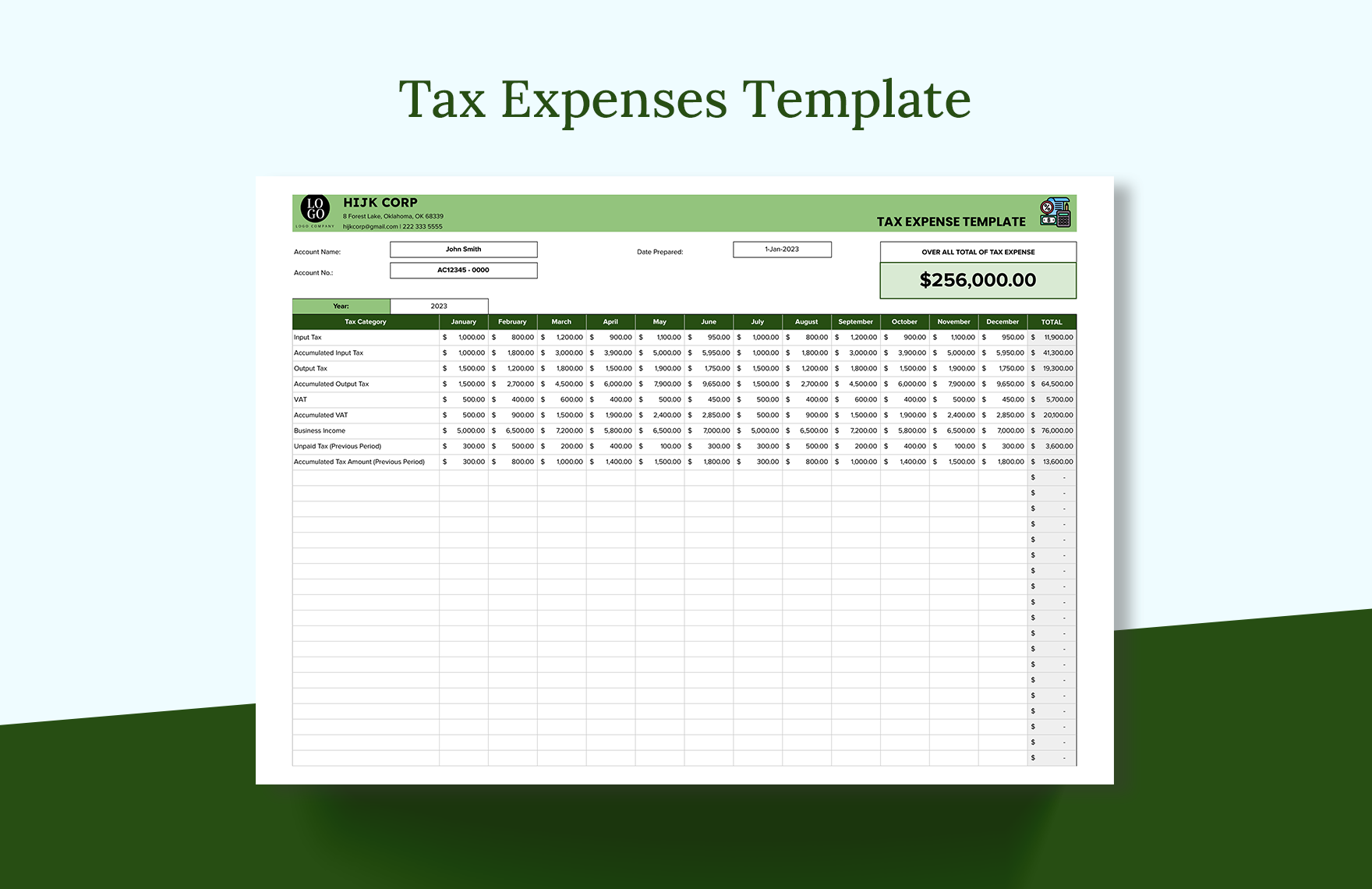

Tax Expenses Template Excel Google Sheets Template

https://images.template.net/136131/tax--expenses-template-lcwmc.png

Deductible Maryland Health Connection

https://www.marylandhealthconnection.gov/wp-content/uploads/2016/06/MHC_Deductible_Chart.png

If you provide an allowance or reimbursement to your employee to compensate them for expenses paid for the use of their own automobile or motor vehicle in the course of their Dec 30 2024 nbsp 0183 32 Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit rates that will apply in 2025

Oct 1 2023 nbsp 0183 32 The excessive interest and financing expenses limitation EIFEL rules limit the deductibility of interest and financing expenses by affected corporations and trusts The rules This form is used by rental property owners to report their rental income and expenses for income tax purposes

More picture related to What Expenses Are Deductible On Form 1041

4 Basic Skills Woodworkers Should Have Unleash Your Inner Woodworker

https://i.pinimg.com/736x/b9/76/ac/b976ac9170bf1f7f342c4f4eee6194f2.jpg

Sample K1 Tax Form Verhotline

https://www.irs.gov/pub/xml_bc/33347002.gif

List Of Tax Deductions 2025 Lola X Enderby

https://files.taxfoundation.org/20200714164745/Tax-Basics-How-Is-Tax-Liability-Calculated.png

Line 8523 Meals and entertainmentOn this page Claiming food and beverage expenses Long haul truck drivers Extra food and beverages consumed by self employed foot and bicycle The following expenses are not a taxable benefit to your employees if you paid or reimbursed them the cost of house hunting trips to the new location including child care and pet care

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/2022Form1041-42ed301e7b3f4e1397e75fc675aea68f.jpg)

Form 1041 2023 Printable Forms Free Online

https://www.investopedia.com/thmb/teQPr8l9oi22oyklIH9q46UPrKY=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/2022Form1041-42ed301e7b3f4e1397e75fc675aea68f.jpg

Irs Form 1041 Schedule G 2025 Amelie J Hutchinson

https://us.meruaccounting.com/wp-content/uploads/2020/04/Structure-of-Form-1041-860x1024.gif

What Expenses Are Deductible On Form 1041 - This form is used by rental property owners to report their rental income and expenses for income tax purposes