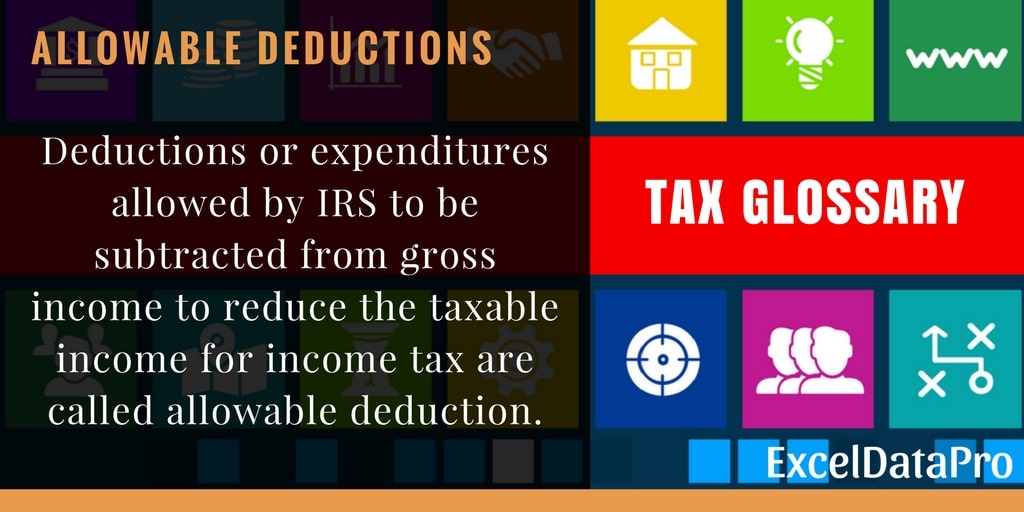

What Expenses Are Allowable Against Capital Gains Tax Rental expenses you can deduct You can deduct any reasonable expenses you incur to earn rental income The two basic types of expenses are current expenses and capital expenses

Find out which deductions credits and expenses you can claim to reduce the amount of tax you need to pay The expenses you can deduct include any GST HST you incur on these expenses minus the amount of any input tax credit claimed However since you cannot deduct personal expenses

What Expenses Are Allowable Against Capital Gains Tax

What Expenses Are Allowable Against Capital Gains Tax

https://i.ytimg.com/vi/IFKDItNtslk/maxresdefault.jpg

16 Calculating The Value Of The Bond

https://tistory1.daumcdn.net/tistory/1762213/attach/cdae5b5b8b1b4dd69ce9f38ad0ea0242

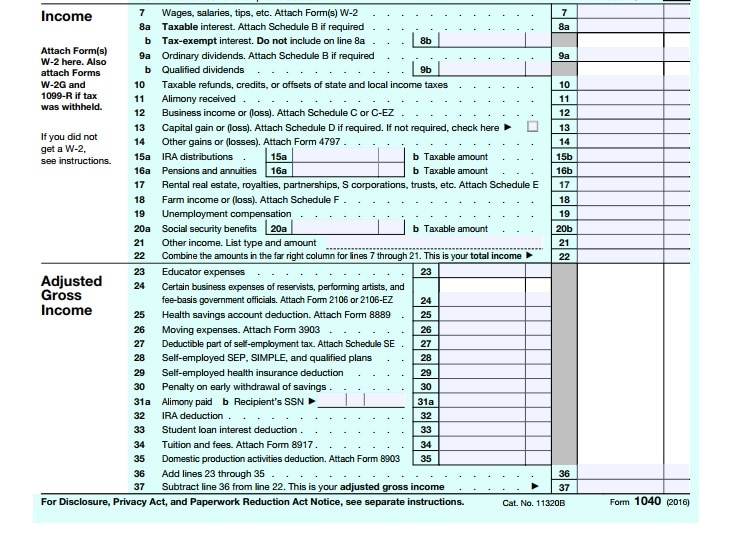

What Are Allowable Deductions ExcelDataPro

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2017/11/1040.jpg

The excessive interest and financing expenses limitation EIFEL rules limit the deduction of excessive interest and financing expenses by affected corporations and trusts The following Jan 21 2025 nbsp 0183 32 Work space in the home expenses If you meet the eligibility criteria you can claim a portion of certain expenses related to the use of a work space in your home Commission

Line 21900 Moving expenses Eligible moving expenses You must first determine if you qualify to deduct moving expenses either as an individual who is employed or self employed or as a You deduct most of your allowable employment expenses on line 22900 of your income tax and benefit return To find out how to get a tax package online or to request a printed copy go to

More picture related to What Expenses Are Allowable Against Capital Gains Tax

What Are Allowable Deductions ExcelDataPro

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2017/11/Allowable-Deductions.jpg

:max_bytes(150000):strip_icc()/capitalexpenditure-b2aaeae25f3648f9929b8e86061eff63.png)

Capital Expenditure CapEx Definition Formula And Examples Form Used To

https://www.investopedia.com/thmb/GPgh6T1XaiUGrVjHMFDodbS9_fw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/capitalexpenditure-b2aaeae25f3648f9929b8e86061eff63.png

What Are Disallowable Expenses Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2020/02/allowable-expenses-list-1024x1024.png

Personal income tax Claiming deductions credits and expenses Find deductions credits and expenses you can claim on your tax return to help reduce the amount of tax you have to pay The expenses are related to the performance of their employment duties step 2 If the allowance or reimbursement you provide to your employee for travel expenses does not meet all of the

[desc-10] [desc-11]

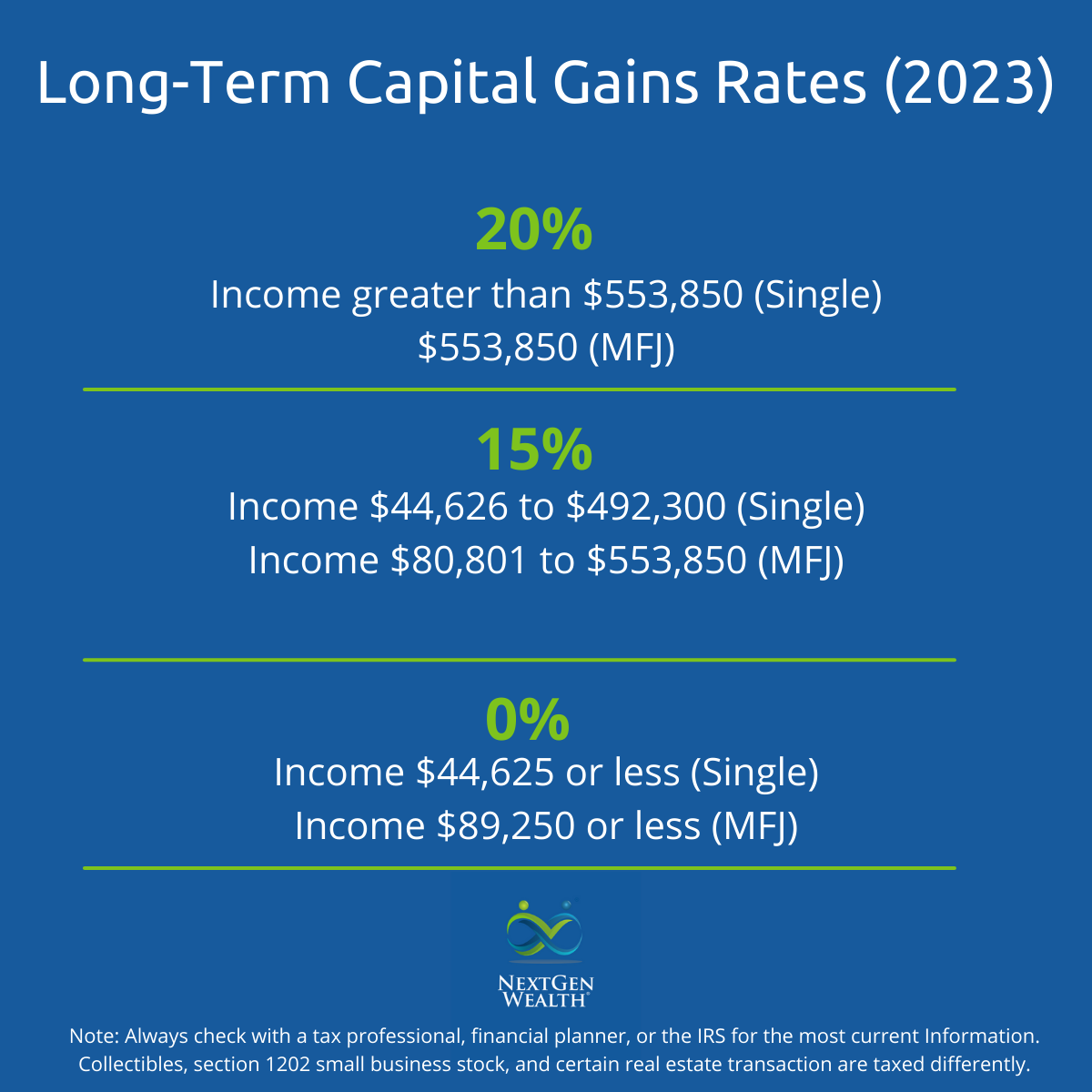

Capital Gains Rates 2025 Leo Cooper

https://www.nextgen-wealth.com/images/blogImages/2023_Long-Term_Capital_Gains_Rates.png

Us Tax Brackets 2025

https://thecollegeinvestor.com/wp-content/uploads/2023/11/TCI-_2024_Short_Term_Capital_Gains_Tax_Brackets.png

What Expenses Are Allowable Against Capital Gains Tax - You deduct most of your allowable employment expenses on line 22900 of your income tax and benefit return To find out how to get a tax package online or to request a printed copy go to