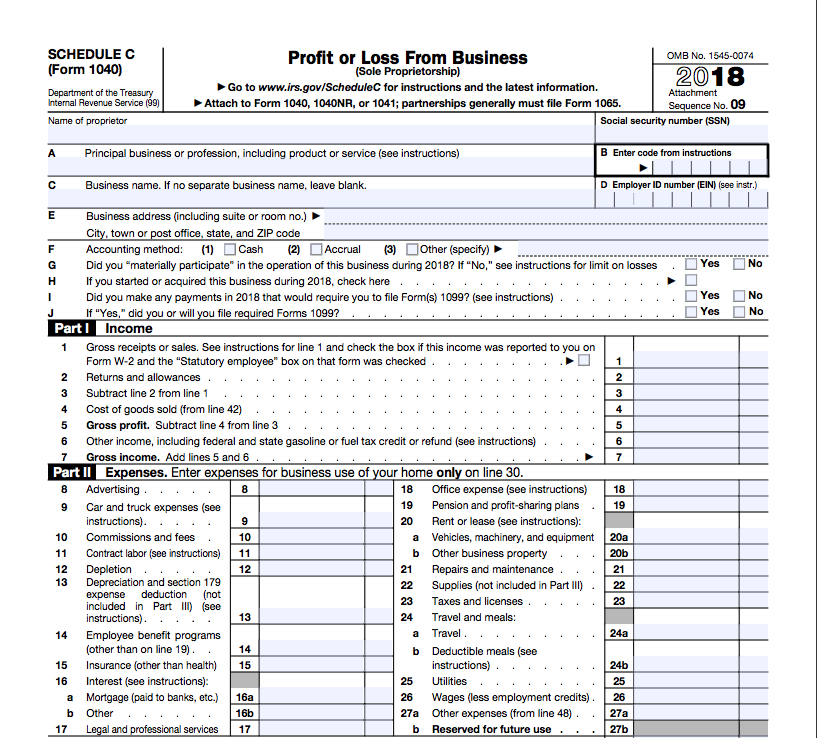

What Does Schedule C Mean On 1099 Jan 22 2025 nbsp 0183 32 IRS Schedule C is a tax form for reporting profit or loss from a business You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040 Schedule C is

Dec 16 2024 nbsp 0183 32 What is Schedule C income Self employment income is reported on Schedule C If you re a freelancer sole proprietor side hustler basically if you re self employed in any Feb 6 2025 nbsp 0183 32 Schedule C is used to report income and expenses from a business you own as a sole proprietor or single member LLC If you are self employed or receive 1099 NEC Forms you ll likely need to use Schedule C to report

What Does Schedule C Mean On 1099

What Does Schedule C Mean On 1099

https://www.paycheckstubonline.com/wp-content/uploads/2022/03/form.png

Understanding Your 1099 R Tax Form YouTube

https://i.ytimg.com/vi/K4RxIKchY4E/maxresdefault.jpg

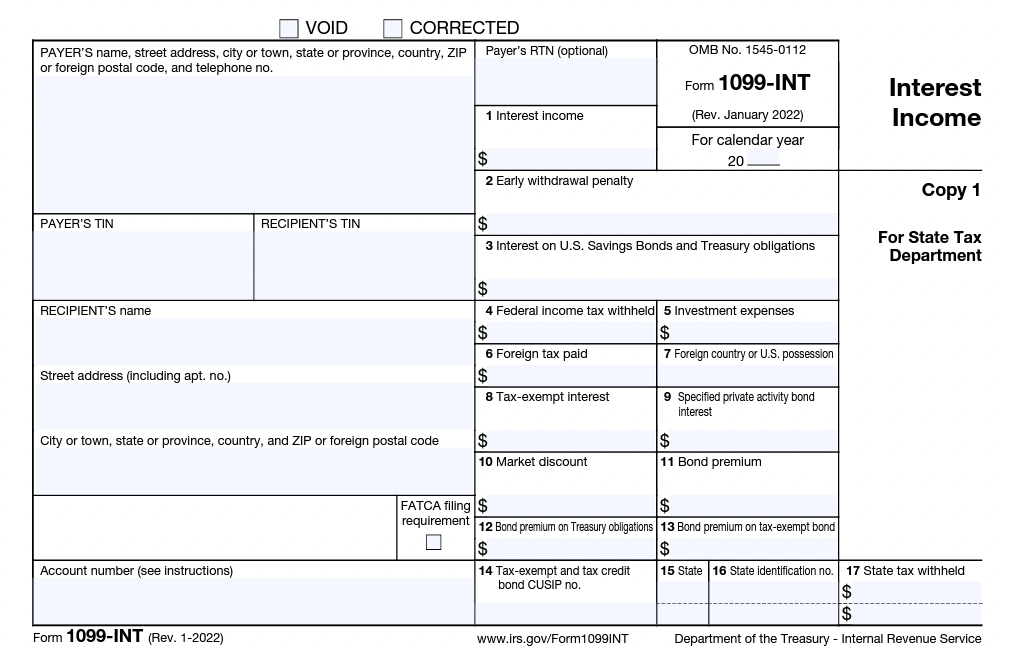

Form 1099 INT Generator ThePayStubs

https://www.thepaystubs.com/bundles/thepaystubswebsite/images/landing-page/1099-int/image1.png

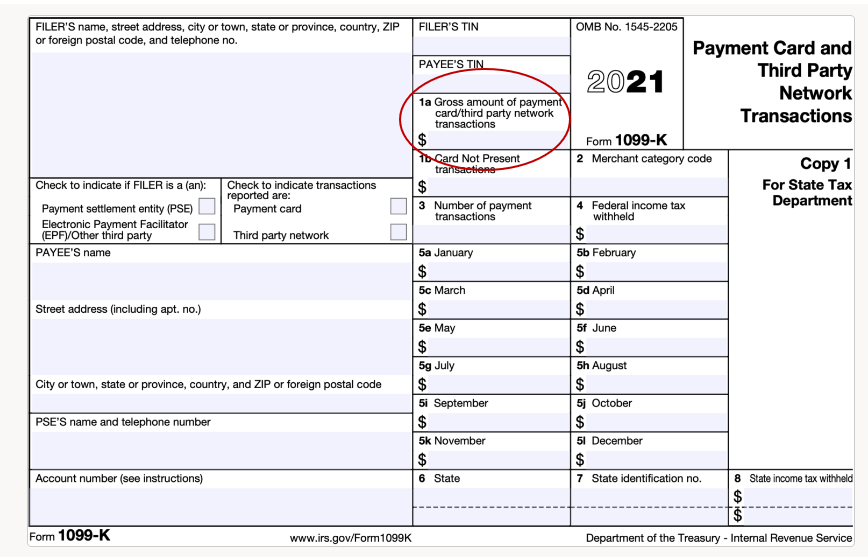

Feb 8 2023 nbsp 0183 32 If you received any 1099 NEC 1099 MISC or 1099 K tax forms reporting money you earned working as a contractor or selling stuff you ll have to report that as income on Line 1 of Schedule C You ll also need to add any Oct 17 2024 nbsp 0183 32 Schedule C is a form that nearly every self employed business owner will touch during tax time This document allows you to report income deductions profits and losses for your business activities It also helps

3 days ago nbsp 0183 32 Accurate records of purchase dates costs and depreciation schedules are essential for compliance Fixed Business Premises Costs Fixed business premises costs such as rent What is Schedule C Schedule C is for self employed individuals report profits and losses from their business The form is a part of the individual tax return so the net income or loss gets

More picture related to What Does Schedule C Mean On 1099

What Does Schedule C Look Like

https://www.patriotsoftware.com/wp-content/uploads/2019/04/what-is-a-schedule-C-1024x576.jpg

Your Etsy 1099 How To Make Sense Of Your Tax Form Made On The Common

https://images.squarespace-cdn.com/content/v1/62b9d7514bb78670003c18b4/c7ca50b8-4b0d-486e-9270-54809d6fc6bf/1099+Form+Example.png

Schedule C Worksheet Amount

https://images.ctfassets.net/ifu905unnj2g/3mUkiUrgyWotiLGkafKTka/25cc7ffe9179f37de6dff5fb68d2d6eb/Schedule_C.png

Jun 7 2019 nbsp 0183 32 If you are indeed self employed you will need to file a Schedule C Schedule C Profit or Loss from Business is an IRS form filed by sole proprietors and other self employed Dec 4 2024 nbsp 0183 32 With 1099 forms from clients it s imperative to ensure you report the correct income on your Schedule C These forms notify you and the IRS of the income you ve earned for

Schedule C allows for multiple income allocation types when reporting your earnings Gross Income Income recognized from services provided Amounts reported from Form 1099 K or Jul 19 2019 nbsp 0183 32 The first few lines of Schedule C A E aren t too bad It s the simple name and address information about your business Let s dig into the more challenging questions

2023 Form 1099 R Printable Forms Free Online

https://mtrs.state.ma.us/wp-content/uploads/2022/12/Form1099-R-for-web_2022.png

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)

Schedule C Printable Guide

https://www.investopedia.com/thmb/st7P9DHU5c0MafugWTXlKMNol0s=/2200x1700/filters:no_upscale():max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png

What Does Schedule C Mean On 1099 - Feb 8 2023 nbsp 0183 32 If you received any 1099 NEC 1099 MISC or 1099 K tax forms reporting money you earned working as a contractor or selling stuff you ll have to report that as income on Line 1 of Schedule C You ll also need to add any