What Can Contractors Claim On Tax Contractors can take reasonable home business deductions With recent changes to tax practice contractors who really use their homes for business can deduct more expenses from their taxes What expenses can contractors claim for

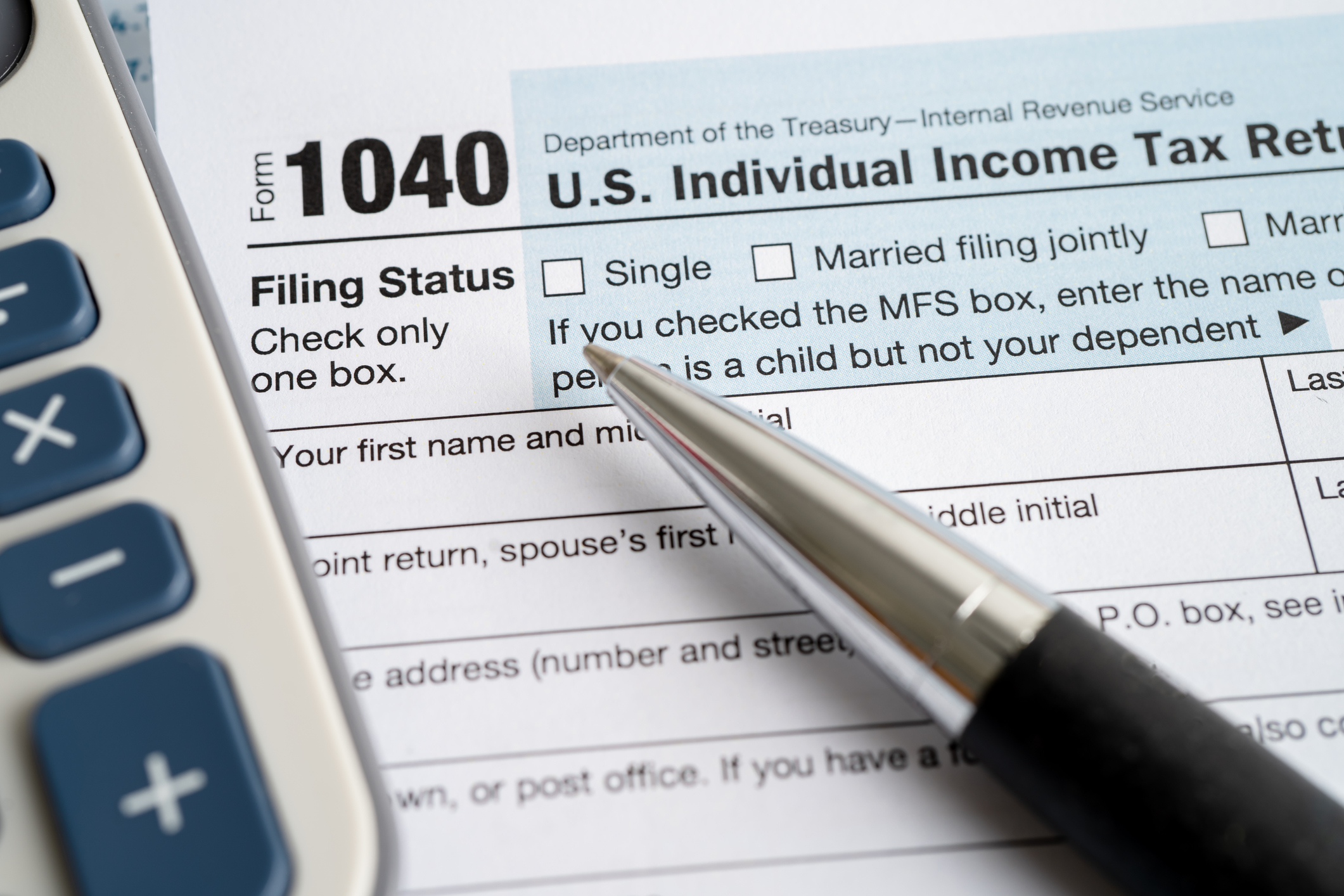

May 7 2024 nbsp 0183 32 What are the principle expenses contractors can claim Most contractors should as a minimum consider the following tax deductible expenses 1 their salary 2 any travel costs they incur 3 company pension Mar 6 2022 nbsp 0183 32 How Do You Claim Tax Deductions As A Contractor Tax deductions are claimed depending on your business structure Sole Trader Sole traders can claim tax deductions when individual tax returns are lodged

What Can Contractors Claim On Tax

What Can Contractors Claim On Tax

https://i0.wp.com/templatediy.com/wp-content/uploads/2023/01/Insurance-Claim-Letter-PDF.jpg?fit=1414%2C2000&ssl=1

Free Intellectual Property Non Disclosure Agreement NDA PDF Word

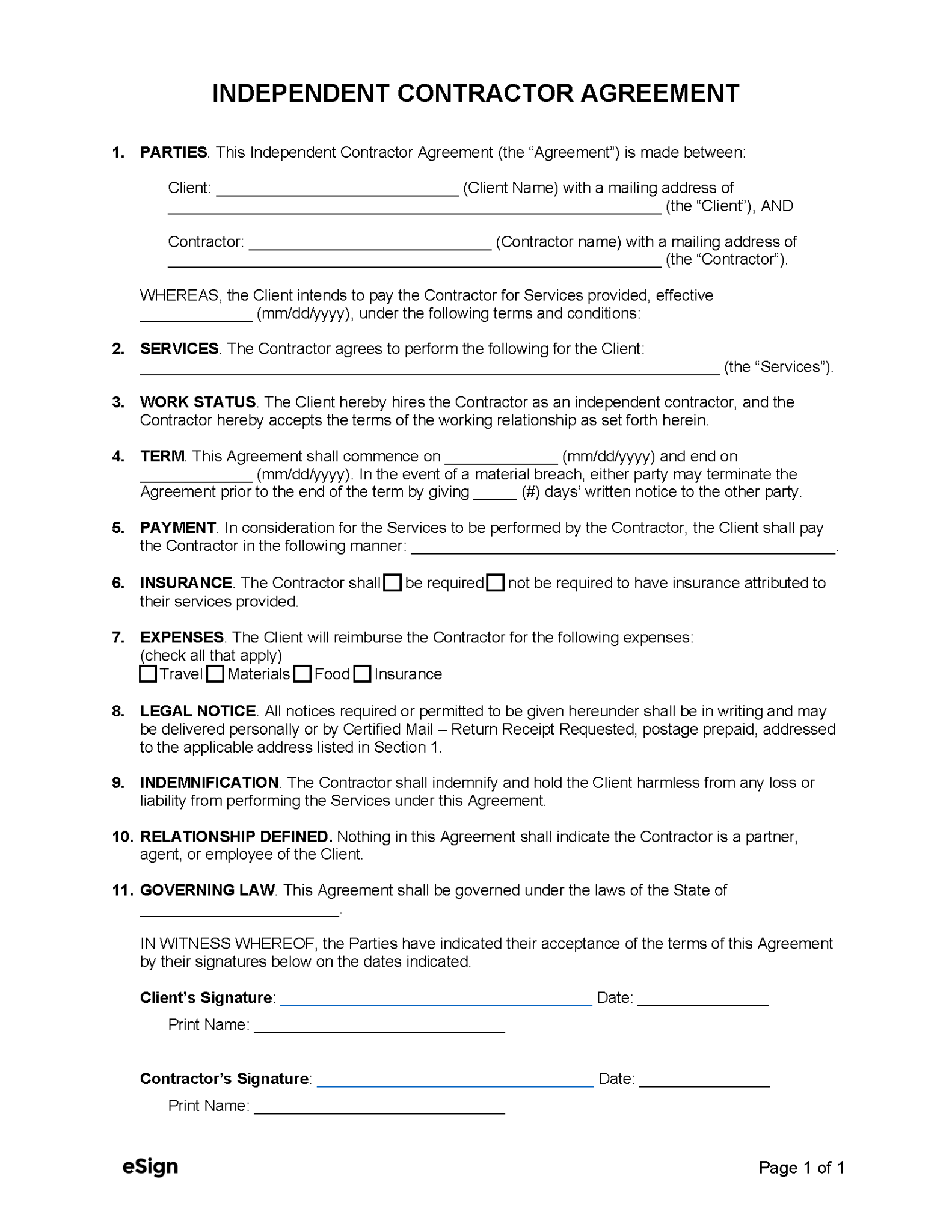

https://esign.com/wp-content/uploads/Simple-Independent-Contractor-Agreement-1583x2048.png

A Guide To Independent Contractor Taxes Ramsey

https://cdn.ramseysolutions.net/media/blog/taxes/business-taxes/independent-contractor-taxes.jpg

Mar 6 2025 nbsp 0183 32 A CIS tax deduction is an amount taken from your pay by contractors to cover your tax obligations These deductions are sent straight to HMRC and count towards your annual tax bill How do CIS tax deductions Mar 14 2024 nbsp 0183 32 By following these essential record keeping practices contractors can ensure they are well prepared to claim all eligible work related tax deductions reduce their taxable income

When you are a Professional Contractor or Self Employed you can claim expenses to reduce your tax liability Staying on top of your expenses is critical for maintaining financial health and Jul 9 2021 nbsp 0183 32 As a contractor you can claim most expenses against your tax bill Learn how business expenses work and how to claim them in this guide by Countingup

More picture related to What Can Contractors Claim On Tax

Free Printable Contractors Estimate Template

https://www.templateral.com/wp-content/uploads/Contractors-Estimate-Template-Sample.png

Free Tax Form 2023 Printable Forms Free Online

https://www.pwcva.gov/assets/2023-02/penandtaxform.jpg

154 Construction Jokes That Are The Real Brick And Mortar Of

https://www.boredpanda.com/blog/wp-content/uploads/2023/11/construction-jokes-11-655770daec3f8__700.jpg

Feb 4 2015 nbsp 0183 32 When you are a freelance contractor you will incur certain costs Some of these can be claimed before taxes are applied i e they are tax deductable It is therefore important that Dec 20 2024 nbsp 0183 32 As a contractor working under the Construction Industry Scheme CIS you are entitled to claim allowable expenses to reduce your taxable income These expenses must be incurred wholly and exclusively for your

Jun 2 2024 nbsp 0183 32 Building and construction employees guide to income allowances and claiming deductions for work related expenses For a summary of common expenses see Building and Jul 23 2024 nbsp 0183 32 16 independent contractor tax deductions Below you ll find some of the most common 1099 tax deductions for self employed workers along with where to claim the

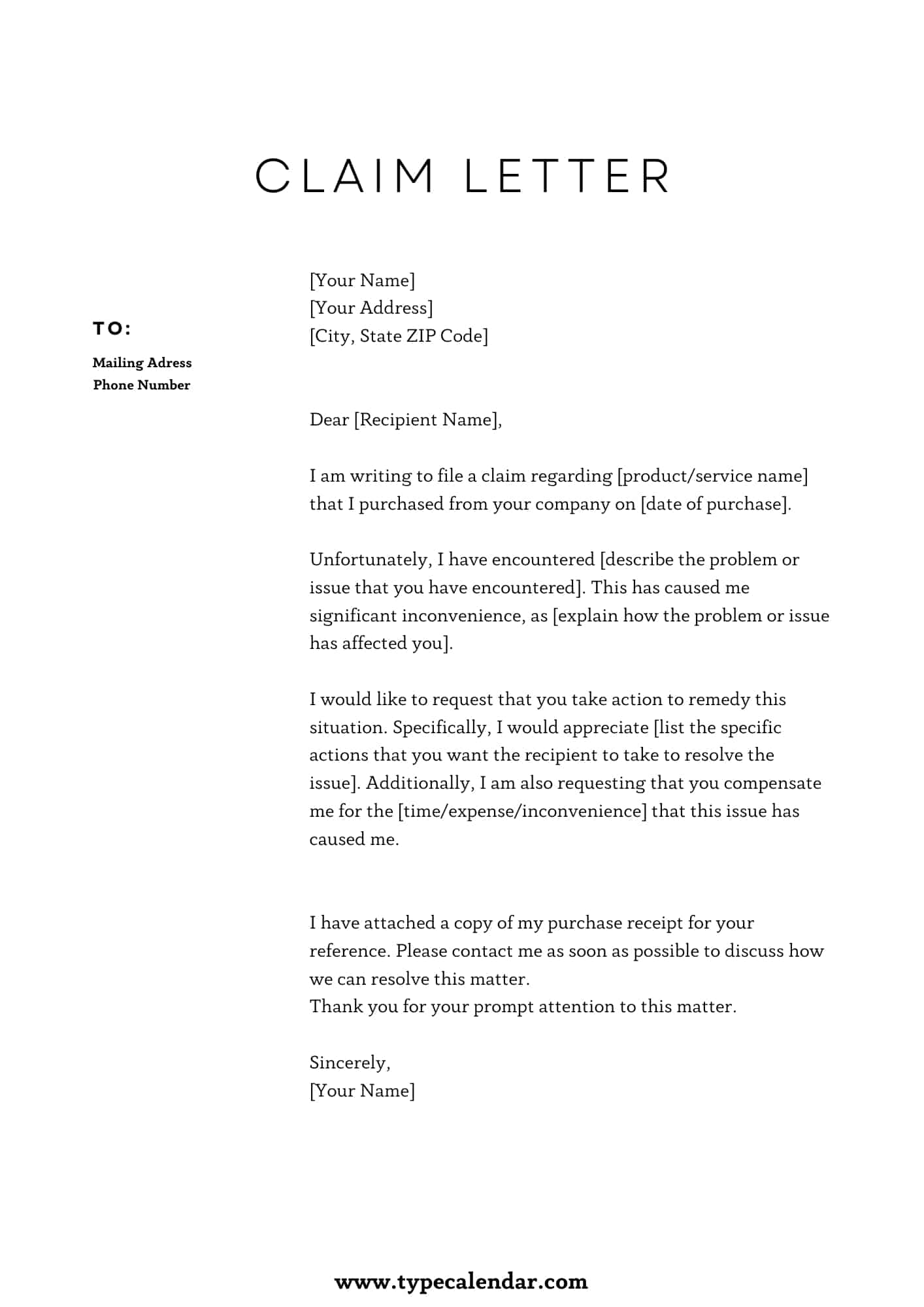

Settlement Demand Letter Exle Infoupdate

https://www.typecalendar.com/wp-content/uploads/2023/03/Claim-Letter.jpg

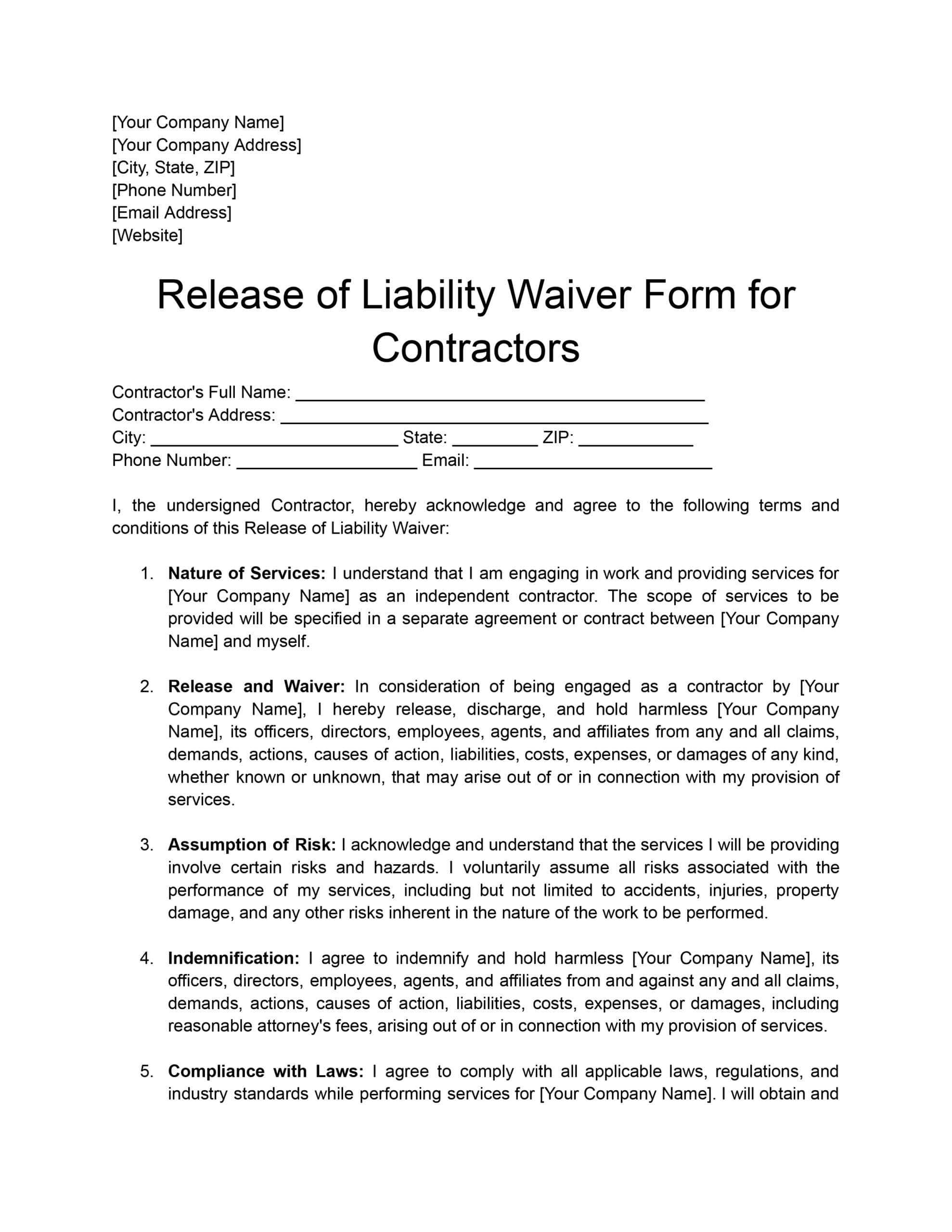

LETTER3 5 Lowes Contractor Paper Terms Of Use

https://www.workyard.com/wp-content/uploads/2023/05/Release-of-Liability-Waiver-Form-for-Contractors-scaled.jpg

What Can Contractors Claim On Tax - Mar 14 2024 nbsp 0183 32 By following these essential record keeping practices contractors can ensure they are well prepared to claim all eligible work related tax deductions reduce their taxable income