What Antibiotic For Group B Strep Uti 6 days ago nbsp 0183 32 Each month 118 is taxable as income and 200 is a tax free return of premium At age 87 all 318 per month is taxable as income Annuities are popular with clients seeking tax

Oct 28 2024 nbsp 0183 32 Income withdrawn from all types of deferred annuities is taxed as ordinary income not long term capital gain income This tax treatment applies to fixed rate fixed The taxable part of your pension or annuity payments is generally subject to federal income tax withholding You may be able to choose not to have income tax withheld from your pension or

What Antibiotic For Group B Strep Uti

What Antibiotic For Group B Strep Uti

https://i.ytimg.com/vi/EMJigm102eo/maxresdefault.jpg

56 Cephalexin Keflex Cephalosporin For Strep UTI Bacterial

https://i.ytimg.com/vi/9CKSopdHt8g/maxresdefault.jpg

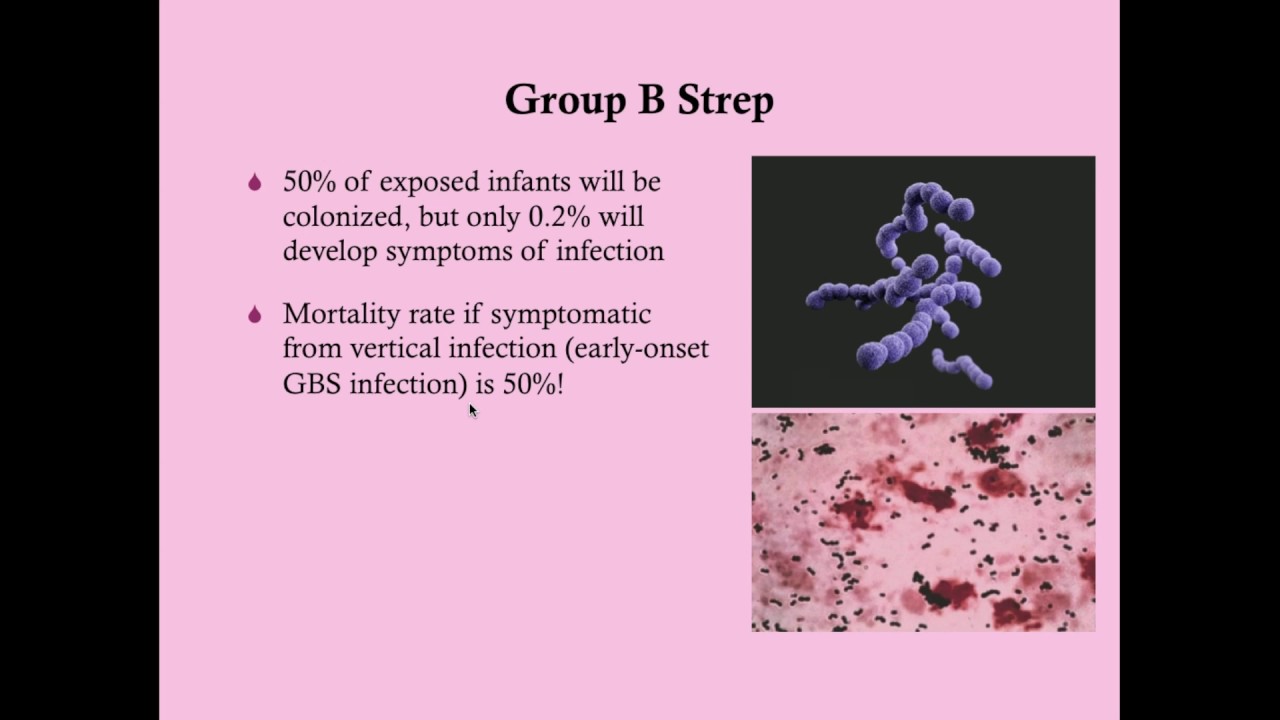

Group B Strep In Pregnancy CRASH Medical Review Series YouTube

https://i.ytimg.com/vi/fj126iTP8-A/maxresdefault.jpg

This interview will help you determine if your pension or annuity payment from an employer sponsored retirement plan or nonqualified annuity is taxable It doesn t address Individual Mar 26 2025 nbsp 0183 32 How annuities are taxed depends on the type of contract how it was funded and how withdrawals are made Earnings from annuities are generally taxed as ordinary income

Jun 5 2025 nbsp 0183 32 Withdrawals from annuities may be subject to taxes and early withdrawal penalties An annuity is a financial product designed to provide a steady income stream during Apr 11 2025 nbsp 0183 32 How much is taxed on annuity income depends on the type of annuity the timing of withdrawals and whether you fund the annuity with pre tax or post tax dollars Read on for

More picture related to What Antibiotic For Group B Strep Uti

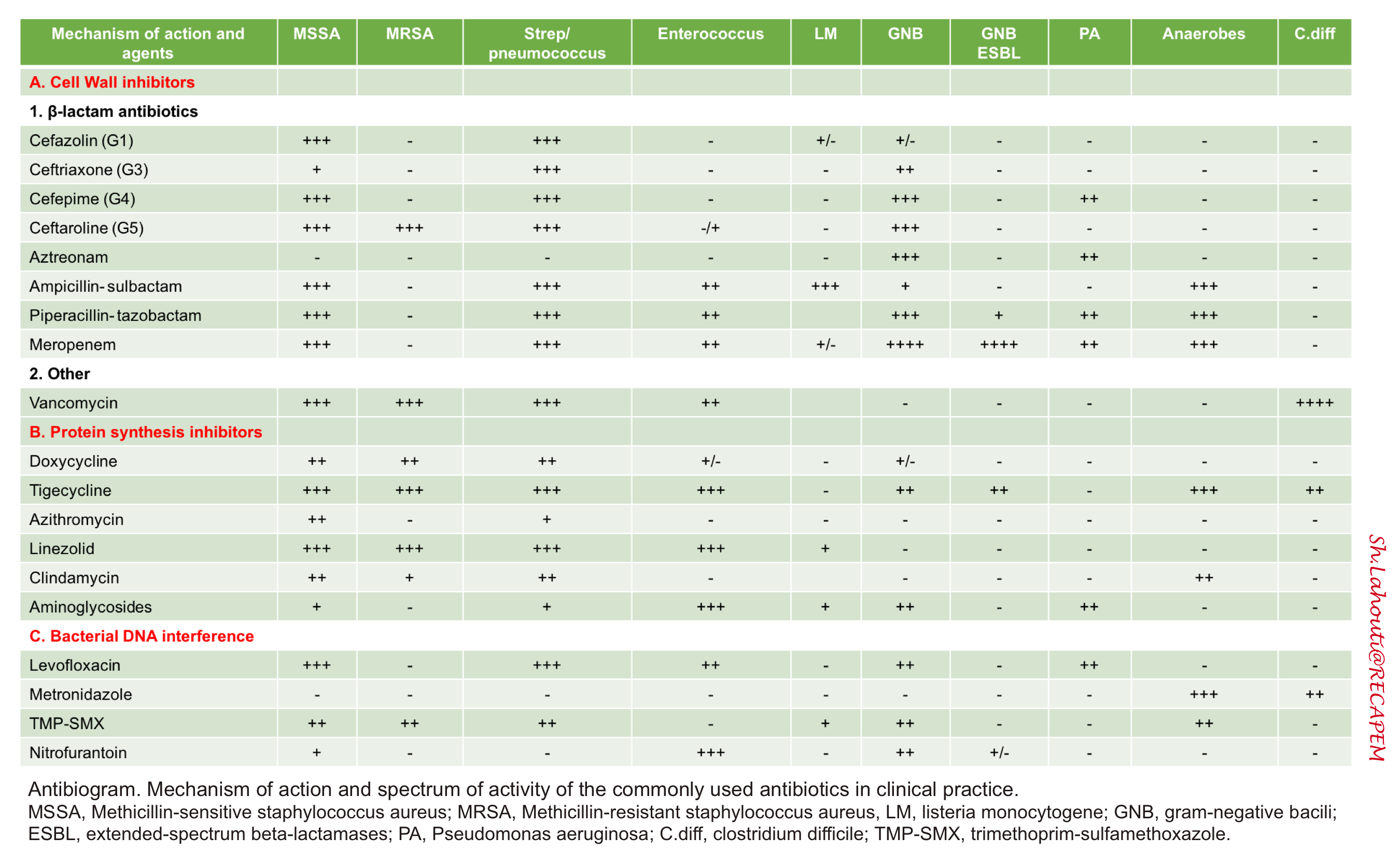

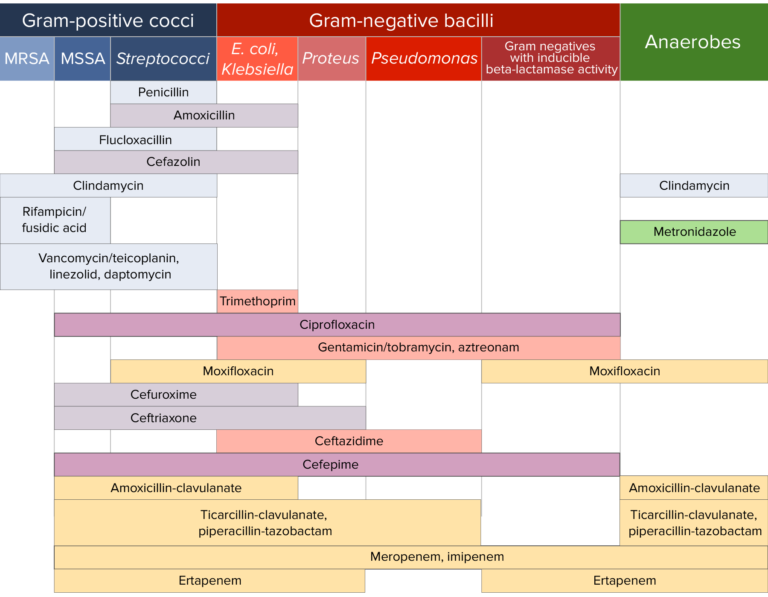

Antibiogram RECAPEM

https://recapem.com/wp-content/uploads/2021/12/ANTIBIOGRAM.png

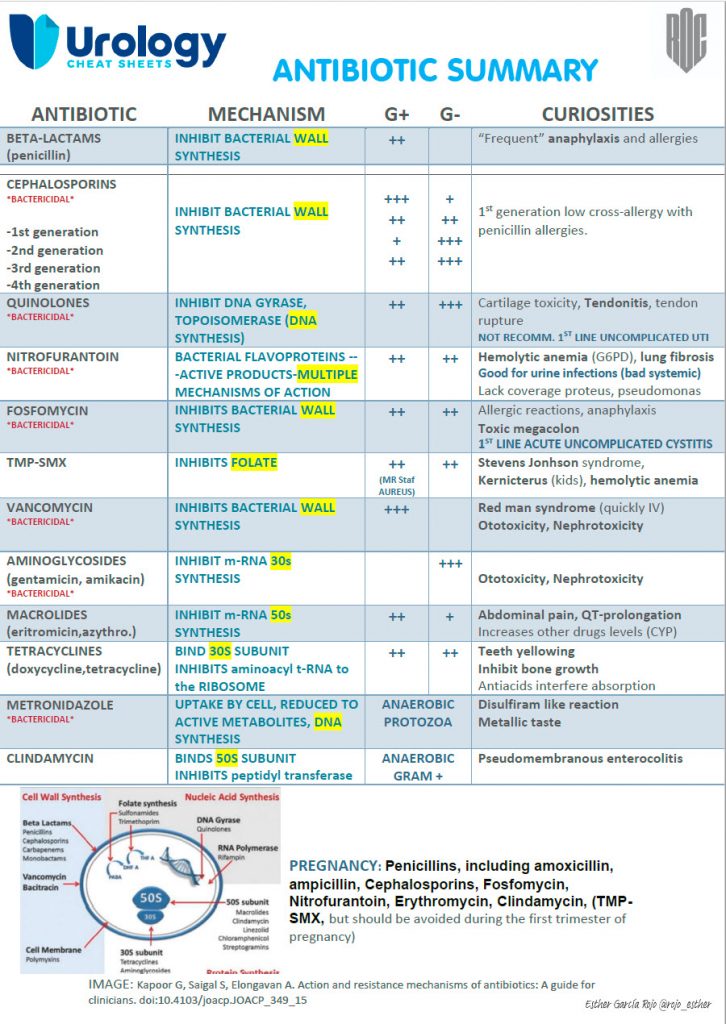

Antibiotics Urology Cheatsheets

https://urologycheatsheets.org/wp-content/uploads/2020/11/antibiot-726x1024.jpg

Streptococcus

https://www.medicalmedium.com/blog-images-optimised/Streptococcus.jpg

Feb 17 2025 nbsp 0183 32 Qualified annuities funded with pre tax dollars through accounts like 401 k s or IRAs are fully taxable upon distribution Taxes were deferred on both the principal and Feb 28 2025 nbsp 0183 32 Qualified annuities are paid with pre tax money and all payouts are taxed while nonqualified annuities are paid with taxed money and only the earnings are taxed If you take

[desc-10] [desc-11]

Oxazolidinonas Concise Medical Knowledge

https://cdn.lecturio.com/assets/Antibiotic-sensitivity-chart-768x597.png

Vaginal Infection Nerv s

https://adc.bmj.com/content/archdischild/102/1/72/F1.large.jpg

What Antibiotic For Group B Strep Uti - Jun 5 2025 nbsp 0183 32 Withdrawals from annuities may be subject to taxes and early withdrawal penalties An annuity is a financial product designed to provide a steady income stream during